Lululemon 4Q'24 Update

Disclosure: I own January 2026 $165 Call Options

Since its IPO back in 2007, Lululemon always posted double-digit revenue growth every single year. While there was plenty of skepticism throughout 2024, they managed to eke out double digit growth last year. But 2025 topline guidance of 5-7% implies the era of persistent double digit growth regardless of the economy is likely behind us!

Here are my highlights from the quarter.

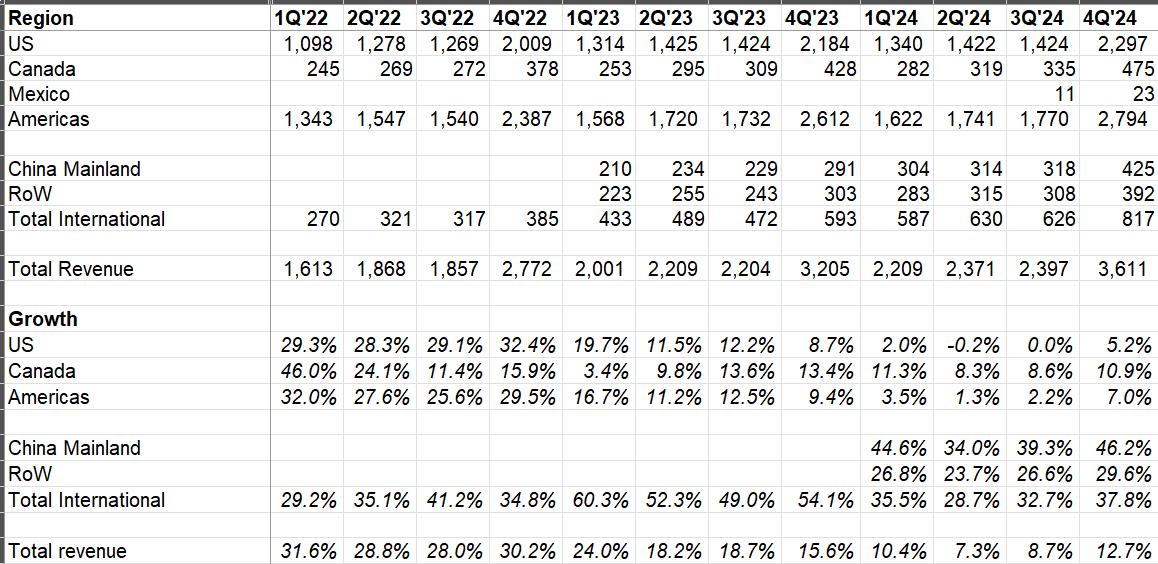

Sales Growth by Region

After three quarters of anemic growth in the US, Lulu managed to post MSD growth in the US in 4Q’24. Canada was double digit. China remains on a different growth stratosphere and even Rest of the World (RoW) segment’s growth was ~30% last quarter.

Lulu’s struggle in the US was mostly due to lack of its newness last year which they have largely corrected now:

“Looking at quarter one, we have increased our level of newness on par with the past. We believe this increase along with a robust pipeline of innovation will enable us to meet the expectations of our guests and I'm excited about what the product teams are bringing to market this spring throughout the year. We started the year strong with the launch of several new innovations.

Initial response has been very strong and we've been selling out across several sizes and colors. The teams are chasing into it now and we have several additions planned for later this year. Based on this response and performance, we believe Daydrift become a new core franchise.”

While Lulu talked about increased newness, they guided for LSD-MSD revenue growth in the Americas; to be more specific, they expect US to be closer to the lower end of the range and Canada to be on the higher end. Why such lackluster growth despite the increased newness?

we started this year with several compelling new product launches, but we also believe the dynamic macro environment has contributed to a more cautious consumer. In fact, based on a survey we conducted earlier this month in conjunction with Ipsos, consumers are spending less due to increased concerns about inflation and the economy. This is manifesting itself into slower traffic across the industry in The U. S. in Q1 which we are experiencing in our business as well. However, we see guests who visit us responding to the newness and innovations we brought into our assortment. We believe this is a positive indication as we continue to flow new product engage with our guests through unique and compelling activations and launch brand campaigns. We are controlling what we can control and we expect to see modest growth in U. S. Revenue for the full year of 2025.

Later, they clarified it’s mostly a US thing and they haven’t seen similar traffic trend in other regions:

“So in terms of traffic, I would say the notable trend we saw was that shift in The U. S. Nothing materially different in terms of either Canada or the international markets. I would call out just the difference in Lunar New Year timing, a shift in the timing this year. Have a little bit of a headwind on Q1 in terms of our China trend and overall international. And then in terms of U. S. Regional, we aren't seeing any meaningful differences regionally”

Lulu emphasized that their new guest acquisition is still strong and when guests arrive at the store, their conversion and average order size has increased; so it’s the decline in traffic itself that warranted the caution for the guide. In their guide, they assume Q1 traffic trend to continue which means they don’t expect improvement or further deterioration in traffic trend from here.

Their guide for other regions remains healthy: China ~25-30% and RoW at ~20%. Also, if you look at the comps for the US, Q2 and Q3 were pretty weak last year, so if traffic improves later in the year, that can boost their US revenue growth. But at their current size, it is quite clear they cannot be insulated from broader macro trend.

Lulu emphasized the long-term opportunity is still there given low unaided awareness across the world:

our unaided brand awareness in France, Germany and Japan is in single digits In China Mainland, it's in mid to high teens In The UK and Australia, it's in the 20s And in The U. S, unaided brand awareness is in the 30s.

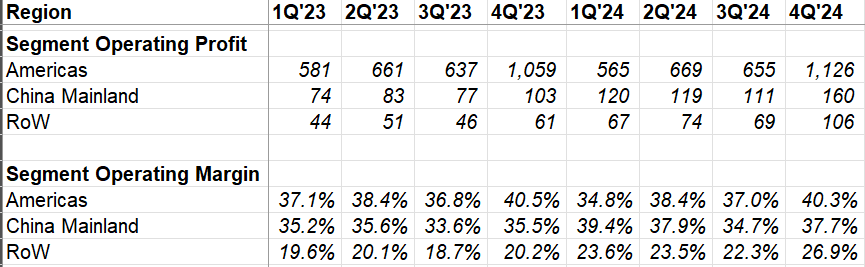

Margin

In 4Q’24, Lulu’s operating margin was more or less flat YoY in Americas but China and RoW margins were comfortably up. I would highlight RoW’s margin progression throughout the year.

Lulu’s gross margin in 2024 was 59.2% and and operating margin was 24.3%, both at or near all-time high for the company. Given the lower revenue growth in Americas, it is impressive that they were able to improve margins for the overall company, mostly thanks to operating margin expansion of 250 bps in China and 460 bps in RoW.

I would highlight though that Lulu’s spending on advertising as % of sales increased from 4.1% in 2022 to 4.5% in 2023 to 5.1% in 2024. Such increased spending may be indicative of higher competitive intensity. As a side note, in my recent visit to LA, I would guesstimate the number of people I noticed wearing Alo and Lulu was almost 50-50. Despite the competitive intensity, Lulu’s product gross margin did improve by 40 bps in 2024 in Americas, but the higher SG&A led to 50 bps decline in operating margin last year. After hearing Lulu’s plan to more community activation planned throughout this year, I think Lulu will keep their marketing spending intensity and mostly look for other areas to maintain/improve operating margins.

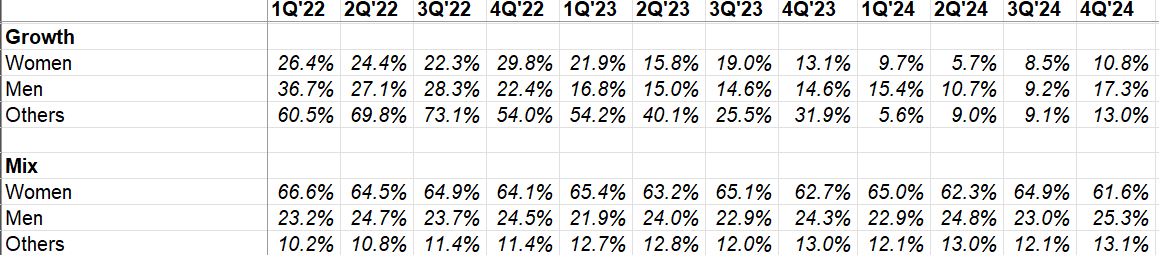

Sales by Gender

Women’s segment returned to double digit growth in 4Q’24. Both men and other segment also grew at low to high teen despite tough comps. I am somewhat disappointed that Lulu couldn’t make much inroads in shoes, especially in light of Nike’s woes. They are still trying to test out products here, but given that they haven’t been mentioning anything about shoes during the call tells me these experiments haven’t quite gone well.

Inventory

Even though Lulu guided inventory to increase by low double digits, it grew by 9%. They, however, guided for high-teen inventory growth for Q1 as they chase the newness.

Tariff is assumed to be 20 bps headwind this year.

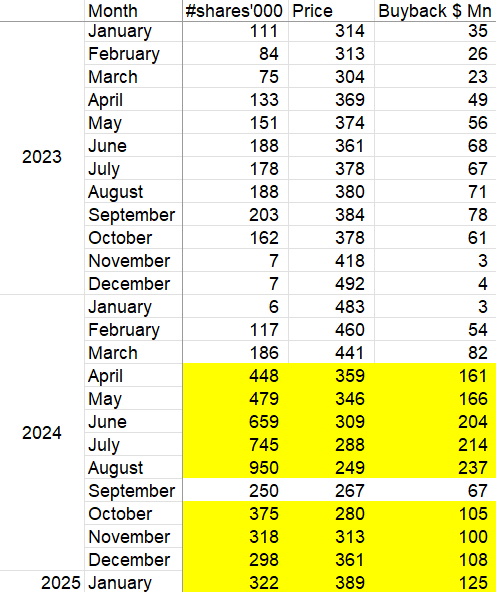

Capital Allocation

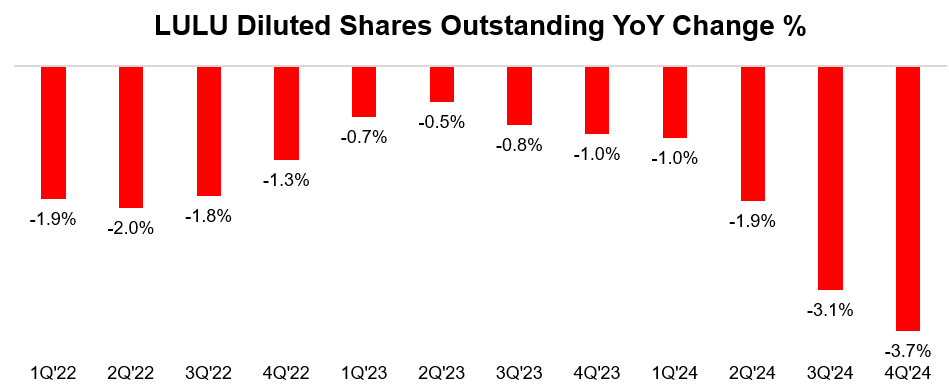

Lulu maintained their buyback intensity throughout last quarter. As you can see below, their buyback intensity varies materially over time which implies their activity is somewhat indicative of management’s opinion on the stock. Their actions suggest management continues to think the stock is quite attractive as they repurchased $332 million last quarter. They still have $2 Bn cash on the balance sheet, and given the stock price today and how cash generative this business is (they generated $3.2 Bn cumulative FCF in last two years), I expect buyback activity to continue unabated for the coming months.

Thanks to these buybacks, Lulu’s shares outstanding declined by 3.7% YoY in 4Q’24.

Outlook

I have already somewhat touched on the outlook, but here’s a more granular breakdown:

For 2025, topline guide is $11.15-11.3 Bn, implying ~5-7% YoY growth. If you exclude the 53rd week impact, this implies ~7-8% growth. FX is assumed to 100 bps headwind.

Gross margin is expected to be down 60 bps, driven by deleverage on fixed cost, FX, and tariff impact. Operating margin is expected to be down ~100 bps, but half of the decline is driven by FX headwind).

EPS guide for 2025 is $14.95-15.15 vs $14.64 in 2024, implying only 2-3.5% growth. Please note FX is assumed to be $0.3-0.35 drag this year.

Final Words

After last year’s uninspiring growth in the US, I came to 2025 hoping Lulu’s US business will pick up the pace this year as they introduce more newness to their products. Unfortunately, with potential macro softness it appears we may be set for longer wait for the US business to get back to MSD-HSD growth.

In my interview with Speedwell early this year, I mentioned how I worry about recession for a company such as Lululemon which sells consumer discretionary products. Given Lululemon’s size, they cannot be immune from macro headwinds anymore. A recession also makes the job of differentiating broader macro headwinds and the impact from higher competitive intensity very difficult, especially given many of Lulu’s competitors are not public (Alo, Vuori, Gymshark etc.). As a result, admittedly my enthusiasm for the stock has abated a bit in the current macro environment. So, I won’t be adding to my position here unless the stock trades at 10x NTM EBIT.

Thank you for reading.