Texas Instruments: Leading the Analog Chips Industry

Disclosure: I own shares of Texas Instruments

You can listen to this Deep Dive here

Texas Instruments (TI) is a storied company in the semiconductor industry since it’s been there from almost the very beginning of the industry. But believe it or not, it changed its name not once or twice, but four times since its founding in 1930. Initially, its name was “Geophysical Service, Inc.” (GSI) which used the technique of reflection seismology to find and map areas most likely to yield oil. However, the oil exploration business proved to be a bit erratic, and as the World War II was underway, GSI wanted to transfer some of its oil exploration skillsets to help the US military manufacture electronic equipment. GSI became a subsidiary of the parent company named “Coronado Corporation”.

After the war, Patrick Haggerty joined GSI’s Laboratory and Manufacturing (L&M) division and played instrumental role in TI’s eventual rise in semiconductors. Haggerty believed that the consumer market is much bigger opportunity than the military market. By early 1950s, L&M division was growing much faster than GSI’s Geophysical division and the company was then reorganized and renamed to be “General Instruments”. However, it turned out that the name was already used by another company and hence, they changed it to “Texas Instruments”. Its geophysical business was eventually sold to Haliburton in 1988.

By 1953, TI became a publicly listed company and went on an acquisition spree by buying seven companies in that very year. As TI was starting to be a major electronics manufacturer, their revenue increased from ~$20 Mn in 1952 to $92 Mn in 1958.

It was in 1958 when Jack Kilby joined TI and invented Integrated Circuits (IC) for which he ended up winning the Nobel Prize in Physics in 2000. What’s an IC? It is a tiny electronic device that combines lots of small electronic parts on a single small piece of material, usually silicon. Imagine it like a mini city where instead of houses and streets, you have tiny components like transistors, resistors, and capacitors all living together on a small piece of land. These tiny parts work together to perform specific tasks, such as processing information, storing data, or controlling other devices. The invention of IC was a pretty big deal as Asianometry explains “how the integrated circuit took us to the moon”.

TI built the first computer to use silicon ICs for the Air Force, but it was the consumer market that started to show a lot of promise after IBM started integrating ICs in all its computers in the late ‘60s. Then in early ‘70s, TI entered the consumer-electronic calculator market and disrupted the then ubiquitous slide rule. Calculators were an immediate hit! After launching the first handheld calculator in the retail market in 1972, sales volume from calculators increased from 17 mn units in 1973 to 28 mn in 1974 to 45 mn units in 1975.

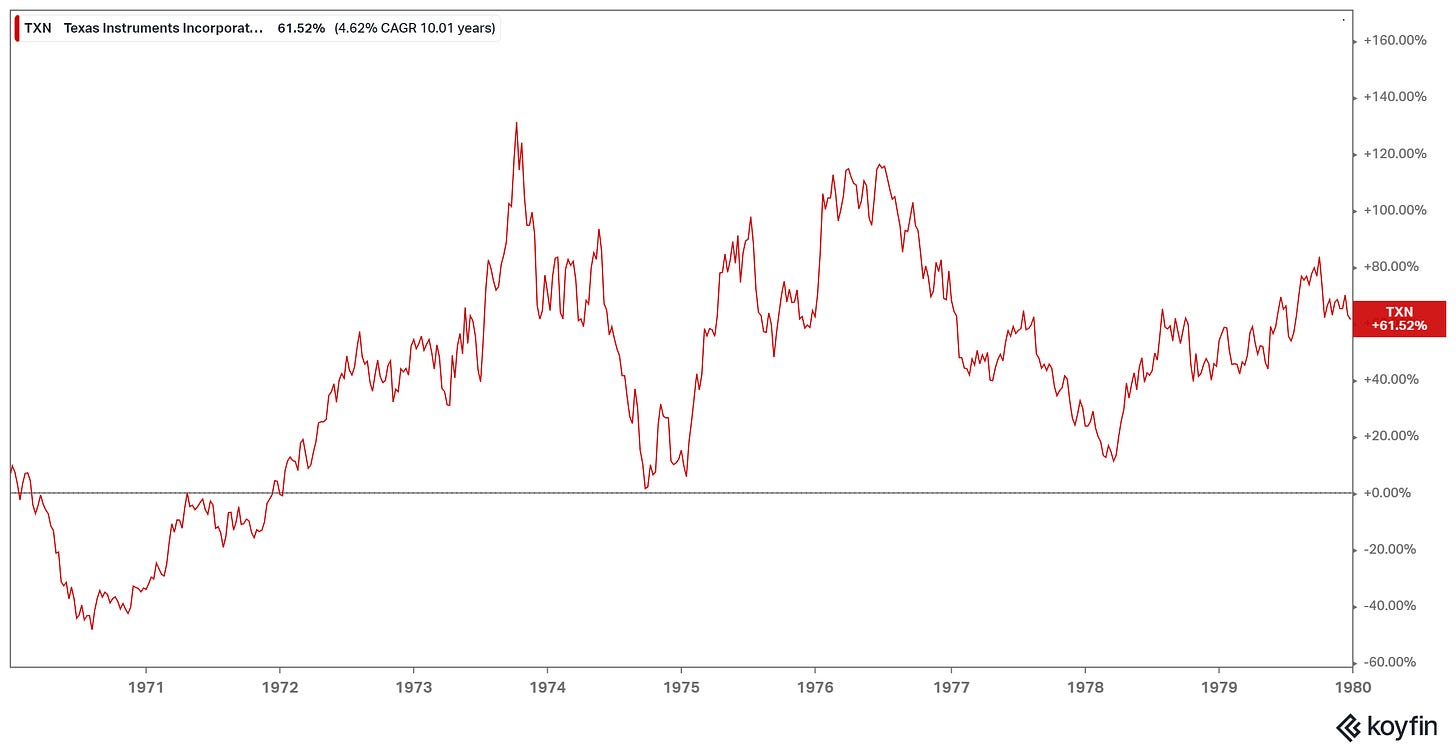

While new technical gadgets such as calculators, digital watch, and LCD watches started gaining wider adoption among consumers, price war ensued among the competitors which made profits lot more volatile and uncertain. Thanks to strong semiconductor demand and the very profitable defense electronics segment, TI still did okay during the ‘70s as revenue increased from $1 Bn in 1973 to $3 Bn in 1979. While the stock only generated ~4.6% CAGR, S&P 500 compounded at only ~2% during the ‘70s.

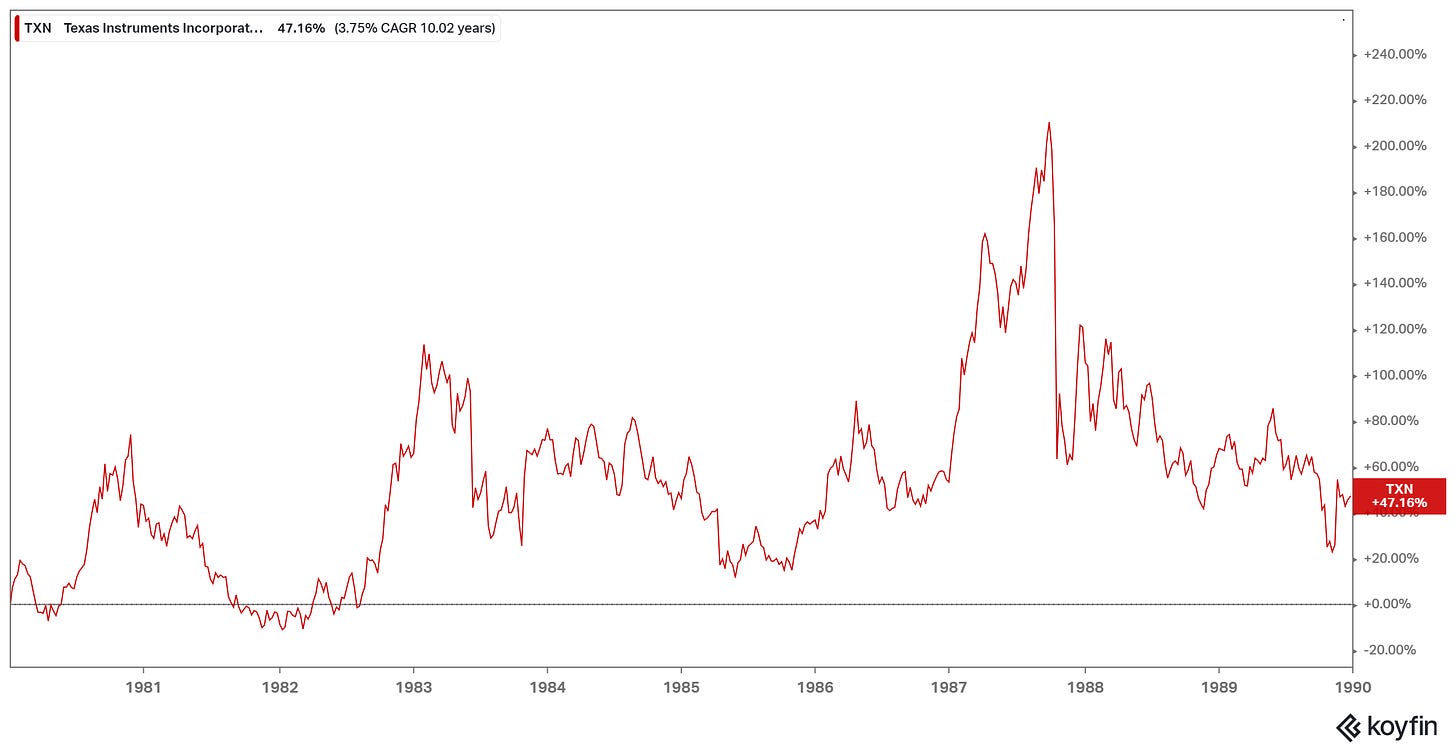

Then the 80s was a challenging decade for TI. While the stock generated 3.75% CAGR return in this decade, it severely underperformed S&P 500’s ~13% CAGR return this decade. In the late ‘70s, TI entered the home computer market which also eventually ended up in a price war that led to TI’s first ever loss of $145 Mn in 1983. TI’s presence in both consumer and industrial markets often led to shortages of components and reduced shipments. They incurred another loss year in 1985. In the late ‘70s, TI set an ambitious goal of reaching $15 Bn revenue by 1990. The actual revenue ended up being only ~$6 Bn when TI ended the decade of ‘80s. Their market share in semiconductor also fell precipitously from ~30% to just 5% over the course of this decade. No wonder TI’s stock lagged S&P 500 considerably!

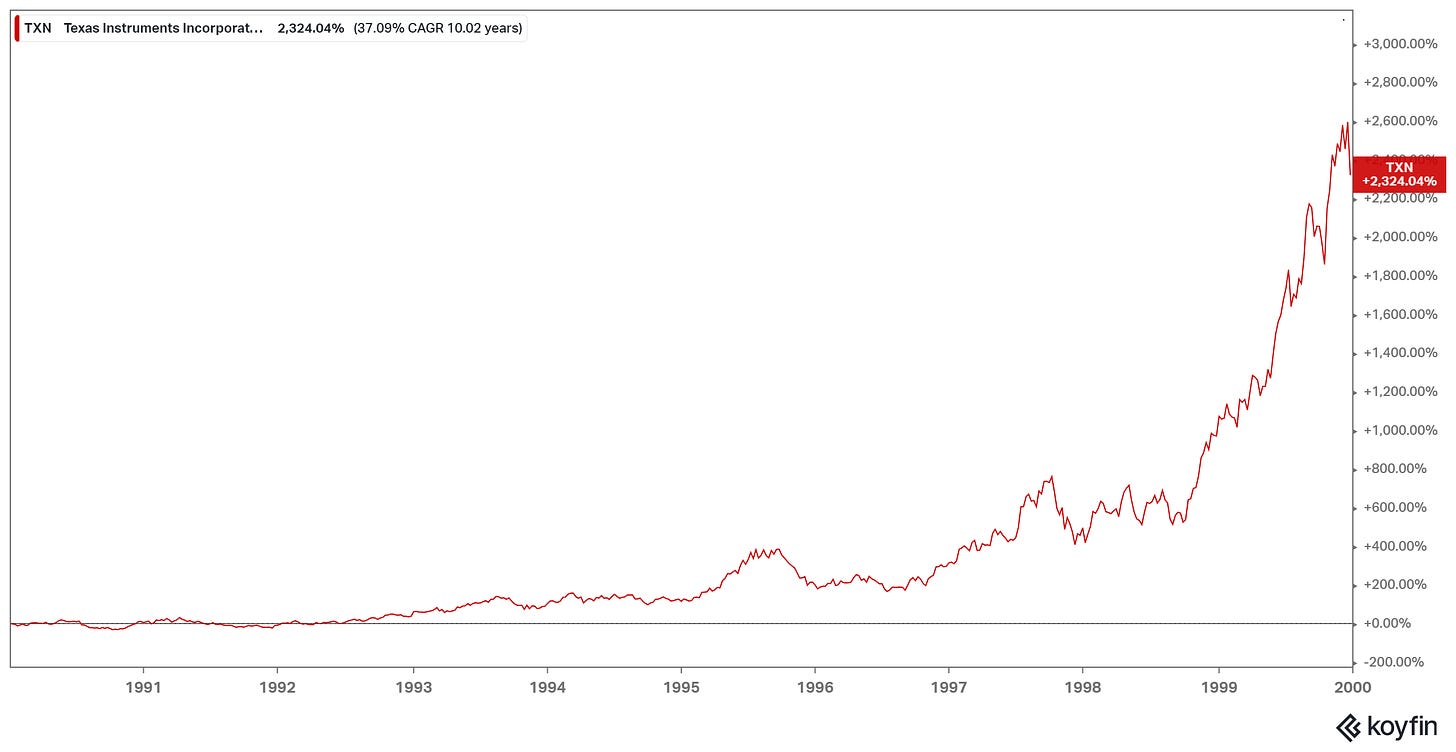

Thankfully, TI’s fate radically changed in the ‘90s as the stock almost 23x-ed (~37% CAGR) vs S&P 500’s performance of ~16% CAGR during this decade. Sure, quite a bit of this massive rally was due to the lead up to the tech bubble in the late ‘90s, but the company also took some decisions to deepen their focus on their core business. They sold their memory business to Micron for ~$800 Mn and started focusing more on developing new products in analog semiconductor market. For example, in 1999, TI launched 191 analog products (~7x more than they did in 1996) and became the leading player in analog semiconductor industry (more on analog semiconductor later). In 1999, ~84% of their revenue came from semiconductor market and they were clear beneficiaries of the rise of electronic systems in the ‘90s. TI’s semiconductor products were being used in digital cell phones, computers, printers, hard disk drives, modems, networking equipment, digital cameras and video recorders, motor controls, autos, and home appliances.

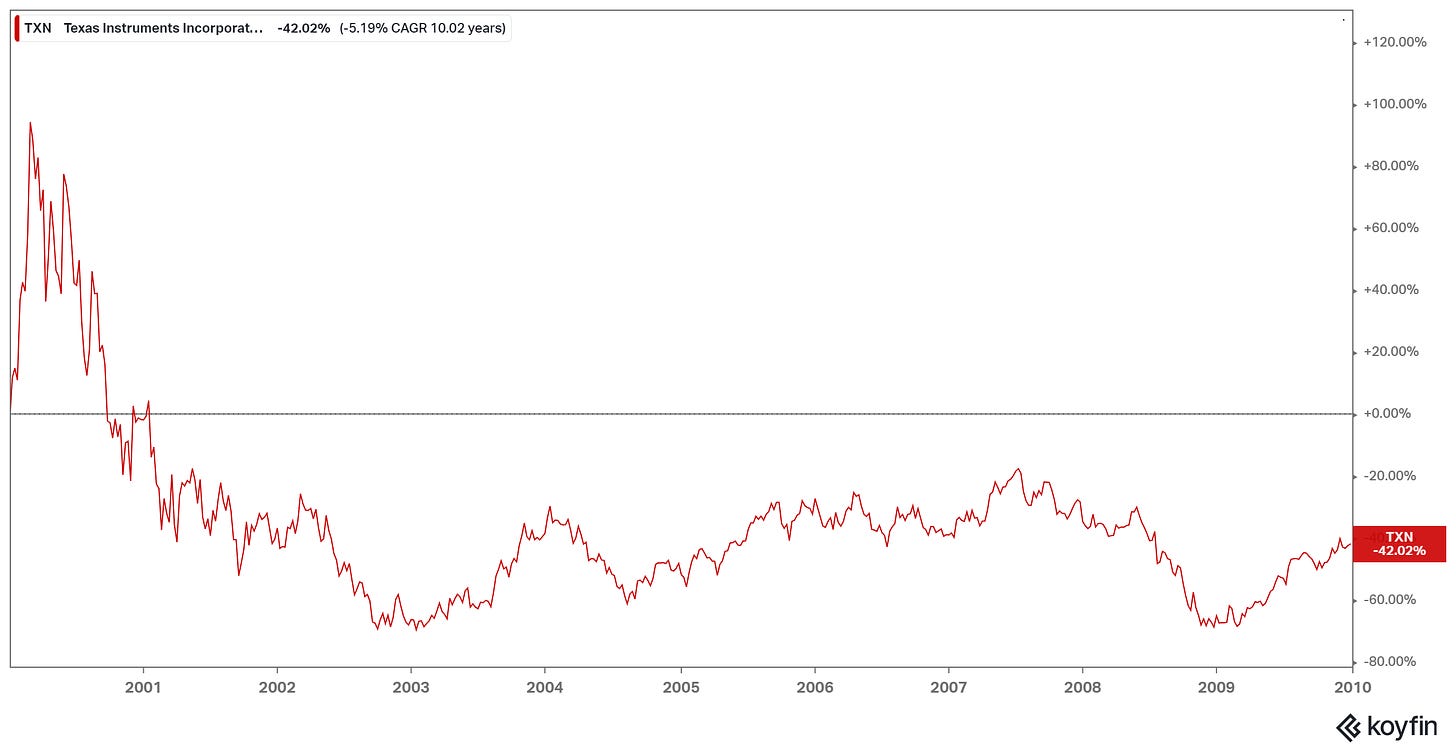

Then of course the first decade of the 21st century started with the crash of the tech bubble. TI’s revenue fell by a whopping ~31% in 2001. It took TI nearly five years to exceed its revenue in 2000. Just as it started to recover, Global Financial Crisis (GFC) hit the economy and TI’s revenue declined for three consecutive years. As you can imagine, it was a sorry decade for TI and its shareholders.

However, a lot was going on in the background during this decade. In early 2000, TI acquired Burr-Brown for $7.6 Bn. While both companies were analog-focused, their product lines were very complementary with little overlap. Burr-Brown was strong in high-performance, high-precision converters, amplifiers and interface products whereas TI had a broader analog portfolio. The combination enabled TI to offer more complete analog system solutions.

TI was also overly reliant on consumer electronics and given the potential short product cycle and OEMs bargaining power in consumer electronics, it was not the easiest business to navigate for TI. So, TI started plotting to lower its dependence on this industry and shift more to industrials and automotive industry, both industries which tend to have larger product/design cycle and diverse, fragmented customer base. TI ended up divesting Sensata for $3 Bn to Bain in 2006. Sensata later IPO-ed and given its market cap today is only ~$5 Bn, that was clearly a good deal for TI shareholders in hindsight.

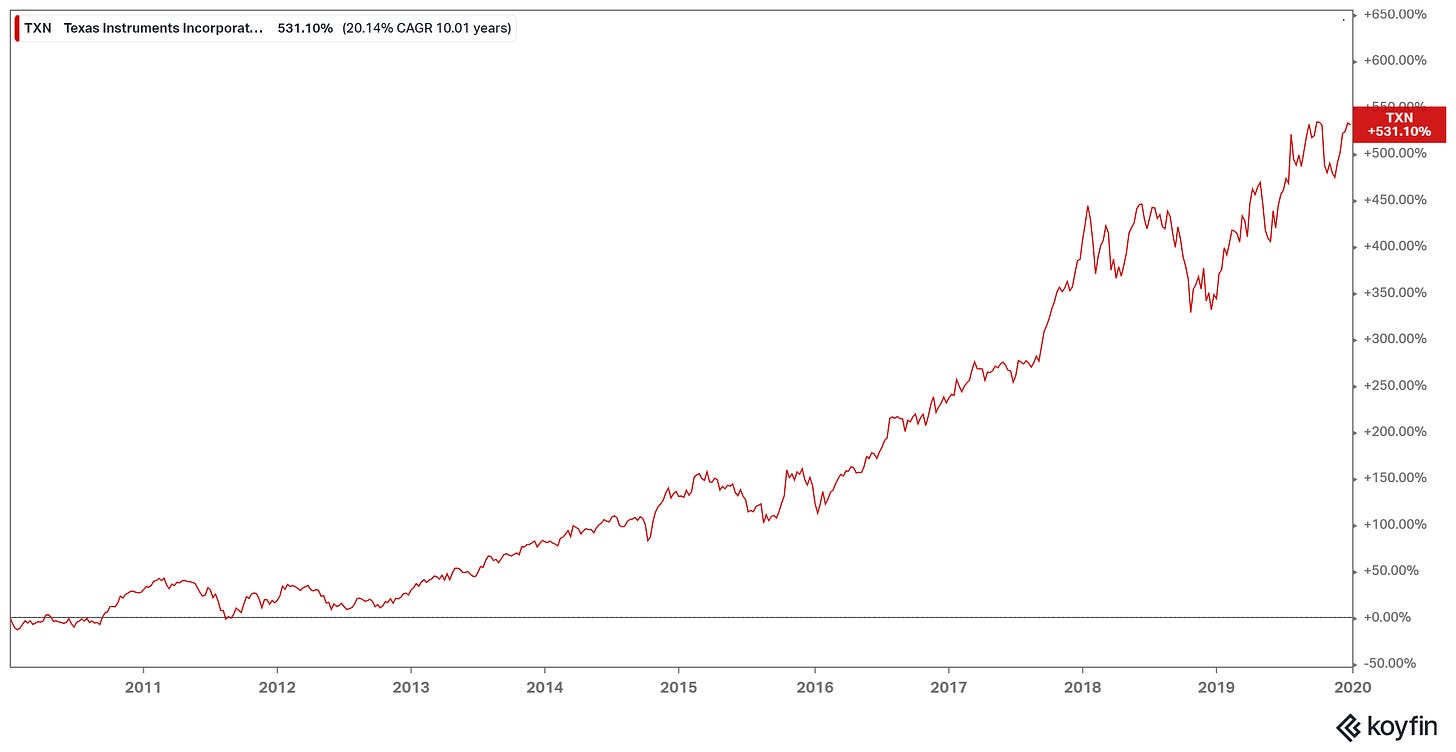

After the severe beating in 2000s, 2010s was a different story as the stock compounded at ~20% (vs S&P 500 at ~11%). But much of this staggering performance in the 2010s was essentially somewhat architected in 2000s when the stock was going through a tough period in the market.

As alluded earlier, over the course of 2010s TI went through a bit of a transformation. Back in 2013, nearly half of TI’s revenue came from personal electronics and communications equipment. Today, that number has come down to only 20%. TI also did their last major acquisition: National Semiconductor (NSC) in 2011. At the time of the acquisition, TI was generating 22% revenue from industrials whereas 46% of NSC’s revenue came from industrials. NSC had higher gross margin (~69%) vs TI (~54%) at that time and contributed 12k analog SKUs to TI’s ~30k products at that time.

Now, industrials and automotive contributes nearly three-fourth of overall revenue of TI. With ~$20 Bn revenue, TI is the leading analog chips company in the world.

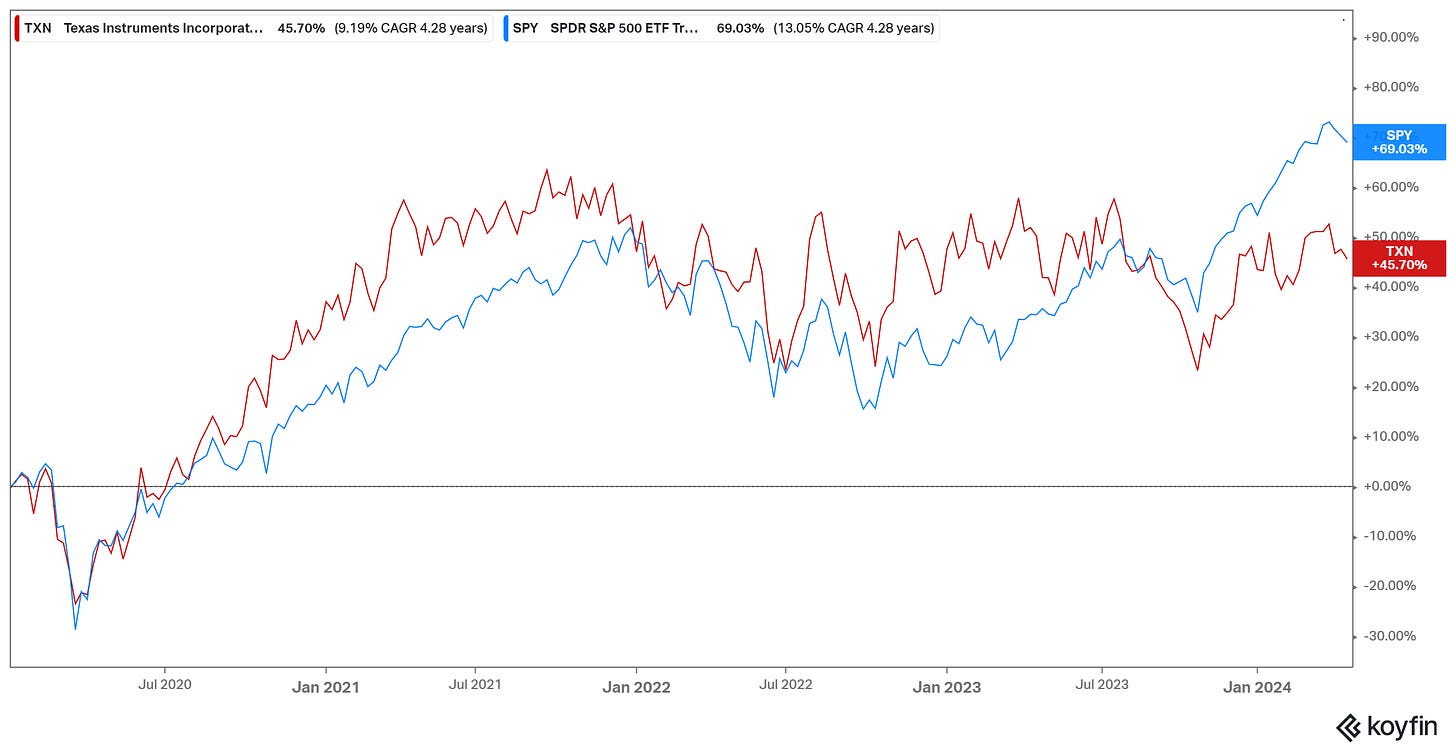

In 2020s so far, TI has underperformed S&P 500. Revenue has been declining YoY for the last six consecutive quarters as the industry is currently going through a cyclical downturn. I reckon this is likely to be an interesting opportunity for long-term investors.

Here’s the outline for the rest of this Deep Dive:

Section 1 Basics, Demand Drivers, and Economics: I start with some basics such as what exactly is analog chip. Then I primarily focused on the two largest sectors that drive TI’s revenue: industrials and automotive to understand the demand drivers of the business. Finally, I discussed the overall economics of TI’s business.

Section 2 Competitive Dynamics: First, I discussed why both ADI and TI may be attractively positioned in this industry. Then I compared and contrasted between their approaches which was followed by a discussion on the China risk/question posed to both these companies.

Section 3 Capital Allocation and Management Incentives: I looked at last 20 years of capital allocation history of both TI and ADI. Then I discussed TI’s management incentives.

Section 4 Model Assumptions and Valuation: Model/implied expectations in the current stock price are analyzed here.

Section 5 Final Words: Concluding remarks on Texas Instruments, disclosure/discussion of my overall portfolio, as well as couple of updates on my previous Deep Dives.