IDEXX: Leading the Humanization of Pet Care Through Diagnostics

You can listen to this Deep Dive here

A couple of weeks ago, Instagram showed me this funny reel:

Like most good comedy bit, it is funny probably because there is an element of truth to it. As a society, we are increasingly humanizing our pets. When we look at our pets, we increasingly don’t just consider them our mere properties, rather we sense a much deeper bond to a sentient beings. Former Petco CEO Ron Coughlin provided some numbers to contextualize society’s growing sense of devotion to our pets:

“Pet parents don’t want to be called pet owners. Seventy-seven percent say they want to be called pet parents, and 60 percent say they love spoiling their pets.”

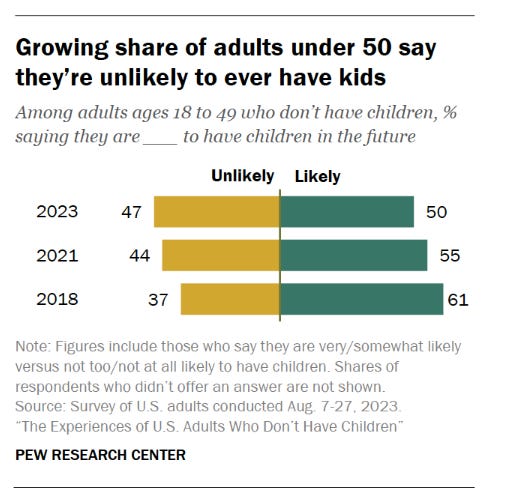

While pets have been a core part of many American family experience for decades, I do think pets may play a even more critical role in many people’s lives in the coming decades. Pets may fill a potentially growing void in millions of childless households not just in the US, but in the world. Pew Research published in 2018 that among adults aged 18 to 49 years old in the US, 37% said they are unlikely to have children in the future. Since then, that number has increased to 44% in 2021 and 47% in 2023!

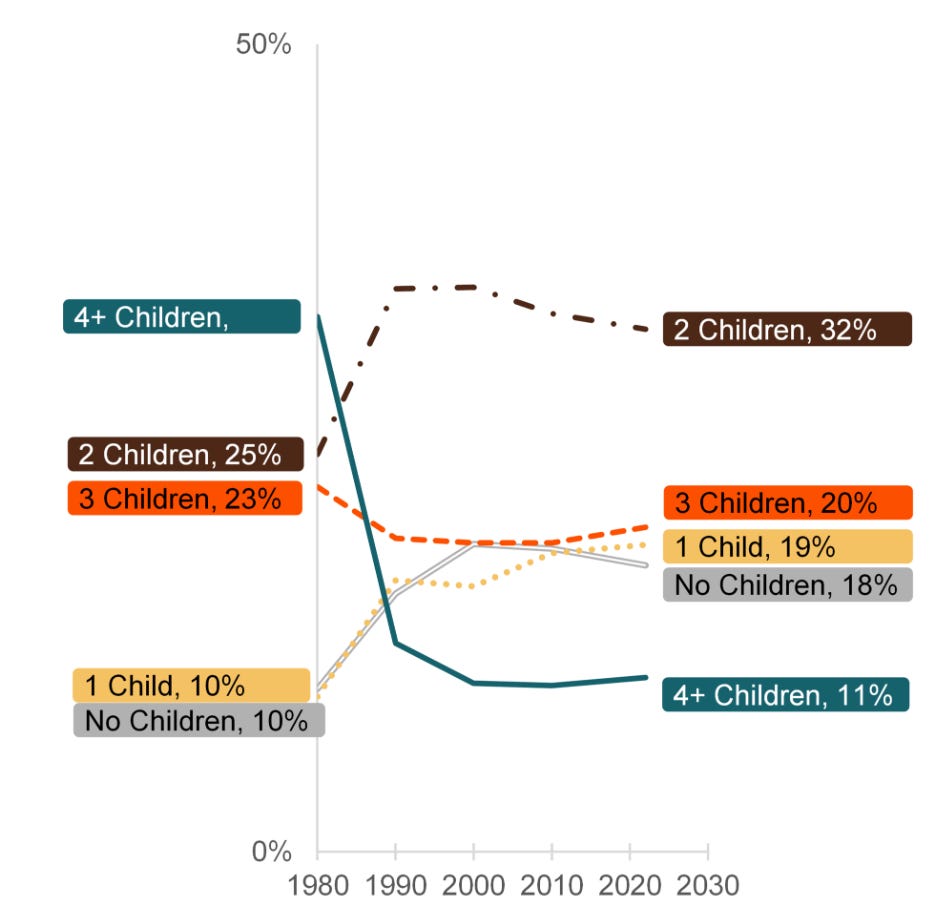

While one may think perhaps many of these 18-49 year old may change their minds later (and I hope they do), the reality is even the status quo already indicates that too many of them will not. When we look at the historical trend of the number of biological children women aged 40-44 year old have, only 10% such women had no children in 1980, and another 10% had one child. Fast forward to 2022, both those numbers have basically doubled. If those survey data is even directionally correct, it seems highly likely that these numbers may increase even further.

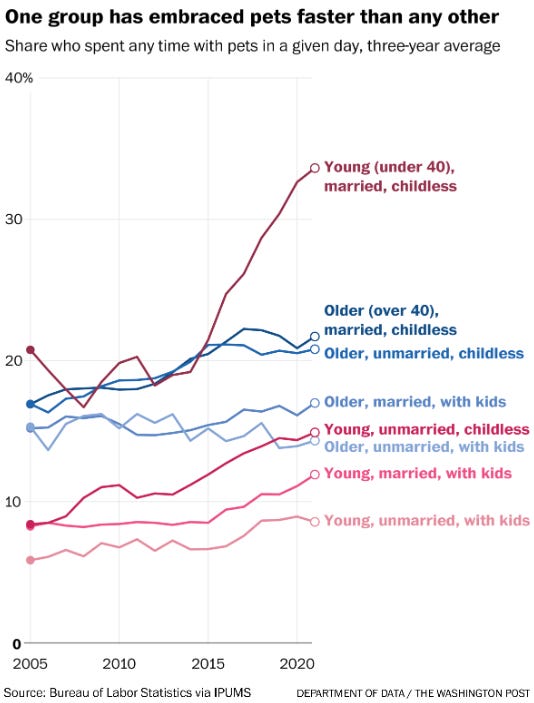

Childless or single child households, relatively speaking, have a lot more time, money, and energy to spend on their pets. While pet ownership in general has mostly steadily risen across household types, the most noticeable expansion has occurred among childless households. For such households, it is quite conceivable that pets may indeed be key source of bonding, love, and meaning that human beings generally crave.

I do not own a pet. So when I asked around my friends and acquaintances who own pets, they all let me know that their pets are very much part of their family. Then when I asked them whether they own pet insurance, the answer was almost consistently no. Even though pet insurance has been growing at double digit rate for years, pet insurance penetration is still hovering around just 2.5%. Therefore, almost all of the pet healthcare expenses come out of pocket of pet parents. If we are going to truly humanize our pets, we will probably need to see much higher pet insurance penetration in the US. If my friend’s dog gets affected by cancer (or some other terminal disease) and he chooses to put the dog down instead of spending tens of thousands of dollar, most people are not going to judge him for such a decision. Perhaps in 2050, that may change and society may increasingly find such trade-off distasteful, and to not have pet insurance will perhaps be considered irresponsible behavior.

With this context in mind, IDEXX sits on the sweet spot to ride on this secular theme of humanization of pets. It was founded in 1983 by David Shaw in Westbrook, Maine, with a vision to revolutionize the veterinary diagnostics industry. Shaw recognized a gap in the market for advanced diagnostic tools tailored to veterinarians, a profession that had traditionally relied on outdated and less efficient methods borrowed from human medicine. IDEXX began with a focus on developing innovative diagnostic products that offered rapid and reliable results, empowering veterinarians to make timely decisions about their patients' care.

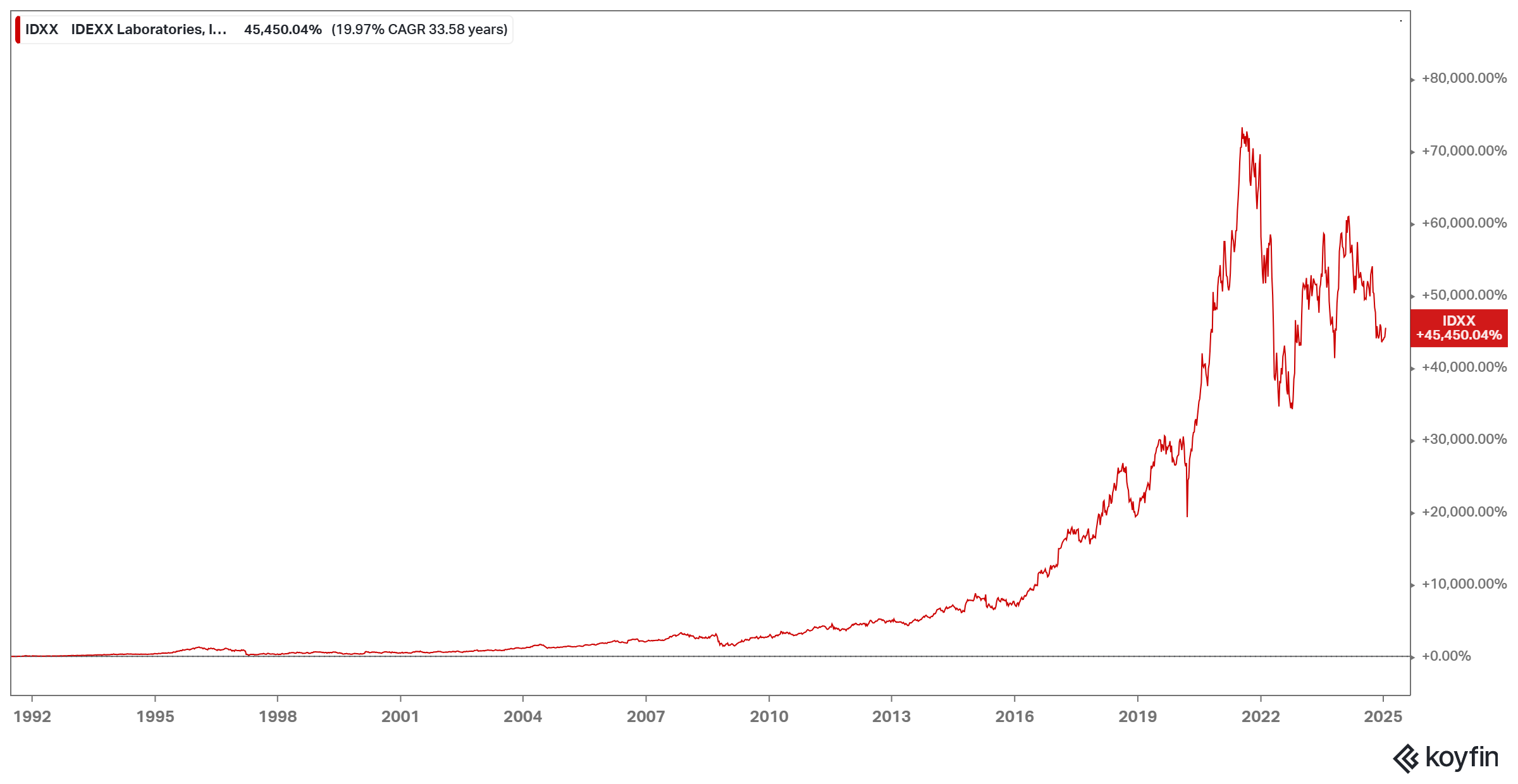

Over the years, IDEXX expanded its offerings to include a wide range of diagnostic solutions, including in-clinic analyzers, reference laboratory services, and software tools to streamline veterinary workflows. The company IPO-ed in 1991 and has compounded at almost 20% rate over more than three decades to have current Enterprise Value of ~$36 Billion!

Before we get into the weeds of IDEXX business, let me first discuss the size of the opportunity here. That’s section 1.

In section 2, I will give you an overview of the business as well as the economics of different segments. In section 3, I will elaborate on the competitive dynamics in this industry. Section 4 highlights capital allocation and management incentives. Then in section 5, I will show what’s likely embedded in the current stock price. Finally, in section 6, I will share some concluding thoughts and disclose current portfolio holdings.