Alphabet 1Q'24 Update

"...it took Google more than 15 years to reach $100 billion in annual revenue. In just the last 6 years, we have gone from $100 billion to more than $300 billion in annual revenue"

Despite following Big Tech closely for the last 5 years, this sentence from today's call still somewhat surprised me! The scale and the height of success of Google truly boggles my mind.

Over the last year or so, Google has had its fair share of skeptics, including yours truly. While the stock price used to embed some tension and debate about Search's future, following after-hours (AH) rally, as I will show, it appears that the stock is finally priced as "AI winner".

Here’s my highlights from today’s earnings.

Revenue

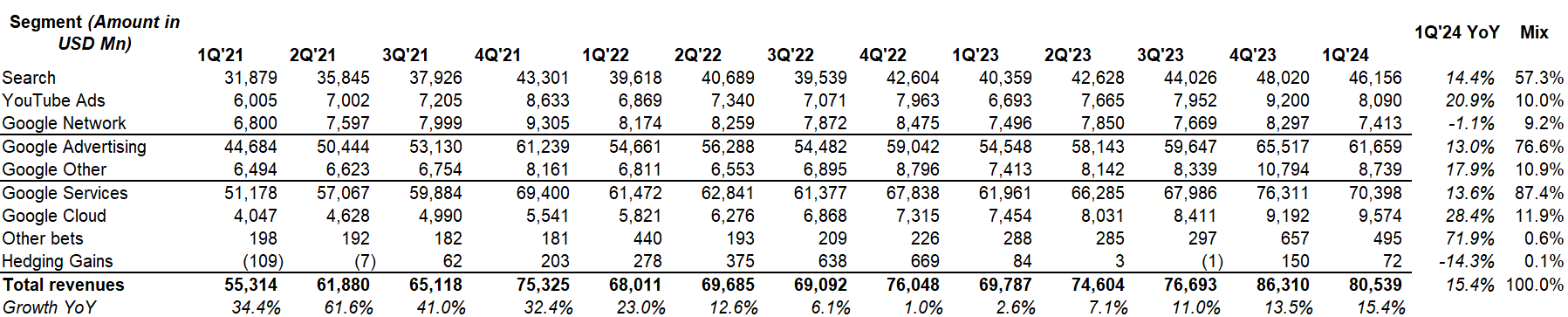

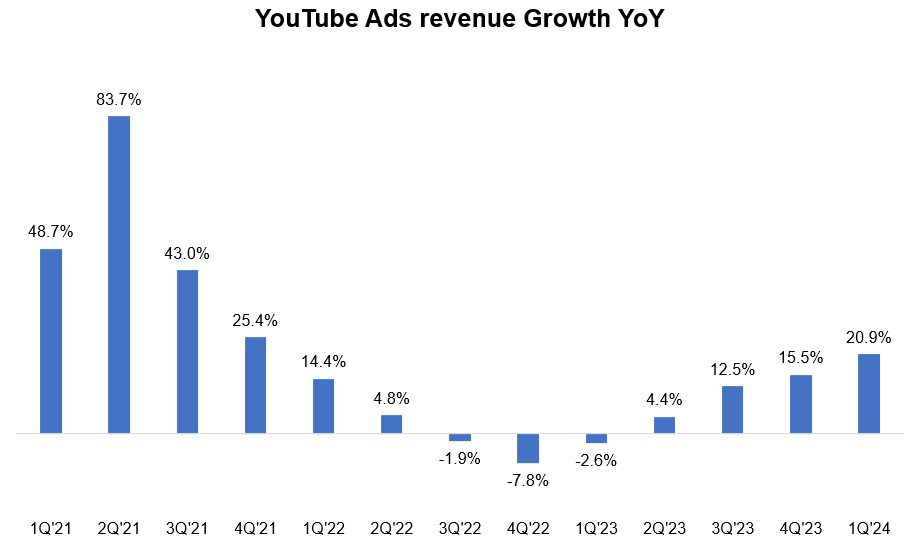

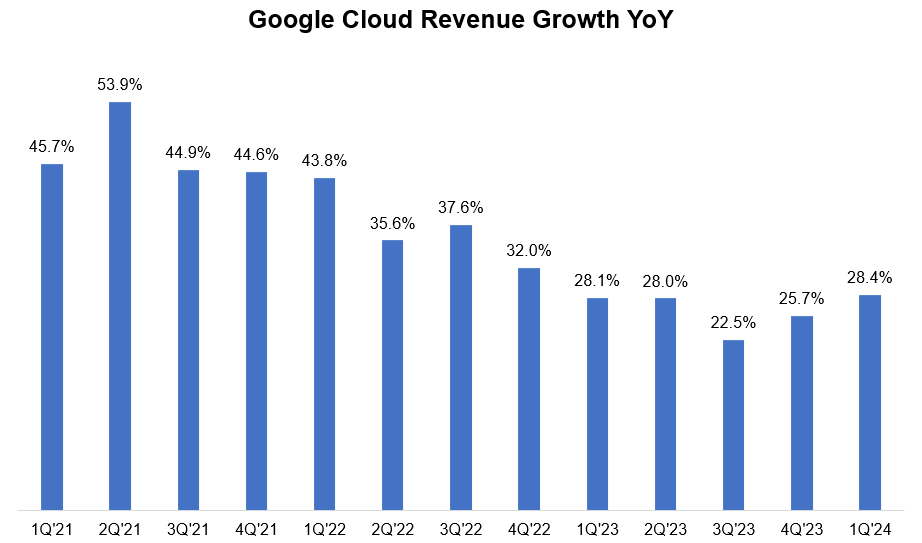

For the second consecutive quarters, every important segments i.e. Search, YouTube, Cloud accelerated their topline growth.

Overall revenue growth was +15% YoY (+16% FX Neutral)

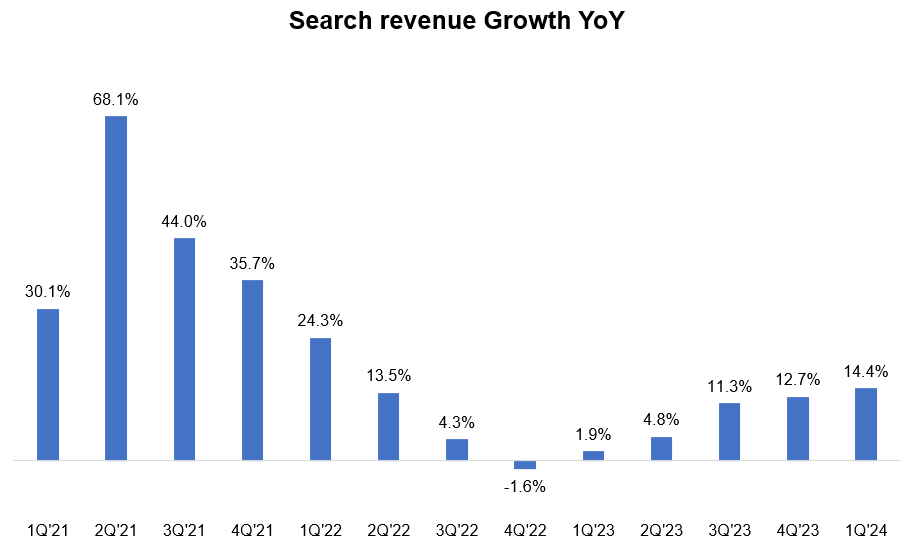

Amidst the bearish narrative around Search, Google Search's topline growth of 14.4% was quite impressive. But to appreciate Search's resiliency, I would like to highlight something else.

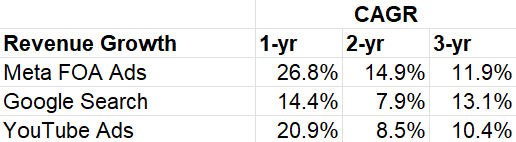

If it were a trivia question which of these three businesses (Meta's Family of Apps' or FOA Ads, Google Search, and YouTube Ads) generated highest topline growth over the last three years, my guess is most people would get it wrong. While many may think growth in Meta's FOA has been extraordinary, Search actually outpaced FOA and YouTube ads over the last 3-year period. Meta's FOA just appeared more impressive this quarter primarily due to easier comps.

EBIT

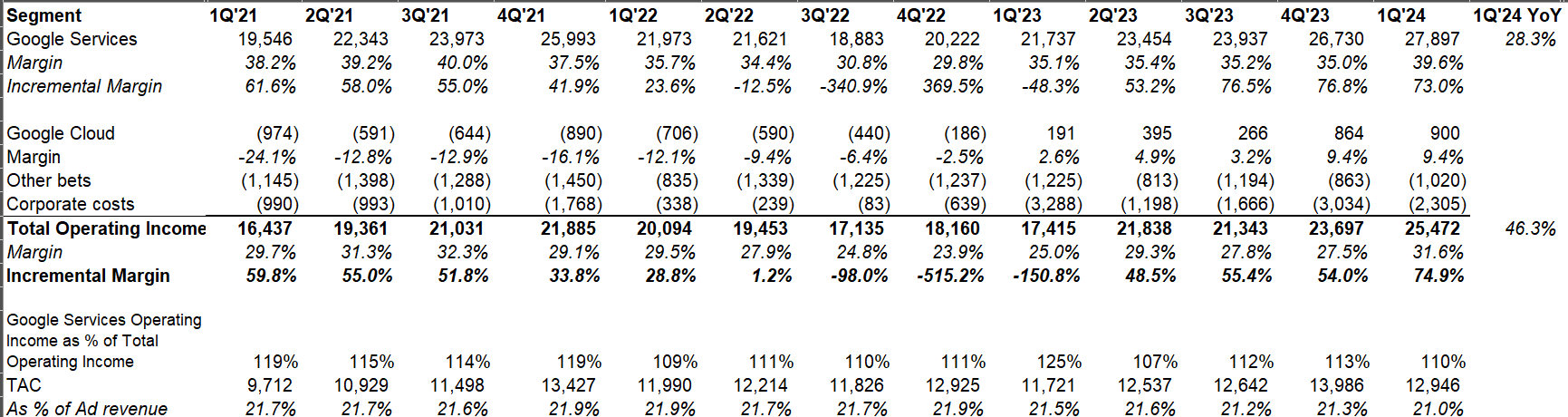

Google Services business posted 39.6% operating margin which was very close to its all-time high reported margin in this segment back in 3Q'21.

When Search related bearish narrative gained momentum last year or so, I too started entertaining the possibility that we may have seen peak margin for Google Service segment back in 3Q'21. With >70% incremental operating margin in the Services segment for three consecutive quarters, Google seems poised to post record margins sooner rather than later.

For the second consecutive quarters, Google Cloud posted +9.4% operating margin.

Moreover, TAC as % of Ad revenue was the lowest as far as my eyes could see in the last 5 years (may be the lowest ever, but not 100% sure about it). Sluggish revenue from Network business (which is higher TAC) perhaps made this metric look lot better (maybe higher Android smartphone share too? Not sure though).

Search

Some interesting comments on Search from the call:

based on our testing, we are encouraged that we are seeing an increase in search usage among people who use the new AI overviews as well as increased user satisfaction with the results.

since introducing SGE about a year ago, machine costs associated with SGE responses have decreased 80% from when first introduced in Labs driven by hardware, engineering, and technical breakthroughs

Overall, I think with generative AI in Search, with our AI overviews, I think we will expand the type of queries we can serve our users. We can answer more complex questions as well as, in general, that all seems to carry over across query categories. Obviously, it's still early, and we are going to be measured and put user experience at the front, but we are positive about what this transition means

Almost near the end of the call, Pichai reminded all the skepticism that was hurled at Google and yet how they have prevailed and expect to thrive going forward:

...if you were to step back at this moment, there were a lot of questions last year, and we always felt confident and comfortable that we would be able to improve the user experience. People question whether these things would be costly to serve, and we are very, very confident we can manage the cost of how to serve these queries. People worried about latency. When I look at the progress we have made in latency and efficiency, we feel comfortable. There are questions about monetization. And based on our testing so far, I'm comfortable and confident that we'll be able to manage the monetization transition here well as well. It will play out over time, but I feel we are well positioned. And more importantly, when I look at the innovation that's ahead and the way the teams are working hard on it, I am very excited about the future ahead.

YouTube

viewers are watching over 1 billion hours of YouTube content on TVs daily.

And on subscriptions, which are increasingly important for YouTube, we announced that in Q1, YouTube surpassed 100 million Music and Premium subscribers globally, including trials. And YouTube TV now has more than 8 million paid subscribers.

In 2023, more people created content on YouTube than ever before, and the number of channels uploading Shorts year-on-year grew 50%.

In the U.S., the monetization rate of Shorts relative to in-stream viewing has more than doubled in the past 12 months, including a 10- point sequential improvement in the first quarter alone.

Advertising Infrastructure

Advertisers using PMax asset generation are 63% more likely to publish a campaign with good or excellent ad strength. And those who improve their PMX ad strength to excellent see 6% more conversions on average.

We're also driving improved results for businesses opting into Automatically Created Assets (ACA), which are supercharged with gen AI. Those adopting ACA see, on average, 5% more conversions at a similar cost per conversion in Search and Performance Max campaigns.

Google Cloud

Cloud revenue growth again accelerated. Interestingly, Google expects YouTube overall (ads+ subscriptions) and Google Cloud will have combined $100 Bn revenue run-rate by the end of 2024 which implies pretty sustained growth momentum throughout the year.

I will discuss more on Cloud when Amazon posts next week.

Google Other

Google One (subscription service that provides additional storage for Google Drive, Gmail, and Google Photos) now has ~100 million paid subscribers.

AI

Contrary to popular perception, Pichai outlined how AI can be gamechanger for Google:

I think for the first time, we can work on AI in a horizontal way and it impacts the entire breadth of the company, be it Search, be it YouTube, be it Cloud, be it Waymo and so on. And we see a rapid pace of innovation in that underlying. So it's a very leveraged way to do it, and I see that as a real opportunity ahead. In terms of the challenges, I think it's been a mindset shift, which we've been driving across the company to make sure that we are embracing this opportunity but being very efficient in how we are approaching it

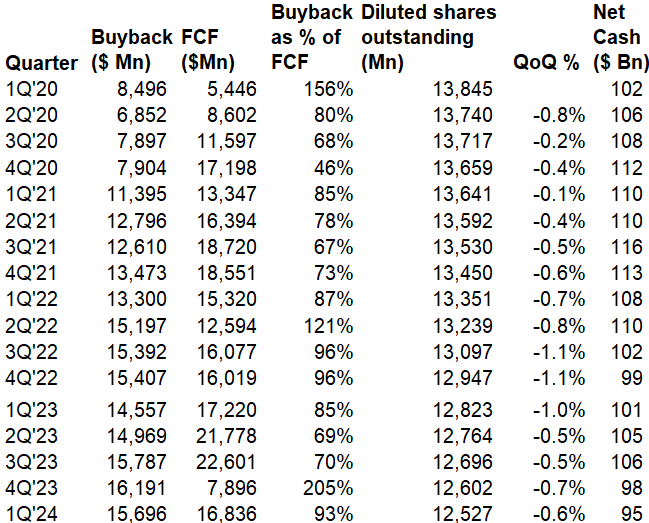

Capital Allocation

Google mostly utilized all of its FCF to buyback shares, declining shares outstanding by 0.6% QoQ. For the first time, they have declared cash dividend of $0.20/share.

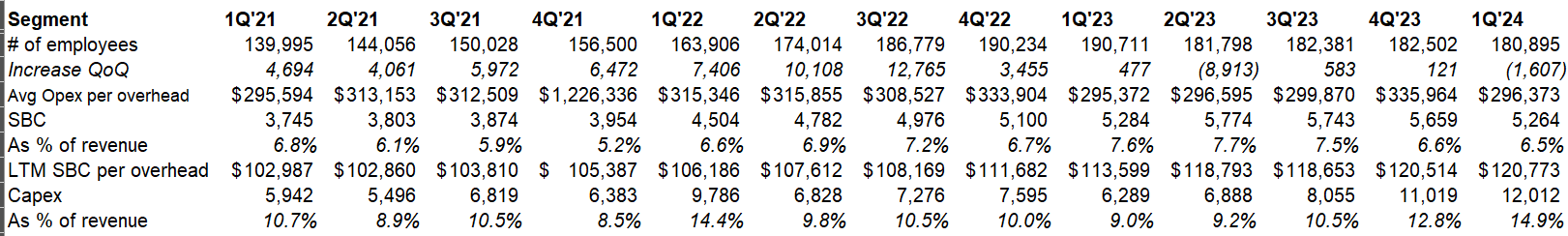

Capex and Opex

Google spent $12 Bn capex in Q1 and indicated capex will be around $12 Bn or above for each of the three remaining quarters. So, call it ~$50 Bn capex in 2024 (vs ~$32 Bn in 2023) compared to Meta's $35-40 Bn in 2024.

Google reminded how committed they always have been with their infrastructure (and frankly in my opinion it is perhaps an underrated moat):

We have the best infrastructure for the AI era. Building world-leading infrastructure is in our DNA, starting in our earliest days when we had to design purpose-built hardware to power Search. Our data centers are some of the most high-performing, secure, reliable, and efficient in the world. They've been purpose-built for training cutting-edge AI models and designed to achieve unprecedented improvements in efficiency. We have developed new AI models and algorithms that are more than 100x more efficient than they were 18 months ago. Our custom TPUs, now in their fifth generation, are powering the next generation of ambitious AI projects. Gemini was trained on and is served using TPUs. We are committed to making the investments required to keep us at the leading edge in technical infrastructure. You can see that from the increases in our capital expenditures. This will fuel growth in Cloud, help us push the frontiers of AI models and enable innovation across our services, especially in Search.

Google’s headcount declined QoQ, but capex as % of revenue increased to 14.9% in 1Q’24 which was highest since 3Q’19. Google seems to be balancing between headcount and emboldening their infrastructure investments.

Outlook

Google doesn’t provide guidance, but management did seem to hint at tougher comp ahead:

Looking ahead, two points to call out: first, results in our advertising business in Q1 continued to reflect strength in spend from APAC-based retailers, a trend that began in the second quarter of 2023 and continued through Q1, which means we will begin lapping that impact in the second quarter; second, the YouTube acceleration in revenue growth in Q1 reflects, in part, lapping the negative year-on-year growth we experienced in the first quarter of 2023.

...Q1 results reflect the benefit of leap year

Looking ahead, we remain focused on our efforts to moderate the pace of expense growth in order to create capacity for the increases in depreciation and expenses associated with the higher levels of investment in our technical infrastructure. We believe these efforts will enable us to deliver full year 2024 Alphabet operating margin expansion relative to 2023.

Valuation

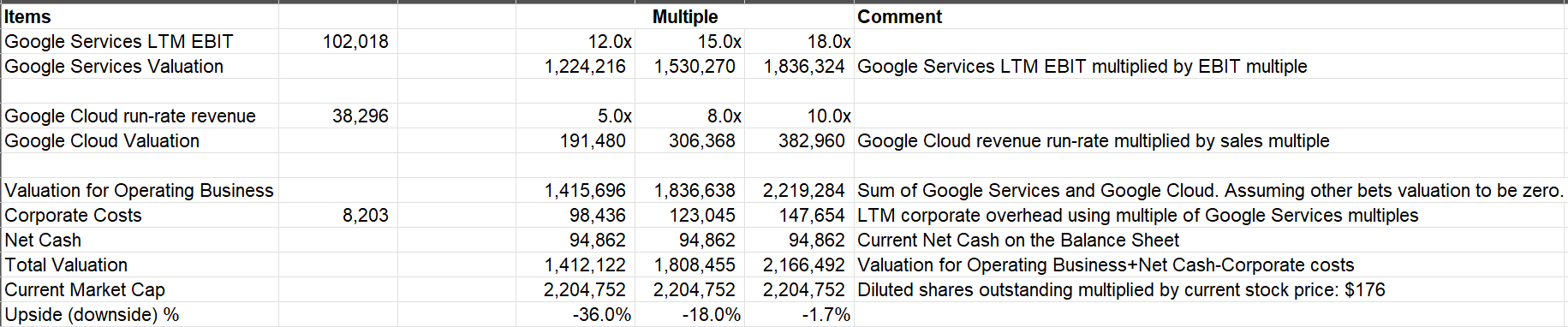

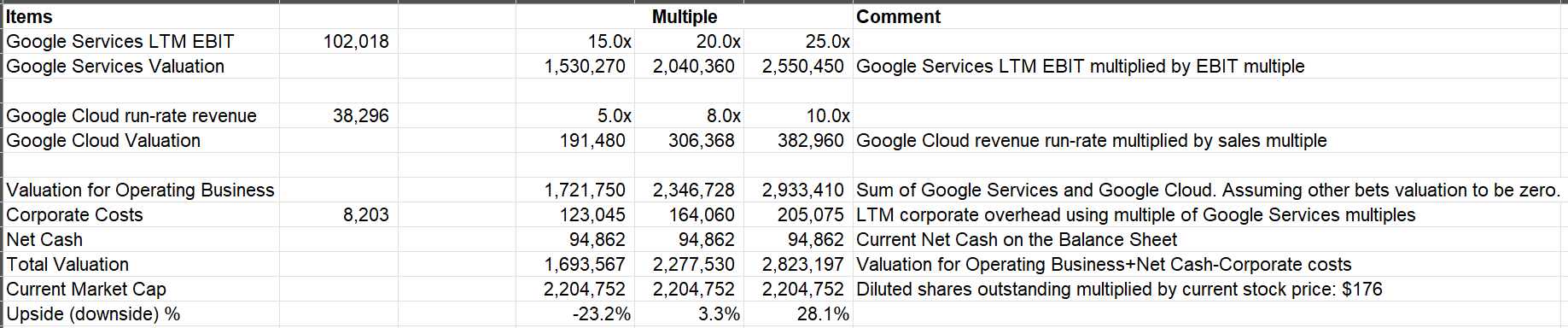

Since 3Q'22, I share the following valuation framework every quarter. For the first time since then, each of the following scenario indicates upside to be limited.

Market is likely valuing Google Service segment at ~20x LTM EBIT and the Cloud business at ~8-10x revenue multiple. I think it's fair to say despite plenty of bearish narrative around Google, it's hard to find figment of that in the financials. Management seems rather confident that early numbers indicate GenAI is not really a threat to Search economics. As a result, investors seem to be finally willing to embrace Google as one of the winners of "tomorrow".

While almost all big tech seem to be cruising along today, what matters for long-term investors is where each of these businesses will stand 5-10 years from now. I have mentioned this before, but would like to reiterate that understanding, assessing, and predicting competitive dynamics, moats, and durability of such moats for big tech remains quite a challenging task.

I will cover earnings of Amazon next week. Thank you for reading.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.