Meta 2Q'24 Update

Disclosure: I own shares of Meta Platforms

While the meme of “nobody uses Facebook” sort of evolved to “only old people use Facebook”, Meta reminded us that it’s just another urban myth:

“…The growth we're seeing here in the U.S. has especially been a bright spot. WhatsApp now serves more than 100 million monthly actives in the U.S., and we're seeing good year-over-year growth across Facebook, Instagram, and Threads as well, both in the U.S. and globally. I'm particularly pleased with the progress that we're making with young adults on Facebook. The numbers we're seeing, especially in the U.S., really go against the public narrative around who's using the app. A couple of years ago, we started focusing our apps more on 18 to 29 year olds, and it's good to see that those efforts are driving good results.

Here are my highlights from today’s call.

Users

After adding 50 mn in two consecutive quarters, Daily Active People (DAP) across its Family of Apps (FOA) decelerated to 30 mn QoQ in 2Q’24. Still pretty impressive given their scale.

I have already mentioned how Young Adults are driving growth on Facebook. What are they doing on Facebook? Posting on Marketplace and Group.

We've seen healthy growth in young adult app usage in the U.S. and Canada for the past several quarters. And we've seen that products like Groups and Marketplace have seen particular traction with young adults.

Ad revenue by Geography

Even though easy comp ended in 1Q’24, Meta continued to post quite strong YoY growth rates in 2Q’24.

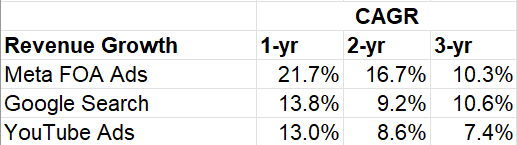

Looking at Family of Apps (FOA) ads revenue growth, YouTube’s number looks a bit perplexing. YouTube’s ads have materially underperformed both Search ads and FOA ads over the last one, two, and three-year period despite being ~18-20% of the size of Search ads and Meta FOA. Of course, as I have mentioned earlier, it’s hard to infer any conclusion about YouTube ads with high conviction given we don’t know how much of the revenue simply shifted from ads to subscription segment.

Ad Impression and Avg. Price Per Ad

We got ad impression and ad price related disclosure by geography since 1Q’24.

Overall impression grew by ~10% and avg. price per ad grew by ~10% YoY. Interestingly, the strongest ad price growth was in RoW segment (which includes Africa, Middle East, and LATAM) which incidentally also had the highest revenue growth.

Segment Reporting

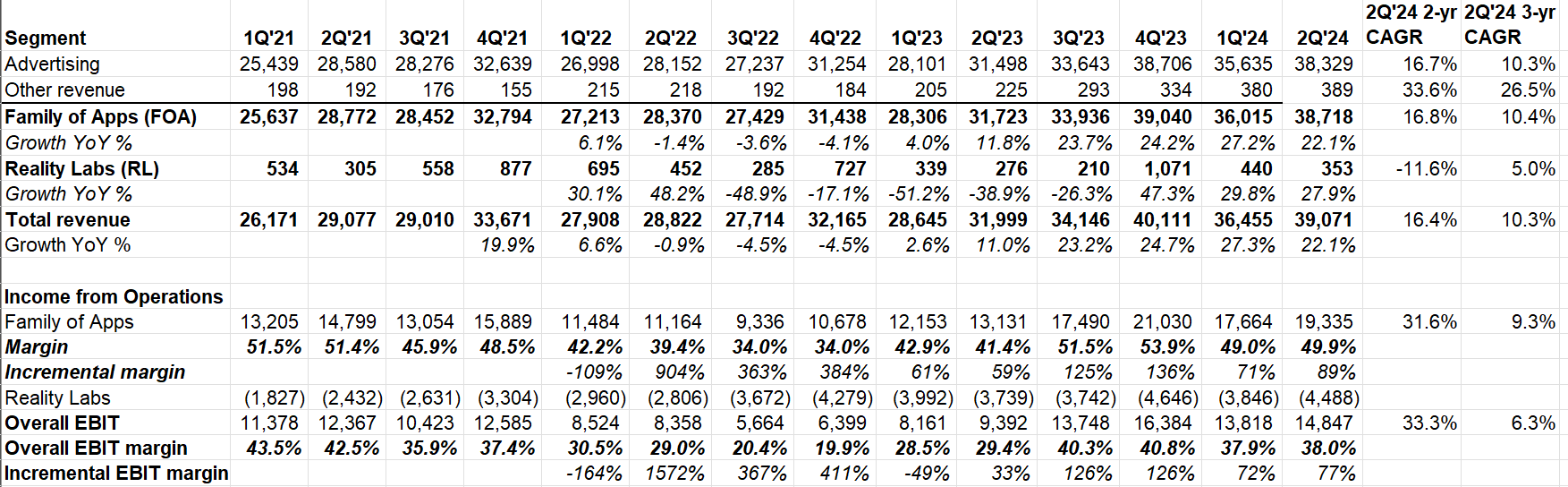

Overall 2Q’24 revenue was +22.1% YoY; on a 2-yr and 3-yr CAGR basis, Meta’s topline increased by 16.4% and 10.3% respectively.

FOA had another near ~50% operating margin quarter and Reality Labs (RL) continues to bleed. Like Google Services , Meta continues to post truly incredible incremental operating margins. FOA had 89% incremental operating margin whereas overall Meta posted 77% incremental margins in 2Q’24!!

Let’s look at some interesting comments from the earnings call:

AI, AI, AI

Zuck has recently been talking about moving to a unified recommendation/AI system. What stood out to me is such a shift is leading to higher engagement and it seems there is still upside left as Meta completes this transition over time:

In this quarter, we rolled out our full screen video player and unified video recommendation service across Facebook, bringing reels, longer videos, and live into a single experience. And this has allowed us to extend our unified AI systems, which had already increased engagement on Facebook Reels more than our initial move from CPUs to GPUs did. Over time, I'd like to see us move towards a single unified recommendation system that powers all of the content, including things like People You May Know across all of our services. We're not there yet. There's still upside and we're making good progress here.

Of course, advertisers remain the key early beneficiaries of Meta’s AI investments:

…today, advertisers still need to develop creative themselves. And in the coming years, AI will be able to generate creative for advertisers as well, and we'll also be able to personalize it as people see it.

Over the long term, advertisers will basically just be able to tell us a business objective and a budget, and we're going to go do the rest for them. We're going to get there incrementally over time, but I think this is going to be a very big deal.

…We've seen promising early results since introducing our first generative AI ad features, image expansion, background generation, and text generation, with more than 1 million advertisers using at least one of these solutions in the past month.

Zuck expects Meta AI to be the most used AI assistant by the end of the year. Admittedly, the only time I typically use Meta AI is when I am wearing my Meta Ray-Ban smart glasses (mostly while I’m driving/walking). It turns out India is driving the strong adoption of Meta AI which is not surprising given the Indian userbase on WhatsApp and their understandable lack of willingness to pay $20/month to access closed models:

People have used Meta AI for billions of queries since we first introduced it. We're seeing particularly promising signs on WhatsApp in terms of retention and engagement, which has coincided with India becoming our largest market for Meta AI usage.

Usage or adoption is one thing, but how is Meta going to make money here? Zuck essentially says “trust me; we have seen this before and we know what we are doing here.”

before we're really talking about monetization of any of those things by themselves, I mean, I don't think that anyone should be surprised that I would expect that, that will be years, right? I think that, like what we've seen with Reels. It's what we sell with all these things. But I think for those who have followed our business for a long time, you can also get a pretty good sense of when things are going to work years in advance. And I think that the people who bet on those early indicators tend to do pretty well, which is why I wanted to share in my comments the early indicator that we had on Meta AI, which is, I mean, look, it's early.

Last quarter, I think it just started rolling it out a week or 2 before our earnings call. This time, we're a few months later. And what we can say is I think we are on track to achieve our goal of being the most used AI assistant by the end of this year. And I think that's a pretty big deal. Is that the only thing we want to do? No. I mean, we obviously want to kind of grow that and grow the engagement on that to be a lot deeper, and then we'll focus on monetizing it over time.

But the early signals on this are good, and I think that, that's kind of all that we could reasonably have insight into at this point. But I do think that part of what's so fundamental about AI is it's going to end up affecting almost every product that we have in some way. It will improve the existing ones and will make a whole lot of new ones possible.

Zuck was pushed near the end of the call about these new potential opportunities coming out of Meta AI.

when I was talking before about we have the initial usage trends around Meta AI but there's a lot more that we want to add, things like commerce and you can just go vertical by vertical and build out specific functionality to make it useful in all these different areas are eventually, I think, what we're going to need to do to make this just as -- to fulfill the potential around just being the ideal AI assistant for people.

Then there is business piece of AI, especially on messaging:

“We're still in alpha testing with more and more businesses. The feedback we're getting is positive so far. Over time, I think that just like every business has a website, a social media presence and an e-mail address, in the future, I think that every business is also going to have an AI agent that their customers can interact with…our goal is to make it easy for every small business, eventually every business, to pull all of their content and catalog into an AI agent that drives sales and saves them money. When this is working at scale, I think that this is going to dramatically accelerate our business messaging revenue.”

For what it’s worth, FOA’s other revenue increased by 73% YoY in 2Q’24 (was +85% YoY in 1Q’24), driven by business messaging revenue growth from WhatsApp business platform. So we clearly have early signs of potential for business messaging even without AI coming into play.

Llama

If you haven’t read it already, I encourage you to read Zuck’s letter when Meta launched Llama 3 model. A lot of the points from that letter were repeated which I’m not going to mention and I would rather encourage you to read the letter instead.

During the call, Zuck also hinted at the ever increasing and kind of mindboggling cost increases for building the next models:

The amount of compute needed to train Llama 4 will likely be almost 10x more than what we used to train Llama 3. And future models will continue to grow beyond that. It's hard to predict how this trend -- how this will trend multiple generations out into the future. But at this point, I'd rather risk building capacity before it is needed rather than too late, given the long lead times for spinning up new infra projects. And as we scale these investments, we're, of course, going to remain committed to operational efficiency across the company.

To be clear, Meta does seem to have ample capacity to build Llama 4. Llama 3 was trained on ~16k H100s, and Meta expects to have ~600k equivalent H100 capacity by the end of 2024. If Llama 5 is 10x more than Llama 4, of course that changes the equation dramatically (speaking in hypotheticals, so not a prediction).

Just like Google, Meta seems also committed to not face the scenario of under capacity. Perhaps I’m suffering from bit of PTSD in 2022, but it does remind me of the 2021 era hiring spree which almost every big tech did except Apple. Ironically, Apple remains largely absent in the capex spree here as well, and yet remains the consensus AI winner given their end-to-end control and primacy of their devices in our lives. We will see whether ROI on these capex will be much better than the terrible return we have seen on the opex in 2021.

Meta, however, reminded the investors about the fungible nature of the capex which somewhat allays my concerns a bit:

…we're continuing to build our AI infrastructure with fungibility in mind so that we can flex capacity where we think it will be put to best use. The infrastructure that we build for gen AI training can also be used for gen AI inference. We can also use it for ranking and recommendations by making certain modifications like adding general compute and storage. And we're also employing a strategy of staging our data center sites at various phases of development, which allows us to flex up to meet more demand and less lead time if needed while limiting how much spend we're committing to in the outer years.

While Meta takes ROI-based approach for their core AI work, their investments in GenAI products are understandably more speculative/experimental in nature:

On our core AI work, we continue to take a very ROI-based approach to our investment here. We're still seeing strong returns as improvements to both engagement and ad performance have translated into revenue gains, and it makes sense for us to continue investing here.

Gen AI is where we're much earlier, as Mark just mentioned in his comments. We don't expect our gen AI products to be a meaningful driver of revenue in '24. But we do expect that they're going to open up new revenue opportunities over time that will enable us to generate a solid return off of our investment while we're also open sourcing subsequent generations of Llama.

Reels

On Instagram, Reels engagement continues to grow as we make ongoing enhancements to our recommendation systems. Part of this work has been focused on increasing the share of original posts within recommendations so people can discover the best of Instagram, including content from emerging creators. Now, more than half of recommendations in the U.S. come from original posts.

Threads

Threads Monthly Active Users over time:

3Q’23: 100 Mn

4Q’23: 130 Mn

1Q’24: 150 Mn

2Q’24: 200 Mn

Just as you expect an app that benefits from network effects, growth here is accelerating. Zuck seems committed to grow Threads to reach 1 Bn userbase and he appears to be under no hurry to monetize it. When X/Twitter is perhaps wondering whether they can make the next quarterly interest payments, Threads is focused on just growing the userbase with zero ads. While fintwit is barely active on Threads, let’s not underestimate how lopsided this game may prove to be over the next 2-3 years as Meta may continue to leverage its FOA apps to drive adoption and engagement on Threads.

…a lot of other companies that ship something and start selling it and making revenue from it immediately. So I think that's something that our investors and folks thinking about analyzing the business, if needed, to always grapple with is all these new products, we ship them and then there's a multiyear time horizon between scaling them and then scaling them into not just consumer experiences but very large businesses.

But the thing that I think is just super exciting about Threads is that we've been building this company for 20 years, and there are just not that many opportunities that come around to grow 1 billion-person app. I mean, there are, I don't know, maybe a dozen of them in the world or something, right? I mean, there are certainly more of them outside the company than inside the company, but we do pretty well and being able to add another 1 to the portfolio if we execute really well on this is just really exciting to have that potential.

AR/VR

Meta mentioned both Meta Quest and Ray-Ban Meta Smart glasses are selling better than they expected. On AR glasses:

Demand is still outpacing our ability to build them, but I'm hopeful that we'll be able to meet that demand soon.

Ray-Ban Meta smart glasses are showing very promising traction with the early signals that we are seeing across demand, usage and retention, increasing our confidence in the long-run potential of AR glasses.

Please note 2Q’24 RL sales are largely driven by Quest headsets and it’s not clear how the revenue is recognized by Meta in AR glass sales for which they have a partnership with EssilorLuxottica.

Capital Allocation

Meta returned ~70% of their FCF via dividend and buyback. Net cash balance remains ~$40 Bn, and diluted shares outstanding decline by 57 bps QoQ. LTM SBC per employee for the first time exceeded $200k per employee

Despite the buybacks, shares outstanding decreased by only 0.2% QoQ, thanks to Meta’s quite generous SBC program which is currently nearing ~$200k/employee. Meta makes even Google look pretty conservative on SBC as Google’s LTM SBC per employee is “only” $125k. To be clear, I would rather let Meta keep an exceptionally high bar for talent and pay people more than the hiring spree they went on during 2021-22. After all, these comp packages are likely important source of competitive advantage of big tech as most of these talents get priced out from much of the Silicon Valley startups/smaller companies.

Opex Guide

I will stop sharing the below graph after this quarter. While Meta used to decrease their opex guide gradually over the course of the year, clearly this is likely just Dave Wehner phenomenon, and Susan Li doesn’t seem to have any such approach. She appears to mostly stick to her initial opex guide.

Capex

Capex guide range was again increased to $37-40 Bn (from $35-40 Bn in 1Q’24, and $30-37 in 4Q’23). More importantly, Meta mentioned “we currently expect significant capital expenditures growth in 2025”

What does “significant” mean? Meta didn’t clarify further, but my guess is a number closer to $50 Bn.

Outlook

3Q’24 topline guide is $38.5-41 Bn (~2% FX headwind). Mid-point YoY growth is ~16.4% (vs consensus estimates of 14.7%)

Closing Words

After 1Q'24 call, Meta’s stock went down by almost 20% as the market was quite jittery about increased capex. This time the stock went up by +7% (and almost ~30% from 1Q’24 post-earnings low). Why the diametrically opposite reaction despite the fact that Meta is signaling another year of massive capex increases? My best guess is investors are increasingly appreciating Meta’s avenue of opportunities on capitalizing on GenAI, especially the fungibility of capex and hence the risk to the upside is perhaps more likely than to the downside from these investments.

For more in-depth analysis on Meta Platforms, you can read my analysis here (February, 2024).

I will cover Amazon’s earnings tomorrow. Thank you for reading.

If you are not a subscriber yet, please consider subscribing and sharing it with your friends.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.