Shopify 4Q'22 Earnings Update

"If you look at our 7 years since IPO, we were profitable 5 out of the 7."

-Harley Finkelstein (4Q'22 Call)

Except that's not true! Shopify was profitable only 2 out of 7 years since IPO. Perhaps he was adding back SBC?

You can add back SBC if you want, but you cannot add back SBC and then define it as "profitable".

Let's look at my other highlights from the call.

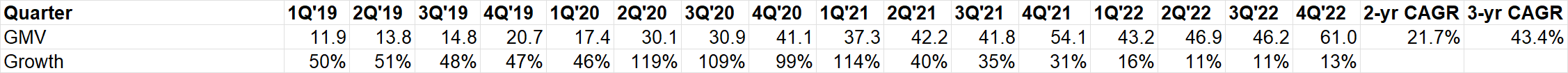

GMV

GMV grew +13% YoY (+17% FXN) vs US retail growth of +6%. Tough comps, and 3-yr growth shows pretty robust 43% CAGR.

At $197 Bn GMV in 2022, Shopify has ~10% penetration in the US e-commerce market.

During Black Friday, 52 mn (+12% YoY) consumers bought from brands powered by Shopify.

Off-line GMV was +25% YoY in 4Q'22; +40% in FY'22.

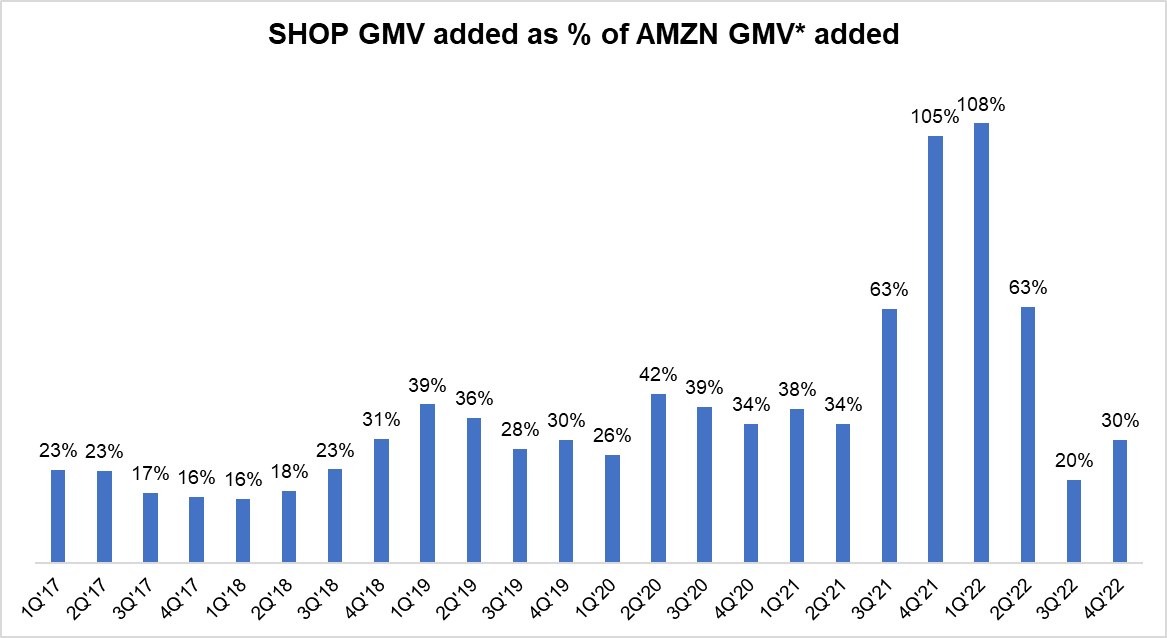

Amazon vs Shopify

One metric that I like to track is how Shopify's GMV growth $ fares against estimated Amazon's GMV add. After some significant momentum in 3Q'21-2Q'22, this number came down to closer to 2019-1H'21 level.

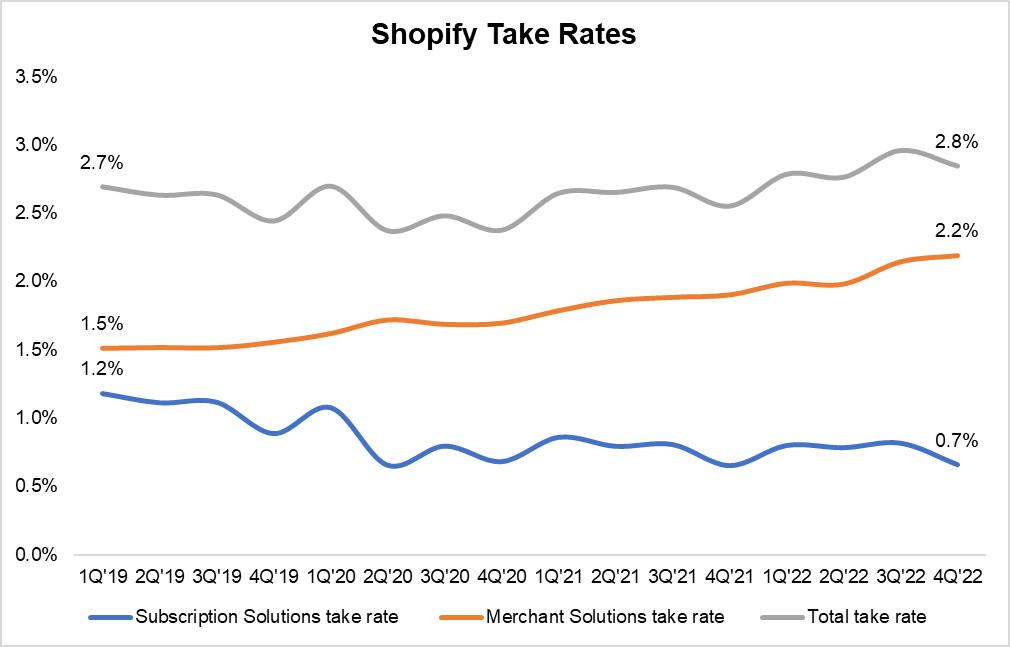

Take rates

While take rates for merchant solutions increased from 1.5% in 1Q'19 to 2.2% in 4Q'22, overall take rates remains largely static over the same period.

Shopify recently raised prices for its monthly subscription plans by 33%; while it went into effect immediately for new merchants but will take effect on April 23 for existing merchants.

In the US, there were 4 mn new business applications on an average per year during 2015-2020. In 2021 and 2022, that number has been 5 mn/year which is a good sign for Shopify.

Contribution from our Plus merchants to total MRR increased year-over-year to 33% from 29% in Q4 of 2021 as larger volume brands join the platform and thousands of additional retail locations began using Point-of-Sale Pro.

For 2022, our MRR per merchant remained relatively consistent with 2021, excluding those on our free and paid trials. We expect to see some incremental benefit to MRR in 2023 from the pricing changes we announced last month.

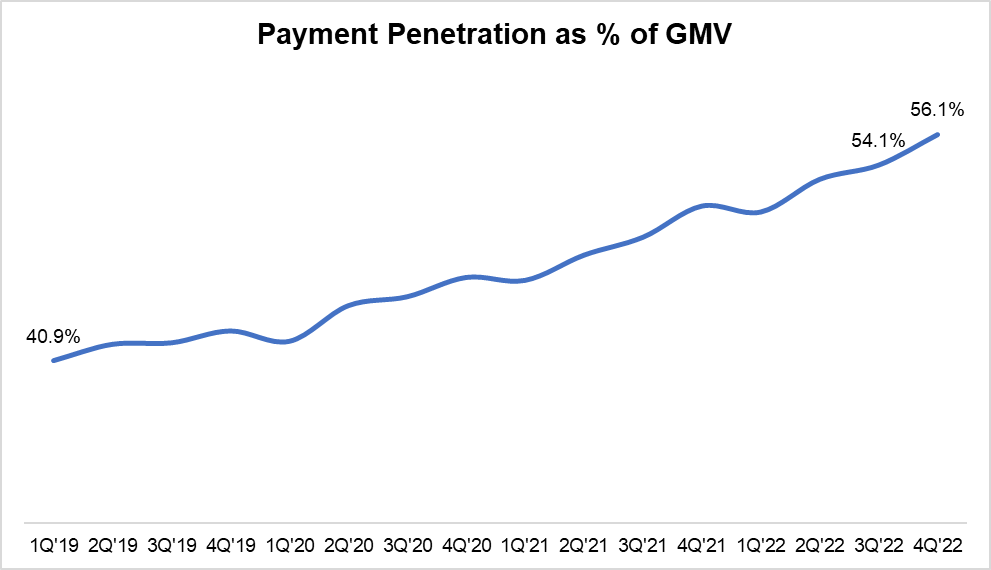

Payment penetration

Shopify Payments continues to march forward as penetration increased from 41% in 1Q'19 to 56% in 4Q'22.

Shop App

Lots of interesting details about Shop App; Shopify clearly has larger ambitions about this in the long-term:

Since we introduced the Shop App in early 2020, it has grown from an accelerated checkout and order tracking utility to become an important driver of many of our merchants business performances. Shop gives merchants new ways to stay connected with their buyers like in-app offers and notifications when their favorite products are back in stock. In a nutshell, Shop enables a Shopify merchant on their first day to have a storefront in a native mobile app. That's very powerful.

In 2022, we shipped dozens of enhancements to Shop, including discounts and expanded search function, personalized shopping experiences and embedding Shop Cash, our loyalty program that is currently in early access. With tens of millions using the app every month, we're able to match the right merchants to the right buyers, creating personalized shopping feeds for the buyer segment and a new customer acquisition tool for merchants.

Shop is still in its early days, but it's one of the ways we're investing to help merchants win over the long term. A key feature of the Shop App is Shop Pay, our accelerated checkout feature that continues to commerce better for merchants and buyers alike. With well over 100 million buyers opted into Shop Pay, our accelerated checkout facilitated $11 billion in GMV in Q4 and a cumulative $77 billion at year-end since its launch in 2017.

International

One area where Shopify may outpace Amazon over time is international markets. 45% of its merchants now based outside of North America generating 27% of revenue. Shopify Payments is now available in 22 countries; Point-of-Sale in 14 countries, Shipping in 7 countries, and Shopify Capital in 4 countries. Shopify advanced $400 mn (+21%) capital to merchants in 4Q'22.

Interesting stat about cross border transactions:

In 2022, Shopify enabled approximately $28 billion in cross-border sales, capitalizing on the surge of international interest, with nearly 28% of all traffic to Shopify stores coming from buyers outside of the merchant's home country.

New Products

Shopify discussed a few new products that they have recently launched: Commerce Components by Shopify or CCS, and Shopify Tax.

To kick off the year, we made a major announcement that we were launching our enterprise retail solution, Commerce Components by Shopify or CCS.

Shopify signed business partnership agreements with Accenture, Deloitte, Ernst & Young and KPMG to enable greater opportunities for larger brands to adopt Shopify

Also in Q4, we launched Shopify Tax, a new product offered to U.S.-based merchants that takes a stress out of sales by simplifying tax compliance. Early data shows that merchant adoption has ramped quickly, speaking to the trust that merchants have in Shopify. As we work to sell their toughest problems, our merchants are eager to utilize more of our products.

SFN

Over the past 6 months, we have made significant strides in integrating Deliverr into SFN. We're creating one unified network that enables data-driven inventory distribution and access to our logistics services. Compared to Q4 of 2021, we've seen a 40% increase in orders per merchant, while Deliverr has achieved over 50% growth in units fulfilled and more than doubled its services outside of fulfillment, services like freight, B2B, parcels and returns.

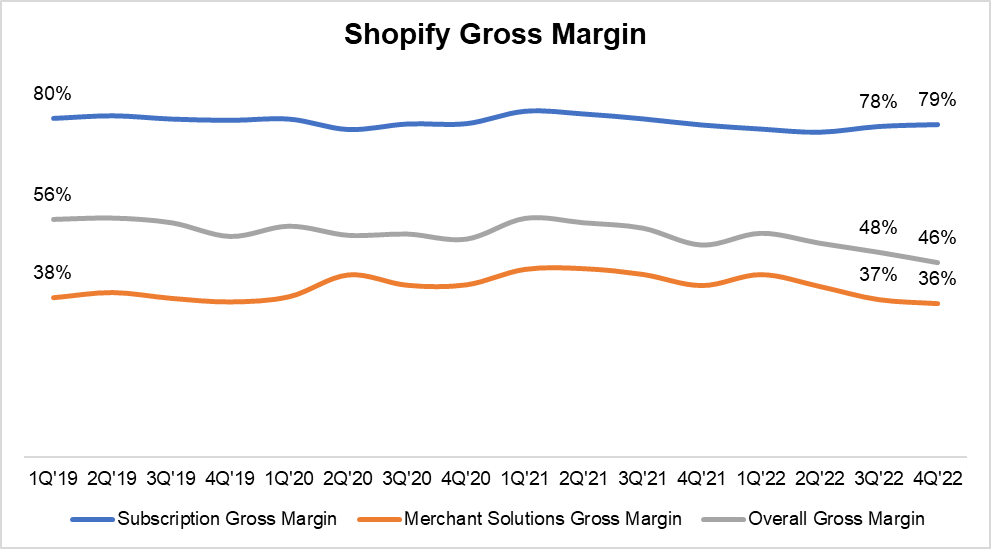

Gross Margin

Merchant Solution's gross margin continues to decline, primarily due to Payments and Deliverr both of which are likely lower margin business than overall reported margin.

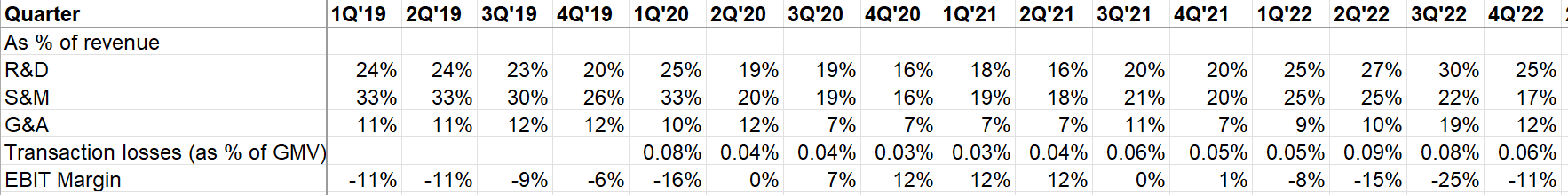

Cost structure

Shopify had one impairment charge of $84 Mn. it would still be unprofitable even if we adjust for that.

Adjusting one-off expenses, 4Q'22 opex was flat compared to 3Q'22. Interestingly, Shopify went through a process of benchmarking comp for their employees and decided to pay higher comp, primarily in R&D.

Outlook

...expect Q1 revenue to grow in the high teens on a year-over-year basis. We expect Q1 gross margin to be slightly higher than our gross margin for Q4 of 2022.

We believe that our Q1 operating expenses will be up in the low single-digit percentage versus our Q4 2022 operating expenses when excluding the onetime charges that we had in Q4. Stock-based compensation for Q1 is expected to be in line with Q4 of 2022. Finally, we expect that capital expenditures for Q1 will be in line with what we spent for the full year of 2022.

SFN will be "headwind to gross margin and a significant contributor to operating expenses in 2023. This impact on year-over-year comparability will be most prominent in the first half of 2023 given that the Deliverr acquisition closed in July 2022."

No update on Buy with Prime.

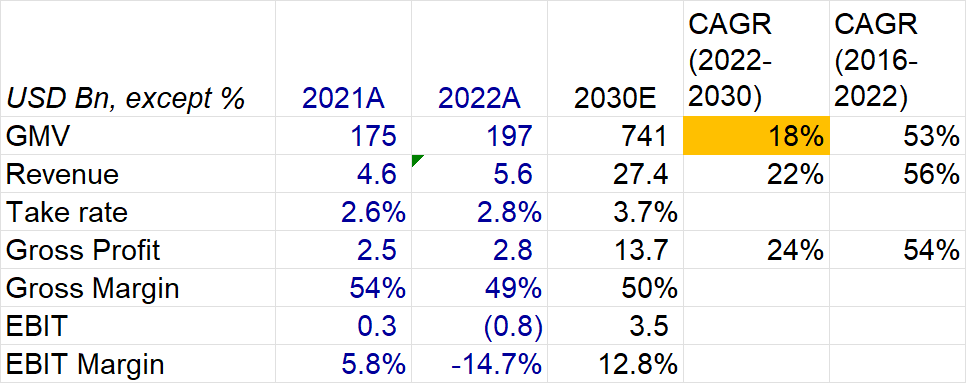

Valuation

I have recently sold my shares of Shopify. The last time I showed this valuation exercise, its EV was $30 Bn and you could make the case that despite Buy With Prime and SFN execution related risks, the risk-reward was likely to be quite favorable.

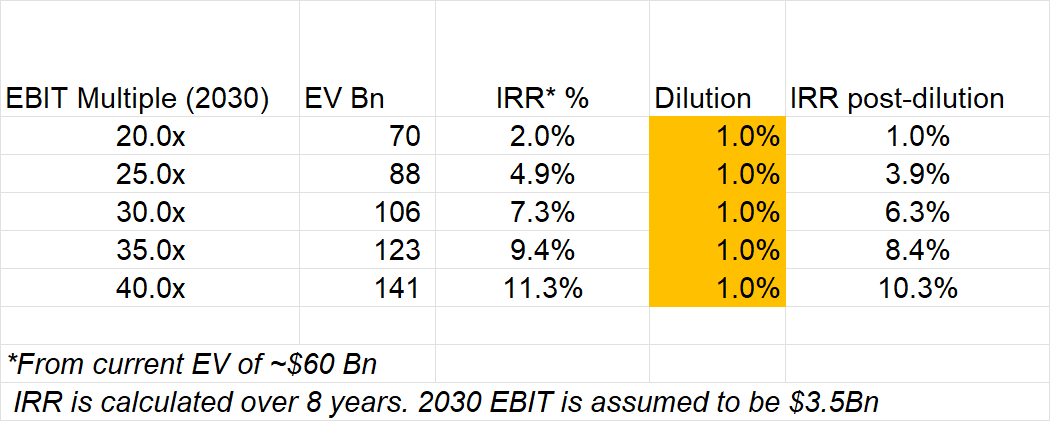

At $60 Bn EV today, it seems risk-reward is likely to be quite unfavorable. For context, if we assume 18% GMV CAGR in 2022-2030 (vs ~12% YoY growth in 2022) and increase take rate 100 bps (vs 26 bps increase over last 5 years), 50% gross margin, 15% S&M, 15% R&D, and 5% G&A, we get to $3.5 Bn GAAP EBIT (~13% margin).

You need to multiply that EBIT by 40x to get to ~10% IRR. At 20x, you get ~1% IRR. Of course, there are some optionality such as Shop App which, if it becomes massively successful, can change the math materially. At this prices, you probably need to start getting comfortable with valuing the optionality and hope the company defies the risk of Buy With Prime.

Thank you for reading!