Amazon 1Q'24 Update

Disclosure: I own Jan 2025 $55 call options of Amazon

Now that Meta, Alphabet, Microsoft, and Amazon all reported their quarters, we now have better context to how their quarters went. So, while I will mostly discuss Amazon's earnings in this update, I will briefly touch on some broader themes as well.

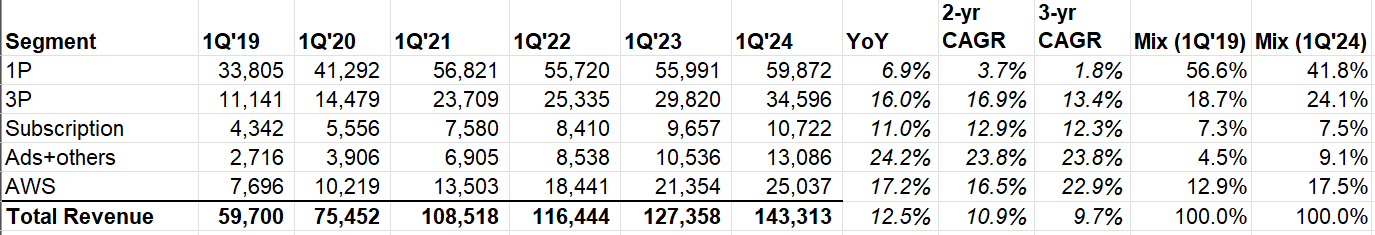

Revenue

Overall revenue was slightly below the high end of Amazon's guidance. However, once you adjust for the FX (~$700 mn adjustment), revenue was actually higher than high end of Amazon's guide last quarter.

It's interesting to note that while all of their businesses basically overcame the pandemic hangover, Amazon's 1P business (online +physical stores) is barely growing on 3-yr CAGR basis.

Apart from 1P which is also likely their least profitable segment, every single segment of their business is growing at a healthy rate. Both AWS and 3P are now >$100 Bn run-rate business and yet growing at high teen rates YoY.

While most people are focused on Gen AI's implications for AWS, it's interesting to see how this technology can be a boon for Amazon's 3P business as well:

We've recently launched a new generative AI tool that enables sellers to simply provide a URL to their own website, and we automatically create high-quality product detail pages on Amazon. Already, over 100,000 of our selling partners have used one or more of our gen AI tools

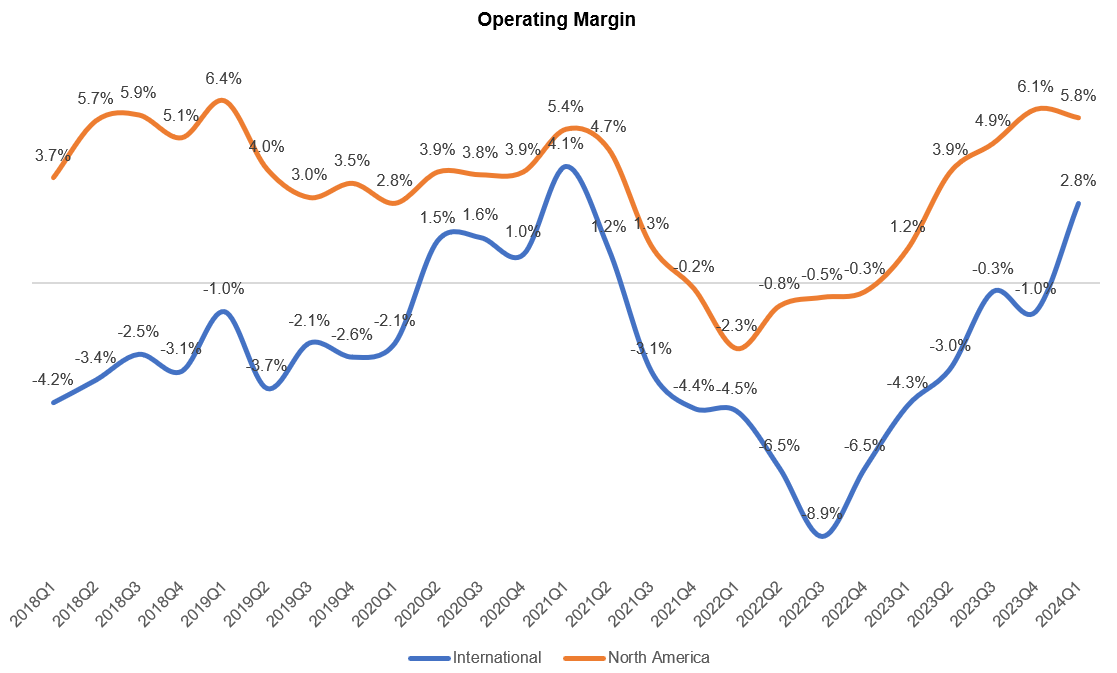

Amazon ex-AWS

While North America's margin slightly went down QoQ, it was still +5.8% in 1Q'24 vs +1.2% in 1Q'23. International segment's operating margin improvement was even more impressive as it went from -4.3% in 1Q'23 to +2.8% in 1Q'24. Ads was an "important contributor":

Advertising remains an important contributor to profitability in North America and international segments. We see many opportunities to grow our offerings, both in the areas that are driving growth today like sponsored products and in areas that are newer, like streaming TV ads.

While North America's operating margin got pretty close to pre-pandemic level, Amazon reminded that it should not be seen as a ceiling since advertising used to be much less of a contributor back then. With ads ramping up, these segments should be more profitable:

We look back to before the pandemic, and we say, first, we can achieve those operating margins even without the impact of advertising. And we're not quite there yet. But we're not limiting ourselves to that. We're looking for ways to, again, turn over every rock, look at every process and everything that we do on the logistics side and see how can we get our cost structure down and how can we get speed up and selection up.

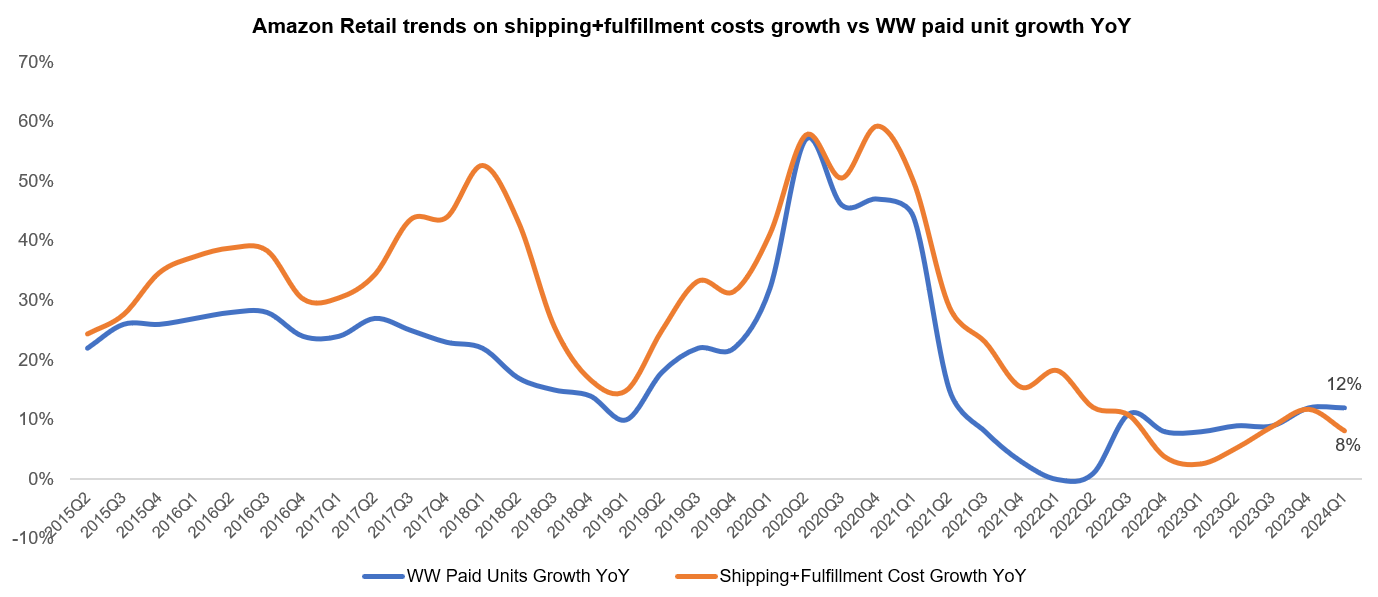

Fulfillment+ Shipping

Speaking of logistics, here are some highlights from on this topic from today's call:

In this past Q1, we delivered to Prime members at our fastest speeds ever. In March, across our top 60 largest U.S. metro areas, nearly 60% of Prime members orders arrived the same or next day. And globally, in cities like Toronto, London, and Tokyo, about 3 out of 4 items were delivered the same or next day..

As we further optimize our network, we've seen an increase in the number of units delivered per box, an important driver for reducing our cost. When we're able to consolidate more units into a box, it results in fewer boxes and deliveries, a better customer experience, reduces our cost to serve, and lowers our carbon impact..

If you look at worldwide paid unit growth vs shipping+ fulfillment cost growth, you would notice that the latter used to consistently outpace the former pretty much all the time since 2015 until 3Q'22. Since then, unit growth is faster (was at par in 3Q’23) than shipping+ fulfillment costs, indicating operating leverage in their logistics footprint.

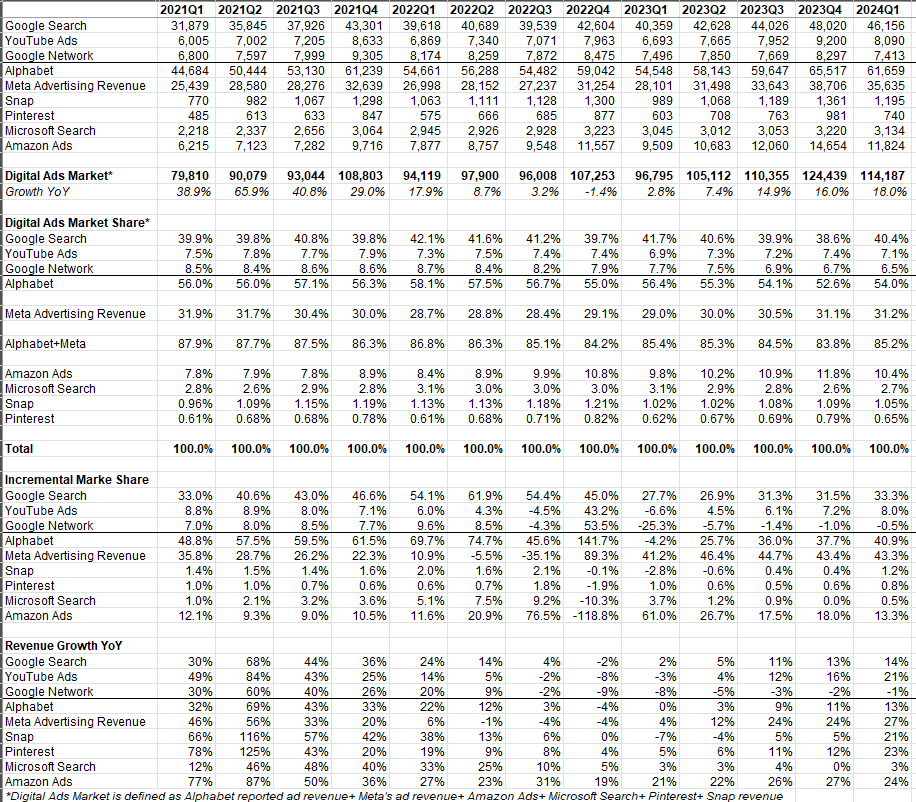

Advertising

For the first time in a long time, Amazon didn't grow its advertising revenue the fastest among the big three (Google, Meta, and Amazon). To be fair, Amazon didn't have as much of an easy comp as Meta did, so would discourage anyone from inferring much from this data.

While Meta has ~30% market share in digital ads (Note: see definition of "digital ads), it has taken >40% incremental ad dollars in the last 5 quarters. It will be interesting to observe how the next 5 quarters play out given their easy comp is now behind them. If Meta AI leads to some share in the bottom of the ad funnel thanks to high intent data from user chats, Meta's high incremental market share may persist even beyond their easy comp duration.

(Note: quite a few subscribers suggested me to include TTD in this table; while I wanted to do that, TTD hasn't reported their Q1 yet, so I will update it once they do)

AWS

Okay, now let’s talk about AWS.

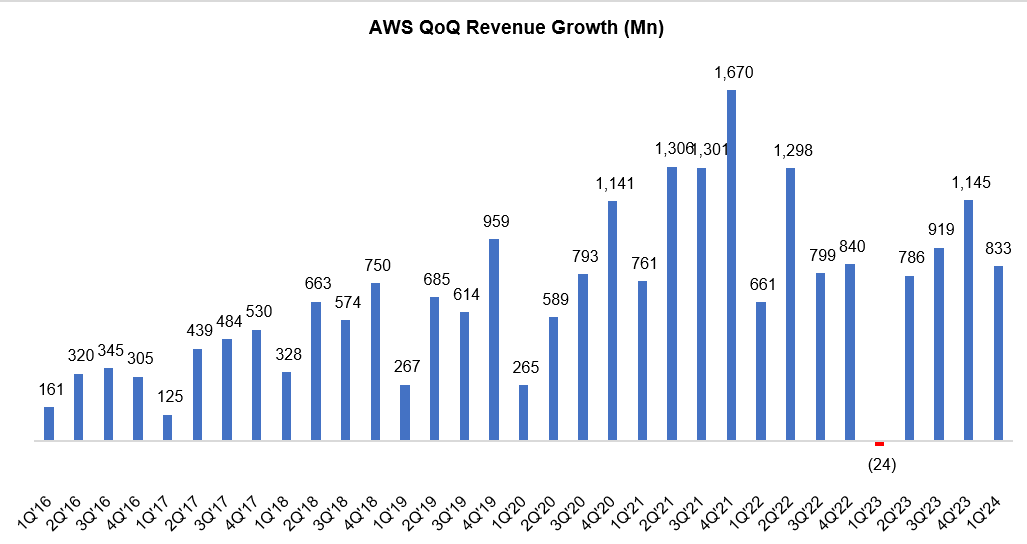

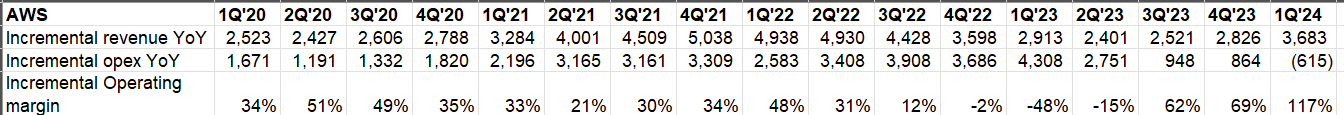

This was Amazon's best Q1 ever. If you notice last few years, historically incremental QoQ revenue in Q1 is generally the lowest. If that remains the case in 2024, this may prove to be a pretty robust growth year for AWS after digesting through last several quarters of "optimization" from their customers.

Azure vs Google Cloud vs AWS

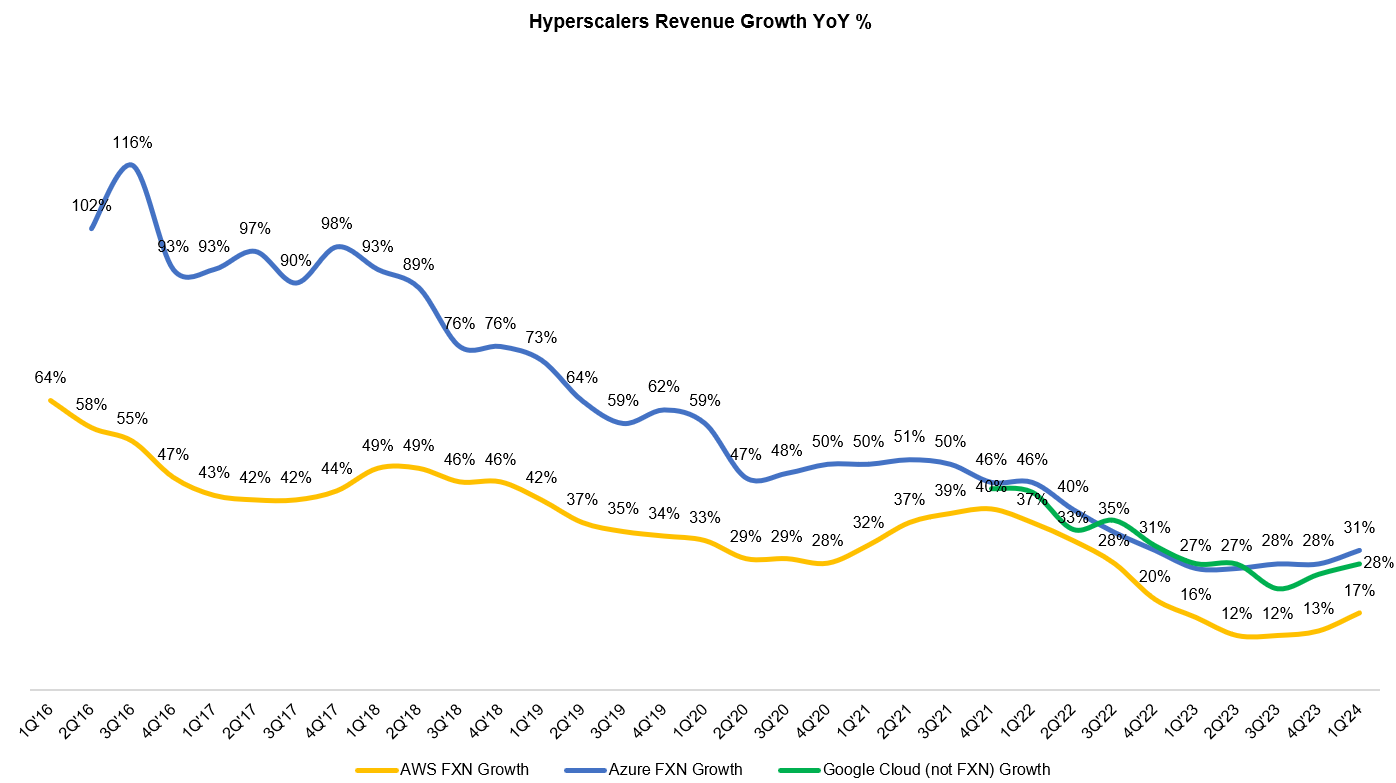

Amazon believes they continue to enjoy the highest absolute growth over their competitors (hard to validate since others don’t disclose exact numbers):

It's useful to remember that year-over-year percentages are only relevant relative to the total base from which you start. And given our much larger infrastructure cloud computing base, at this growth rate, we see more absolute dollar growth again quarter-over-quarter in AWS than we can see elsewhere.

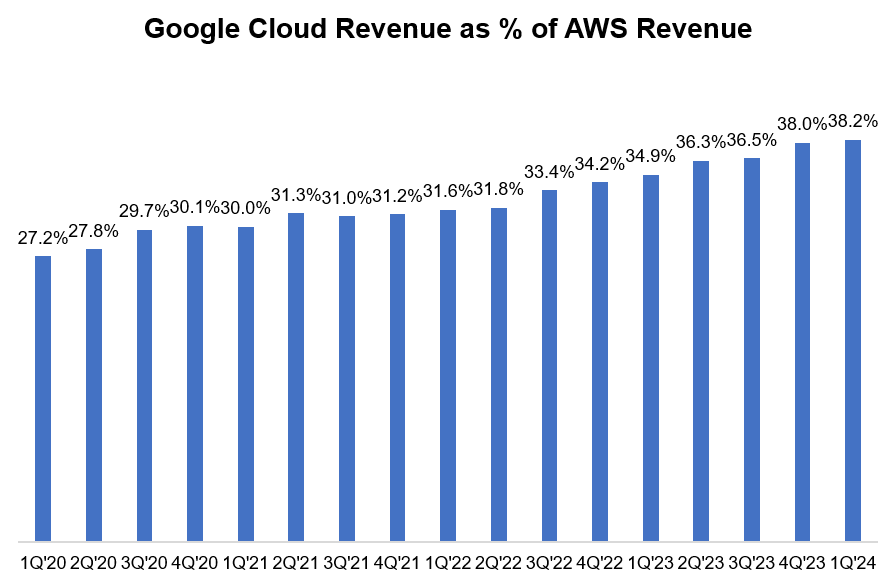

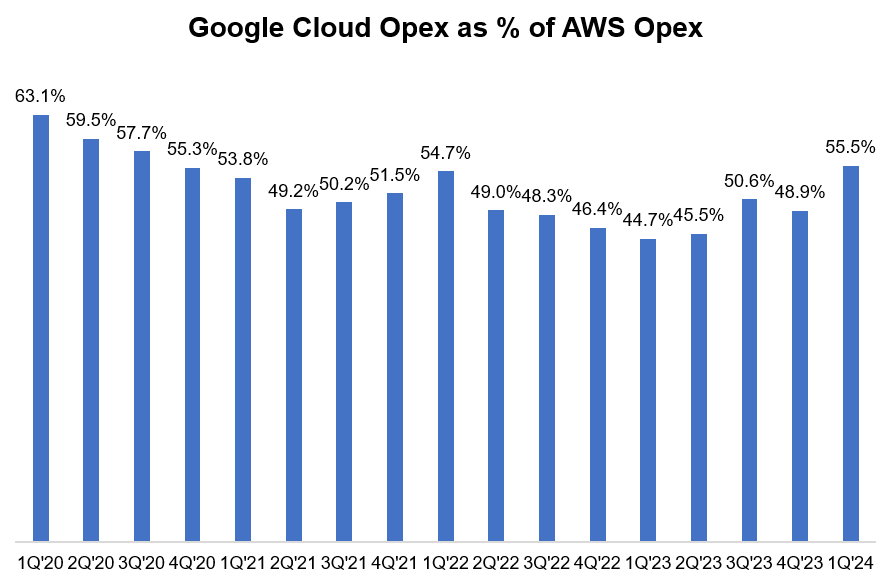

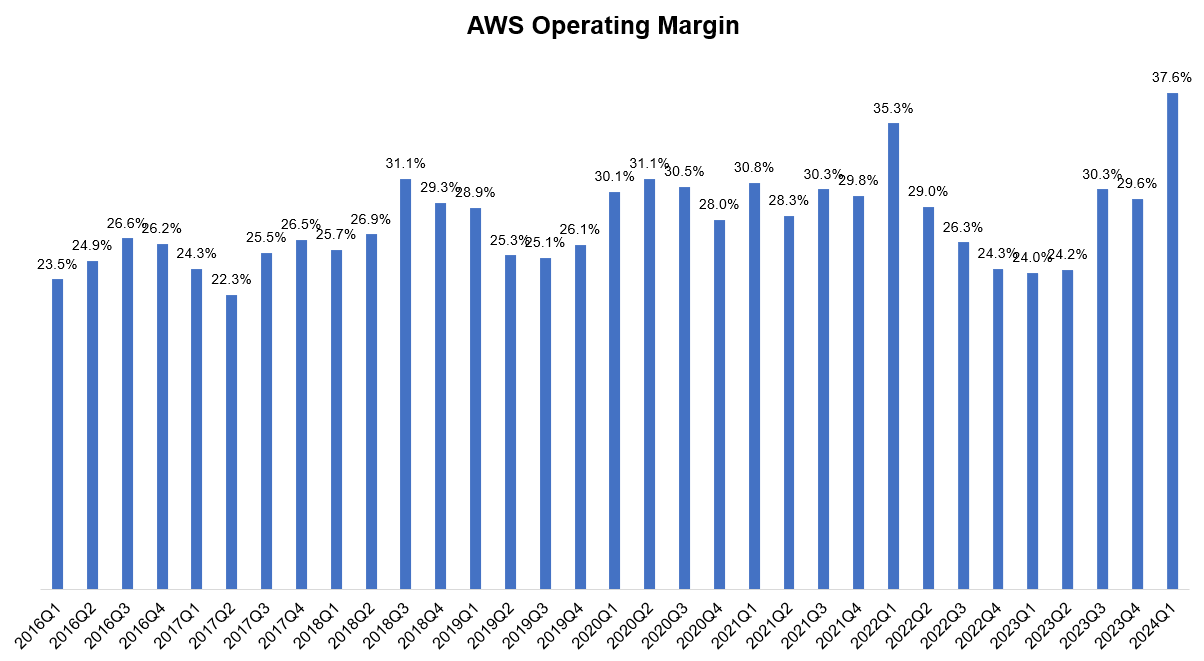

One thing I would like to track is Google Cloud’s operating performance trajectory against AWS. While Google Cloud’s revenue somehow managed to maintain its gradual momentum against AWS, opex trajectory went to the opposite direction. That may be less of a fault by Google Cloud and more of a credit to AWS. But do remember that given Google Workspace is likely higher margin segment within Google Cloud, GCP's economics is likely considerably worse than AWS and may have plenty of catch up to do in the future.

Nonetheless, the reason I was saying Google Cloud's opex trajectory is likely less of a fault on their part is AWS opex actually declined YoY while their revenue increased by ~$3.7 Bn, which led to an eye-watering operating margin of ~38%. Don't get used to such margins though as AWS expects to ramp up their capex materially going forward which will lead to higher depreciation and lower margin initially but will get to normalized margin once the utilization improves:

We expect the combination of AWS' reaccelerating growth and high demand for gen AI to meaningfully increase YoY capital expenditures in 2024, which given the way the AWS business model works is a positive sign of the future growth. The more demand AWS has, the more we have to procure new data centers, power and hardware. And as a reminder, we spend most of the capital upfront. But as you've seen over the last several years, we make that up in operating margin and free cash flow down the road as demand steadies out. And we don't spend the capital without very clear signals that we can monetize it this way.

...in Q1, we had $14 billion of CapEx. We expect that to be the low quarter for the year...And we continue to see strong CapEx performance in our stores business. Most of that will be related to modest capital or capacity increases in addition to our same-day fulfillment network and some Amazon Logistics upgrades to the fleet. But for the most part, what you'll see is really going to be on the AWS side.

Some other interesting tidbits on AWS from the call:

...companies have largely completed the lion's share of their cost optimization and turned their attention to newer initiatives. Before the pandemic, companies were marching to modernize their infrastructure, moving from on-premises infrastructure to the cloud to save money, innovated at a more rapid rate, and to drive more developer productivity. The pandemic and uncertain economy that followed distracted from that momentum, but it's picking up again. Companies are pursuing this relatively low-hanging fruit in modernizing their infrastructure.

...We see considerable momentum on the AI front where we've accumulated a multibillion-dollar revenue run rate already.

today, we announced the general availability of Amazon Q, the most capable generative AI-powered assistant for software development and leveraging company's internal data.

...I think the thing that people sometimes don't realize is that while we're in the stage that so many companies are spending money training models, once you get those models into production, which not that many companies have, but when you think about how many generative AI applications will be out there over time, most will end up being in production when you see the significant run rates. You spend much more in inference than you do in training because you train only periodically, but you're spinning out predictions and inferences all the time.

...we see both training and inference being really big drivers on top of AWS. And then you layer on top of that the fact that so many companies, their models and these generative AI applications are going to have their most sensitive assets and data. And it's going to matter a lot to them what kind of security they get around those applications. And yes, if you just pay attention to what's been happening over the last year or 2, not all the providers have the same track record. And we have a meaningful edge on the AWS side so that as companies are now getting into the phase of seriously experimenting and then actually deploying these applications to production, people want to run their generative AI on top of AWS.

Opex+Capex

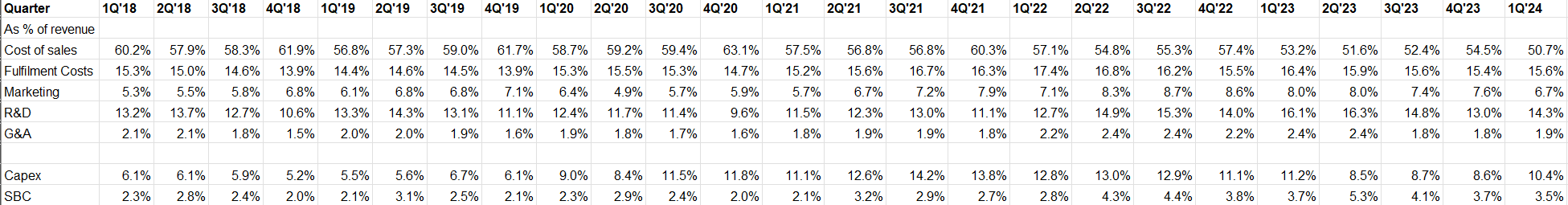

I would caution readers from getting too excited about Amazon's higher gross margins in 1Q'24 since the cost of sales for AWS is actually reported within R&D (or as they say "Technology & Content"). As a result, we don't really know for sure what Amazon's gross margin is. However, looking at its cost of sales as % of revenue and AWS reported operating margin, it is perhaps safe to assume that its gross margin is indeed improving (but just wanted to remind that the lack of hard data as evidence).

Just like other big tech, Amazon's capital intensity has also gone up materially with their increased scale. However, given much of the current capex cycle is driven by AWS which has a pretty high visibility to attractive ROIC, I very much applaud this capex.

Other Bets

What I like less and less is complete lack of disclosure or even paltry discussion on Amazon's "other bets" (i.e. Alexa, Kuiper et al) in their earnings call.

Outlook

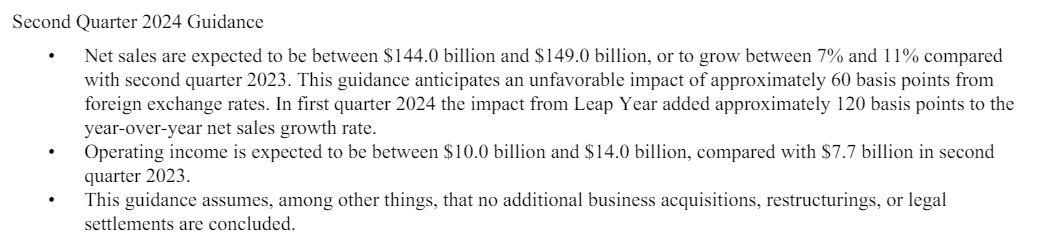

Amazon’s guidance for 2Q’24 is below:

One thing Amazon highlighted in the call while discussing the guide is they are seeing Europe to fare worse than the US in the current quarter:

As part of our guidance considerations, we also continue to keep an eye on consumer spending and macro level trends, specifically in Europe, where it appears to be a bit weaker relative to the U.S.

For more in-depth valuation discussion of Amazon, see my analysis here (February, 2024).

Please feel free to share with your friends and network. Thank you for reading.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.