April 2024 Update

First things first, this month's Deep Dive on Texas Instruments will be published by April 25th. Thank you for all the great feedback on my Semiconductor Primer last month; I'm glad that many of you found it useful to get up to speed on the industry.

Although I rarely explain my investment activities in these monthly updates, I will share some thoughts on why I have started buying Lululemon today.

Before I explain my rationale to start buying Lululemon (Ticker: LULU), let's go down the memory lane first. I first published my Deep Dive on the company in November 2020. I would suggest you read the Deep Dive for more comprehensive and detailed analysis, especially to grasp LULU's competitive advantages. I thought the valuation was a bit rich back then, but later I changed my mind in June 2021 and started buying the stock at $335/share. However, I later sold the stock at ~$385 in May 2022 (see Section 6) and mentioned this for my rationale to sell LULU to increase my exposure in some of my other portfolio holdings:

"While LULU’s long-term future is likely to be bright, I thought IRR in some of my other portfolio holdings are potentially much higher."

Indeed, while my portfolio nearly doubled since May 2022, LULU has been basically flat since then. Moreover, the stock is down ~25% YTD and is actually flat since August 2020. Today, I think I am in the opposite situation of May 2022; my guess is LULU is likely to outperform much of my current portfolio holdings in the next 3-5 years and hence took a ~4% position at $380/share (and open to increase my exposure depending on how stock price and/or fundamentals move going forward).

This isn't a Deep Dive, so I will be rather brief and highlight just a couple of points on why I like LULU today.

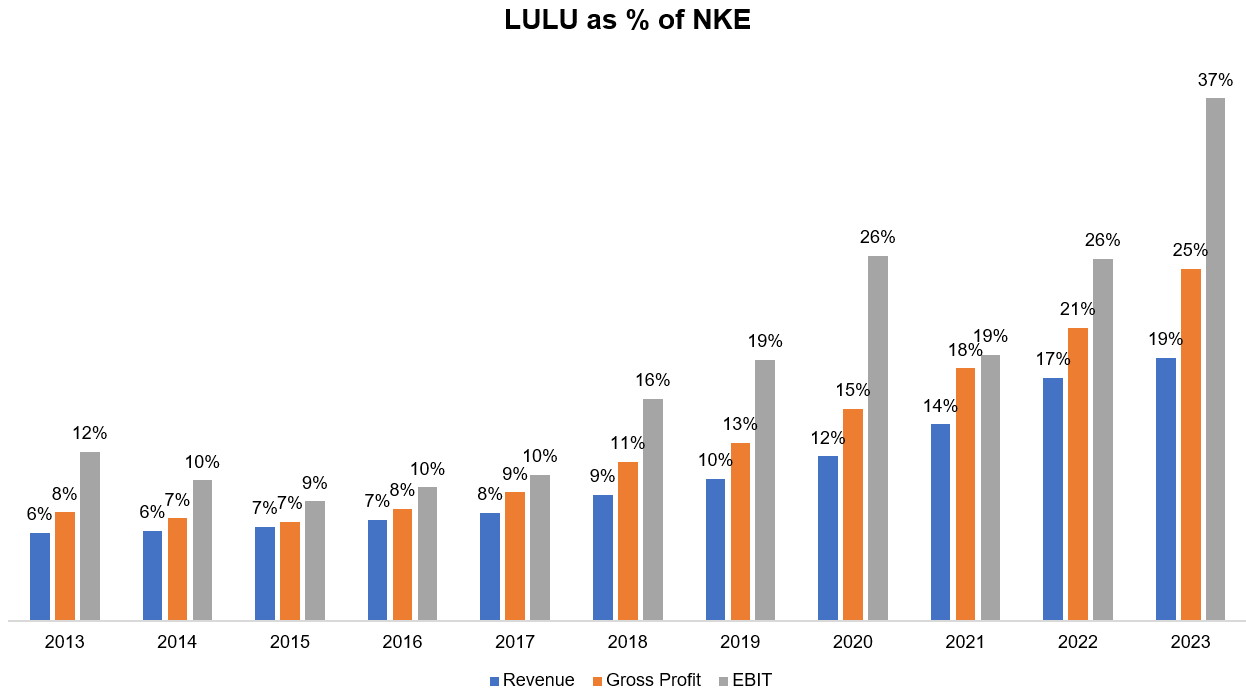

Perhaps nothing encapsulates how LULU has somewhat quietly graduated from a fashion cult brand to a scaled, mainstream brand than looking at some of its numbers in comparison with Nike (Ticker: NKE). During 2013-2018 period, LULU's revenue and gross profit was consistently Mid to high single digit as % of Nike's revenue and gross profit. Since LULU has higher operating margin than NKE, operating profit was low double digit to mid-teen as % of NKE's operating profit. Then something changed in 2020!

LULU has been on a tear for the last four years since the pandemic. Last year, LULU was almost ~20% of NKE's sales, ~25% of NKE's Gross Profit, and a whopping ~37% of NKE's EBIT. Given their financial years are different from each other, this isn't quite apple-to-apple, but even when we look at the last three years aggregate numbers, it still sort of depicts similar picture.

During 2021-2023, NKE generated ~$64 Bn aggregate gross profit. LULU posted $13.7 Bn or 21.5% of NKE's. During this period, NKE generated ~$20 Bn aggregate operating profit whereas LULU posted $5.3 Bn or ~27% of NKE's. You may find this surprising but LULU generated these numbers by spending ~10% of what NKE spends on advertising! I'm not going to delve deep into why/how LULU can pull off such a thing and I encourage you to read my initial Deep Dive where I did explore exactly that.

LULU's performance in the last 3-4 years is nothing short of staggering and looking at a massive, global brand such as NKE for comparison really highlights their height of success.

What surprises me is that despite such a staggering success especially compared to NKE, LULU actually trades at lower NTM EV/EBIT multiple today. In fact, it is hardly an anomaly. Historically, NKE often traded at higher multiples than LULU, implying that investors have nurtured a persistent skepticism about LULU's durability and brand power, especially compared to brands such as NKE. Let me explain why I don't share such skepticism and I, in fact, believe LULU should trade at higher multiple than NKE.

Back in 2020, Gavin Baker wrote a really insightful piece titled "Why category leading brick and mortar retailers are likely the biggest long term Covid beneficiaries." Let me share some relevant excerpts here:

"Many of the perceived Covid winners such as e-commerce, videogame and streaming media companies have simply been pulled a few years forward into a future that was inevitable. Their destiny did not change. The future for those businesses simply accelerated whereas the future for category leading “brick and mortar” retailers has changed dramatically as a result of Covid, more so than for any other business of which I can think.

Said another way, long term steady state FCF will likely be the at the same level for many e-commerce, videogame and streaming media companies as it would have been before Covid. This is not to say that Covid did not increase their value; it did but primarily by pulling their financials forward a few years which obviously matters in a DCF. Whereas long term steady state FCF will likely be significantly higher for category leading brick and mortar retailers who had reasonably strong e-commerce businesses coming into Covid. Especially so for those category leading retailers who operate in inflationary categories where inventory turns are less important than they are in deflationary categories where e-commerce only companies have structural cost advantages due to faster inventory turns.

The future was always going to be omnichannel. Pundits have been prematurely predicting this for many years, but it is finally happening.

Brick and mortar stores have tremendous online value in addition to enabling true omnichannel commerce. Nothing matters more for an e-commerce company than marketing efficiency expressed either as gross margin $ payback period or the ratio of CAC to LTV. Brick and mortar stores significantly lower online CAC by improving marketing efficiency (higher click through rates, higher quality scores for ads). Consumers are more likely to trust a brand they have seen in the real world. Ironic in a world where “CAC is the new rent” that one of the best ways to lower your online rent, i.e. CAC, is to pay rent offline for physical stores. Brick and mortar stores also enable BOPIS (buy online pickup in store) and the in-store return of items purchased online, which consumers value. Economically, BOPIS will always be cheaper than same day delivery and large numbers of consumers are highly cost sensitive."

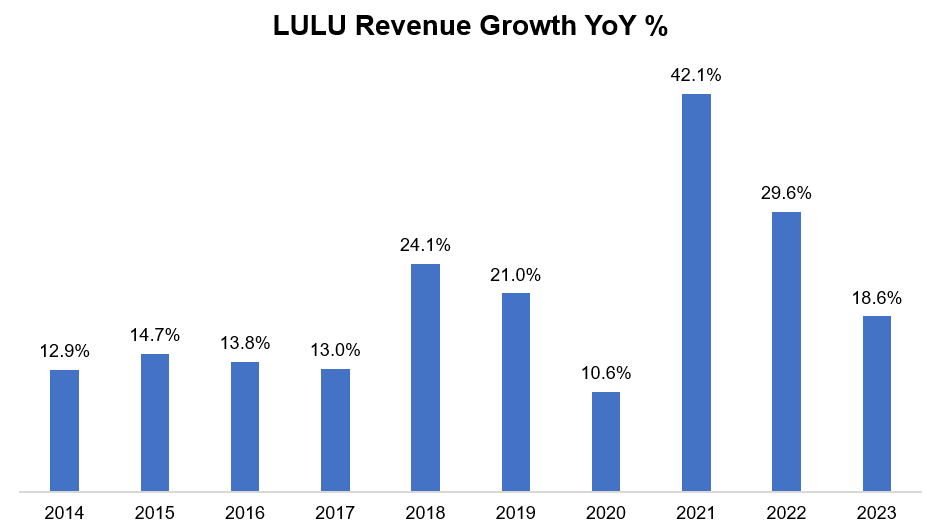

While Baker didn't mention LULU in his piece, there are hardly better companies that fit and proved this thesis. Like many e-commerce companies, LULU, who already had a pretty decent omnichannel offering to their customers even before the pandemic, had a meteoric growth (~42%) in 2021. I'm not sure there are too many e-commerce companies which managed to then grow at ~30% in 2022 and ~20% in 2023. Remember, this used to be mid-teen to low 20s topline grower before the pandemic. LULU's vertical integration (and hence control over the brand) and direct relationship with its customers by executing a seamless omnichannel experience likely perhaps created a durable change in competitive dynamics. Every person I discuss LULU with (the stock) never forgets to mention the threat from up and coming brands such as Alo, Vuori etc. but I think they fundamentally underestimate and underappreciate that LULU's brand has likely found an escape velocity in the last few years. While those up and coming brands can enjoy some success in their niche, it may require a shocking mismanagement from LULU's management to fumble the structural CAC advantage they now currently enjoy. To be clear, LULU used to be terribly managed business in much of the 2010s; even that wasn't enough to deteriorate the brand too much, implying the strength of the brand in the first place. The current management, led by Calvin McDonald, really deserves some high praise for what they accomplished in the last few years (despite their hiccup with Mirror acquisition).

Now that the stock trades at ~18-19x EBIT, we don't have to underwrite heroic assumptions to get to pretty decent returns. LULU's current operating margin is ~23% which seems already quite optimized, so margin upside is rather limited or non-existent. But I think it's quite likely that their topline continues to grow at HSD to low double digits in the next 3-5 years, mirroring the potential IRR from current stock price (assuming no multiple compression/expansion which is likely a fair assumption). The stock recently has gone down ~25% YTD as the management guided low double digit topline growth in 2024; investors were perhaps getting too accustomed to ~20% growth in the last few years. After such a meteoric growth in 2021-23, it is not surprising to me at all that LULU may need bit of a digestion period to grow at a more sustainable pace. HSD to low double digit topline growth seems very much achievable for the next 3-5 years and therefore, I started a new position in the stock.

Speaking of new position, I also bought XPEL yesterday. I haven't published a Deep Dive on XPEL yet and I may not publish anything on XPEL in 2024 (highly likely I will do so in 2025). If you're interested in understanding more about XPEL, I suggest you read yesterday's piece by Scuttleblurb.

Thanks for reading. I will come back with the TXN Deep Dive later this month.