Lululemon 1Q'24 Update

Disclosure: I own January 2026 $165 LULU Call Options

Lululemon was facing some really thorny questions from Mr. Market ever since 4Q’23 earnings. Today’s earnings should help calm some nerves.

Here are my highlights from tonight’s call.

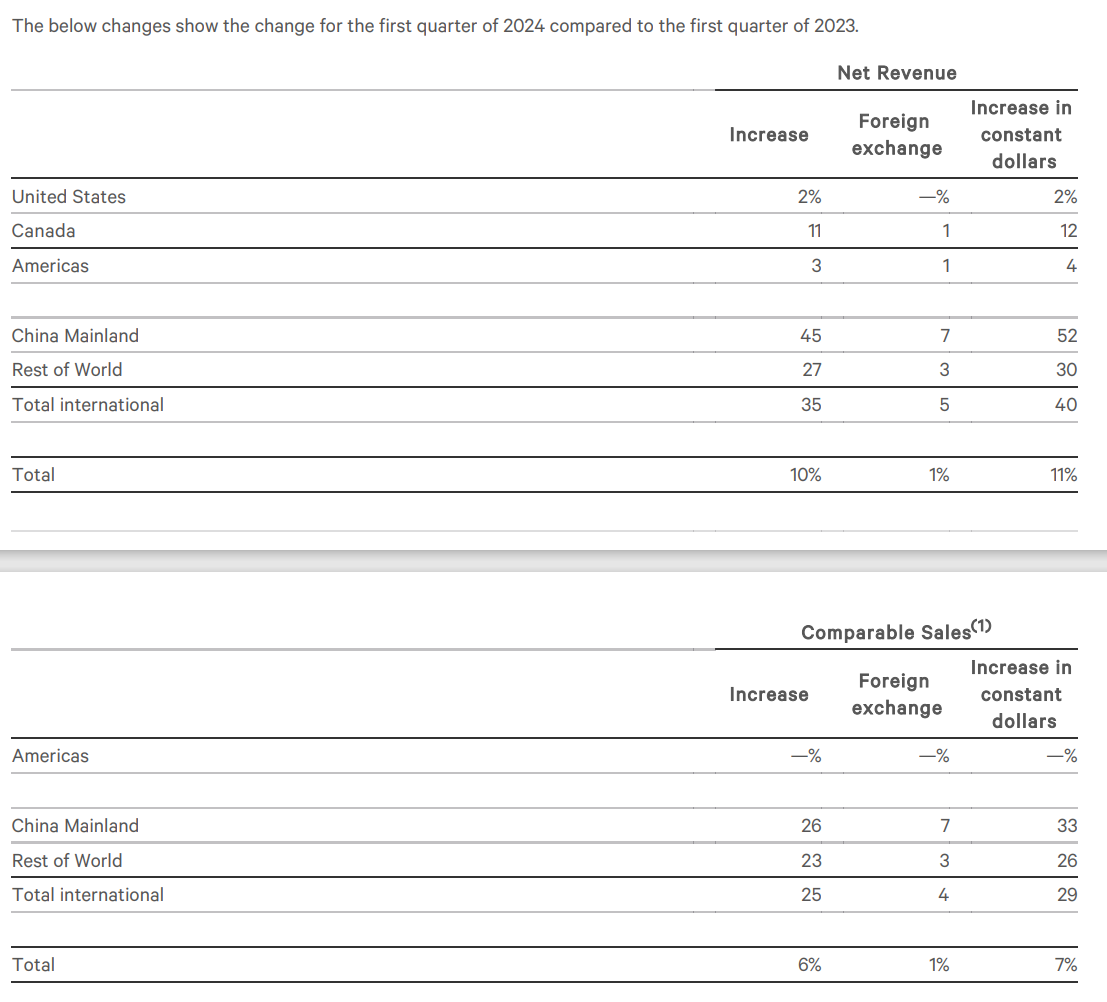

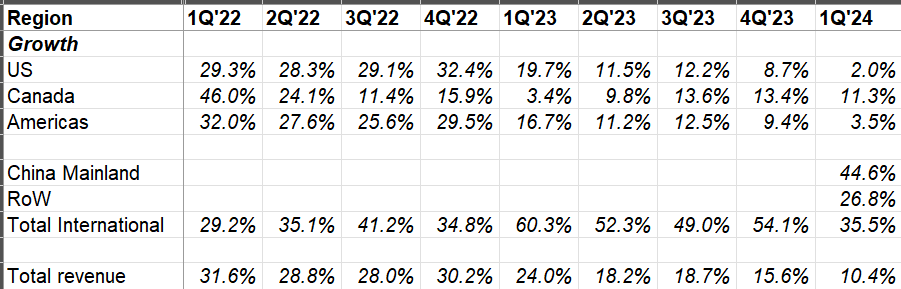

Sales Growth by Region

At first glance, one may find confirmation to plenty of concerns for LULU. US sales, which was ~61% of overall sales this quarter, grew by only 2%. Growth momentum in international markets, especially in China helped mask the weakness in the US.

Looking at Canada’s continued double-digit growth momentum assuage my concerns related to maturity of the US business as Canada is LULU’s most mature market. There are quite a few factors at play here. US business had much tougher comp than Canada this quarter (1Q’23 US business grew by ~20% vs Canada’s ~3%). The “Everywhere Belt” bag was much more popular in the US last year than it was in Canada. I will discuss a few other reasons for US weakness later.

Let me focus a bit more on international opportunity, which was ~21% of LULU’s revenue in 2023. Interestingly, while Nike is ~3x the size of LULU’s North America business, Nike’s China business is ~8x the size of LULU’s, hinting at the large runway available for LULU to further penetrate the market. LULU’s China business grew by ~67% in 2023, and yet China revenue grew by 52% FXN in 1Q’24.

LULU management expects international to eventually contribute 50% of overall revenue. That may seem overly ambitious, but looking at China growth momentum and low penetration it doesn’t seem inconceivable to me. Moreover, LULU doesn’t even operate in potentially large markets such as India yet (although they may enter soon). Admittedly, India for LULU may be more of a 2030s story than 2020s story, but in the fulness of time, ~50-50 revenue mix between North America and International seems plausible to me.

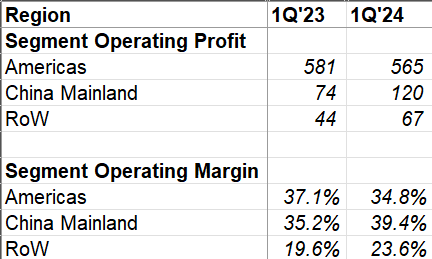

Margin

What’s perhaps even more interesting is LULU’s margins in China are quite incredible. In 1Q’24, they reported ~39% operating margin in China (vs ~35% in Americas). Operating margins in Rest of the World (RoW) have also improved by ~400 bps YoY.

LULU’s overall gross margin was 57.7%, ~20 bps improvement YoY which was driven by 120 bps increase overall product margin (lower product costs, lower air freight costs and lower inventory provisions) but was offset somewhat by a 50 bps increase in markdowns.

LULU expects inventory markdown to increase YoY in Q2 as well (but less than in Q1) but annual markdown is still expected to be flat YoY, implying lower markdown in the back half of the year

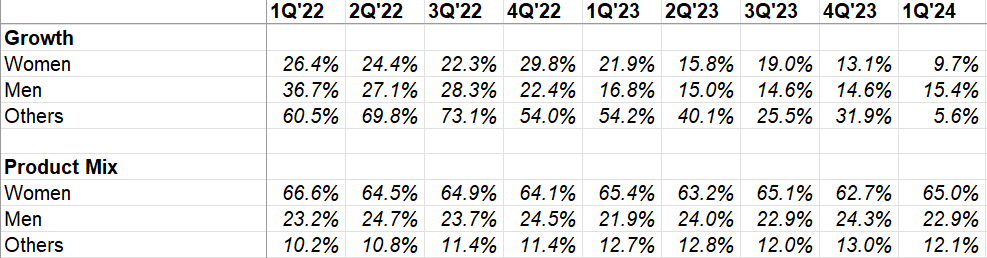

Sales by Gender

While LULU’s men’s business maintained its robust mid-teen growth, women’s segment reported <10% revenue growth for the first time since 2Q’20 (which was marred by Covid anyway). As discussed earlier, “others” category which includes bags had a particularly tough comp (1Q’23 grew by 54%).

Why did women’s segment perform poorly? From today’s call:

When looking at women's, we did not maximize the business in the U.S., which was the result of several missed opportunities, including a color palette and our core assortment, particularly in leggings that was too narrow. Where we had color guests responded well, we just needed more as they are looking for additional choices. And we are also out of stock in some of our smaller sizes.

…The 1 color and newness we did have, she responded incredibly well to, but she was looking for more, and our palette that we chose was just more limited than what she was looking for as well as because of the success in Q4, we came into the year with some missed opportunity across our size profile, particularly our smaller sizes. All of this is within our control. All of this, the teams have been chasing and we expect much of that to be addressed in the second half of this year as well as a lot of the newness and innovation, we did have planned for this year and our women's business was scheduled more for mid to back half of the year.

The pain in women’s segment seems mostly self-inflicted to me and something that can be corrected over the course of the year.

Lack of product assortment was also an issue in “other” category:

In the accessories business, we know that we're cycling over the success of the Everywhere Belt Bag which is incredible. It really validates and shows what's possible for our brand in accessories, in particular, in bags. And although that bag continues to perform well, not quite to the levels of last year, but the team has introduced a number of new styles of bags that the guests responded incredibly well to.

We just didn't have the depth of inventory to satisfy the demand that could have offset some of the headwind of the Everywhere Belt Bag success last year. That is something we can control. We know the newness is resonating and the guest is moving beyond just an Everywhere Belt Bag, and we have opportunity and the teams have been chasing into that and expect to be in a better in-stock position in the back half, the 2-tone bag is a good example of that sold out almost immediately. We were able to chase bring some in, offer it as an Essentials member early access, it again sold and did incredibly well, and we continue to chase into that.

To put LULU’s success in perspective, they did $549 mn revenue in “other” category in 2021 which then more than doubled by 2023 to reach $1.2 Bn. I know competition is the hot topic for LULU; but frankly speaking, I’m not sure whether they were even able to match LULU’s momentum in their “other” category, let alone men’s and women’s category over the last 2-3 years! Perhaps thanks to such outsized success, things had to be a bit rocky in 2024. I do, however, expect LULU’s management to be better prepared with product assortments than they were in the first half of the year. Management did mention a number of new products to be launched in second half of the year, so we will have better clarity on this issue in a couple of quarters.

Membership

LULU now has 20 mn members in North America (vs 17 mn in 4Q’23). LULU continues to acquire new customers, but it would be bit more helpful if they provided more color on guest retention numbers. In 2019, for example, they mentioned they had 92% guest retention for high value guests.

Inventory

Inventory declined by 15% YoY and LULU expects it to decrease mid-teens in Q2 as well before starting to increase in line with revenue in the second half of the year.

Competition

Has the intensity of competition gone up recently? From the call:

There remains competitors in this space that use promo as a means to drive demand for their product. We've seen that increase over the last few years.

But I wouldn't say in this quarter, it's either gone deeper or pulled back. It's sort of the same, which I would say is a heightened level from a few years ago, but nothing dramatic in the quarter.

Capital Allocation

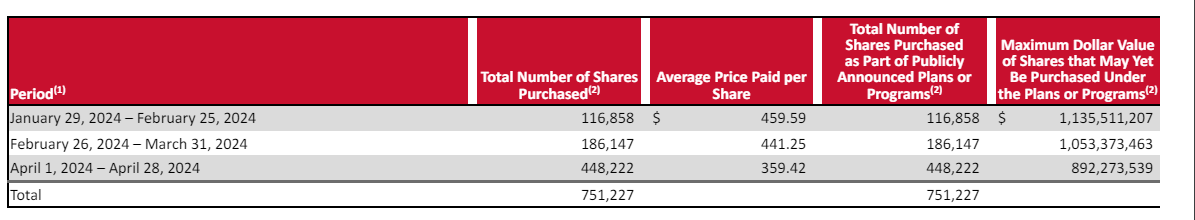

It’s not everyday you see a company increasing the buyback intensity as stock price goes down, so it’s good to see LULU execute that. As the stock went down, they increased buyback intensity from ~117k shares in February to ~186k in March to ~448k in April. We know the stock did even worse in May, and thankfully management mentioned they bought back another $230 Mn (so another ~650-700k shares in my estimates) in May. Moreover, they raised buyback authorization by $1 Bn and have $1.9 Bn cash on balance sheet.

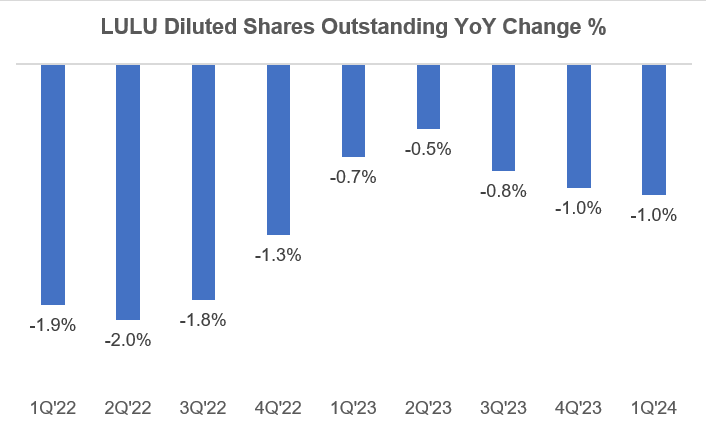

Thanks to these buybacks, LULU’s shares outstanding has been going down by ~1% YoY each quarter.

Outlook

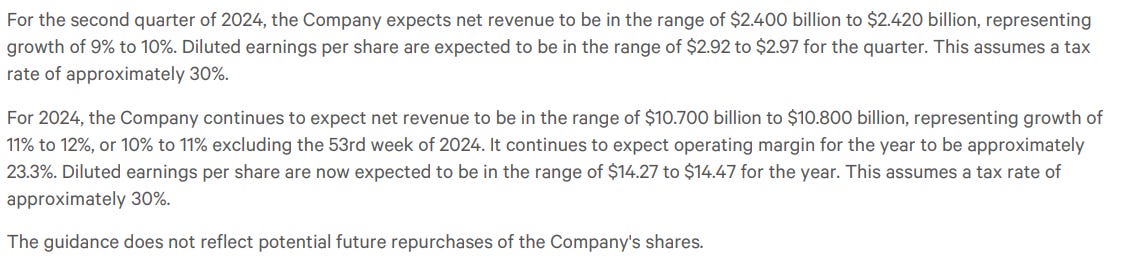

LULU maintained their topline and operating margin guidance. EPS guide was slightly increased 14-14.2 to 14.27-14.47 (without assuming future buybacks).

Final Words

Overall, this quarter highlighted that there are indeed some issues for LULU’s product assortments, especially for women’s segment in the US, but it does appear to be largely self-inflicted. The rest of the business seems to be largely continuing its momentum. If LULU manages to address the concerns for women’s segment in the US, I’m still optimistic that they may be able to do better than their high-end of revenue guidance for 2024, and that’s likely not priced in despite the ~10% rise in the stock price After-hours!

More reading on Lululemon: here, here, and here (see section 5)

Thank you for reading.