Lululemon 2Q'24 Update

Disclosure: I own January 2026 $165 LULU Call Options

It is far from common for a stock to be up 4% after missing the revenue guide for the quarter and slashing the full-year revenue guide. That’s exactly what happened with Lululemon today which should tell you the kind of sentiment going into the earnings!

Here are my highlights from tonight’s call.

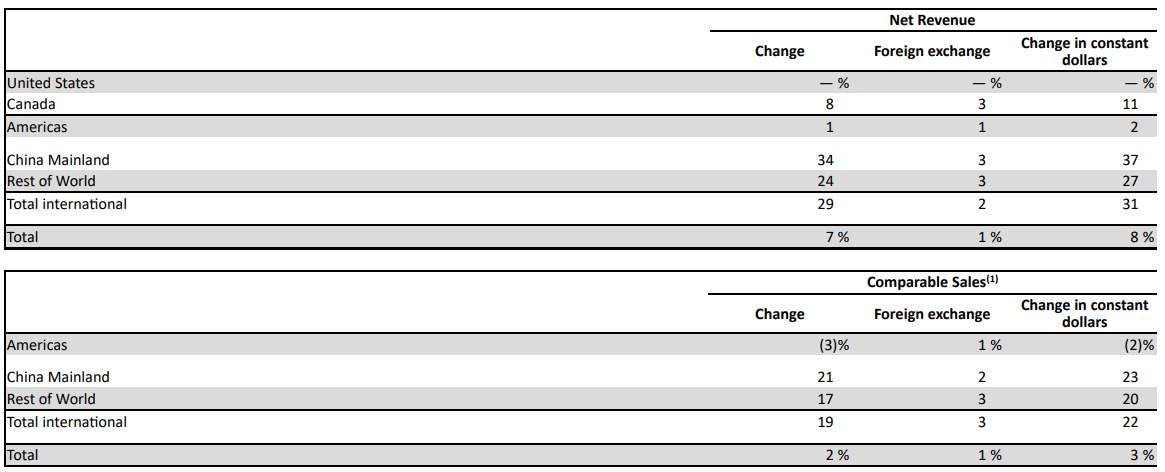

Sales Growth by Region

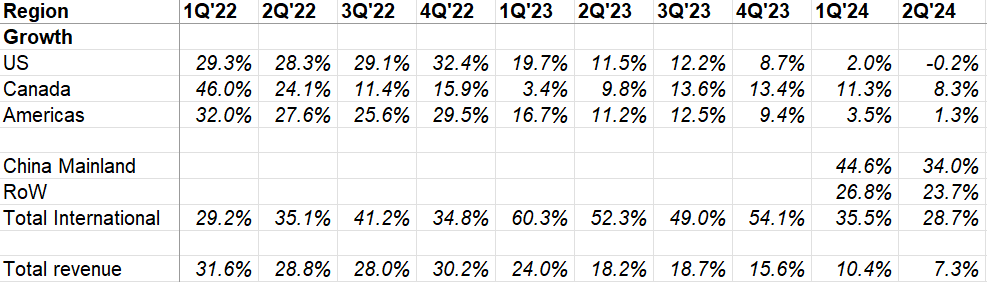

The crux of the bear thesis on Lulu usually circles around their US business. After growing sales +2% YoY in 1Q’24, it was flat in 2Q’24. So, I don’t quite expect bears to bow out unless and until Lulu’s US business dispels their concerns. We are clearly not there yet. More on the US business later, but looking at Canada which is Lulu’s most mature market, I continue to be optimistic that the brand hasn’t peaked in the US.

While China revenue grew by +37% YoY this quarter, skeptics might think the deceleration from last quarter (+52% YoY) is also a bit concerning. A good counterargument is the Chinese New Year was in Q1 this year which lifted the growth last quarter.

Management mentioned in the US “traffic was up across both channels and Google search queries remain positive”, and reiterated ~5% sqft growth per annum in Americas through 2026. They also reminded that comps for the US will be easier next year; my guess is if Lulu can deliver HSD to LDD growth next year in the US, much of the bear concerns will likely evaporate. While the comps will be easy, the big question remains whether the macro will be supportive of such growth trajectory next year.

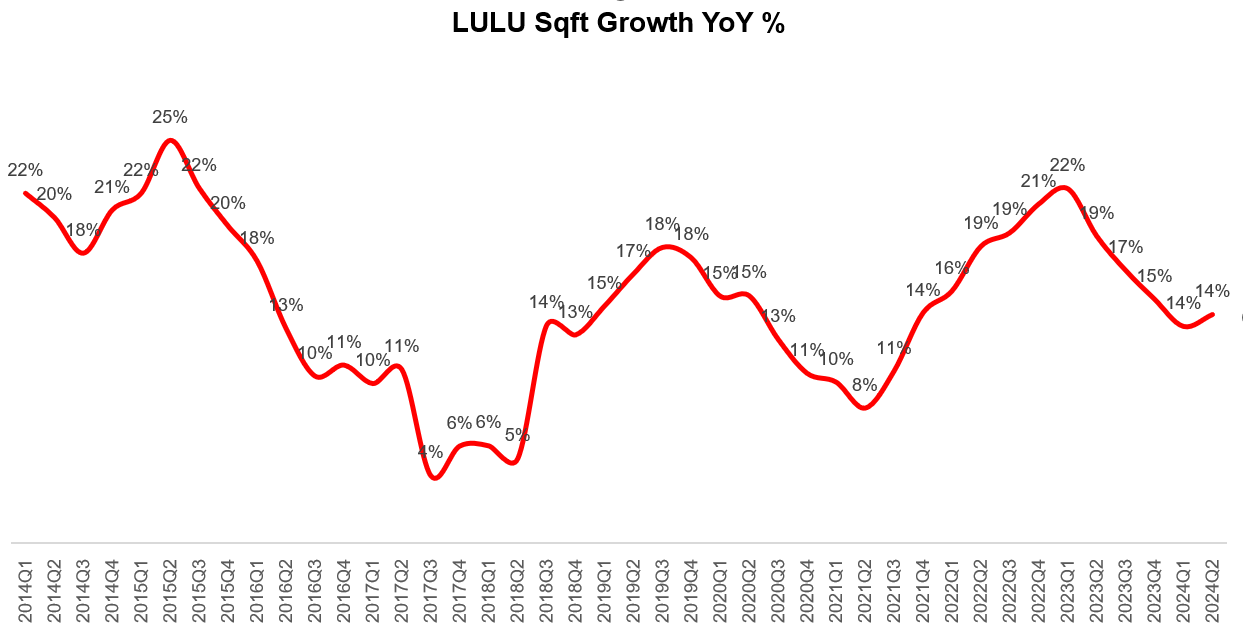

After four quarters of YoY decelerating sqft growth trend, 2Q’24 quarter saw a slight uptick. Although this is nice to see, please note Digital was ~38% of the revenue. So, unlike most physical retailers, Lulu story is not necessarily hinged on sqft growth.

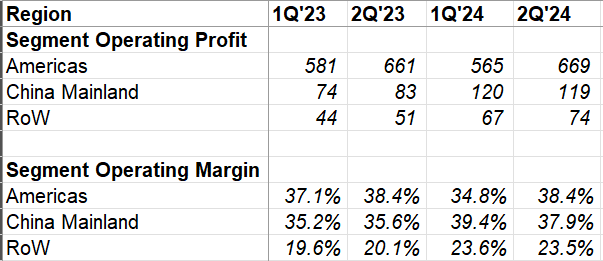

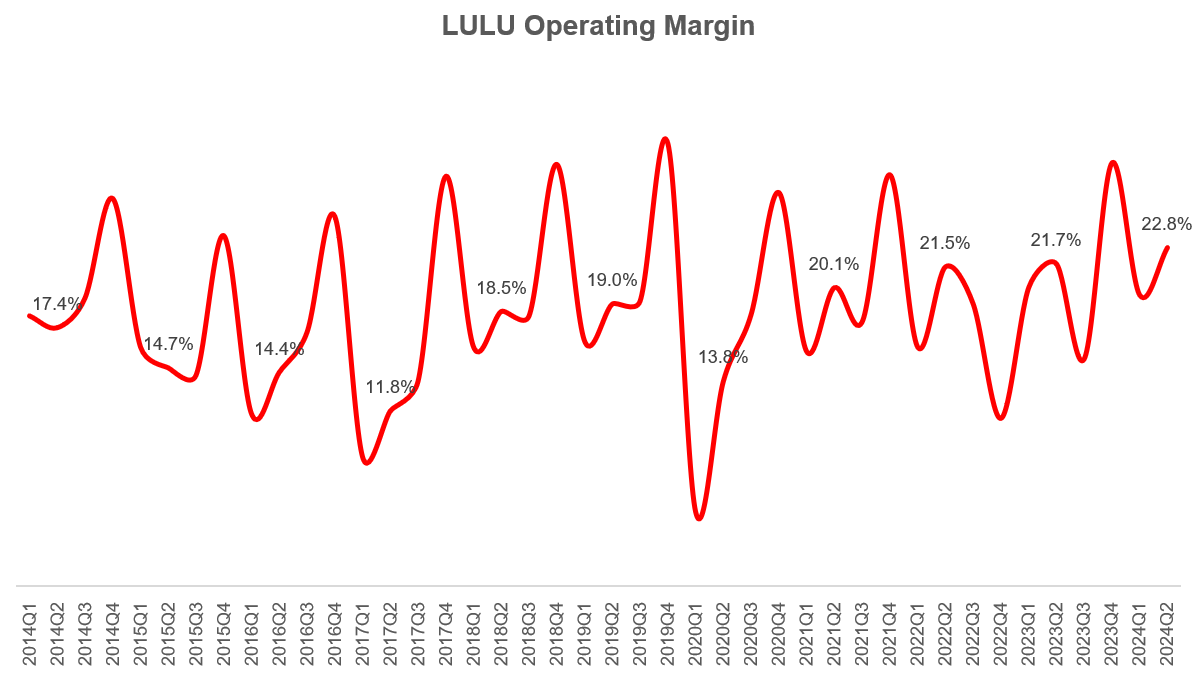

Margin

Another popular bear case circles around Lulu’s margins which many suspect Lulu over-earned during the pandemic and now that consumer is weak and Lulu is facing intensifying competition from the likes of Alo/Vuori, Lulu will be compelled to defend its turf by sacrificing margins. So far, we don’t see this thesis playing out in the numbers.

Americas margins was flat YoY, China was +229 bps YoY, and Rest of the World (RoW) posted +334 bps YoY operating margin improvement.

Lulu’s gross margins used to be in the low 50s during 2014-17 period. Lulu posted its highest ever gross margin in 2Q’24. Similarly, Lulu also posted its highest ever 2Q operating margin this year. For a retailer that’s experiencing some hiccups in the topline and typically have material fixed cost, it is quite impressive that Lulu has been able to pull this off. While I understand the appeal of that bear thesis on margin contraction, there is so far scant evidence on this point. We’ll see if that materially changes going forward.

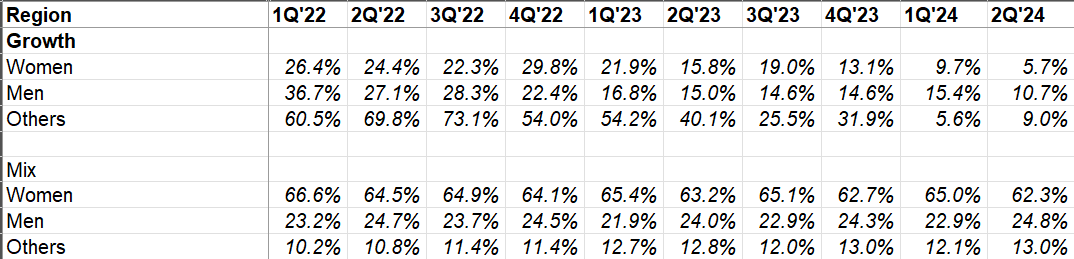

Sales by Gender

One area that can embolden bears is the mediocre results in women’s segment which has come down to a meagre MSD growth in 2Q’24. Men’s and accessories/others continue to chug along just fine, but women’s segment (~62% of overall sales) is clearly bit of a headache at this point.

So what’s going on with women’s segment? Here are some quotes from the call discussing this segment:

While we continue to see growth in our men's business, we have experienced a slowdown in women's. We have improved our in-stocks in smaller sizes through Q2 and are entering Q3 better positioned. As we've analyzed our women's business in more detail, we have determined the most significant factor was a product plan that introduced less newness across core and seasonal styles. By newness, I'm referring to the seasonal updates we bring into the assortment, typically expressed as color, print, patterns and silhouettes.

I'm not referring to our pipeline of innovation, which remains full…As we have learned more, it's become clear to us that this reduced newness, which is below our historical levels and stems from earlier product decisions has impacted conversion rates given the fewer new options available to our female guests. While this reduction was seen across our women's assortment, it had a more pronounced impact in bottoms and in our online channel. The newness that we had performed well, we simply did not have enough to inspire her to purchase.

…Guest was coming in traffic was positive across all channels and the opportunity was in conversion.

So I see that as an opportunity that they were there with intent to spend, and there was a noticeable reduction in those historical levels of newness. So those were the product decisions that we made earlier and the new teams in action. And as I alluded to the chase, but definitely, I think majority is within our control.

…For 2025, we are fast-tracking several new styles within performance shorts, tops and track suits. We are optimistic that we will begin to see the benefits of these strategies over the upcoming quarters and return to our historical levels of newness no later than spring 2025.

It is really, really disappointing to see management score such an own goal. For the two consecutive quarters, we are hearing about this lower conversion rates. I think much of this problem emanates from not what they did this quarter, but due to their poor preparation over the course of last few quarters. I should note about the recent debacle related to Breezethrough which Lulu pulled away after noticing design complaints from their customers. Management mentioned it had immaterial impact on revenue or inventory and since customers really liked the fabric (but not the design), they’ll reintroduce the fabric with a different design in 2025 (or later).

The problems management has outlined here made me wonder whether management fell asleep at the wheel here. I harbor mostly positive opinions about Calvin McDonald (just see pre and post Calvin era growth trajectory until this year), but I don’t think McDonald can afford to have any more mishap without attracting activist shareholders.

The good thing is McDonald will have the power of Lulu brand to give him some time to course correct; despite management’s recent spotty ability to serve their core customers, Lulu continues to acquire new customers:

In terms of the guest profile, nothing meaningful in that we continue to grow our new guest base and continue to do it across the demographics that we have been growing.

Inventory

Inventory declined by 14% YoY and LULU expects it to increase by mid-teens in Q3 and slightly higher in Q4.

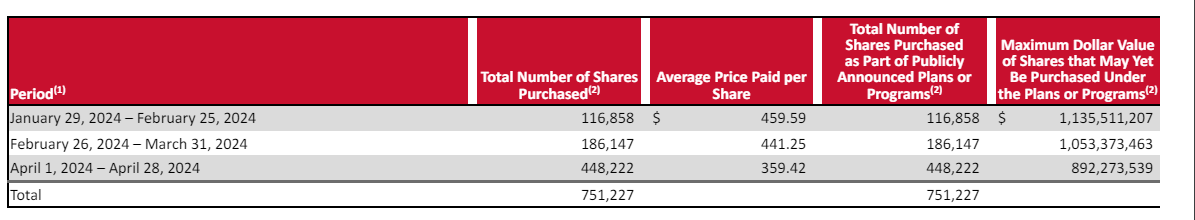

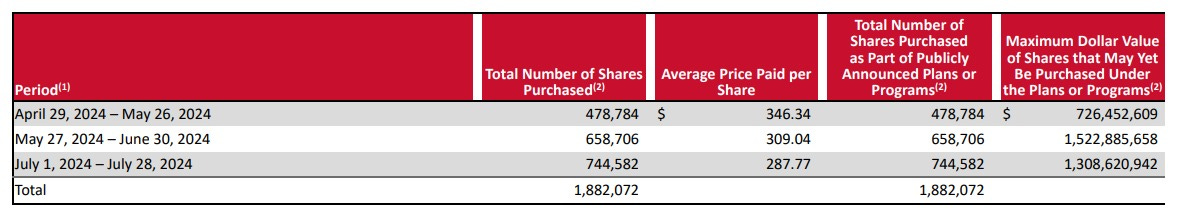

Capital Allocation

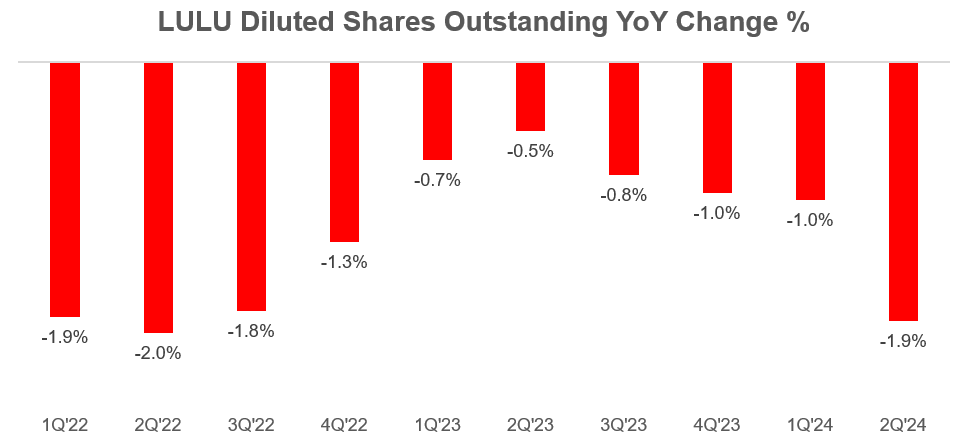

While management will get probably a “D” grade from me in terms of operational execution in the last couple of quarters, I am at least pleased to see that as the stock kept going down, they increased their buybacks. While Lulu mentioned they repurchased $1.2 Bn YTD, their 10-Q shows they bought back $889 Mn until Q2 which implies they bought back another $311 Mn so far this quarter. Assuming $260/share, it means they repurchased 1.2 mn shares in August i.e. ~1% shares. (MBI Note: updated this section after going through the 10-Q)

Thanks to these buybacks, LULU’s shares outstanding has gone down by ~2% in 2Q’24.

Outlook

As mentioned earlier, Lulu guided down for the full-year. 2024 revenue outlook is now $10.375-10.475 Bn (down 3% from prior guide). The reason for guiding down was macro uncertainty. Management mentioned in Q2, May was more in line with Q1 trend, then it deteriorated in June, but July was slightly above June. Some more colors around the guide below:

…we are assuming that revenue trends in the second half of the year remained fairly consistent with Q2, when excluding the 53rd week and the impact of a shorter holiday shopping season in Q4

…For the full year, we now expect gross margin to be approximately 20 basis points below our adjusted gross margin in 2023, due prominently to deleverage on fixed costs associated with lower forecasted sales and an increase in freight costs relative to our prior estimates. We continue to expect markdowns to be relatively flat with last year. Turning now to SG&A for the full year. We now expect it to be approximately flat versus 2023. When looking at operating margin for the full year 2024, we now expect a decrease of 10 to 20 basis points versus adjusted operating margin in 2023, which expanded 110 basis points versus 2022.

Final Words

As mentioned earlier, unless and until Lulu starts posting healthy topline growth in the US, it will likely prove difficult for the stock to take a decisive upward trajectory. Over the long run, I do think international growth will be a material driver for the stock, but in the next 12-18 months, Lulu’s fate will likely hinge on the trajectory of their US business. I have no plan to add/trim following this quarter.

More reading on Lululemon: here, here, and here (see section 5)

Thank you for reading.