Spotify 1Q'23 Earnings Update

Disclosure: I own shares of Spotify

Over the last 6 months, Spotify stock has doubled. The business, however, remains largely work-in-progress with users accelerating but operating efficiency yet to reflect in the financials.

Here are my notes from today’s earnings.

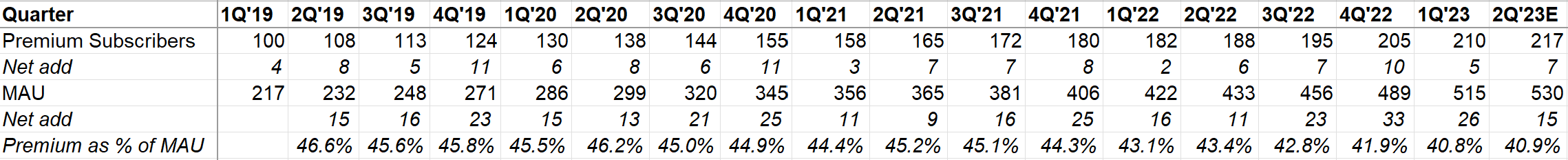

Users

Spotify experienced its largest two MAU growth (mn) quarters in its history for two consecutive quarters. Management mentioned they’re seeing an acceleration in MAU retention, higher DAU/MAU, and lower churn. MAU was 15 mn ahead of guidance!

“retention is higher, the DAU over MAU is higher than before, and the actual engagement is higher. And that's across music, but it's certainly true on podcasting as well. And we've seen a healthy trend sort of up to the right on podcasting for now many, many, many quarters. And we're seeing how both podcast and music is acting in great symbiosis together to drive an overall healthier user funnel on Spotify.

…The strength was broad-based, and we had record Q1 net additions across nearly all age demographics in both developed and developing regions.”

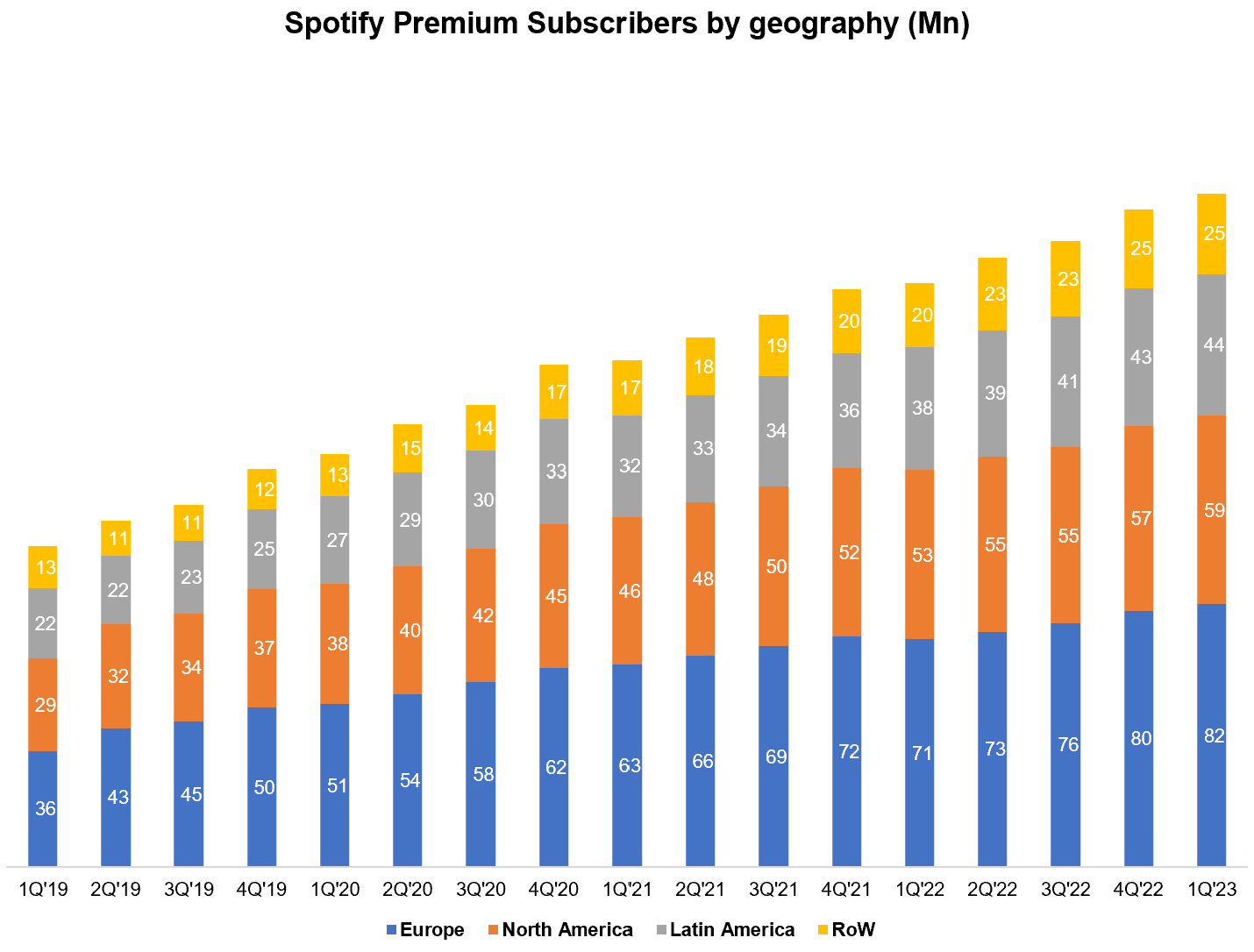

Premium Mix

Premium as % of MAU went down over the last 4-5 years as Rest of the World (RoW) region in the MAU mix went from 13% in 1Q’19 to 28% in 1Q’23. RoW MAU basically doubled in two years and it usually takes time to convert MAU to premium. Spotify thinks recent MAU momentum usually bodes well for future premium subscriber growth.

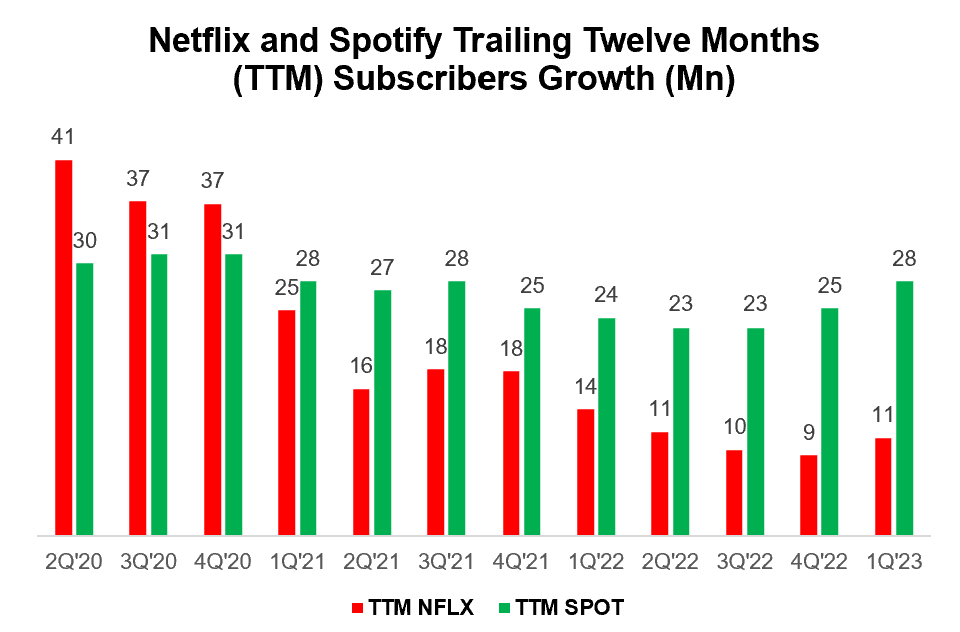

Netflix vs Spotify

This is something I track every quarter. The divergence between Netflix and Spotify premium subscriber trend continues to widen every quarter.

I should mention that definition of subscriber of NFLX and SPOT is not apple-to-apple, so I would caution not to infer more than what this data can tell us.

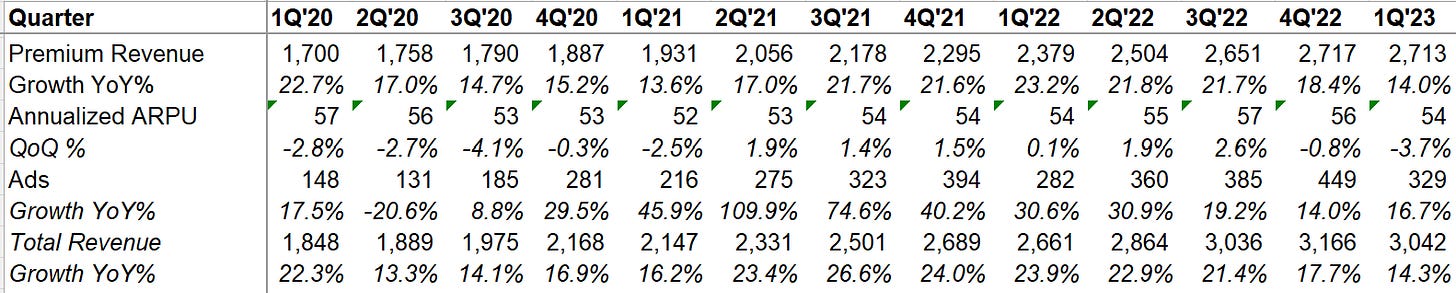

Revenue

While user growth kept surprising for two quarters, ARPU has been negative for two consecutive quarters. Spotify admitted the recent acceleration of subscribers may be marginally helped by being a lower cost provider (vs competitors most of whom raised price recently)

The primary driver for negative QoQ ARPU growth was higher mix of family/duo plans.

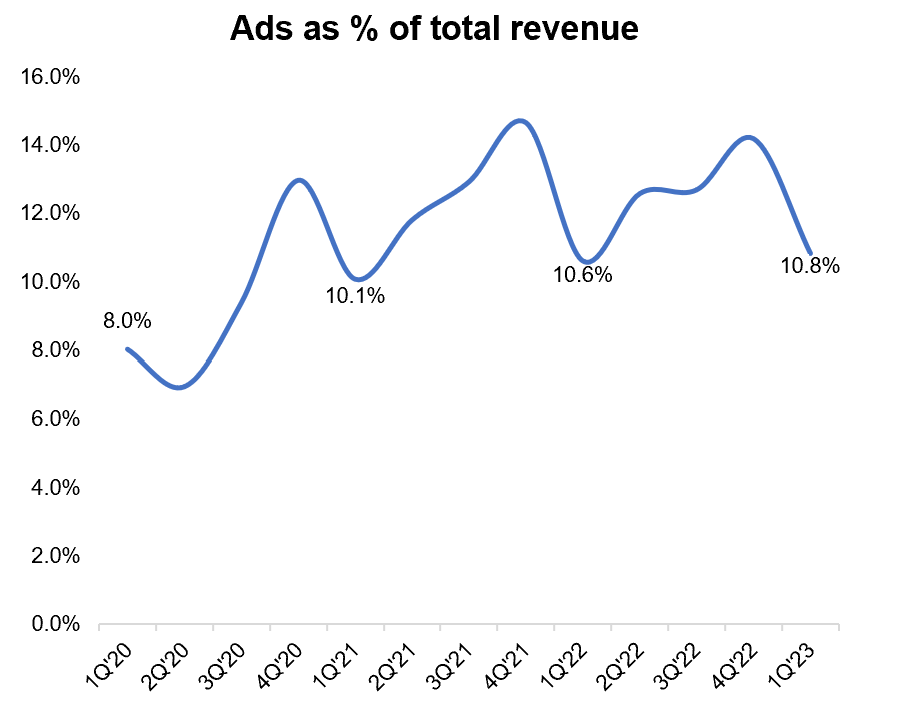

While ads growth is higher than premium segment, things aren’t quite moving as fast as investors would like.

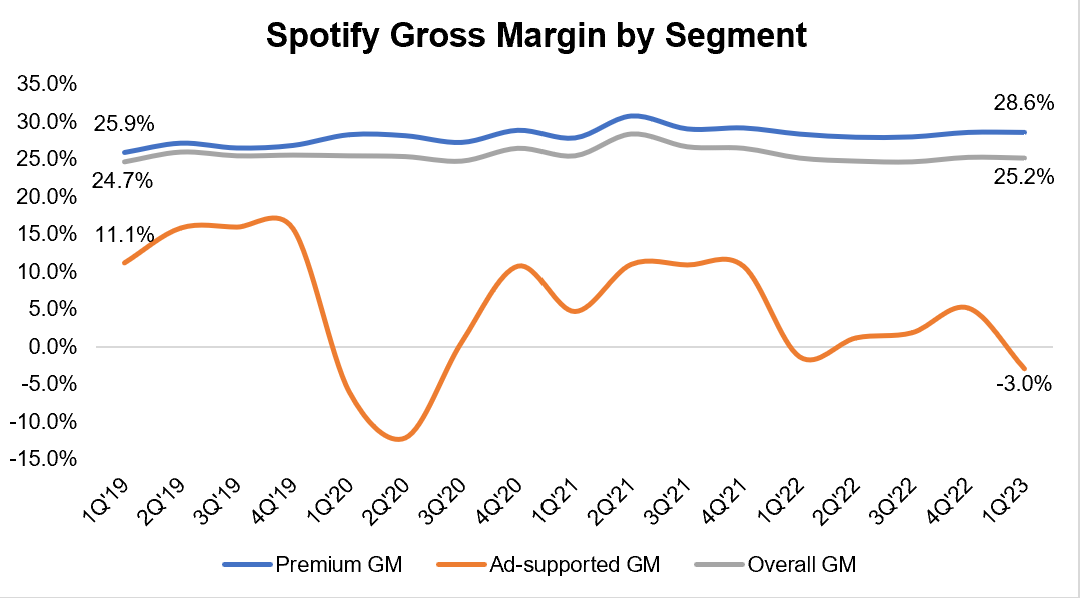

Gross margin (GM)

Spotify guided 24.9% GM this quarter, so the actual GM came out ~30 bps higher. Ad’s GM was -3% in 1Q’23 (vs -1.4% in 1Q’22).

Building a negative gross margin segment when the primary investor concern about Spotify’s music business is GM is what you call “fate loves irony”.

Content Cost

The primary culprit for negative gross margin in ads is, of course, the podcast related investments which Spotify has vowed to take a much closer look:

we're going to be very diligent in how we invest in future content deals. And the ones that aren't performing, obviously, we won't renew. And the ones that are performing, we will obviously look at those on a case-by-case basis on the relative value. And I would say 2 things here. One, we have very sophisticated tools for measuring impact on the platform where we talked about this at the Investor Day, where we do understand the relative impact on lifetime value in our subscribers and so on and so forth. I think that helps us paying a fair price or understanding what a fair price would be. But then the second part also, because we are now the largest podcasting platform, that means we have a great opportunity to amortize across a larger base. So relative to someone that's smaller, we should be in a better position should we want to renew a deal because we obviously can amortize that against a larger base of users.

Opex

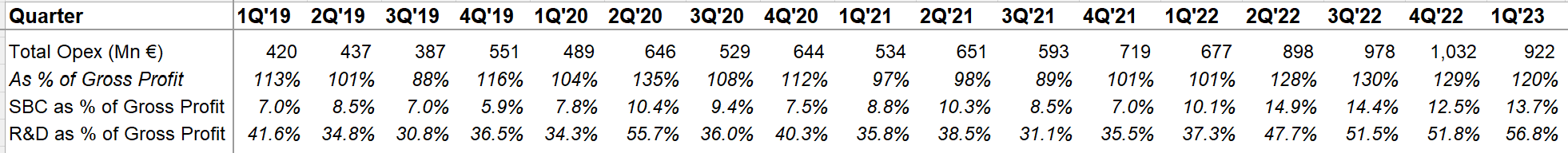

Spotify had €41 mn severance related charge in opex (€44 mn overall, but even if we subtract one-off charges, opex as % of gross profit would be 115%. That’s obviously not sustainable.

R&D as % of gross profit increased from mid-30s in 2021 to above 50% in the last three consecutive quarters. Spotify needs to gain leverage on its cost base. With AI in the horizon, I wonder if any material leverage may be hard to come by anytime soon.

AI

Speaking of AI, it does seem Spotify is likely to be beneficiary as music content creation process can get materially easier thanks to AI:

…to caution everyone, this is very early days, and it's an incredibly fast developing space. As I mentioned before, I don't think I've ever seen anything like it in technology, how fast innovation and progress is happening in all the really both cool and scary things that people are doing with AI at the moment. But I think it's important.

I guess on the risk side would be not just for Spotify, but I think for our -- the entire creative ecosystem is obviously the question around copyrights and who owns what copyrights and what the fairway would be to attribute value when you're doing things in name and likeness situations or inspired [ by a certain ] artist, et cetera. I think the whole industry is trying to figure that out and trying to figure out training -- and I would definitely put that on the risk account because there's a lot of uncertainty, I think, for the entire ecosystem.

But on the positive side, to flip on that for a moment because I don't think that's been as highlighted as part of the story. One, I think this could be potentially huge for creativity on the positive side. I go in and talk a little bit more in detail about this on our -- for the record podcasts.

If you really think about it, with now these conversational interfaces, it will allow people that perhaps don't know anything about how to play a music or even know these complex music production software tools to now create just using their voice, instruct the AI to make something to sound a little bit more upbeat, make something sound a little bit more like add some into the mix when you're creating a drum pattern or something like it. And that has the chance, I think, to meaningfully augment that creative journey that many artists to do. And you could even imagine someone just humming something and then the AI helping you out by creating a backdrop that you then can add it and alter, which is the music sort of software environment that many producers and music creators are doing. And that should lead to more music. And that more music, obviously, we think it's great culturally, but it also benefits Spotify because the more creators we have on our service the better it is and the more opportunity we have to growing the engagement and growing the revenue. So that would be on the upside, which a lot of people aren't talking about. And then, of course, there's entirely new potential products that perhaps can happen where you can have users creating their own music and perhaps Spotify could be a conduit of that, but I think it's way too early to speculate on those types of things at present moment. .

Outlook for 2Q'23

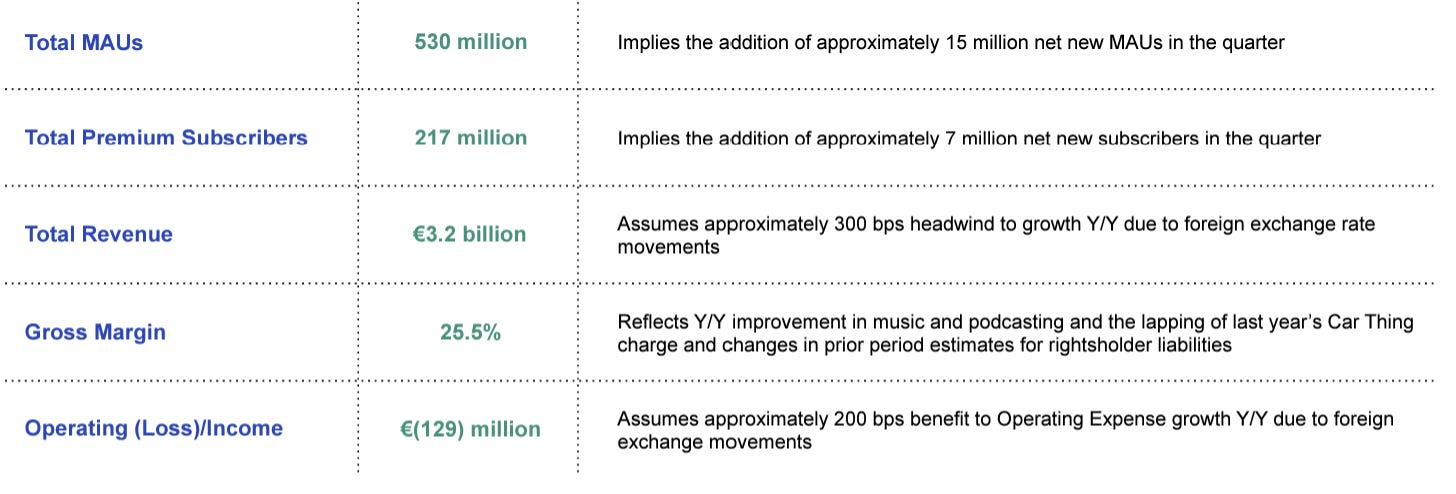

In Q2, Spotify is assuming 300 bps FX headwind; FXN topline growth is expected to be 14%. They do expect a steady ramp in gross margins throughout 2023 as well as sequential improvements in our operating loss.

You can read my Spotify Deep Dive (December, 2021) here

I will cover Alphabet’s earnings tonight!