Illumina: A "Monopoly" in a Knife Fight

You can listen to this Deep Dive here

The Human Genome Project was an epic scientific quest launched in 1990 to decode the complete blueprint of human life i.e. the 3.2 billion letters that form our DNA. Scientists around the globe collaborated tirelessly, meticulously assembling this genetic puzzle one fragment at a time. Initially slow, relying on painstaking sequencing techniques, the project unfolded over thirteen years. By 2003, most of the genome was revealed.

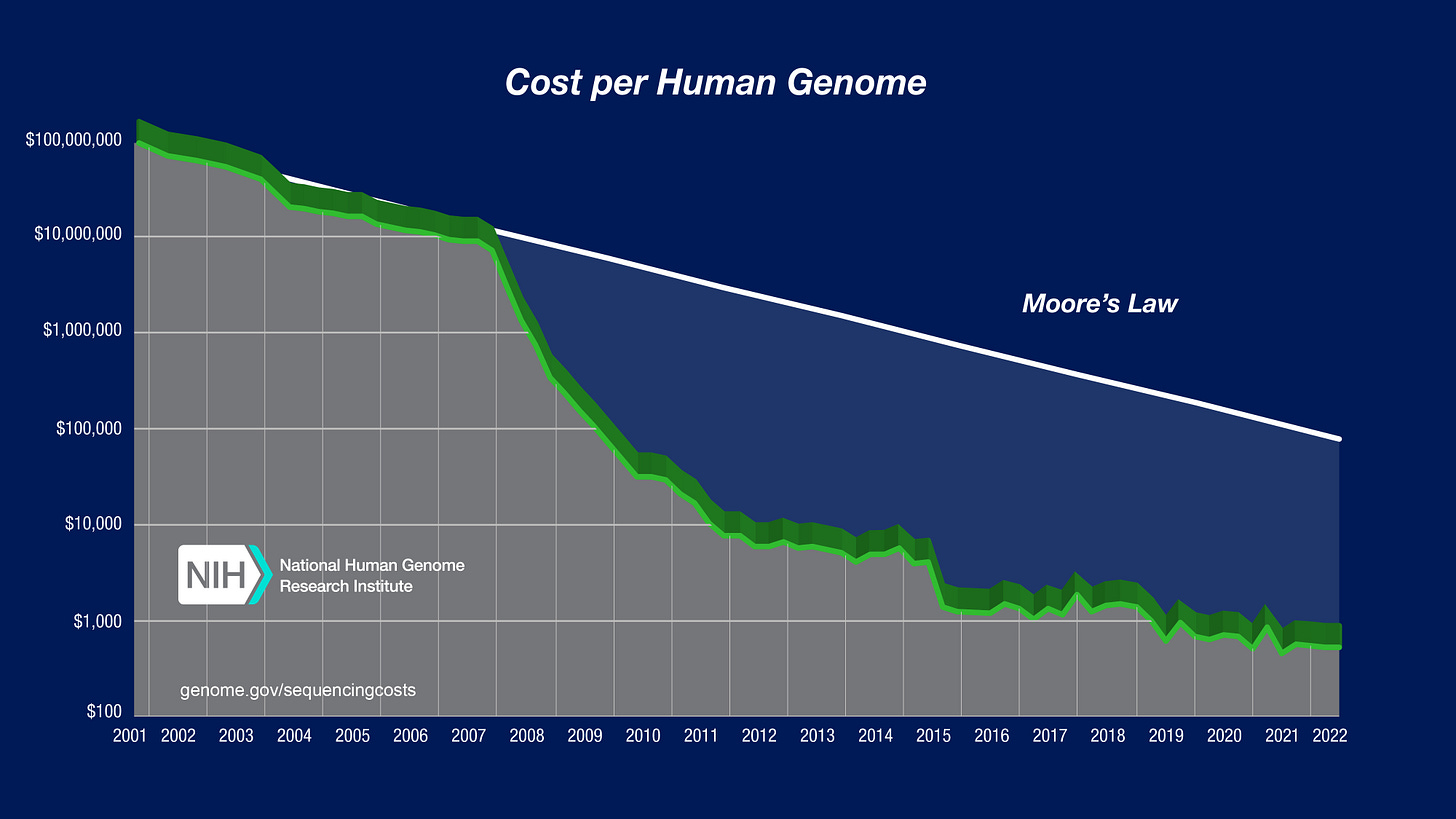

While even a “draft” human genome sequence took 15 months and cost $300 million in early 2000s, today a human genome can be sequenced in hours, and it can cost as low as ~$100 (and we are perhaps not done yet). The progress is so breathtaking that even Moore’s law appears to be shabby in comparison! The company that helped lead this progress is Illumina through their Next-Generation Sequencing (NGS) technology.

Illumina, however, was bit of an accidental torchbearer in leading this progress. “The Century of Biology” had a good piece covering the history of Illumina’s rise:

“A small startup in San Diego founded by a blind venture capitalist, a veterinarian with an MBA, a Harvard professor, a chemist, and a molecular biologist produced a genomics instrument that would become synonymous with DNA sequencing. Ironically, this company played no role in The Genome War—the first ideas for its technology had nothing to do with genomics.” (Note: while this piece is overall informative, you may also want to read a more critical review of the piece by “ASeq”)

Indeed, as the human genome project was ongoing in the ‘90s, Illumina was incorporated in 1998 and believe it or not, they came to IPO just two years after being incorporated. On their S-1, Illumina indicated the far-reaching potential of sequencing a human genome and how they want to sell the picks and shovels to power this revolution:

“Understanding genetic variation and function is critical to the development of personalized medicine, a key goal of genomics. Our tools will provide information that could be used to improve drugs and therapies, customize diagnoses and treatment, and cure disease.

Completion of the sequencing of the human genome will drive demand for tools that can assist researchers in processing the billions of tests necessary to convert raw genetic data into medically valuable information. This requires functional analysis of highly complex biological systems, involving a scale of experimentation not practical using currently available tools and technologies. Using our technologies, we are developing a comprehensive line of products that can address the scale of experimentation and the breadth of functional analysis required to achieve the goals of molecular medicine.”

There was just one pesky little problem. The same S-1 mentioned the below first thing in their “risk factors”:

“We Have Generated No Revenue from Product Sales to Date…To date, we have derived all of our revenues from grants and partnerships.”

No revenue? Actually, that’s even better because you could then be a “potential pure play” 😉

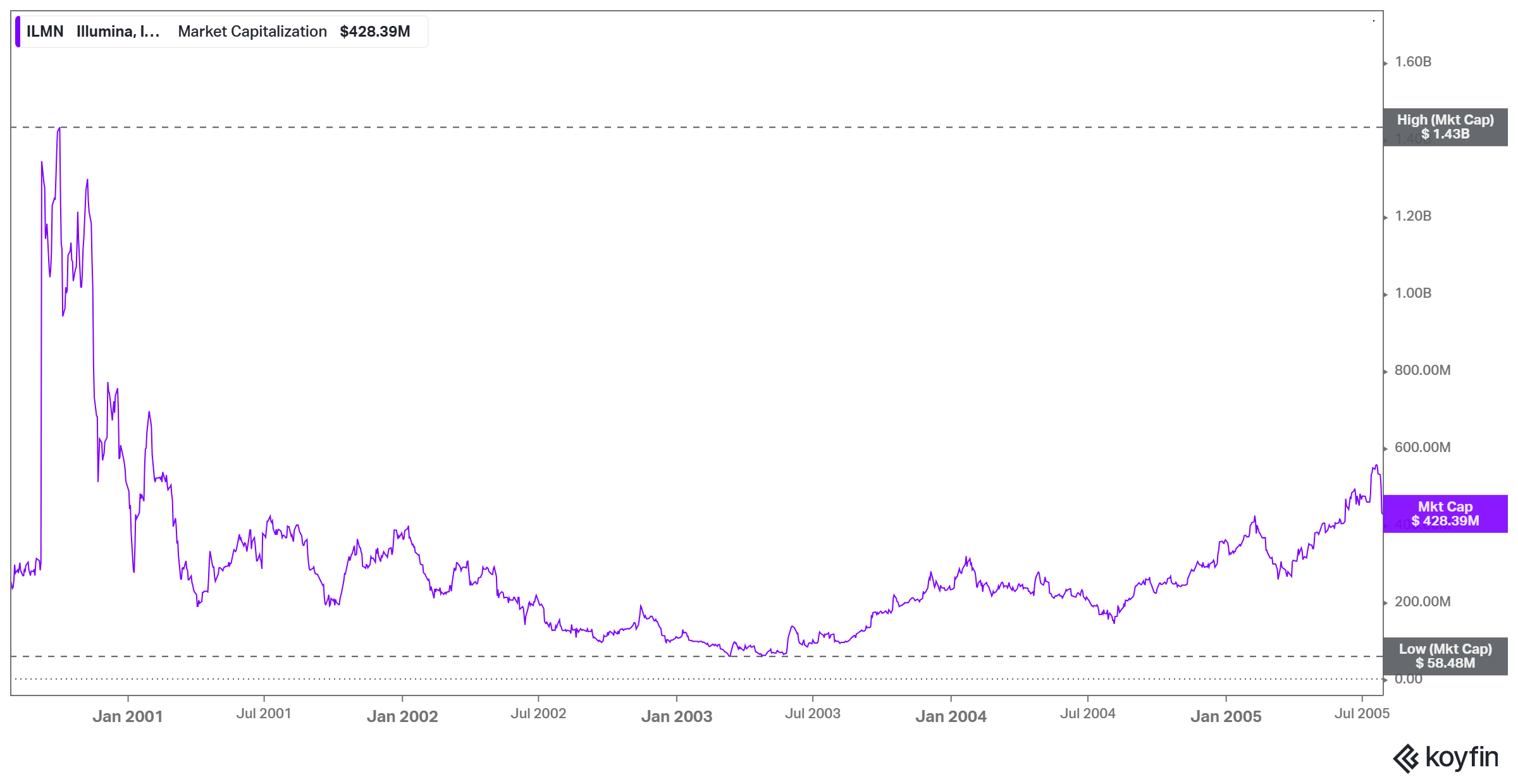

In the early 2000s, it wasn’t just the tech and telecom bubble that plagued the investors; biotech bubble was also going on a full swing back then. So a company with zero product revenue (but a very open-ended possibilities) quickly ballooned to reach $1.4 Billion market cap. The bubble, of course, eventually popped and Illumina stock came back to earth to reach just $58 Million market cap, a whopping 96% decline from the then peak! As you can imagine, Illumina had quite the tumultuous beginning as a public company!

Thankfully, Illumina did figure out some products to generate revenue. In the early 2000s, Illumina's bead array technology placed tiny beads coated with DNA probes into microscopic wells on fiber-optic slides. When sample DNA matched these probes, the beads lit up, allowing scientists to quickly study many genetic markers at once. If the last two sentences are not quite legible to you, that’s okay. Considering Illumina’s primary business today has evolved considerably since those early years, we can skip a granular discussion on a segment that has barely any impact on the company today.

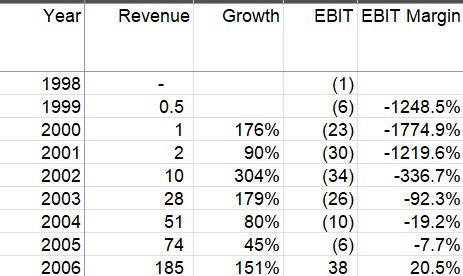

After losing money for the first seven years, Illumina posted ~20% operating margin in 2006. However, its the acquisition in early 2007 that truly changed the fate of the company…for the better!

On January 26, 2007, Illumina acquired Solexa for $600 Million stock. Given Illumina’s market cap was still below $2 Billion back then, it was a pretty significant acquisition. The acquisition of Solexa indeed proved to be quite consequential for Illumina.

By acquiring Solexa, Illumina gained a powerful sequencing technology called sequencing-by-synthesis, which allowed DNA to be read quickly and affordably. This technology transformed Illumina from a company focused mainly on DNA microarrays into the leading provider of DNA sequencing instruments.

Before moving any further, let me briefly explain what exactly DNA sequencing is.

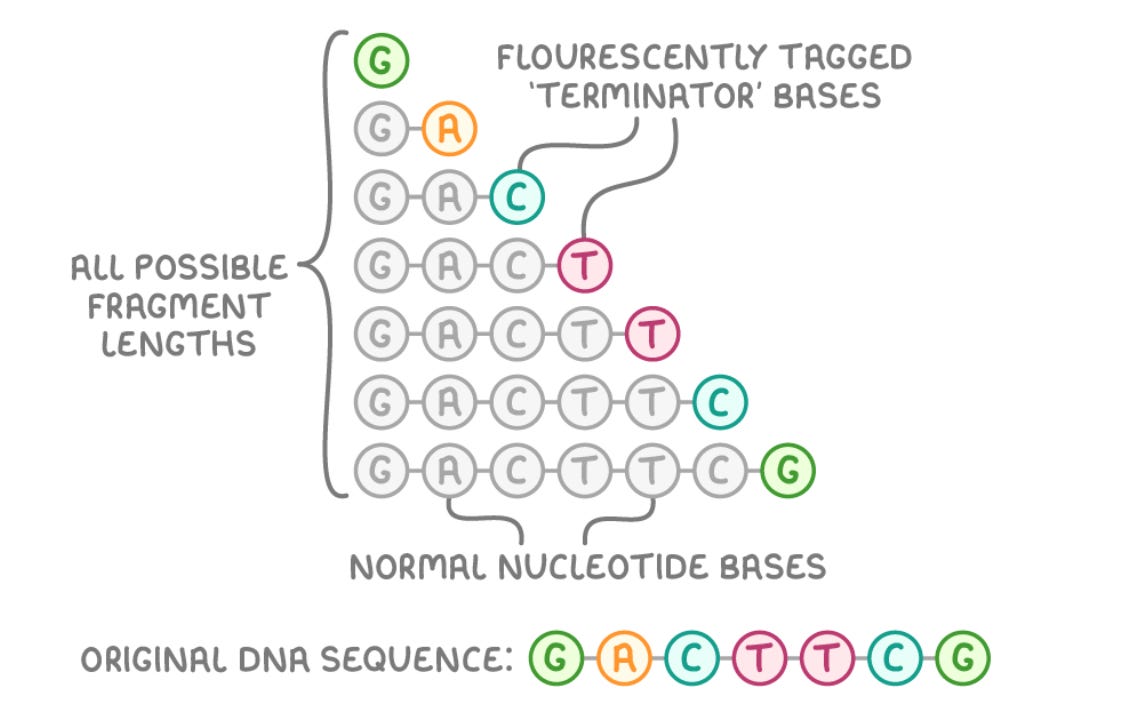

DNA sequencing involves determining the exact order of the bases in DNA — the As, Cs, Gs and Ts that make up segments of DNA. A, T, C, and G are letters representing the four chemical building blocks or bases of DNA. A, T, C, and G stands for Adenine, Thymine, Cytosine, and Guanine respectively.

If you imagine DNA as a story written in an alphabet of just four letters i.e. A, T, C, and G, each combination forming words guides how living things grow, move, breathe, and become.

For example, look at the image below. To read these letters, scientists first create many fragments of DNA that end at different lengths, each ending with a special "tagged" letter (colored letters in the image). These tagged letters glow or fluoresce, making it possible to see exactly where each fragment ends. By lining up these fragments from shortest to longest, scientists can see the glowing letters clearly in order. This tells them the exact sequence of the DNA.

At the bottom of the image, you see the original DNA sequence, pieced together from these glowing, tagged letters: G-A-C-T-T-C-G. In essence, DNA sequencing helps scientists read the exact order of the letters inside DNA, revealing the instructions hidden within each cell.

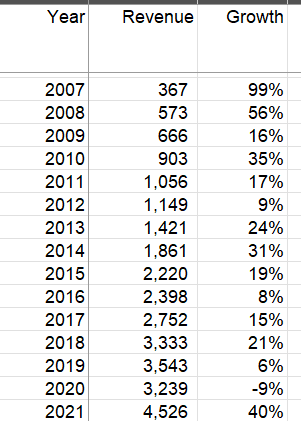

With the acquisition of Solexa and its technology, Illumina almost immediately became THE player in DNA sequencing. In fact, in 2008 10-K Illumina mentioned that “Instrument revenue increased by $64.8 million over prior year, of which $63.0 million was due to increased sales of our sequencing systems”. There was no looking back since then. Even in 2008 to 2010 period when the entire world was grappling with GFC, their revenue grew by 56%, 16%, and 35% respectively. Since 2006 (just the year before Solexa acquisition), Illumina’s revenue became ~25x in the next 15 years. For all intents and purposes, Illumina had monopoly in DNA sequencing tools during this period.

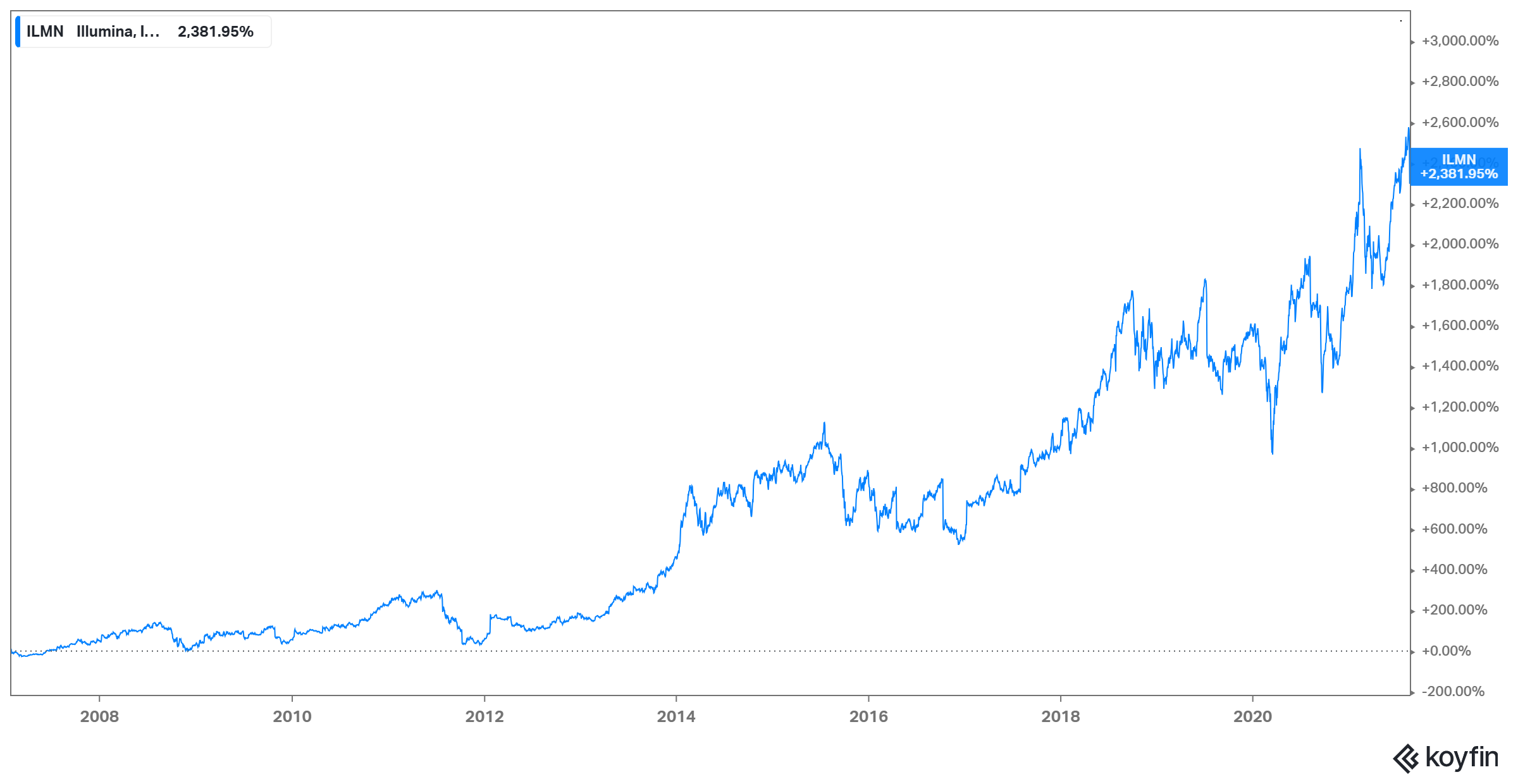

The stock price predictably followed the business performance. Since the acquisition of Solexa was announced, the stock became ~24x at the peak of 2021. Then everything changed!

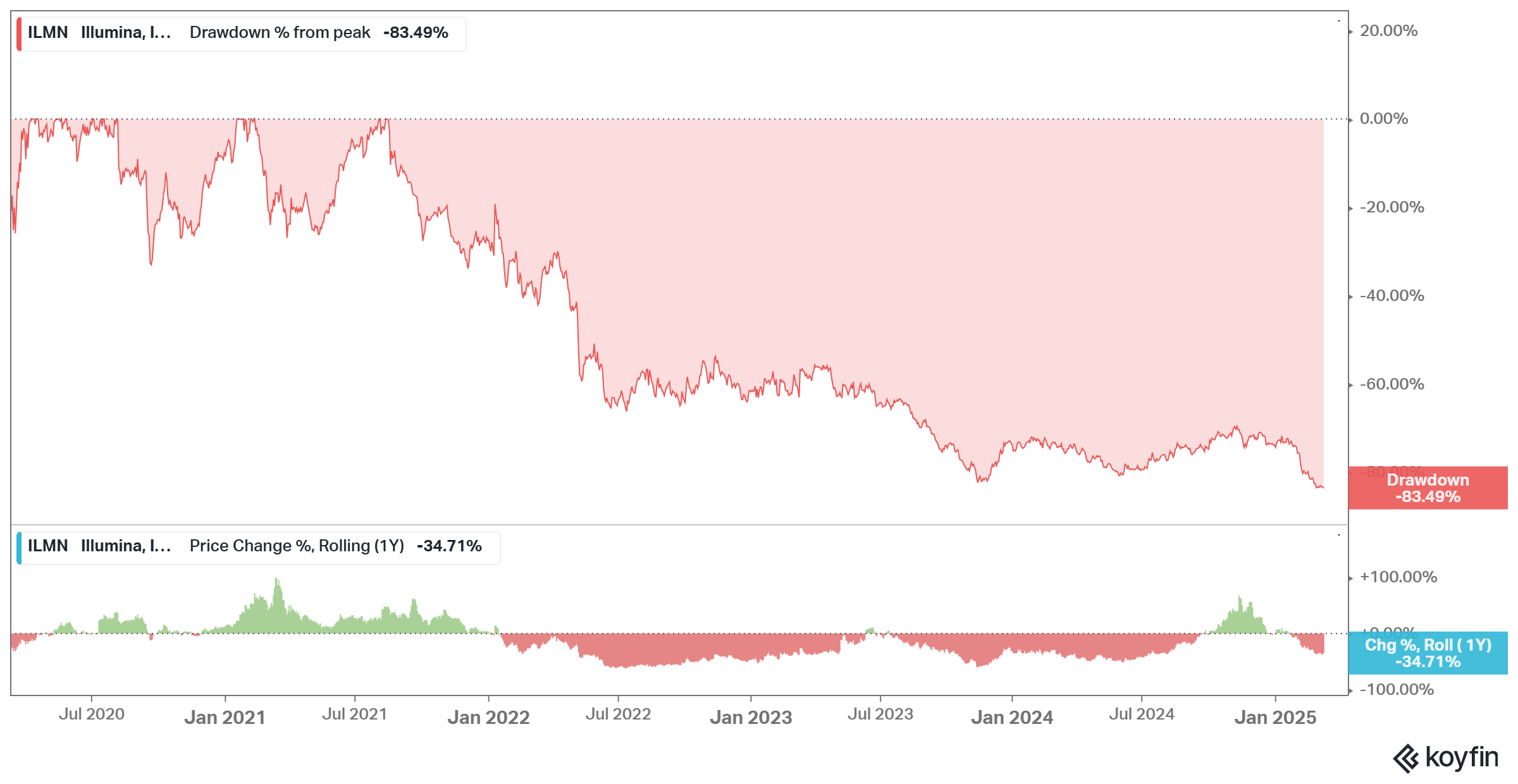

Since its all-time high in August 2021, Illumina experienced a whopping 84% drawdown. Like Solexa, Illumina hoped for another consequential acquisition: Grail for which they paid $8 Billion. This opened pandora’s box which is beyond the scope of this Deep Dive since much of these details are behind the company now following its divesture last year (if you want to explore more on this saga, Nongaap is an excellent source). The whole ordeal led to resignation of the then CEO Francis deSouza; it also attracted attention from Carl Icahn for a proxy fight. Just as people started thinking the worst may be behind Illumina, China just announced Illumina to be in their “unreliable entities” list as part of the retaliation to tariff imposed by the US which likely means Illumina cannot sell new sequencers in China anymore. The recent uncertainty around NIH funding is also adding further fuel to the uncertainty. If that weren’t enough already, the sustainability of Illumina’s monopoly status is currently being seriously questioned by investors.

Before we dig into these issues, let’s start with a deeper understanding of Illumina’s business, size of the opportunity, unit economics, and overall cost structure. That’s section 1.

In section 2, I will dissect the very nature of the knife fight Illumina is dealing with today. In section 3, I will discuss capital allocation and management incentives. Then in section 4, I will show what is likely currently embedded into the stock price. Finally, I will offer some concluding thoughts and disclose my overall portfolio. Subscribe to keep reading!