Management Compensation and Incentives at Big Tech

Note: I appeared on Liberty's Highlights podcast to discuss this topic. It may be better to listen to the podcast since it is done after writing this post below, so I could add more context to it, especially after further discussion and feedback from readers.

I was recently reviewing management incentives at Apple, Microsoft, Alphabet/Google, Amazon, and Meta in their 2022 proxy statements.

My best to worst ranking purely on incentive structure below:

Best: Apple

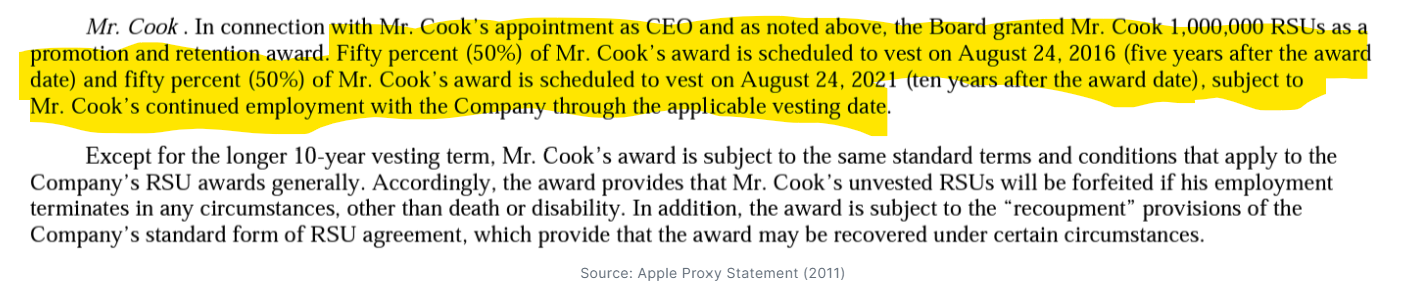

In 2011, AAPL granted time-based restricted Stock Units (RSUs) to Tim Cook with no performance condition i.e. as long as Cook remains CEO, he would receive the RSUs in two installments: 2016 and 2021. See original 2011 grant here:

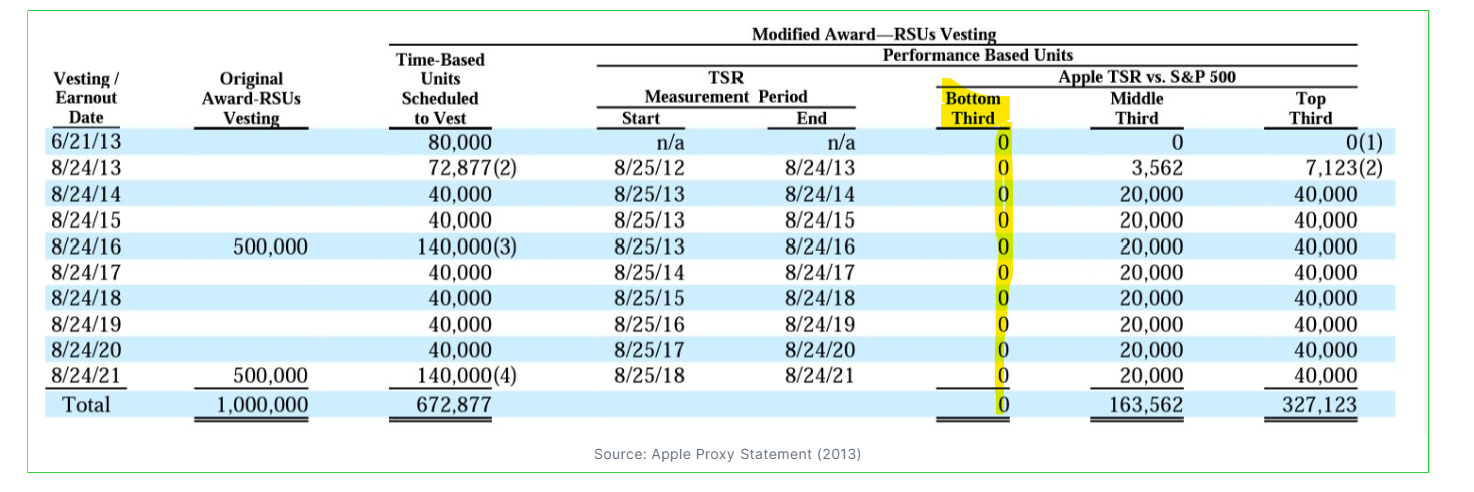

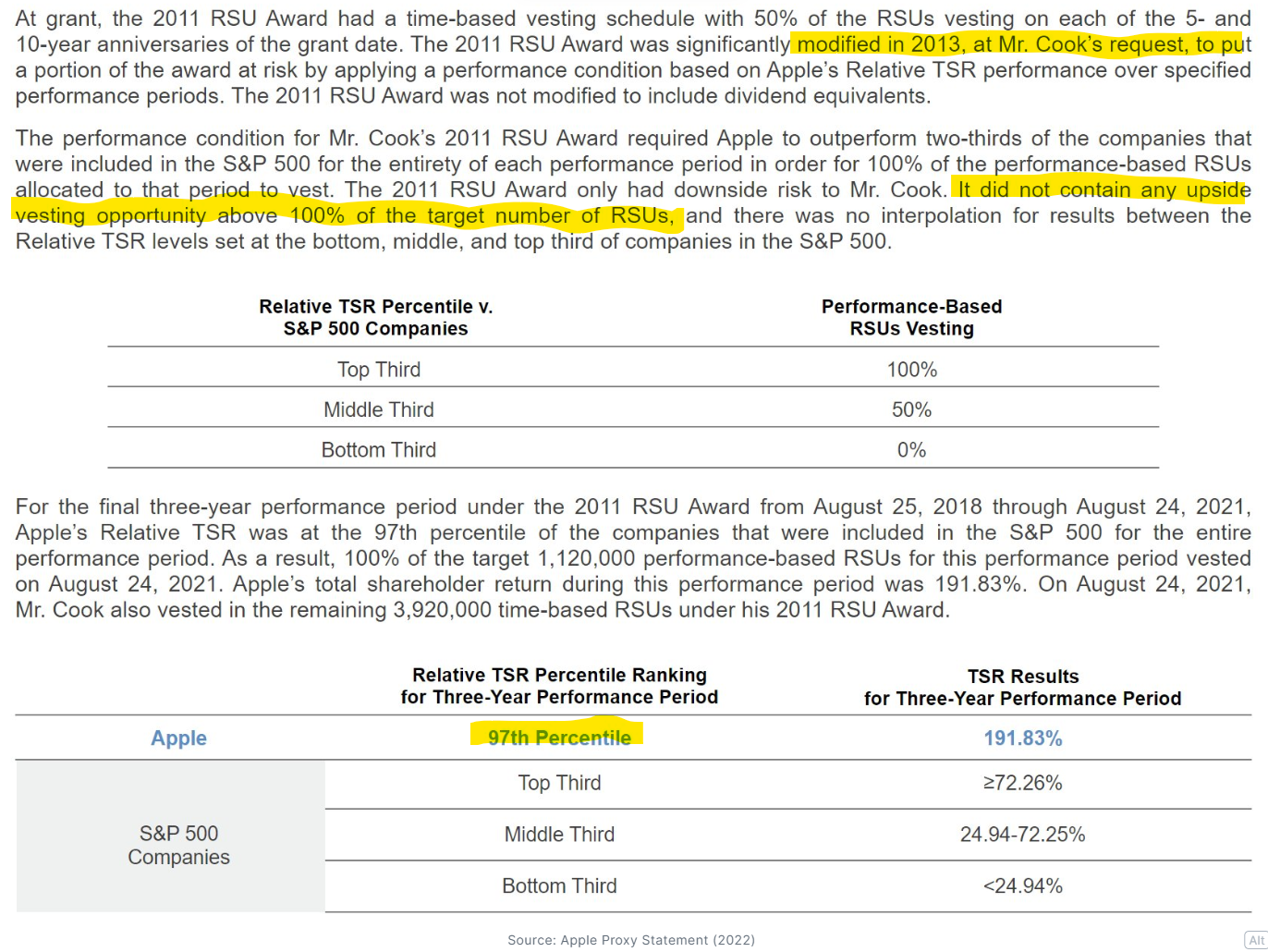

Cook requested in 2013 to insert performance condition: he would get those RSUs only if Apple outperformed two-third of S&P 500. If Apple were bottom-third among S&P 500 companies, Cook would receive zero RSUs.

Apple was in the 97th percentile in 2018-2021 period.

Such a gutsy move by a CEO to align his compensation with the stock performance when probably much of the Wall Street in 2011-13 expected Apple to be terminally ill by 2021.

No wonder someone in Omaha liked this stock.

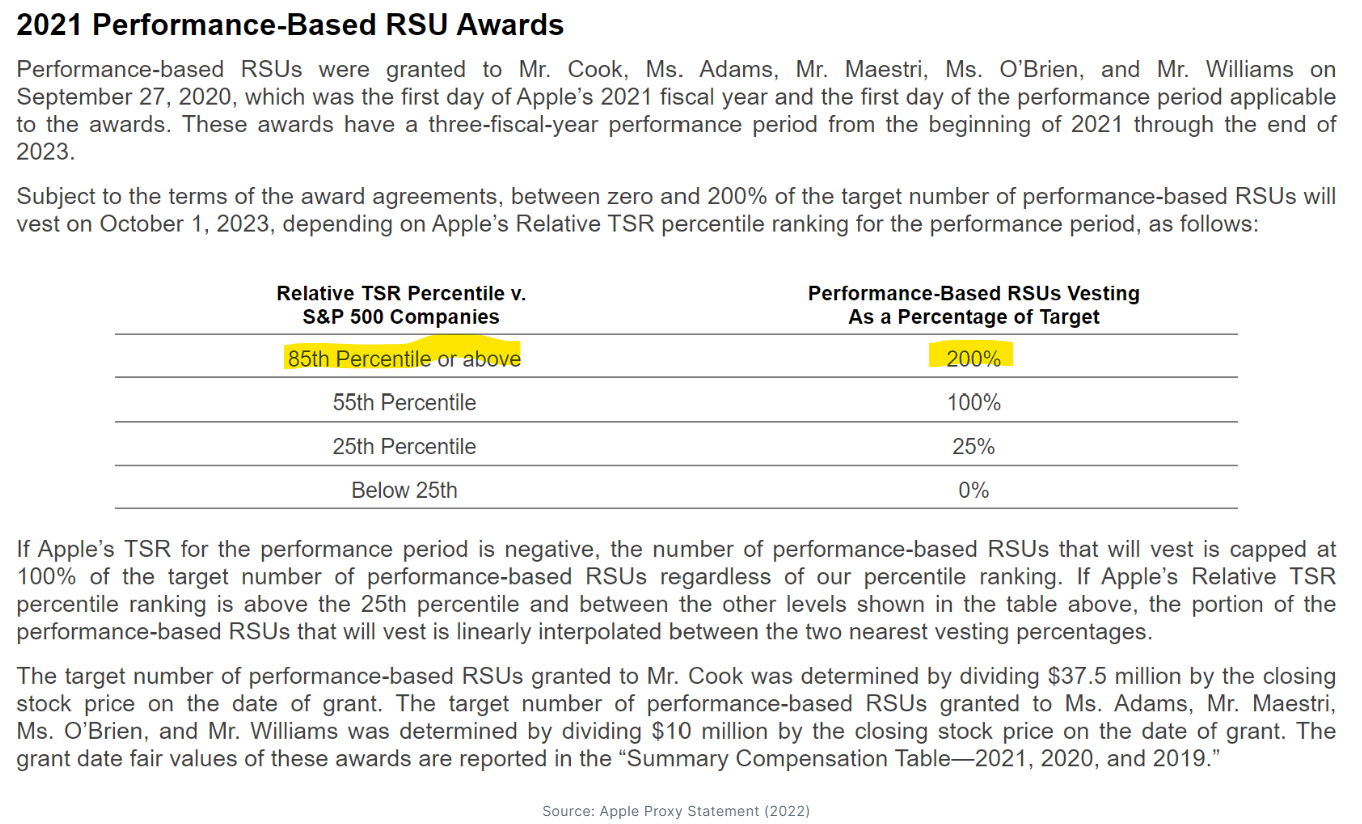

Current incentive program (2021-2023) is also tracked with relative Total Shareholder Return (TSR), with more upside for the executives than the prior one. If AAPL beats 85% of S&P 500 companies, management will receive 200% of target RSUs.

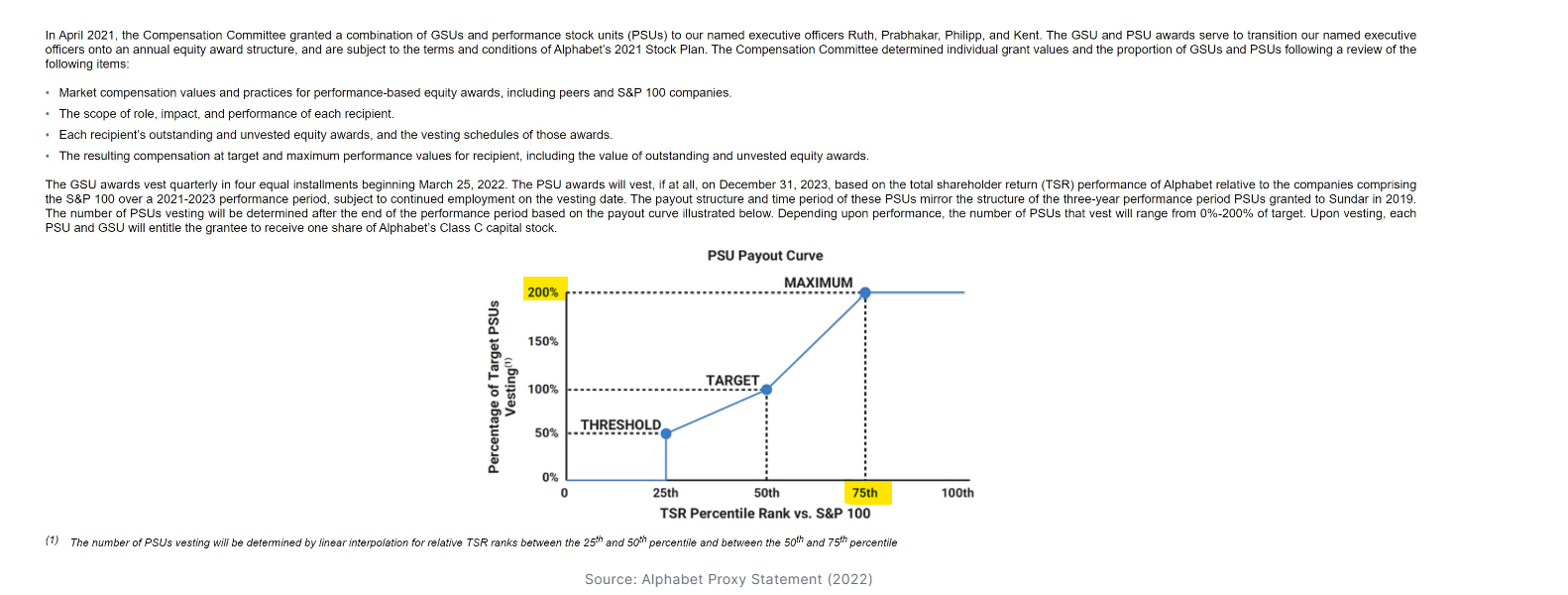

Next is Google/Alphabet

A bit similar to AAPL, but slightly more favorable to the management than AAPL's. If Google beats 75% of S&P 500 companies (Edit: S&P 100 companies, not 500), management will receive 200% of target Performance Stock Units (PSUs).

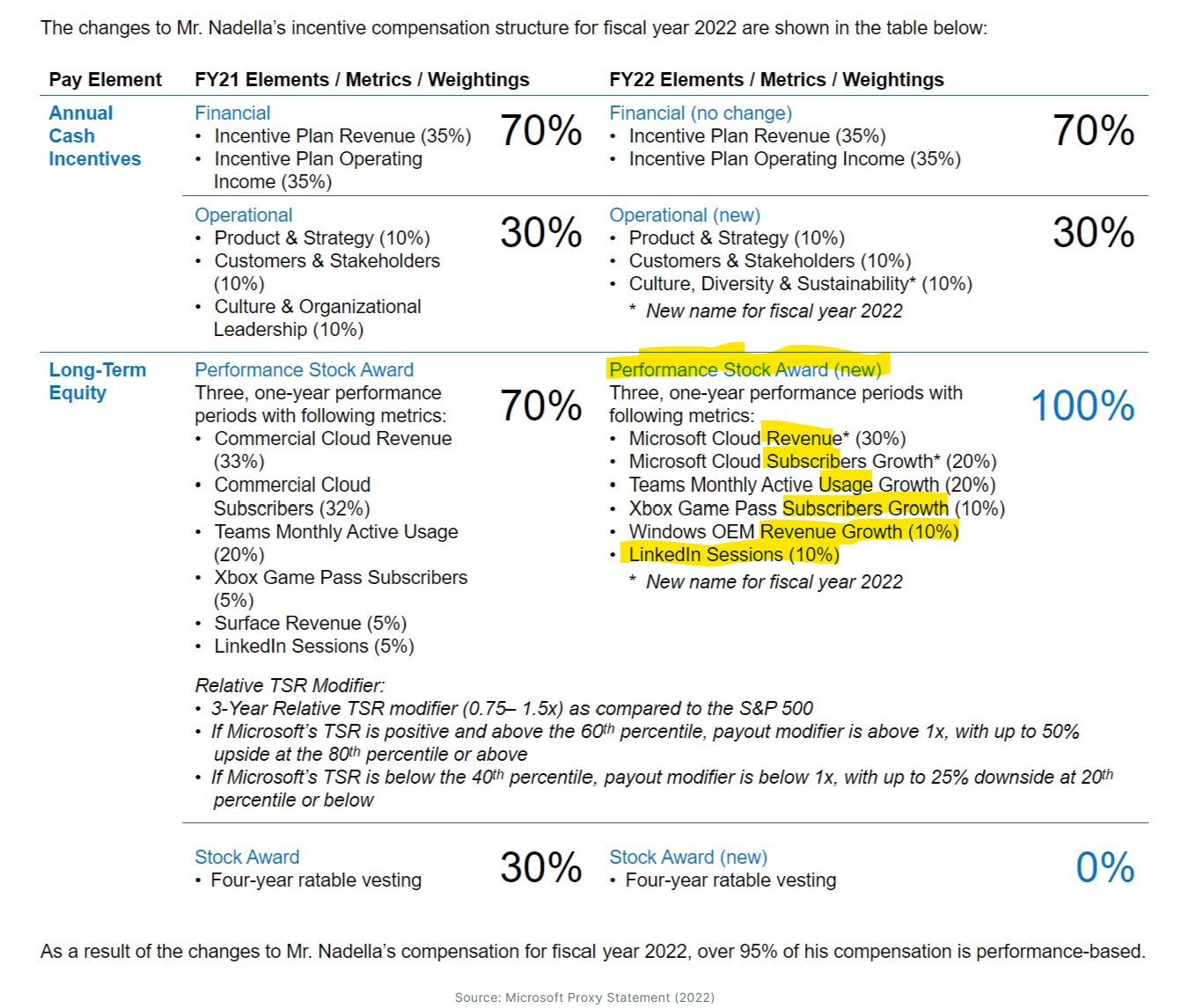

#3 is Microsoft

I don't like their long-term equity incentive plan. Strange to see no profitability or ROIC metric for such a company.

"LinkedIn session", seriously? No wonder it's filled with cringe posts.

For MSFT, Relative TSR is only a modifier. Only 25% downside for management RSUs even if stock goes absolutely nowhere. This incentive structure overly incentivizes for topline growth and doesn't save shareholders from value destructive acquisitions or capital allocations.

Microsoft is, at least, better than Amazon.

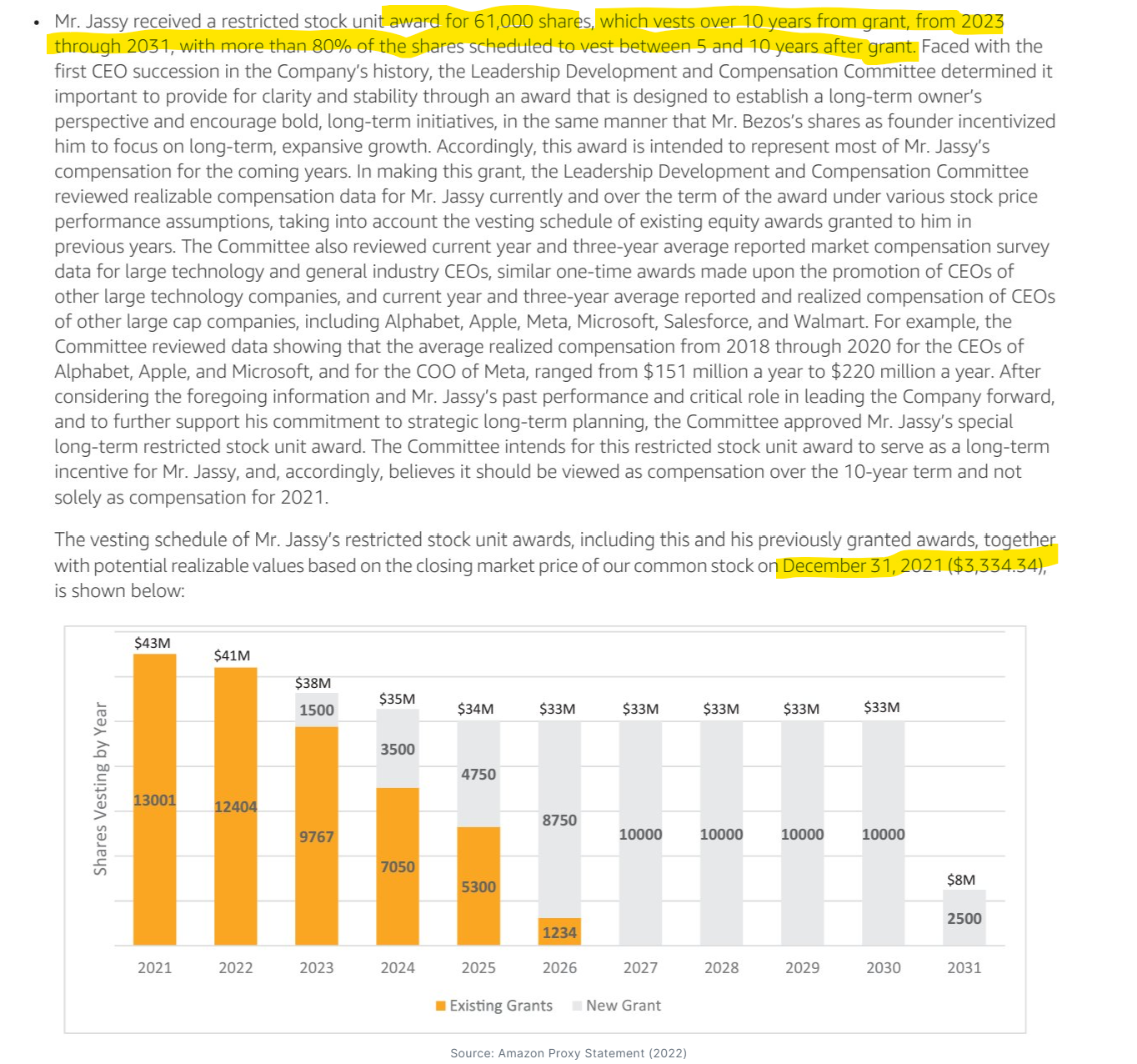

Andy Jassy receives time-based RSUs with no performance condition attached. It is similar to what Cook received originally in 2011. Jassy's RSUs were granted at $166.7/share (split-adjusted).

AMZN has no relative TSR even as a modifier. So even if AMZN is $100/share in 2030, Jassy's total RSUs will be worth ~$122 Mn. That would be pretty good payday for a stock down ~40% 10 years after the grant date.

Not good.

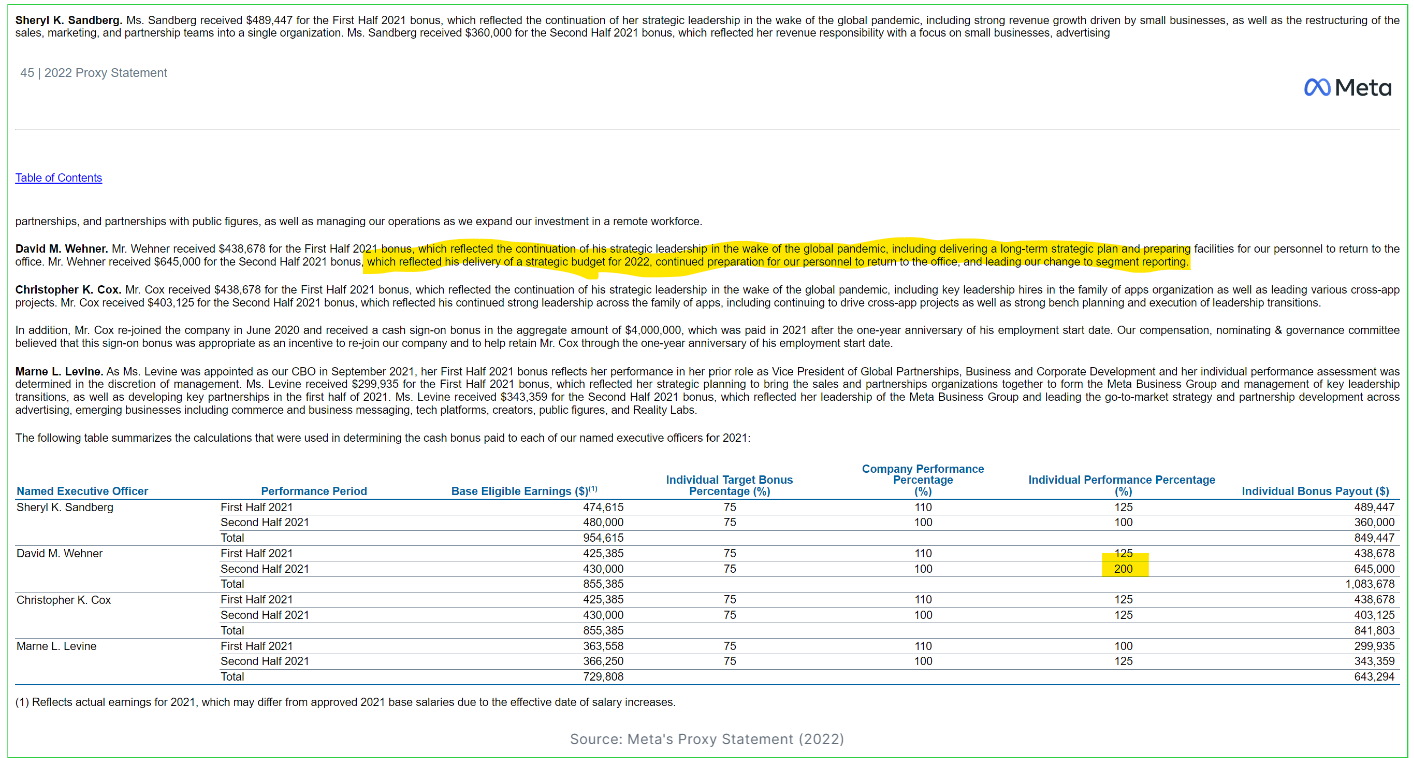

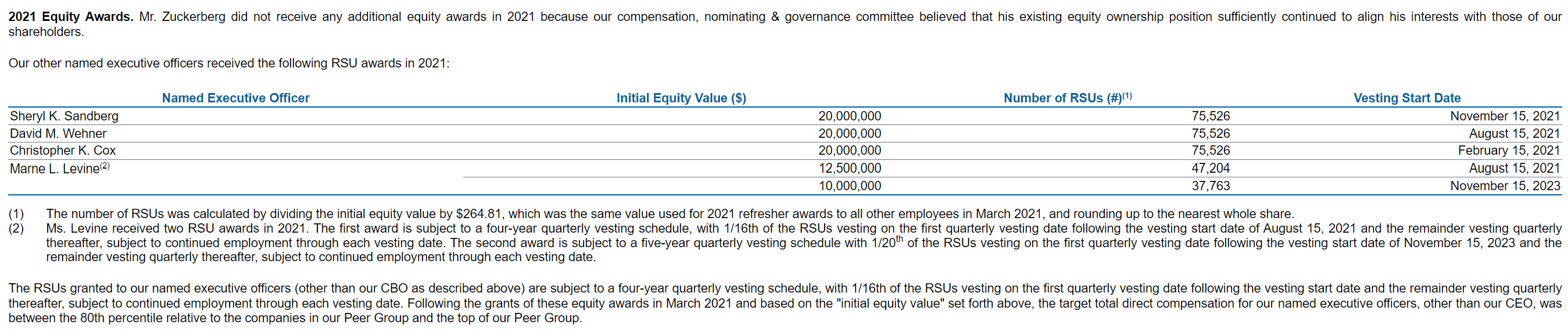

The worst incentive structure "award" goes to Meta Platforms

Perhaps this is one of the many reasons why they aren't part of the Big Tech anymore.

It's comical that the then CFO Dave Wehner was, in fact, awarded for 2H'21 performance when he was essentially lighting cash on fire by buying back stocks at $330.

Similar to AMZN, all their long-term RSUs have nothing to do with relative TSR. As long as they survive in their roles, they will be duly rewarded for their survival.

Not cool.

Peter Thiel used to be Chairman of the Compensation Committee in 2021. After he left the board, Peggy Alford (EVP of Global Sales at Paypal) has become the new Chair. Given PYPL's own incentive shortcomings, I'm not optimistic we'll see much change here.

Charlie Munger once said: “Well, I think I’ve been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it. And never a year passes but I get some surprise that pushes my limit a little further.”

I'll leave it there. Thank you for reading.