Meta 4Q'24 Update

Disclosure: I own shares of Meta Platforms

“This is going to be a really big year. I know it always feels like every year is a big year, but more than usual, it feels like the trajectory for most of our long-term initiatives is going to be a lot clearer by the end of this year.”

-Mark Zuckerberg in Meta’s 4Q’24 Call

In recent weeks, Meta stock has mostly been one-way street: up! That continued to be the case after-hours post 4Q’24 earnings.

Here are my highlights from today’s call.

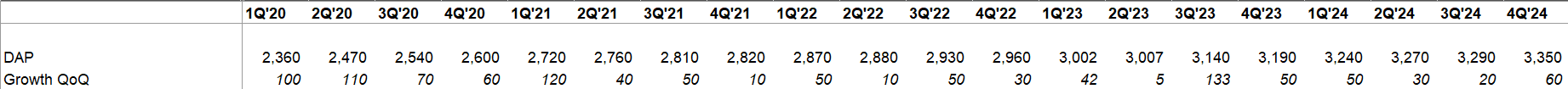

Users

Daily Active People (DAP) across its Family of Apps (FOA) accelerated to 60 mn QoQ in 4Q’24. It’s kind of mind boggling that Meta added 1 Billion DAP since 1Q’20.

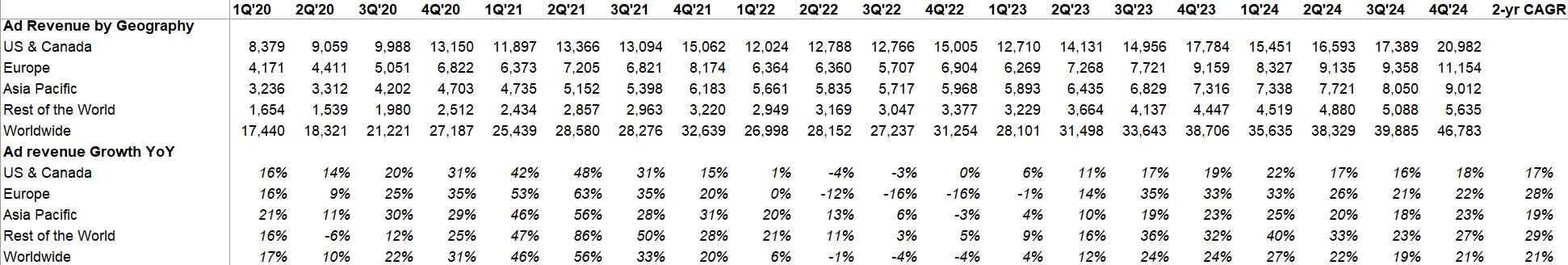

Ad revenue by Geography

I remember many investors were worried about “tough comps” this time last year which is understandable when you look at the comps. Despite growing ad revenue by 24% in 4Q’23, Meta still managed to increase revenue by 21% in 4Q’24.

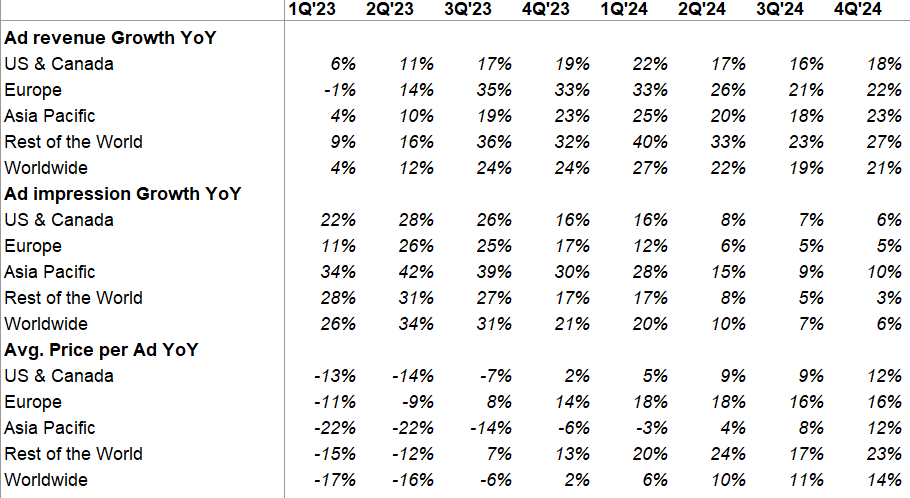

Ad Impression and Avg. Price Per Ad

Overall impression grew by 6% YoY and avg. price per ad grew by 14% YoY.

While many prefer revenue growth driven through impressions, Meta mentioned they think they will have opportunity to drive revenue growth across both pricing and impression growth:

“we generally expect that we are going to be able to deliver ongoing ad performance improvements through a lot of the ongoing work that we're doing across our monetization road map and that will have the sort of effect of benefiting pricing overall…Overall, we are seeing healthy cost per action trends for advertisers for whatever is the action that they are optimizing for. And we believe we'll continue to get better at driving conversions for advertisers. And when we do, that will have the effect of continuing to lift CPMs over time because we're delivering more conversions per impression served, resulting in higher value impressions.”

Later in the call, Meta expanded further on how they are working on improving monetization:

In the second half of 2024, we introduced an innovative new machine learning system in partnership with NVIDIA called Andromeda. This more efficient system enabled a 10,000x increase in the complexity of models we use for ads retrieval, which is the part of the ranking process where we narrow down a pool of tens of millions of ads to the few thousand we consider showing someone. The increase in model complexity is enabling us to run far more sophisticated prediction models to better personalize which ads we show someone. This has driven an 8% increase in the quality of ads that people see on objectives we've tested. Andromeda's ability to efficiently process larger volumes of ads also positions us well for the future as advertisers use our generative AI tools to create and test more ads.

Adoption of Advantage+ shopping campaigns continues to scale with revenues surpassing a $20 billion annual run rate and growing 70% year-over-year in Q4. Given the strong performance and interest we're seeing in Advantage+ shopping and our other end-to-end solutions, we're testing a new streamlined campaign creation flow.

…More than 4 million advertisers are now using at least one of our generative AI ad creative tools, up from 1 million six months ago. There has been significant early adoption of our first video generation tool that we rolled out in October, image animation with hundreds of thousands of advertisers already using it monthly.

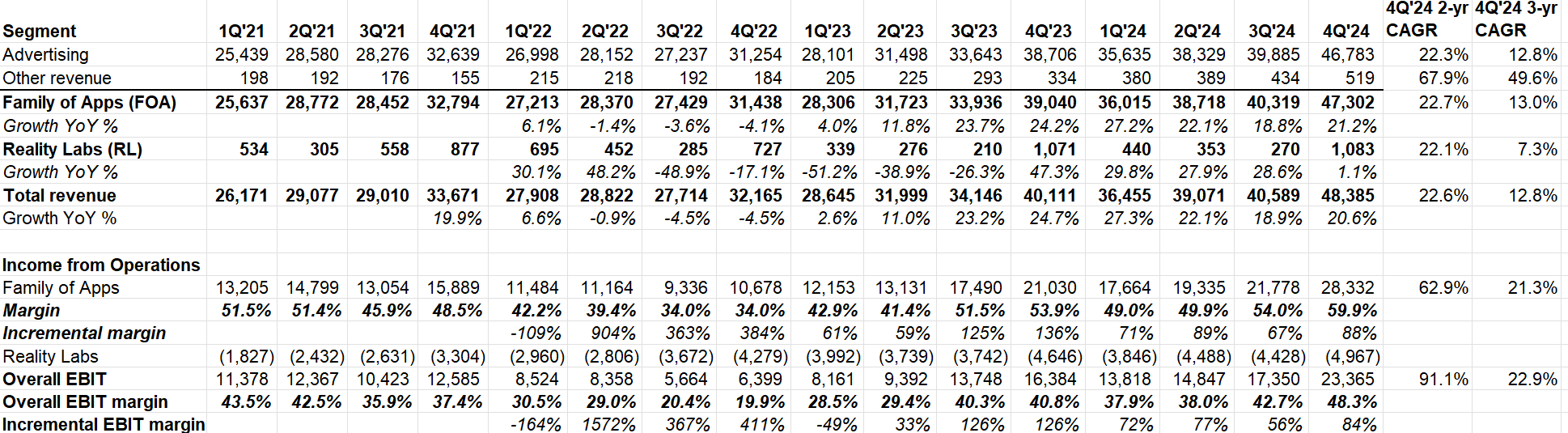

Segment Reporting

Overall 4Q’24 revenue was +21.2% YoY; on a 2-yr and 3-yr CAGR basis, Meta’s topline increased by 22.3% and 12.8% respectively.

FOA’s 4Q’24 operating margin of ~60% (!!) was ~550 bps higher than previous peak margin. Incremental margin at FOA was 88% last quarter!

As you know, inside Meta, “there are two wolves”: one with eyepopping profitability and the other with mind numbing mounting losses quarter after quarter. Reality Labs managed to report $5 Billion losses in 4Q’24. It’s almost hard to fathom that these two segments are within the same company! There was also no indication in the call that losses at Reality Labs have either peaked or close to be peaking. So, I guess we’ll have to keep watching this bleeding in almost suspended disbelief.

To put it in context, since breaking out Reality Labs as a separate segment, Meta has reported a cumulative $60 Billion losses in the last 17 quarters in Reality Labs. Given there has been some recent optimism around Meta’s AR glasses, we are probably looking at tens of billions of continued investments every year.

Let’s look at some interesting comments from the earnings call:

AI, AI, AI

“I expect that this is going to be the year when a highly intelligent and personalized AI assistant reaches more than 1 billion people, and I expect Meta AI to be that leading AI assistant. Meta AI is already used by more people than any other assistant. And once a service reaches that kind of scale, it usually develops a durable long-term advantage.

…I also expect that 2025 will be the year when it becomes possible to build an AI engineering agent that has coding and problem-solving abilities of around a good mid-level engineer. And this is going to be a profound milestone and potentially one of the most important innovations in history, like as well as over time, potentially a very large market, whichever company builds this first, I think it's going to have a meaningful advantage in deploying it to advance their AI research and shape the field. So that's another reason why I think that this year is going to set the course for the future.

Meta AI monthly actives reached 700 million (vs 500 million in 3Q’24). The following bit is also an indication how Meta AI can drive incremental growth over time but don’t expect much monetization of Meta AI anytime soon as they’re still mostly focused on delivering the consumer experience first:

We're now introducing updates that will enable Meta AI to deliver more personalized and relevant responses by remembering certain details from people's prior queries and considering what they engage with on Facebook and Instagram to develop better intuition for their interest and preferences.

Llama

Some very bold predictions and ambitions on Llama:

I think this will very well be the year when Llama and open-source become the most advanced and widely used AI models as well. Llama 4 is making great progress in training, Llama 4 Mini is doing with pretraining and our reasoning models and larger model are looking good too. Our goal with Llama 3 was to make open source competitive with closed models. And our goal for Llama 4 is to lead. Llama 4 will be natively multimodal. It's an omni model, and it will have agentic capabilities.

Recent developments around DeepSeek only emboldened Meta’s strategy to double down on open source:

I also just think in light of some of the recent news, the new competitor DeepSeek from China, I think it also just puts -- it's one of the things that we're talking about is there's going to be an open source standard globally. And I think for our kind of national advantage, it's important that it's an American standard. So we take that seriously, and we want to build the AI system that people around the world are using and I think that if anything, some of the recent news has only strengthened our conviction that this is the right thing for us to be focused on.

Facebook, and Instagram

In Q4, global video time grew at double-digit percentages year-over-year on Instagram, and we're seeing particular strength in the U.S. on Facebook, where video time spent was also up double-digit rates year-over-year. We see continued opportunities to drive video growth in 2025 through ongoing optimizations to our ranking systems.

In the U.S., we recently launched a new destination in reels that consists of content your friends have left a note on or liked. We're seeing very positive early results, and we'll look to expand this globally in the coming months.

One thing I would like to highlight is FOA’s “other revenue” which is mostly revenue from WhatsApp grew at 55%, 68%, and 50% CAGR over 1-yr, 2-yr, and 3-yr respectively. While it’s only ~$2 Billion run-rate business, it’s an interesting area to watch given the growing importance of business messaging in the next 5-10 years. So, it’s pretty goo that WhatsApp has continued to gain momentum in the US:

I expect WhatsApp to continue gaining share and making progress towards becoming the leading messaging platform in the U.S. like it is in a lot of the rest of the world. WhatsApp now has more than 100 million monthly actives in the U.S.

Threads

Threads Monthly Active Users (MAU) over time:

3Q’23: 100 Million

4Q’23: 130 Million

1Q’24: 150 Million

2Q’24: 200 Million

3Q’24: 275 Million

4Q’24: 320 Million

MAU growth has decelerated a bit here, but momentum is still intact.

AR/VR

“This will be a defining year that determines if we're on a path towards many hundreds of millions and eventually billions of AI glasses and glasses being the next computing platform like we've been talking about for some time or if this is just going to be a longer grind.

The number of people using Quest and Horizon has been steadily growing. And this is a year when a number of the long-term investments that we've been working on that will make the Metaverse more visually stunning and inspiring will really start to land. So I think we're going to know a lot more about Horizon's trajectory by the end of this year.

I have noticed some people interpreted this as “make-or-break” year for Meta’s AR/VR investments. I don’t think Meta meant anything drastic changes here, but in case glasses adoption continues to accelerate, it is likely that they’ll double down here with more aggressive investments. If not, they will still very much persist in their investments but perhaps at a more measured pace. However, VR investments do seem to be increasingly bit of a suspect. I doubt “stunning visual” at Metaverse will be any real breakthrough for engagements. However, like Zuck, I too am quite optimistic about the glasses. It seems much easier bet that the people will upgrade to smart glasses in the next 10-15 years:

It's kind of hard for me to imagine that a decade or more from now, all the glasses aren't going to basically be AI glasses as well as a lot of people who don't wear glasses today, finding that to be a useful thing. So I'm incredibly optimistic about this.

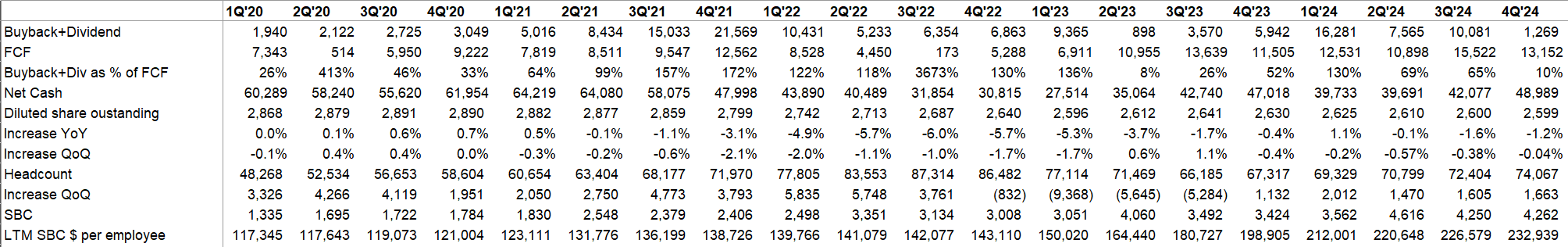

Capital Allocation

Meta didn’t repurchase any shares which I applaud. The stock isn’t nearly as attractive as it was over the last couple of years and given the size of investments Meta is planning, it makes sense to not hurriedly return cash to shareholders. There is perhaps a scenario in which Meta’s FCF can be severely pressured (imagine a recession in a year or two, for example) but still would like to be committed to their investments to not fall behind compared to its competitors.

To exacerbate my concerns around earnings quality (see my recent piece on this topic) even further, Meta changed its depreciation schedule for certain servers and network assets from 5 to 5.5 years. Interestingly, Meta did mention in 3Q’24 follow-up call that they had “no current plans to extend the useful lives in our servers”. I will do more work on this when I publish more detailed annual update on Meta in couple of weeks.

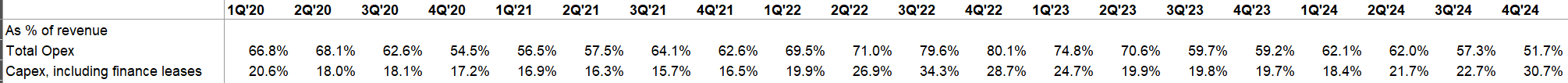

Capex and Opex

Given Meta is going to spend $60-65 Billion on capex in 2025, this topic deserves detailed notes. First, some interesting commentary on Meta’s custom chips MTIA:

…we're pursuing cost efficiencies by deploying our custom MTIA silicon in areas where we can achieve a lower cost of compute by optimizing the chip to our unique workloads. In 2024, we started deploying MTIA to our ranking and recommendation influence workloads for ads and organic content. We expect to further ramp adoption of MTIA for these use cases throughout 2025, before extending our custom silicon efforts to training workloads for ranking and recommendations next year.

we expect that we are continuing to purchase third-party silicon from leading providers in the industry. And we are certainly committed to those long-standing partnerships, but we're also very invested in developing our own custom silicon for unique workloads, where off-the-shelf silicon isn't necessarily optimal and specifically because we're able to optimize the full stack to achieve greater compute efficiency and performance per cost and power because our workloads might require a different mix of memory versus network, bandwidth versus compute and so we can optimize that really to the specific needs of our different types of workloads.

Meta was quite willing to credit DeepSeek to inject some novel advancements which may or may not affect long-term capex intensity:

…on the DeepSeek question. I think there's a number of novel things that they did that I think we're still digesting. And there are a number of things that they have advances that we will hope to implement in our systems.

…I don't know -- it's probably too early to really have a strong opinion on what this means for the trajectory around infrastructure and CapEx and things like that. There are a bunch of trends that are happening here all at once.

There's already sort of a debate around how much of the compute infrastructure that we're using is going to go towards pre-training versus as you get more of these reasoning time models or reasoning models where you get more of the intelligence by putting more of the compute into inference, whether just will mix shift how we use our compute infrastructure towards that. That was already something that I think a lot of the -- the other labs and ourselves were starting to think more about and already seemed pretty likely even before this, that -- like of all the compute that we're using, that the largest pieces aren't necessarily going to go towards pre-training. But that doesn't mean that you need less compute because one of the new properties that's emerged is the ability to apply more compute at inference time in order to generate a higher level of intelligence and a higher quality of service, which means that as a company that has a strong business model to support this, I think that's generally an advantage that we're now going to be able to provide a higher quality of service than others who don't necessarily have the business model to support it on a sustainable basis.

…I continue to think that investing very heavily in CapEx and infra is going to be a strategic advantage over time. It's possible that we'll learn otherwise at some point, but I just think it's way too early to call that. And at this point, I would bet that the ability to build out that kind of infrastructure is going to be a major advantage for both the quality of the service and being able to serve the scale that we want to.

Meta’s 2024 opex turned out to be $95 Billion (vs guide of $96-98 Billion in 3Q’24). 2025 opex guide is $114-119 Billion. So, while opex increased by ~$7 Billion in 2024, it is expected to grow by ~$20 Billion in 2025.

Outlook

Meta guided 1Q’25 revenue growth to be +11% to +18% on a constant currency basis. Consensus was closer to the high end of the guide.

Closing Words

Near the end of the call, Zuck tried to inject some caution:

I guess my note of caution or just my kind of periodic reminder…the actual business opportunity for Meta AI and AI studio and business agents and people interacting with these AIs remains outside of '25 for the most part. And I think that's an important thing for for us to communicate and for people to internalize as you're thinking about our prospects here. But nonetheless, we've run a process like this many times. We built a product. We make it good. We scale it to be large. We build out the business around it. That's what we do. I'm very optimistic, but it's going to take some time.

While the animal spirits are running high in this market and Meta is one of the prime beneficiaries of that, it is indeed good to remember the exceedingly high bar Meta is going to face this year. To put this in context, Meta will have to grow its incremental revenue by $30 Billion to grow its operating profit by ~15% in 2025. Bulls might say they did grow revenue by $30 Billion this year and they can do it again, and bears may see the impending wall that Meta may hit at some point as their business is gradually becoming more and more fixed cost heavy (more PP&E) which will make it harder for them to be agile in case they hit an idiosyncratic or macro-wide rough patch.

Meta is well positioned for the long-term, but better to not expect the path towards long-term a linear one. As alluded earlier, I will expand more on my thoughts on Meta in a couple of weeks on my annual update on Meta.

Notes from follow-up call here.

I will cover Google and Amazon’s earnings next week. Thank you for reading.

If you are not a subscriber yet, please consider subscribing and sharing it with your friends.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.