Meta 3Q'22 Earnings Update

Disclosure: I own shares of Meta

"...I think that those who are patient and invest with us will end up being rewarded."

Mark Zuckerberg

From October 26, 2015 to today (after-hours), the stock is flat. The "reward" remains elusive.

Here are my highlights from 3Q'22.

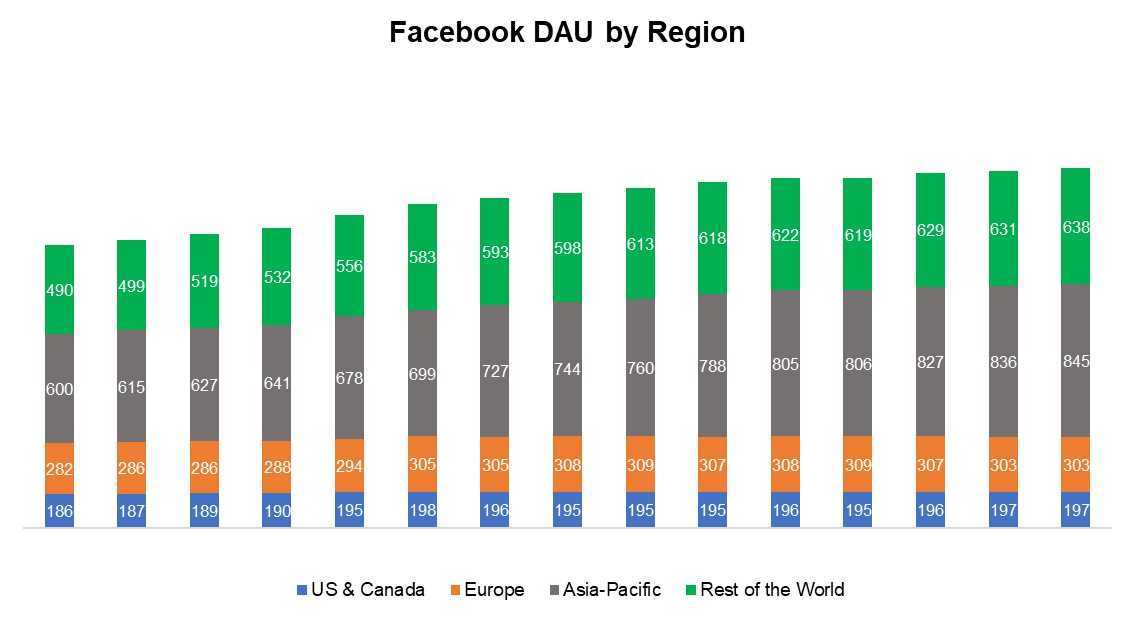

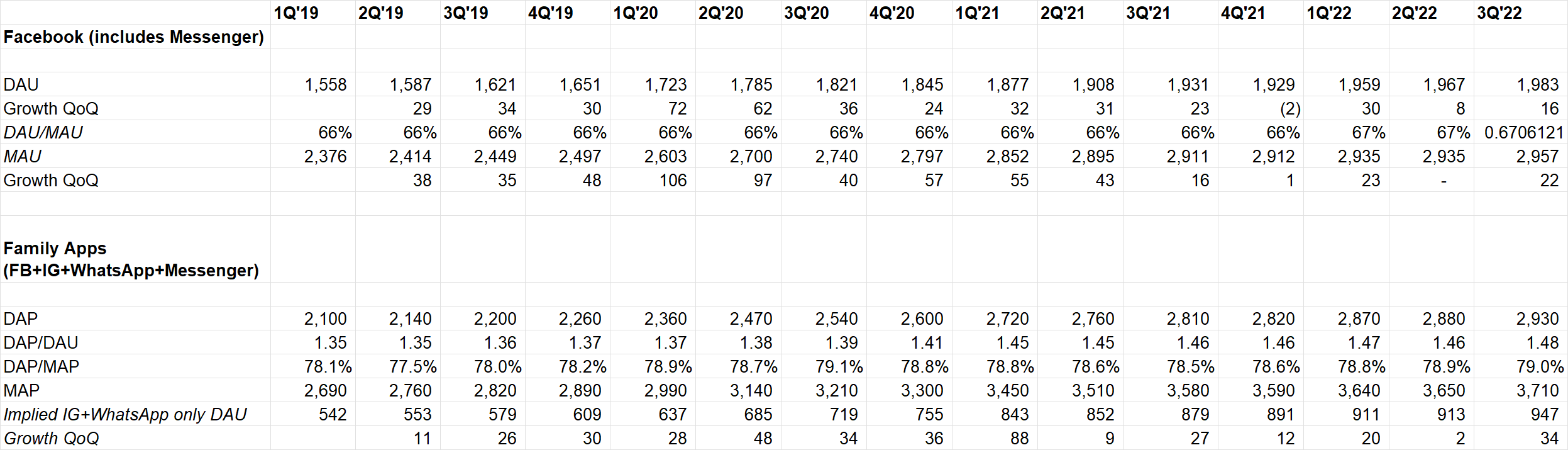

Users

DAU/MAU all look pretty healthy.

Number of ad impressions +17% YoY, price per ad -18%. Pricing was affected by stronger impression growth in APAC and RoW, FX, and lower demand from advertisers.

Interestingly, fastest user growth for WhatsApp is in North America now; global DAU crossed 2 Bn.

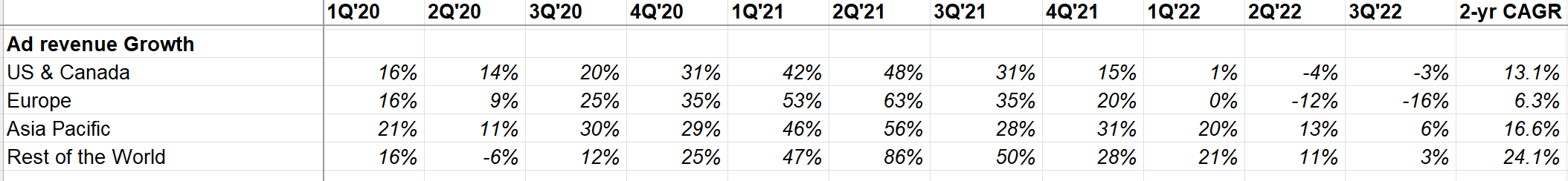

Ad Revenue

Ad revenue decelerated across the globe; FX Neutral looks a bit better since there was 6% FX headwind.

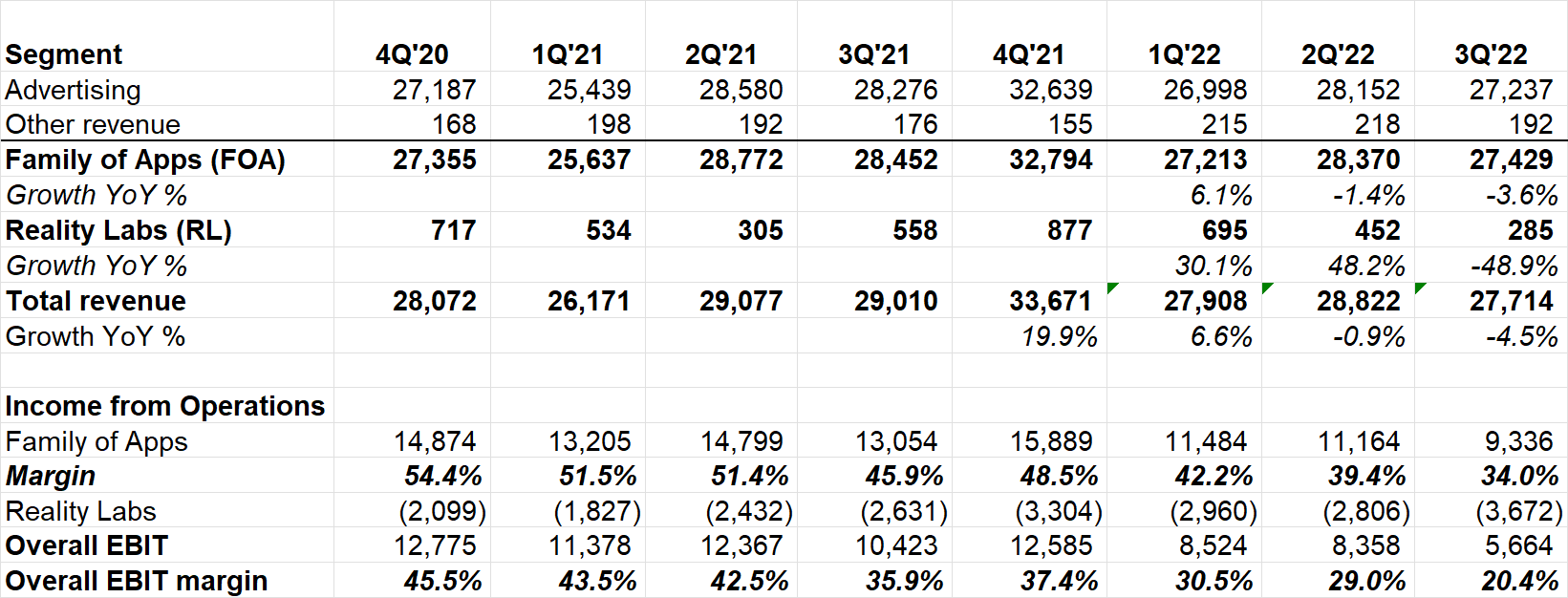

Segment Reporting

Reality Labs (RL) losses continue to climb up but revenue went down almost 50% as Quest 2 units sold fell YoY.

Family of Apps (FOA) went from 50-55% EBIT margin business to mid 30s this quarter. FXN, it would probably be low to mid-40s.

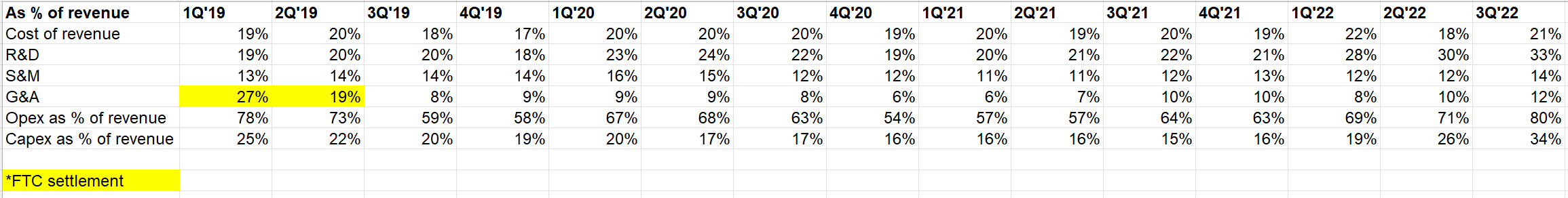

If you look at more granular breakdown, two things stand out:

- R&D went from ~20% as % of revenue in 1Q'19-4Q'21 to ~30-33% in the last two quarters. With RL, Meta is spending a lot on R&D which obviously have negligible contribution on topline.

- G&A also went from 5-8% to ~10-12%. It's not as noticeable as R&D ramp up and likely to go back in MSD-HSD range once topline growth returns. R&D, however, may prove to be quite sticky for a while.

Also, capex as % of sales went from mid teens to ~34% this quarter. Social networking is not a capital light business anymore!

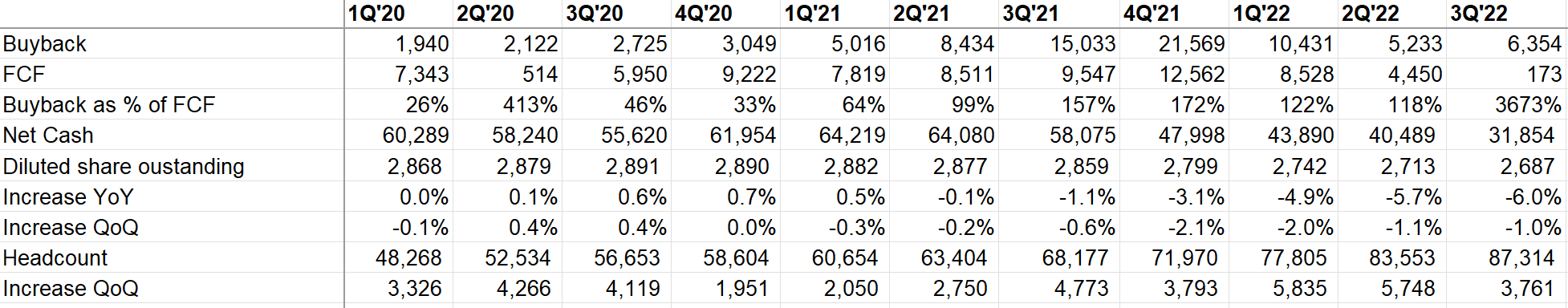

Capital Allocation

Meta generated a meagre $173 Mn FCF, so used its balance sheet to buyback $6 Bn shares which led to ~1% decline in diluted shares outstanding QoQ. Headcount growth slowed QoQ, but still growing fast on YoY basis. Headcount at the end of 2023 will be similar to 3Q'22.

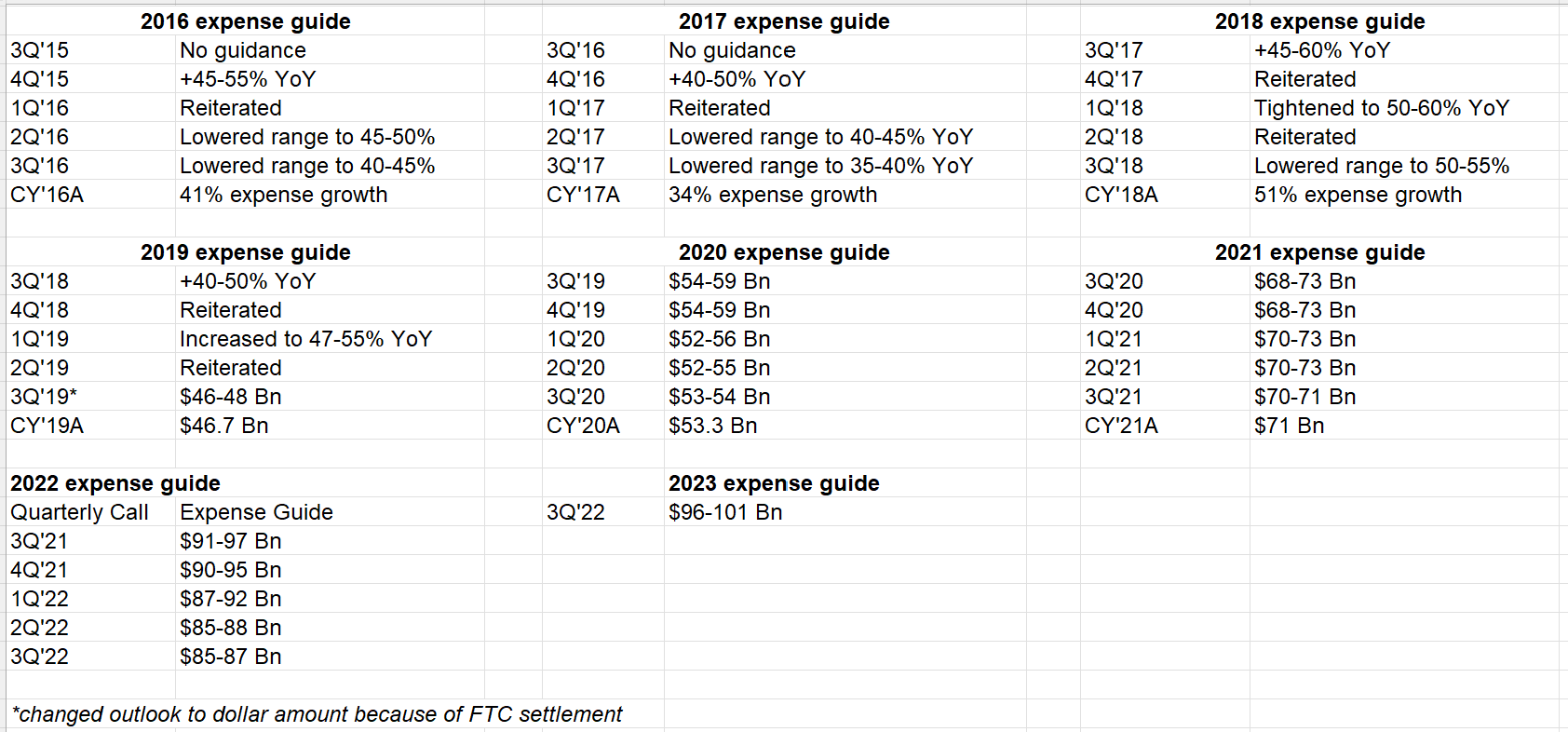

Expense and Capex Guide

Expense guide $96-101 Bn for next year (vs ~$86 Bn in 2022). Capex guide is $34-39 Bn (vs $32 Bn in 2022).

My guess is the stock would do just fine (and might be up) if both these numbers were closer to (or lower than) 2022.

Why is the expense and capex guide going up despite all the headwinds Meta faces?

On expense guide:

One thing I'd point out first is just next year's guide includes an estimated $2 billion in 2023 expenses that are onetime charges as part of our office facilities consolidation as we continue to rationalize our real estate footprint. We also expect a little over half of our expense dollar growth in 2023 to come from OpEx, with the rest coming from cost of revenue.

Cost of revenue will go up primarily via higher expected contribution from RL sales i.e. Quest hardware sales (which is higher cost of revenue). Higher depreciation too given capex ramp up in recent years.

Even though headcount will be largely fixed, some opex growth will come from full-year salaries that were only paid for partial year for new hires this year. So if Meta wanted to lower expense next year (vs this year), they would have to fire people which they are trying to avoid.

Moreover, RL losses will increase "meaningfully" next year. YTD losses in RL is already $9.4 Bn (vs $10 Bn for full year 2021). I shudder to think what "meaningfully" even means; if full-year losses is ~$12 Bn this year, is it $18 Bn in 2023?

How about Capex? Mostly AI and data centers.

Before turning to our CapEx outlook, I'd like to provide some context on our infrastructure investment approach. We are currently going through an investment cycle, which is being driven -- which is primarily driven by 2 large areas of investment. First, we are significantly expanding our AI capacity. These investments are driving substantially all of our capital expenditure growth in 2023. There is some increased capital intensity that comes with moving more of our infrastructure to AI. It requires more expensive servers and networking equipment, and we are building new data centers specifically equipped to support next-generation AI hardware. We expect these investments to provide us a technology advantage and unlock meaningful improvements across many of our key initiatives, including Feed, Reels and Ads. We are carefully evaluating the return we achieved from these investments, which will inform the scale of our AI investment beyond 2023.

Second, we are making ongoing investments in our data center footprint. In recent years, we have stepped up our investment in bringing more data center capacity online. And that work is ongoing in 2023. We believe the additional data center capacity will provide us greater flexibility with the types of servers we purchase and allow us to use them for longer, which we expect to generate greater cost efficiencies over time. These investments, along with revenue headwinds, are contributing to higher capital expenditures as a percentage of revenue in 2022 and 2023 than we expect over the long term.

Some of the capex investments seem to bring some results:

In the Q2 call, we had shared that a single AI advancement in scaling our recommendations models had led to a 15% watch time gain for Facebook Reels, and that gain has continued to grow. And we expect that there will be additional Watch time improvements coming from that work.

Reels

While understandably a lot of attention has been given to expenses and capex, there are plenty of positives in FOA business. Reels is played 50% more vs 6 months ago; 1 Bn Reels were shared per day via DMs on IG.

Reels run-rate is now $3 Bn (vs $1 Bn last quarter). Reels is currently $500 Mn revenue headwind given the lower monetization, but expect to reach revenue neutral position in 12-18 months.

Aggregate time spent on Instagram and Facebook both are up year-over-year and in both the U.S. and globally. Reels is proving to be incremental.

Click to messaging ads

Click to messaging ads is $9 Bn run-rate business. This is mostly Messenger; WhatsApp passed $1.5 Bn run-rate, growing 80% YoY.

Outlook

Turning now to the outlook. We expect fourth quarter total revenue to be in the range of $30 billion to $32.5 billion. Our guidance assumes foreign currency will be an approximately 7% headwind to year-over-year total revenue growth in the fourth quarter based on current exchange rates.

Near the end of the call, Zuck commented the following on his effort around Metaverse:

I think it's some of the most historic work that we're doing that I think people are going to look back on decades from now and talk about the importance of the work that was done here.

That group of people may or may not include shareholders!

I will cover Shopify and Amazon tomorrow.