Lululemon 3Q'24 Update

Disclosure: I own January 2026 $165 LULU Call Options

While the overall market continues to hit All-time High almost every other day, Lulu has been battling the skeptics for much of this year. There is still a long way to go, but with the stock now up almost 50% over the last three months, Mr. Market has likely started acknowledging that the bear narratives perhaps went a bit too far.

Glancing through the numbers for 3Q’24 may seem eerily similar to 2Q’24, but management’s tone was much more upbeat tonight.

Lulu’s CEO Calvin McDonald started the call with an apparent dig at Alo (which ran 30% discount on all products during this Black Friday) while assuaging investors that the current quarter is trending well so far:

We are pleased with our business over the extended Thanksgiving weekend and the traffic trends we saw across both our store and e-commerce channels. In fact, on Black Friday, we had the most visits ever to our Shop app and e-commerce site. Unlike others in this space, we do not run sale events across our entire store. We leveraged the increased traffic over this period to clear through product we are not taking forward and to feature full-price style.

While some competitors such as Alo notched up the promotional intensity, Lulu remained disciplined. McDonald later explained:

..We are happy with how the guests responded to both with full price sales driven by some of our key franchises

..From a year-over-year perspective, I don't think the overall market is any more intense. There's pockets where certain brands and retailers are more promotional and where others are less. I think it obviously depends on the momentum in their business coming in of how they've chosen to play that.

But when I look at the premium athletic space, we've continued to play a non-promotional markdown only reg price business unlike others within this space and pleased to see the results to kick off the holiday and the way the guest responds to our product.

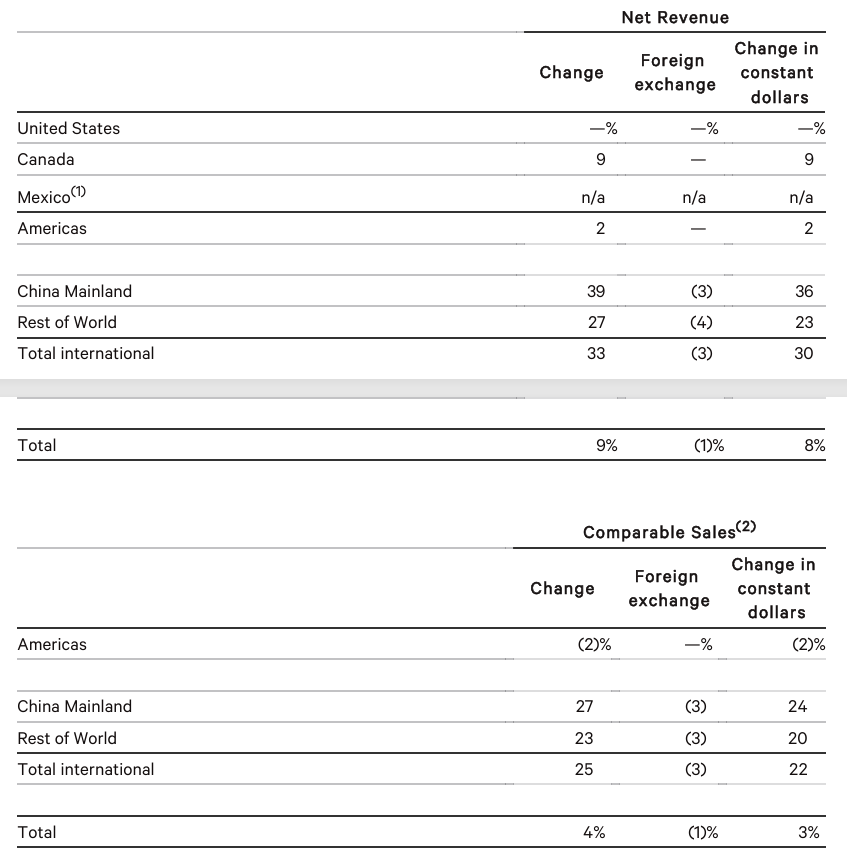

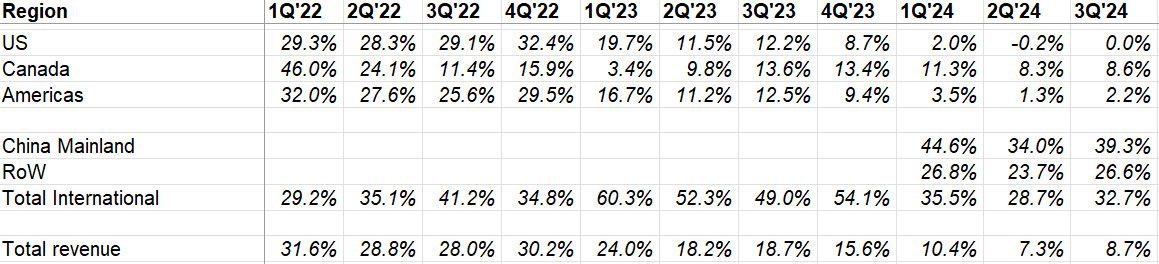

Sales Growth by Region

For the two consecutive quarters, US revenue was flat. US traffic was positive in e-com but slightly lower in stores than last year’s. Given Lulu’s bear thesis mostly revolves around alleged saturation in the US, Lulu won’t be able to kill this bear thesis until US revenue/comp starts growing. Remember, despite the roaring rally in the last three months, the stock is still down ~33% from its peak.

Canada remains a bright spot in North America. Lulu closed their Mexico franchise and instead added 15 company operated stores in Mexico.

While every other brand seems to be struggling in China, Lulu seems to be operating on a different gear there. I have shared more about their China strategy on my WhatsApp community a couple of months ago, so I won’t elaborate much here.

While Lulu’s US trajectory remains an issue, management mentioned that guest retention remains high and their membership program reached now 24 million in North America. If you take LTM revenue of ~$9.5 Billion in North America and assume ~80% of this revenue was derived from Lulu’s “members”, it implies each member spent ~$300 on Lulu in the last 12 months. This is average number, but it is likely that top 10% of Lulu’s customers perhaps spend multiple thousands of dollars per year. This should give you a good idea about the nature of the cult Lulu is for its core customers. Given the high retention of these members, I’m only half joking when I say Lulu is perhaps almost like a “subscription” for many of these core customers. Of course, these customers are not going to buy the same color every year which is why newness is an important driver for Lulu. Unfortunately, they have faltered on this for the last few quarters and management reiterated that by Q1, they expect to reach their historical level of newness:

We continue to see good response to newness from our guests, and we're on plan to hit that historical number by quarter 1. And when I look at our guests, I'm happy with the absolute growth number. Our retention with our guests remains very strong, and the opportunity remains, as I've spoken to in the past revenue per guest related to newness.

Beyond North America and China, Rest of The World (RoW) also continues to grow at a rapid pace. Lulu plans to open company-operated stores in Italy in 2025; they have also decided to enter Denmark, Belgium, Turkey and the Czech Republic under a franchise model. I wish there were more questions why Lulu decided to opt for franchise model in these markets, but there wasn’t much discussion on this during Q&A. But the fact that Lulu is just entering market such as Italy (fourth largest GDP in Europe and 10th in the world) makes me optimistic that there is ample growth runway left in RoW.

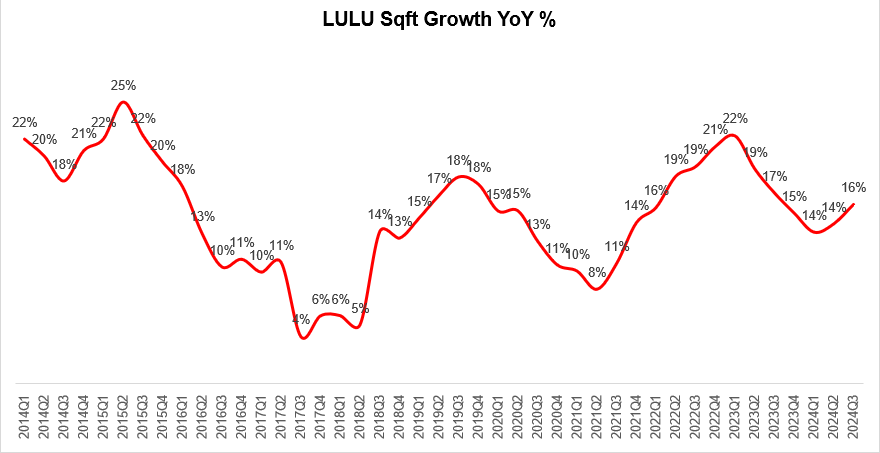

Lulu’s sqft growth gained a bit more momentum in the last quarter; adding 15 stores in Mexico certainly helped.

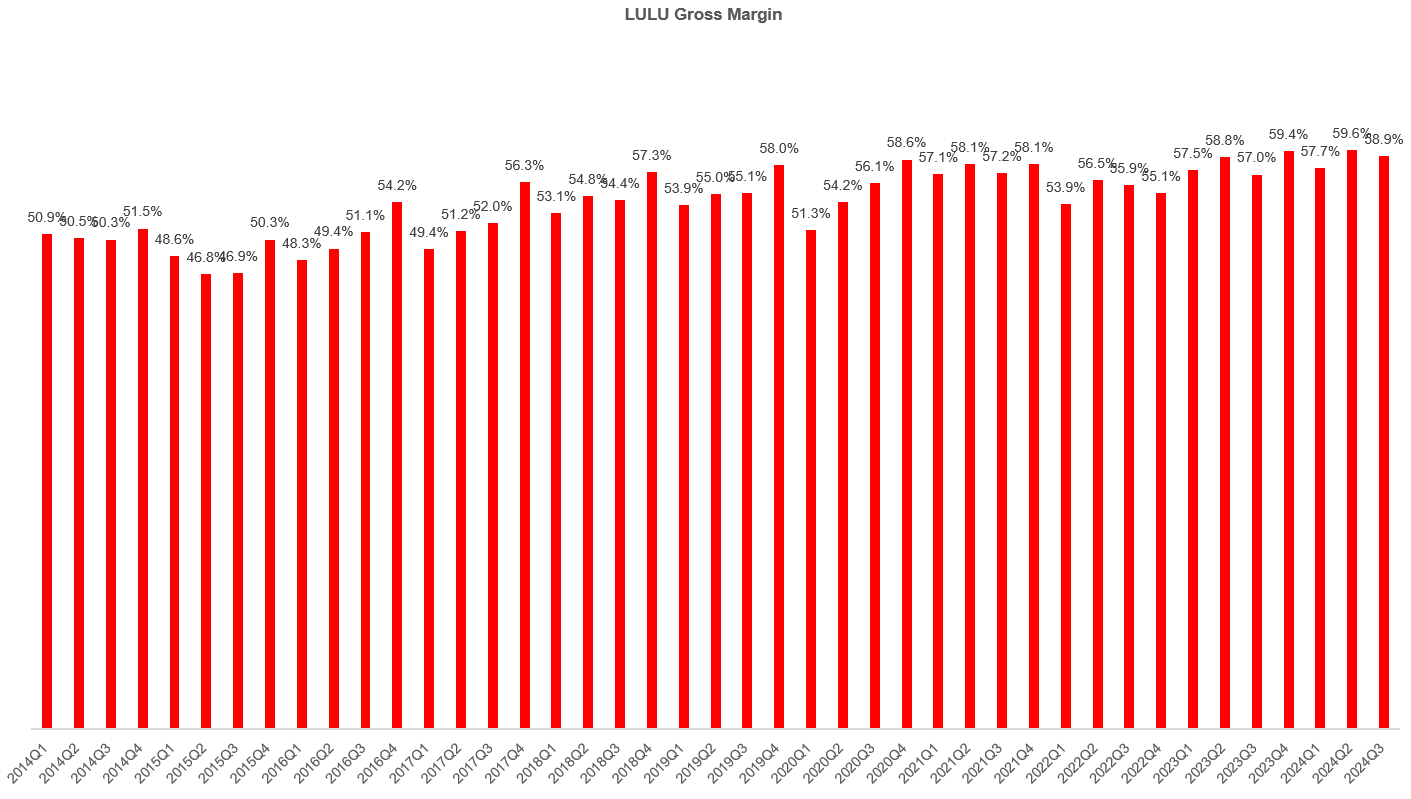

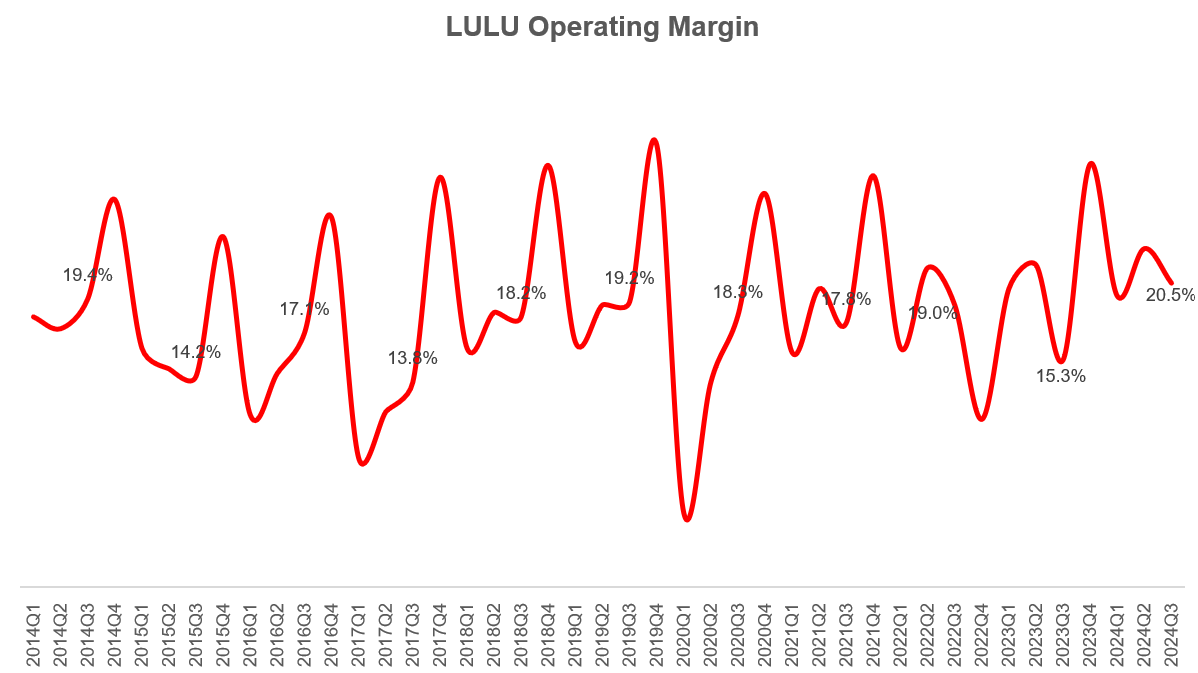

Margin

Lulu’s operating margins in North America and China segment may look pretty elevated, but management hinted that there’s more margin to be gained in China in due time:

it's not a region where we're looking right now to optimize operating margin, really focused on driving our long-term trend, but certainly see opportunity there over the longer term.

Lulu’s Gross Margin (GM) was ahead of their expectation which was driven by +50 bps increase in product margin, lower inventory provision offset by higher freight costs. Markdown was flat YoY; there was also 20 bps deleverage of fixed costs and 10 bps positive FX impact. SG&A, on the other hand, had 20 bps negative impact from FX. 3Q’24 operating margin was still highest in the last 10 years.

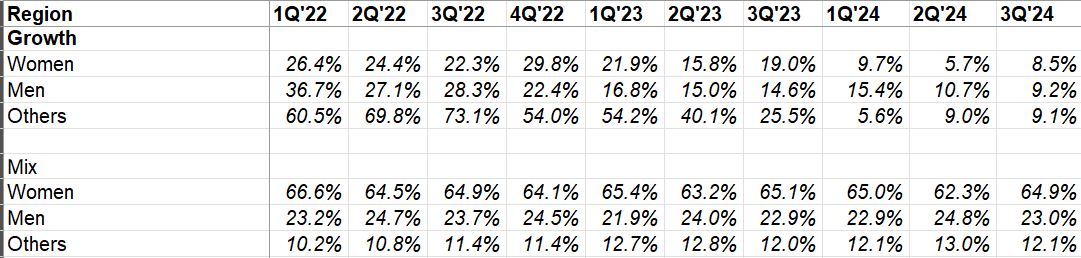

Sales by Gender

After MSD growth in women’s category in 2Q’24, it has picked up in 3Q. Lulu also seems to be planning to focus more on “play category” which I think is a good idea:

In quarter 3, in women's, we saw strength in short skirts and leggings and seasonal colors…We built upon our success this past spring in Golf by focusing on another play category, tennis, when we dropped our Lululemon tennis club collection during the U.S. opened in New York this quarter.

Based on the strong guest response we continue to see an opportunity to grow our play activities and intend to evolve our strategy from a seasonal approach to one where we introduced newness into these collections consistently throughout the year.

Lulu’s accessories business (other category) continues to defy the tough comp and maintained its HSD growth despite facing mid-20s comp from last year.

Inventory

Even though Lulu guided inventory to increase by mid-teens, it only grew by 8%. They, however, guided for mid-teen inventory growth for Q4 as they chase the seasonal newness.

There was a question about potential impact of tariff. It sounds to be quite manageable:

we have very limited exposure in China, we sourced approximately 3% of goods from China. So exposure there is relatively small. Our sourcing from Mexico is less than half of percentage, and we don't source anything from Canada. So also a very small exposure there as well. So I would expect those are probably under some of the competitive landscape.

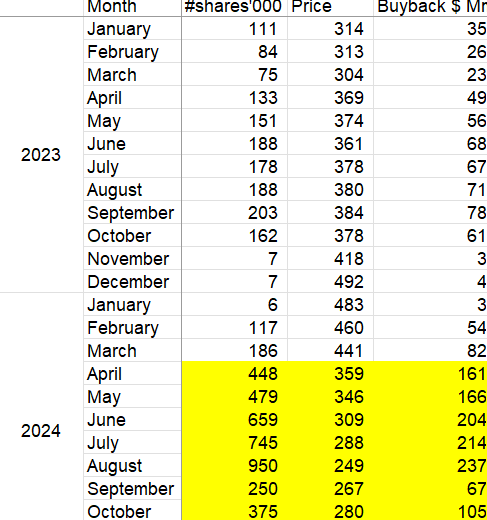

Capital Allocation

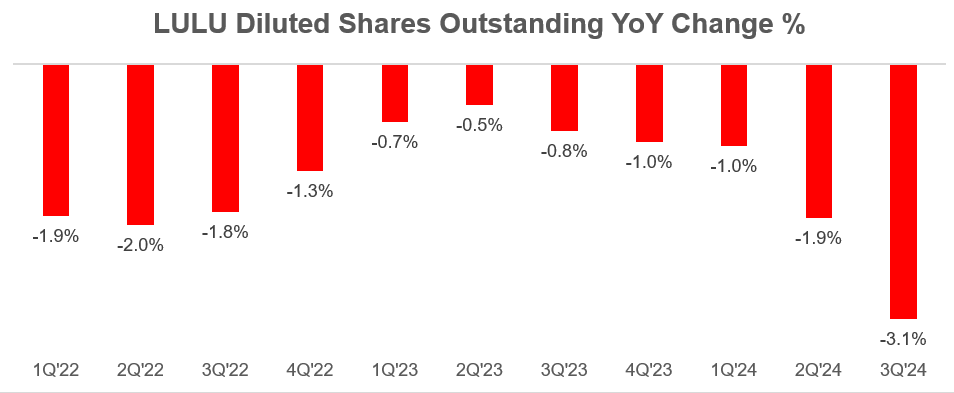

I am so, so impressed by Lulu management’s capital allocation in the recent few quarters. As the market warmed up to Alo/Vuori bear thesis, management decided to be quite aggressive in buying back the stock. When the stock was trading below $300 in July-August, they really ramped up their buyback activity.

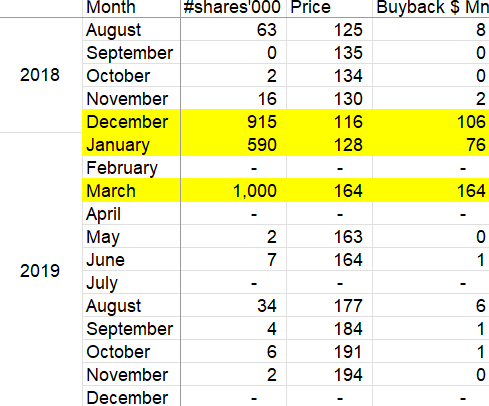

I was curious to see whether management chose to be similarly aggressive in the past. Indeed, I had to go back to 2018-19 when Lulu was similarly aggressive in buying back stocks as the stock was trading at $120-160/share. The stock did 2.5-3x since then, so these buybacks turned out to be quite accretive for remaining shareholders.

The current aggressive buybacks already started proving to be fruitful as Lulu’s shares outstanding declined by 3.1% YoY in 3Q’24.

Outlook

Even though Lulu comfortably beat topline in 3Q, they guided rather conservatively for 4Q. They increased the mid-point of annual guidance after taking it down by 3% last quarter:

Starting with full year 2024, we now expect revenue to be in the range of $10.452 billion to $10.487 million. This range represents growth of 9% relative to 2023…For the full year, we now expect gross margin to increase approximately 10 to 20 basis points versus our adjusted gross margin in 2023. We continue to expect markdowns to be relatively flat with last year…When looking at operating margin for the full year 2024, we continue to expect a decrease of 10 to 20 basis points versus adjusted operating margin in 2023, which expanded 110 basis points versus 2022.

Final Words

Lulu remains a very important holding in my portfolio. I am encouraged to see growth momentum continuing in international markets, but for Lulu to get out of the woods, we will have to wait for the US growth to return. I am optimistic that we will see such return to growth in the US in 2025 which may help evaporate the clouds on Lulu’s business.

More reading on Lululemon: here, here, and here (see section 5)

Thank you for reading.