Buying Puts on QQQ

I posted on X and Threads yesterday why I started buying some puts on QQQ. Since not all of my readers may be on X and Threads, let me share my thoughts with you as well. I have also edited a bit and expanded on a couple of points after receiving some feedback on X.

$440 QQQ Puts for January 2026

The current bull market has finally persuaded me to start buying some insurance for the eventual rainy days. While it’s just ~1% of my portfolio, it is an acknowledgement of the little upside that I see today. Let me put some of my thoughts into words.

Why $440 Puts? Since I paid ~$20 for these puts, I will breakeven at $420. For each $20 decline from $420, these options would be worth one double in $20 intervals. +100% at $400, +200% at $380, +300% at $360…you get the idea. Anything above $440 would make the options worth zero.

The reason I am not buying puts for ATM (At-the-Money) options is it’s psychologically not challenging to go through ~10-20% drawdowns. Having experienced 2022 drawdown, I know that it starts to become unpleasant experience when the drawdown extends beyond 20%. Food starts to taste bland at >30% drawdown. At >40% drawdown, you almost start suffering from apathy which is NOT good because ideally you want to remain excited to deploy capital at depressed prices. So, I have decided to give myself some psychological reprieve if we end up experiencing >20% drawdown.

So, in case QQQ goes down ~30% and my portfolio does the same (TBD), this ~1% put options would increase to become ~5% of my portfolio which I can potentially deploy at more attractive prices. ~5% may not seem much, but near the bottom, every inch of cash deployment counts.

Now, why might QQQ go down ~20-30% (or more)? Time for some blunt truth. I (neither does almost anyone) have no clue. It might be because inflation scare will come back, maybe deficit and/or stagflation concerns, AI investments can become earnings headwinds for mag7, or something much more catastrophic such as China invading Taiwan or some real regulatory challenge for Big Tech in the US/EU. Very few people (if any) could have accurately predicted Covid, stimulus driven demand, HSD inflation, supposedly taming of the said inflation etc. consecutively. But one thing is certain today: the multiples at the index level is now trading at nosebleed level.

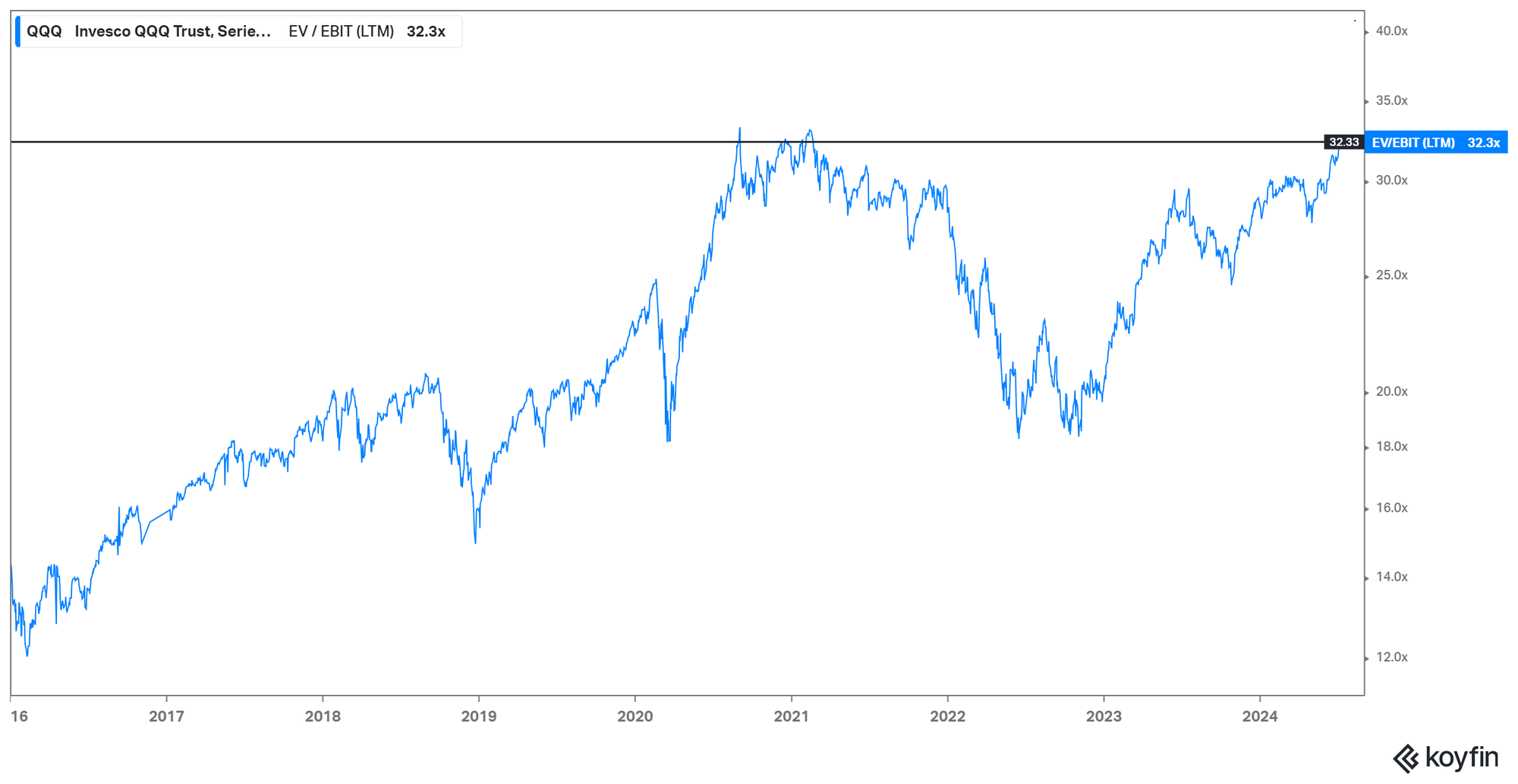

QQQ currently trades at ~32x LTM EV/EBIT multiple (LTM=Last Twelve Months; NTM=Next Twelve Months). For context, it bottomed at ~18x LTM EV/EBIT both in 2020 and 2022 drawdowns and at ~15x during 2018 drawdown. These are all the drawdowns I experienced first-hand since I started investing in the US in August, 2018. If we go beyond that, QQQ consistently traded below ~20x between 2016 and 2018. QQQ currently basically trades at 2021 peak LTM EV/EBIT multiple, and we got to go back to during 2000 tech bubble to find multiples higher than this. Given this context, I think not much needs to go wrong for these options to be a worthwhile bet.

I, however, do not want to have puts regardless of the market environment. My general framework is to have puts whenever QQQ trades at above >30x LTM EV/EBIT multiple (historically, it happened very rarely). So, if we go to 2026 and QQQ still trades at >30x LTM EV/EBIT and we don't have a compelling reason to think earnings is depressed for one-off reasons (think something like Covid), I will maintain ~1% puts in my portfolio. To put it differently, I am okay with losing ~1% of my portfolio per year to protect my downside a bit when index trades at a nosebleed valuation. If it trades at ~20x multiple, I will not have puts in that case.

Wait, shouldn’t we look at NTM? The reason I’m not looking at NTM numbers here is LTM numbers are facts whereas NTM is opinion. Having gone through 2020-2024 cycle, I have very little confidence on anyone’s ability to forecast NTM numbers with high accuracy. Moreover, data quality is a huge concern for me as analysts account for SBC for some companies (mostly big tech) in NTM numbers whereas for most other companies, they don’t. I wanted to avoid the black box of NTM numbers for index and decided to stick to LTM numbers. It’s a time series comparison anyway, so this isn’t a strong limitation.

Why not buying puts for SOXX? I think there are credible (although unlikely) scenarios where mag7 ex-NVDA would engage in an uneconomic GPU war with each other which might (temporarily?) wreck the economics of mag7 ex-NVDA more than SOXX constituents. Although I think it is more likely than not that both SOXX and QQQ would go up/down simultaneously, I wanted to keep it simple by buying puts for QQQ instead of getting too cute with SOXX.

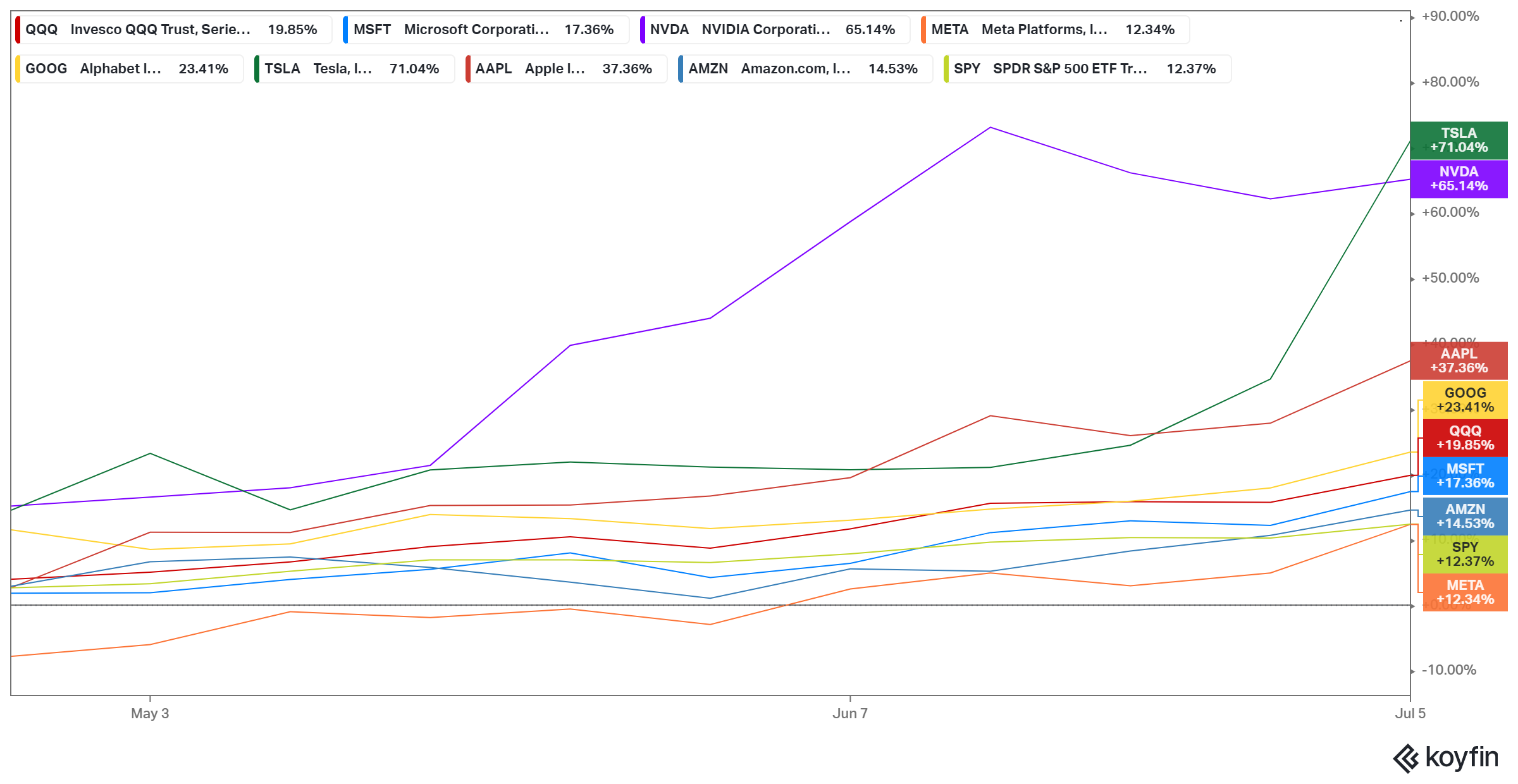

Isn't a static put options expiry a bit more risky than having a more dynamic expiry dates i.e. instead of buying Jan 2026 options, shouldn't I have multiple puts in multiple expiry dates? Perhaps, and I may still do it. To be very precise, these puts are 0.8% of my portfolio now and they're roughly ~18 months in duration. Since I am okay with setting aside ~1% on puts per year, I can potentially add ~0.3-0.4% more of these puts in my portfolio. I will perhaps do that if QQQ has another ~10-20% rally in the next 6-12 months, so I have some additional capacity left here. Some people wonder whether there is upside risk to QQQ as bears may all just give up simultaneously. In some sense, I think it has already happened in last 2.5 months? Of course, it can always continue moving higher which is why I have some tiny capacity left.

Why Jan 2026? Timing is the most challenging aspect of options and there aren’t, unfortunately, compelling answers. Index is unlikely to go down ~30-40% in 3 months (unless China invades Taiwan of course), so I wanted to give it “enough” time for the index to go down and minimize my timing risk a bit. Also 12 months is probably enough time if market decides to get nervous about the new administration’s regulations, plans for spending etc.

Shouldn't we just raise some cash if QQQ is overvalued, especially in a world with ~5% yield on cash? I do have ~6% cash right now and I expect myself to save at least ~10% of my current portfolio in the next 12 months. So, while it may make a lot of sense for someone else depending on their personal context, it makes more sense to me to add an instrument that provides some torque in the upside if index does go down.

Okay, that’s the rough sketch. If these options expire worthless, I am probably not terribly unhappy since it likely means 99% of my portfolio may do just fine. If it becomes worth multiple of what I paid for these put options, I will feel psychologically lot better to have owned at least some insurance for the rainy days. Ultimately, investing is, more often than not, a psychological sport.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.