Oracle: Ellison's Voyage to Software and Beyond

You can listen to this Deep Dive here

(Note: while I usually use my own AI voice to narrate the Deep Dive, I have decided to use a "professional AI voice" and utilized a different AI tool this time. It's better.)

“Why do we do these things? George Mallory said the reason he wanted to climb Everest was because ‘it's there’. I don't think so. I think Mallory was wrong. It's not because it's there. It's because we're there, and we wonder if we can do it.

…It's hard for me to quit when I'm losing—and it's hard for me to quit when I'm winning. It's just hard for me to quit. I'm addicted to competing.”

-From the book “The Billionaire and the Mechanic: How Larry Ellison and a Car Mechanic Teamed up to Win Sailing s Greatest Race, the Americas Cup, Twice”

This addiction to competing even for the sake of it has served Larry Ellison, the Co-founder of Oracle, exceedingly well in life. Ellison, along with Bob Miner and Ed Oates, started Oracle with just $2,000 in 1977; Larry contributed $1,200. They never raised money from venture capital and Ellison was largely allergic to raise equity. As a result, Ellison still owns ~42% stake in Oracle which is currently worth ~$220 Billion.

While working at Ampex, Ellison came across a research paper authored by an IBM employee named E.F. Codd in 1970. The paper introduced the relational model for databases, which revolutionized how we organize and access data. Before this, databases were structured like rigid hierarchies or networks, making them inflexible and requiring users to understand complex data organization. Codd proposed representing data as simple tables (relations) with rows and columns, where each column represents a domain (type of data) and each row contains related values. The paper explained how this simpler model eliminates three major dependencies that plagued earlier systems: ordering dependence (how data is physically stored), indexing dependence (how data is looked up), and access path dependence (how data relationships are navigated).

Ellison thought it was a profound insight, and decided to start a company named “Software Development Laboratories” or SDL with two of his cofounders-Bob Miner and Ed Oates. Ellison was, however, still working at Ampex, but managed to secure a $50,000 contract from the CIA to build a database program. “Oracle” was the codename for this CIA project; it was meant to be able to answer any question about anything, similar to the classical meaning of an oracle as a source of wisdom and predictions.

Later, they changed the company name to Relational Software Inc. or RSI in 1979. In the same year, Oracle released their first version of Database. Ellison believed that customers would be skeptical about purchasing a Version 1 product since first versions are often perceived as untested or incomplete. By starting with “Version 2”, Oracle positioned their database as a more mature and reliable solution, suggesting that the product had already undergone revisions and improvements, even though there was never actually a publicly released Version 1.

By 1983, the company finally changed its name to “Oracle”.

You may be wondering why IBM itself wasn’t pursuing this revolutionary idea at full force at that time given the paper that inspired Ellison was written by an IBM employee.

IBM was initially reluctant to implement Codd's relational database model primarily to protect their revenue from their existing hierarchical database product called IMS Database. IBM viewed Codd’s concept as merely an "intellectual curiosity" that could potentially undermine their existing products. In response to IBM's resistance, Codd started demonstrating the value of his model directly to IBM's customers, who then subsequently pressured IBM to implement it. IBM's cautious approach and focus on their mainframe business meant they were late to fully embrace the relational database market, releasing their first commercial product SQL/DS in 1981 and DB2 in 1983, but by then Oracle had already established themselves in the market. IBM’s sluggishness was well captured by Mike Wilson in his book “The Difference Between God and Larry Ellison: *God Doesn't Think He's Larry Ellison”:

“Think of the marketing of relational technology as a race, with Ellison and IBM as two of the main entrants. IBM taught Ellison to walk, bought him a pair of track shoes, trained him as a sprinter, and then gave him a big head start. How could he lose?”

Of course, there are always numerous ways to lose in business even when you have a head start. Bruce Scott, Co-architect and Co-author of the first three versions of Oracle Database, gives a lot of credit to Larry Ellison to be able to stay ahead of competition almost though sheer will:

“I’ve thought a lot about why Oracle was successful. I really think that it was Larry Ellison. There were a lot of other databases out there that we beat. It was really Larry’s charisma, vision, and his determination to make this thing work no matter what. It’s just the way Larry thinks. I can give you an example of his thought processes: We had space allocated to us, and we needed to get our terminals strung to the computer room next door. We didn’t have anywhere to really string the wiring. Larry picks up a hammer, crashes a hole in the middle of the wall, and says, ‘There you go.’ It’s just the way he thinks—make a hole, make it happen somehow.”

This “make it happen somehow” attitude from the founder itself rippled through the company, and almost everyone else in the company picked up on that energy. While Bruce Scott laid out bit of a positive spin of Ellison’s “by hook or by crook” tactics, “Tech History Channel” had a more sobering take on how the database wars were won by Oracle:

“Ellison built a highly aggressive sales force that was focused on closing deals quickly at any cost. Oracle salespeople were known for their relentless pursuit of customers and the ability to sell the product's vision even when the software was still lacking in functionality. One of Oracle's most famous sales tactics was its promise of future functionality. Oracle would often promise features that didn't exist yet or that were still in development, and many businesses bought into this vision. By the time the promised features were delivered, customers were already locked into Oracle's ecosystem.

Oracle also used aggressive pricing strategies to win over customers. In some cases, Oracle would offer deep discounts or special terms to undercut competitors like Ingress. This allowed Oracle to win contracts even when its product was technically inferior. Larry Ellison was also a master at forming strategic partnerships and alliances, which helped Oracle gain credibility and expand its customer base. One of Oracle's most important early alliances was the US Government, specifically the CIA.

Oracle's first major contract was to build a relational database for the CIA, a project that not only provided critical funding for Oracle, but also gave the company a level of legitimacy that few startups could match.”

-From Tech History Channel on “The Database Wars”

As Oracle found a strong traction in the database market and generated $55 million sales with 450 employees in 1986, they decided to go public on March 12, 1986. The very next day, Microsoft went public, and a few months later, so did Adobe!

Although Microsoft and Oracle didn’t compete against each other at that time, Ellison intentionally picked a fight against Bill Gates. Matthew Symonds in perhaps the most famous book on Oracle “Softwar: An Intimate Portrait of Larry Ellison and Oracle” outlined Ellison’s almost bizarre rationale to go after Microsoft and Gates:

“The terrifying thing about Bill is that he's smart enough to understand what ideas are good, what's worth replicating, and he has the discipline and resources to get on with it and make it just a little bit better. That's very Japanese. That's very scary. Add that to Bill's ruthless perseverance and the fact that Microsoft has more money than God, and you get a most formidable foe, the ultimate foe, the perfect enemy. We pick our enemies very carefully. We decided to pick a fight with the biggest, most dangerous bully in the schoolyard. There's no way to avoid this fight, so let's start it."

Partly because of this somewhat entertaining psyche of Ellison and partly due to my own curiosity to see how Oracle and Microsoft fared once they went public, I am going to show Oracle and Microsoft’s both operating performance and stock performance simultaneously.

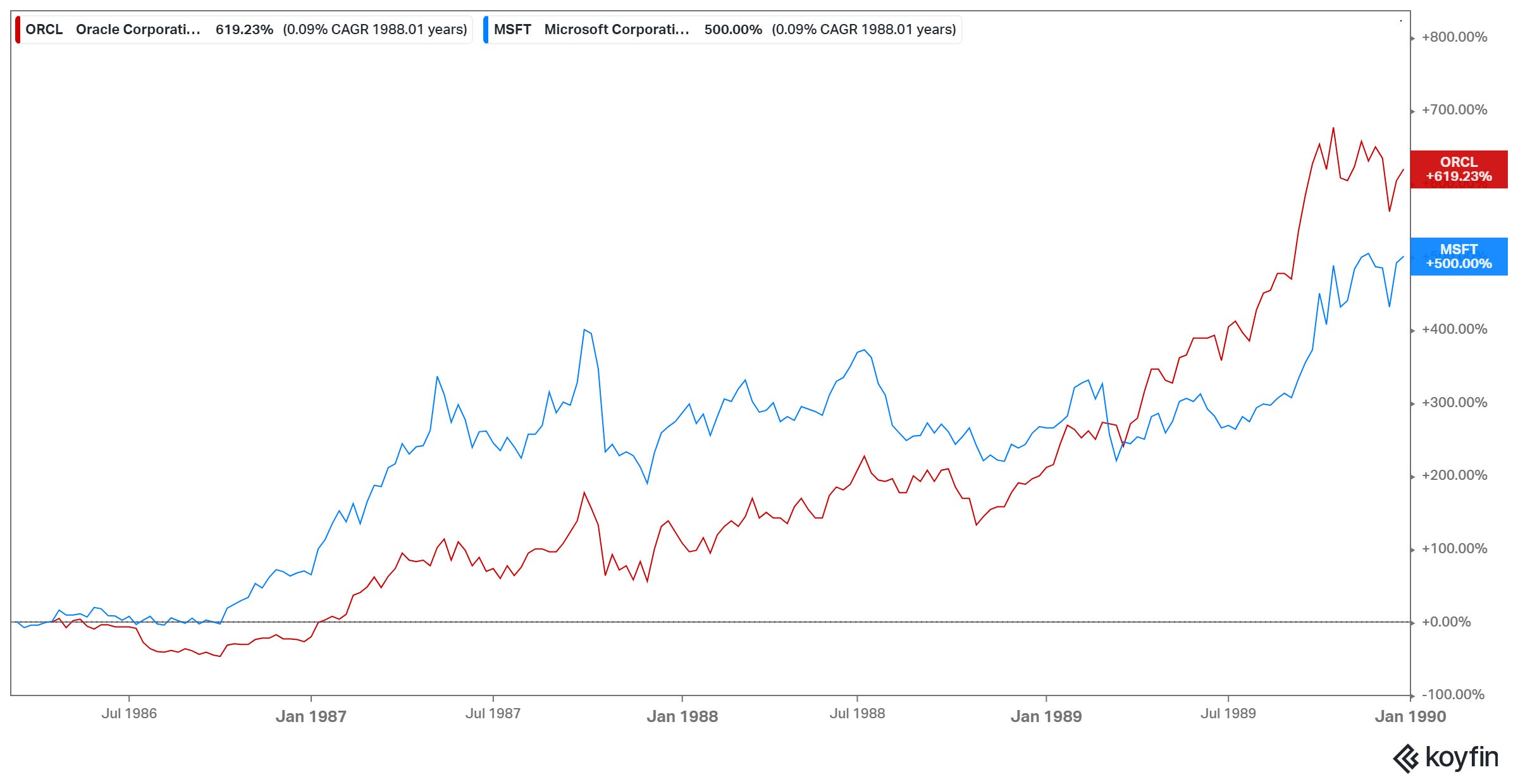

I couldn’t get a hold onto operating performance of Oracle during 1986-1989 period, so let’s start with their stock performance after they both went public in March, 1986. Both had a flying start in the public market as Oracle and Microsoft stock became ~6x and ~5x respectively in less than four years.

After breezing through the first few years in the public market, Oracle started the 1990s with more than a mere hiccup. Ellison’s “take-no-prisoners” attitude towards growing the business eventually caught up with Oracle. Oracle salespeople promised products that never were delivered and the company recorded sales that had not yet happened. Oracle had to restate its financials in early 1990s and the stock went down ~80% in 1990. Ellison blamed the lack of seasoned management at the company for the mishap.

The lack of seasoned management is indeed quite apparent when you see how Oracle used to price its products globally. The book “Softwar” had a great example to substantiate the chaos Oracle was dealing with in much of the 1990s during its heyday of growth. From the book:

"The pricing committee was 'responsible' for deciding how much we would charge for our products—our new application server for example. So we'd do some competitive analysis—what's IBM charging, what's BEA charging, what's Microsoft charging? How does our product compare? What are the market dynamics? After that we'd make a decision, say, $10,000 per processor.

"We'd then produce an updated price list and send it across the hall to our global sales headquarters. Unfortunately, our global sales team had their own pricing people who felt they weren't doing their jobs unless they did their own analysis and—for the good of the company, of course—corrected any pricing mistakes we might have made. They'd say, 'Larry's an engineer, what does he know about setting prices? We're salespeople, we know about pricing.' So they'd reset the price to $20,000 per processor and send out a pricing memo to our European headquarters in Geneva. Of course we had another pricing team in Geneva that redid the analysis and reset the price once more. They'd say, 'What do Americans know about selling software in Europe? We're Europeans, we live in Europe.' So a team in Geneva decides that the right price for Europe is $15,000 per processor. They then send that price out to Paris, Munich, London. The same thing happens all over again. The guys in Germany ask, 'What do French people in Geneva know about selling software in Germany? The right price in Germany is $25,000 per processor.' Every country had a different price. It was crazy.

"We had about two hundred people around the world involved in analyzing and reanalyzing, setting and resetting prices. It cost us a fortune in duplication of effort. It delayed the process and confused most of our customers—but not all of them. One day I get a call from one of our largest customers, located in the northeastern United States. He tells me, 'Larry, we've decided to buy all of our Oracle software from Oracle Brazil.' I said, 'But you're headquartered in Connecticut, Connecticut's not part of Brazil. Why are you doing that?' He said, 'They gave us the best price.' Shit. Everything is so duplicative and decentralized, the right hand doesn't know what the left hand is doing. We're competing against ourselves. This is embarrassing.".

This whole story reminded me a quote by Brent Beshore: “All businesses are loosely functioning disasters, and some are profitable despite it.”

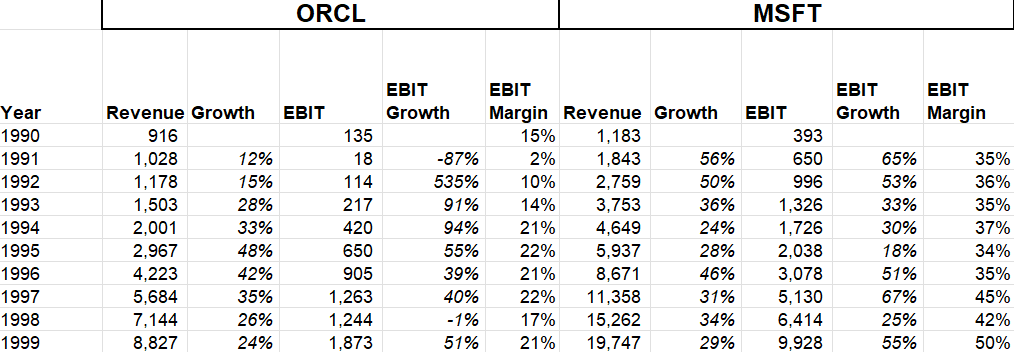

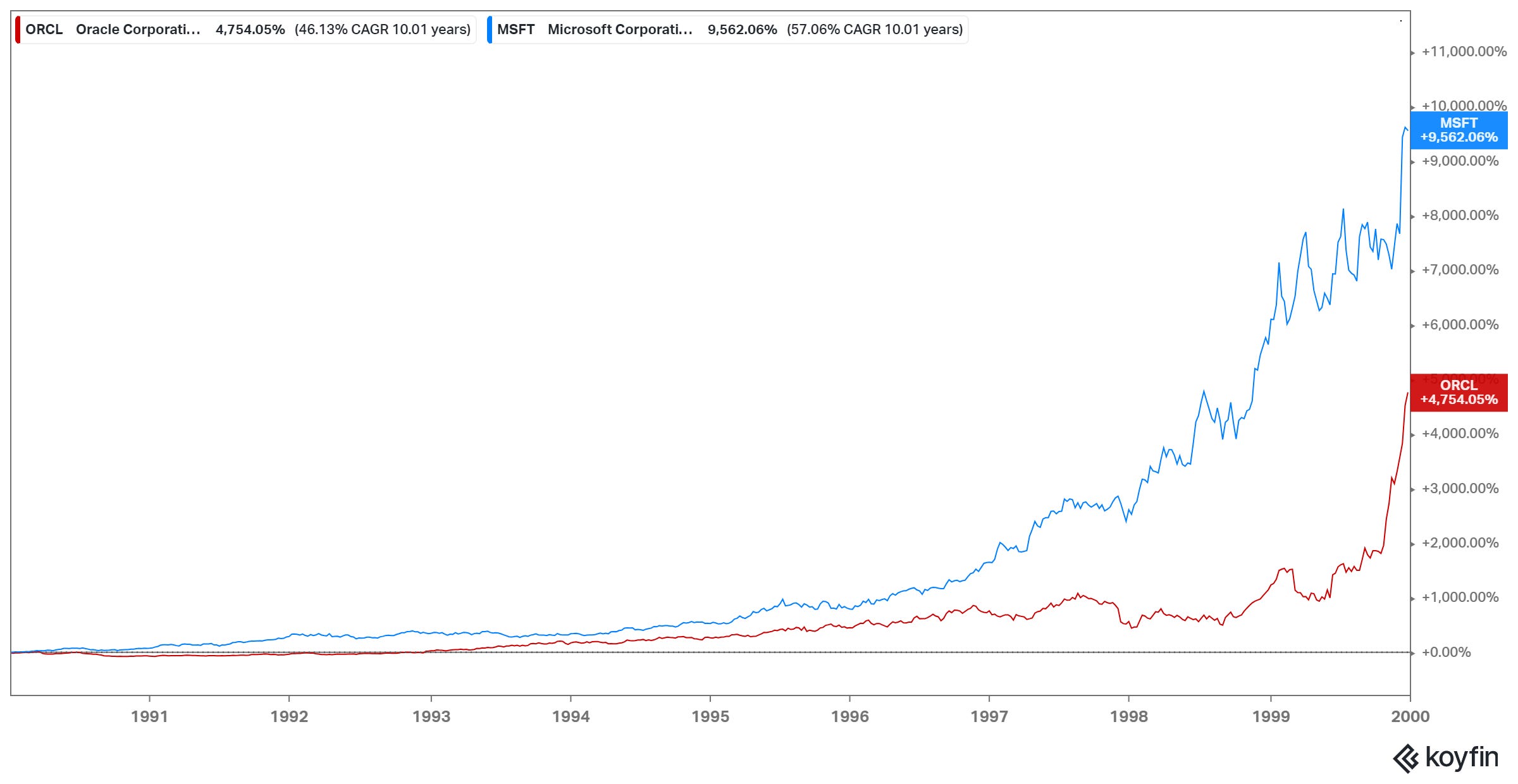

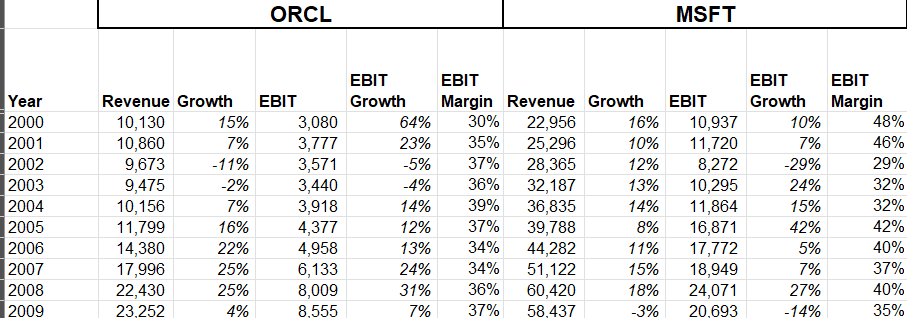

Despite this growing pain of hypergrowth, Oracle grew their revenue and operating profit at ~29% and ~34% respectively in the 1990s. However, it still paled in comparison against Microsoft which was just on a different stratosphere of growth. Even though Oracle started the decade with just ~20% lower revenue than Microsoft, Microsoft’s operating profit was ~12% higher than Oracle’s revenue by the end of the decade!

(Note: Oracle and Microsoft fiscal year ends on May 31st and June 30th respectively)

In light of such operating performance, both Oracle and Microsoft stocks were understandably rocket ships as these stocks became almost ~50x and ~100x respectively during the decade of 1990s.

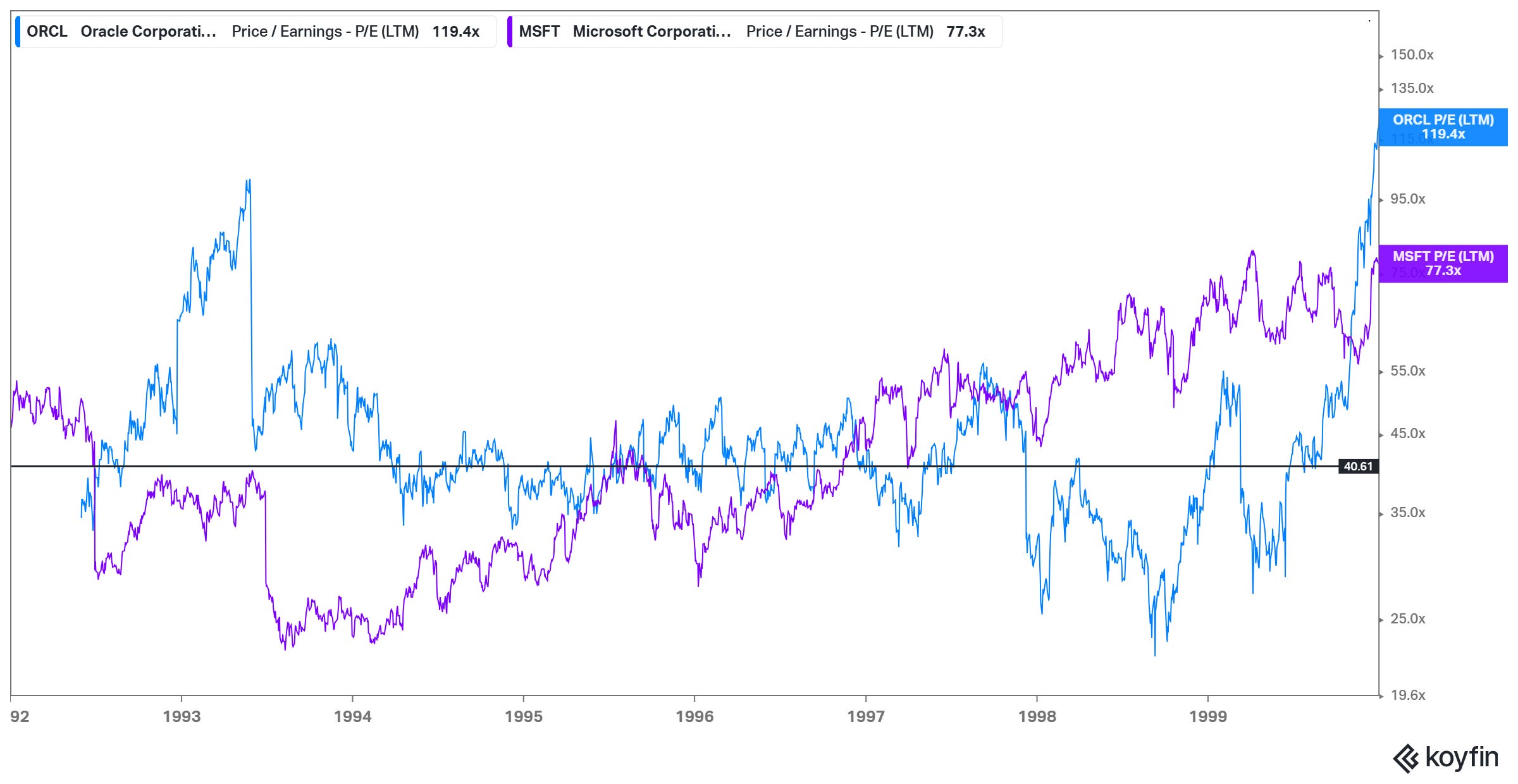

Many may wonder whether such stock price performance was just mere representation of the tech bubble we experienced during the 1990s. When I looked closely, I was admittedly somewhat surprised to see how reasonably Oracle and Microsoft were valued for much of the 1990s despite their mindboggling growth year after year. In fact, while Microsoft and Oracle earnings grew at ~34% and ~43% CAGR respectively during 1990s, they consistently traded below 40x LTM P/E during 1990s. It is only in the second half of 1999 when euphoria seemed to have kicked in. By the end of 1999, Oracle and Microsoft were trading at ~120x and ~80x LTM P/E, far higher than what they typically traded during much of 1990s.

As we all know, the tech bubble burst right after that. Oracle’s LTM P/E crashed from ~170x in March 2000 to just ~12x in March 2001. Oracle’s stock kept going down and bottomed in 2002 after experiencing ~80% drawdown from the tech bubble peak. The stock later started recovering until Global Financial Crisis (GFC) led to a ~40% tumble in 2008-09 period.

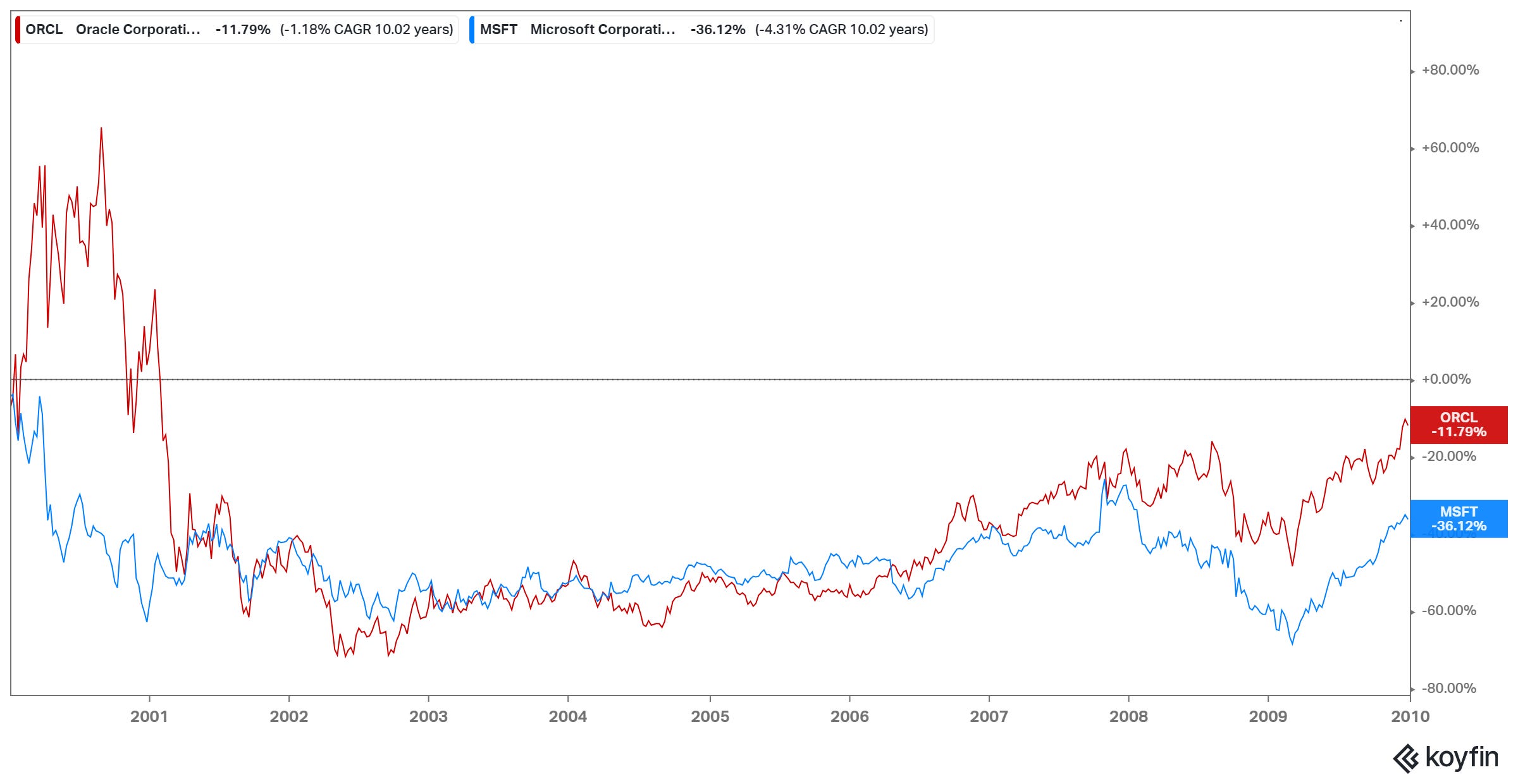

As a result, both Microsoft and Oracle experienced a lost decade (and then some) in the 2000s as they ended the decade being down ~36% and ~12% respectively. In fact, Microsoft and Oracle shareholders had to wait till 2014-15 period to get back to their peak during tech bubble.

Even though the stocks were getting decimated following the tech bubble, the businesses did just fine. Oracle’s operating profit almost tripled in 2009 vs 1999 whereas Microsoft’s profits doubled. As they say, multiple expansion is a helluva drug, but multiple compression is such a bitch!

Once the bubble crashed, analysts wondered after two decades of relentless growth whether the database market had reached its maturing phase. Ellison couldn’t disagree more as he thought over time, database market could be 10x or even 100x of what it was in early 2000s as the internet would exponentially increase both the number of database transactions and the number of people who would interact with Oracle's databases.

While the stock was going through a tough period, Oracle did some consequential acquisitions during 2000s. Between 2005 and 2015, Oracle spent more than $50 Billion on acquiring other companies.

In December 2004, Oracle acquired PeopleSoft for $10.3 billion after an 18-month hostile takeover battle. Large enterprises requiring sophisticated HR and financial software systems typically faced a choice between three major vendors: SAP, Oracle, and PeopleSoft. While SAP was a major player, some customers found their choices effectively limited to just Oracle and PeopleSoft due to SAP's product limitations in certain areas. By acquiring PeopleSoft, Oracle reduced the competitive intensity in this area of the market.

Then in September 2005, Oracle purchased Siebel Systems for $5.9 billion, acquiring a major player in Customer Relationship Management (CRM) software. After a couple of years of pause from major deals, in January 2008 Oracle acquired BEA Systems for $7.2 billion ($8.5 billion including BEA's cash on hand). BEA was a significant player in middleware and Service Oriented Architecture (SOA) technologies.

The very next year, Oracle bought Sun Microsystems in 2009 for $7.4 billion, outbidding IBM's offer of $6.85 billion. Tech History Channel explained why this acquisition helped Oracle maintain their leadership in “database war”:

“The success of MySQL underscored a fundamental shift in the database market. The rise of the Internet and cloud computing, along with the increasing importance of web applications, meant that traditional enterprise databases like Oracle were no longer the only game in town. While Oracle continued to dominate in industries like finance, healthcare and government, where large scale database management and advanced features were essential, MySQL was rapidly becoming the de facto choice for web developers and startups. Oracle saw this as a massive threat, because in time, these small startups would emerge as big competitors that used MySQL instead of Oracle. While Oracle maintained its dominant position in the present, it saw that MySQL had the potential to be a threat to its future…In 2008, the company behind MySQL was acquired by Sun Microsystems for approximately $1 billion. However, the real twisted maestro story came two years later when Oracle, out of nowhere, shocked the tech industry and acquired Sun Microsystems in a 7.4 billion dollar deal in 2009”

Even during 2010s, Oracle kept its acquisition spree with major deals such as MICROS System for $5.3 Billion (2014), and NetSuite for $9.3 Billion (2016).

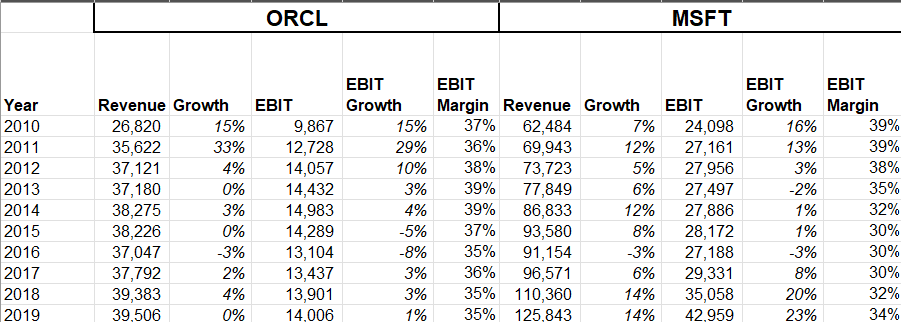

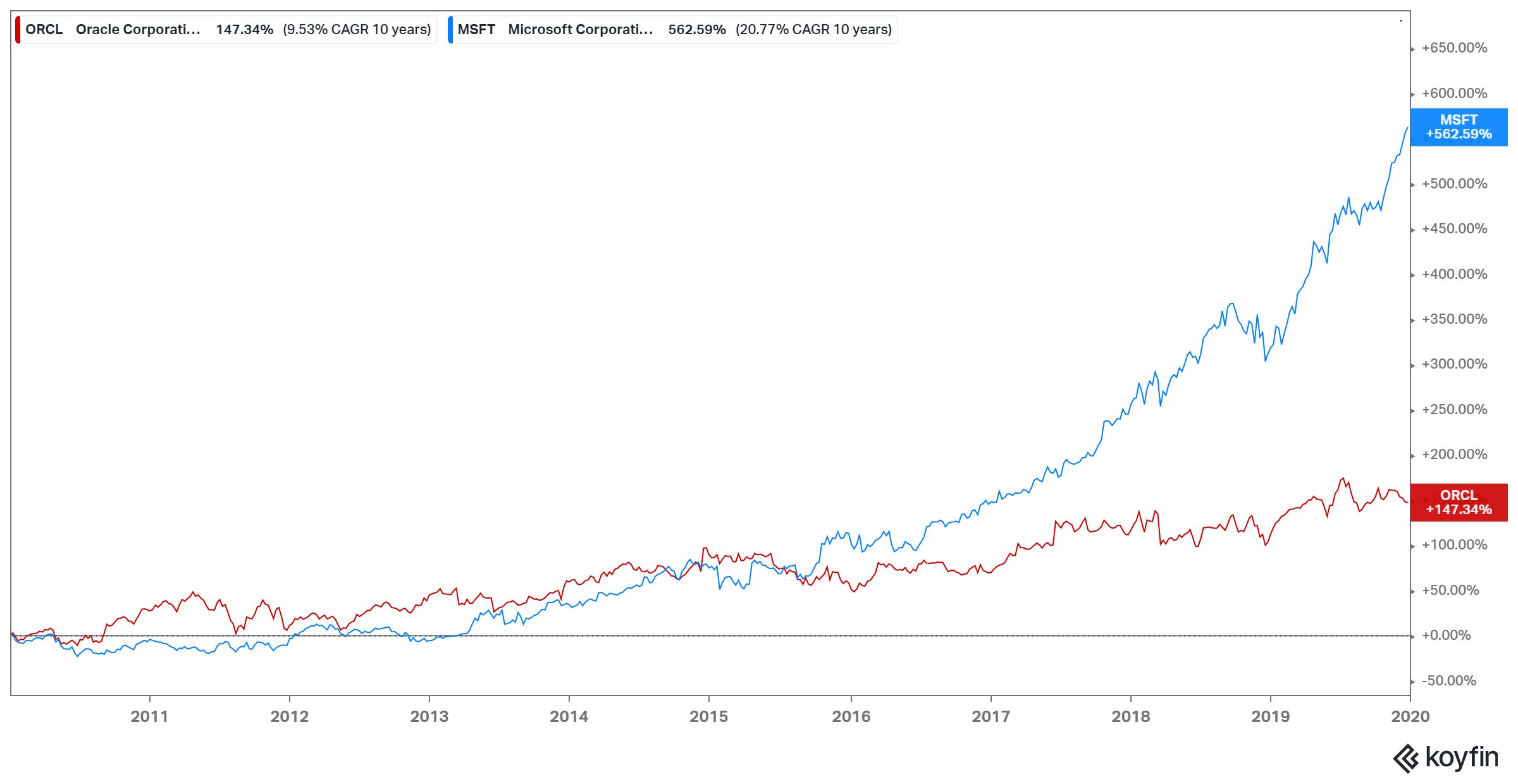

While Oracle started the 2010s decade well, the company’s operating profit stopped growing despite these large acquisitions. Between 2012 and 2019, Oracle’s operating profit largely stayed around $14 Billion. Microsoft’s operating profit also stayed largely flat between 2011 and 2016, but after Satya Nadella went full speed ahead towards cloud, Microsoft ended up more than doubling its profit in 2019 vs what it posted in 2009. If you are curious to explore more about Microsoft, I suggest you read my Deep Dive on the company.

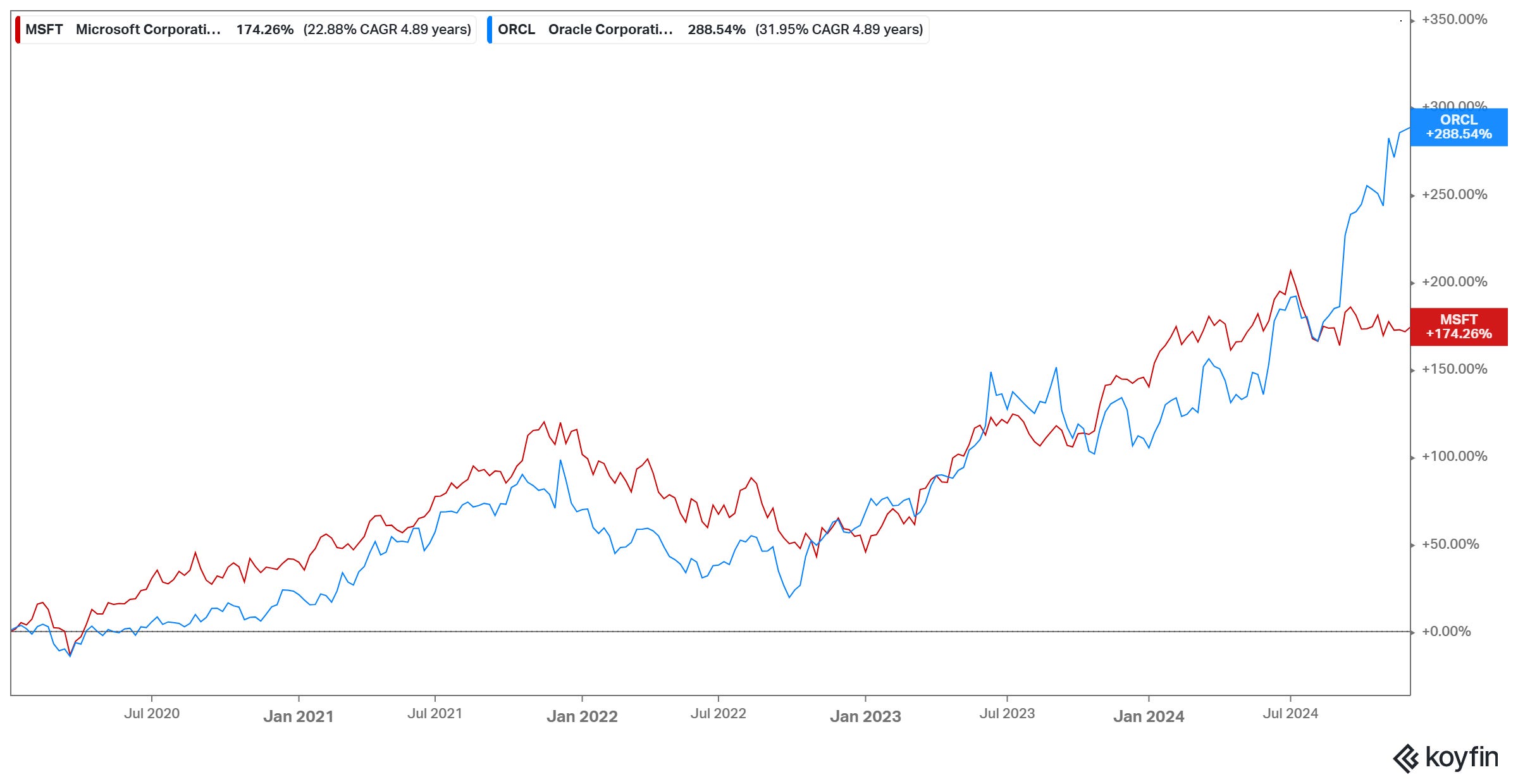

Oracle was still in the middle of its transition from licenses and maintenance revenue of the on-prem world to subscriptions in cloud software. I will elaborate more on this in the next section of this Deep Dive. The stock did okay in 2010s; however, it paled in comparison with Microsoft.

So far in 2020s, however, Oracle has not only accelerated its transition from on-prem to cloud for its software, it has also found their way into joining the hyperscaler party. Even though Microsoft is still very much around the center of the current AI revolution thanks to their investment and partnership with OpenAI, Oracle too is now very much part of the conversation and in fact, the stock has so far performed better than Microsoft in this decade.

In the next section, I would like to dig deep and provide a more comprehensive overview of what Oracle does today.

Then I will discuss the competitive dynamics Oracle faces today, especially in the context of OCI. I will later discuss what’s embedded in the stock price today as well as capital allocation history and incentive structure of Oracle management. Finally, I will share some concluding thoughts, and disclose my overall portfolio.