Hilton: Scaling Hotels in Asset-light Way By Monetizing Brand

You can listen to this Deep Dive here

There is a popular meme that goes around on Twitter which likely originated from a Tom Goodwin piece at TechCrunch in 2015:

“Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate."

These counterintuitive business models are supposedly the evidence for "new economy". Casual observers may not be aware that Hilton is much closer to this "new economy" even though it was founded in 1919. Hilton, despite being one of the largest hotel brands in the world, mostly makes money from franchising its brands and sharing its operating know-hows and best practices to hotel owners all over the world operating under its brands. It is essentially a marketing company that monetizes its most prized asset: brand.

While this is a century old company, it is perhaps more relevant to start our conversation in 2007 when Blackstone acquired Hilton. Blackstone used ~$6.5 Bn equity and ~$20 Bn debt to buy Hilton which appeared to be a terrible deal during the depth of Global Financial Crisis (GFC). In 2009, Blackstone wrote down its investment in Hilton by 70% and restructured its debt in 2010. But by December 2013, the situation had completely reversed as Hilton came to IPO at ~$20 Bn valuation. By the time Blackstone fully exited from Hilton in 2018, it made more than $14 Bn in total profits on its investment in Hilton.

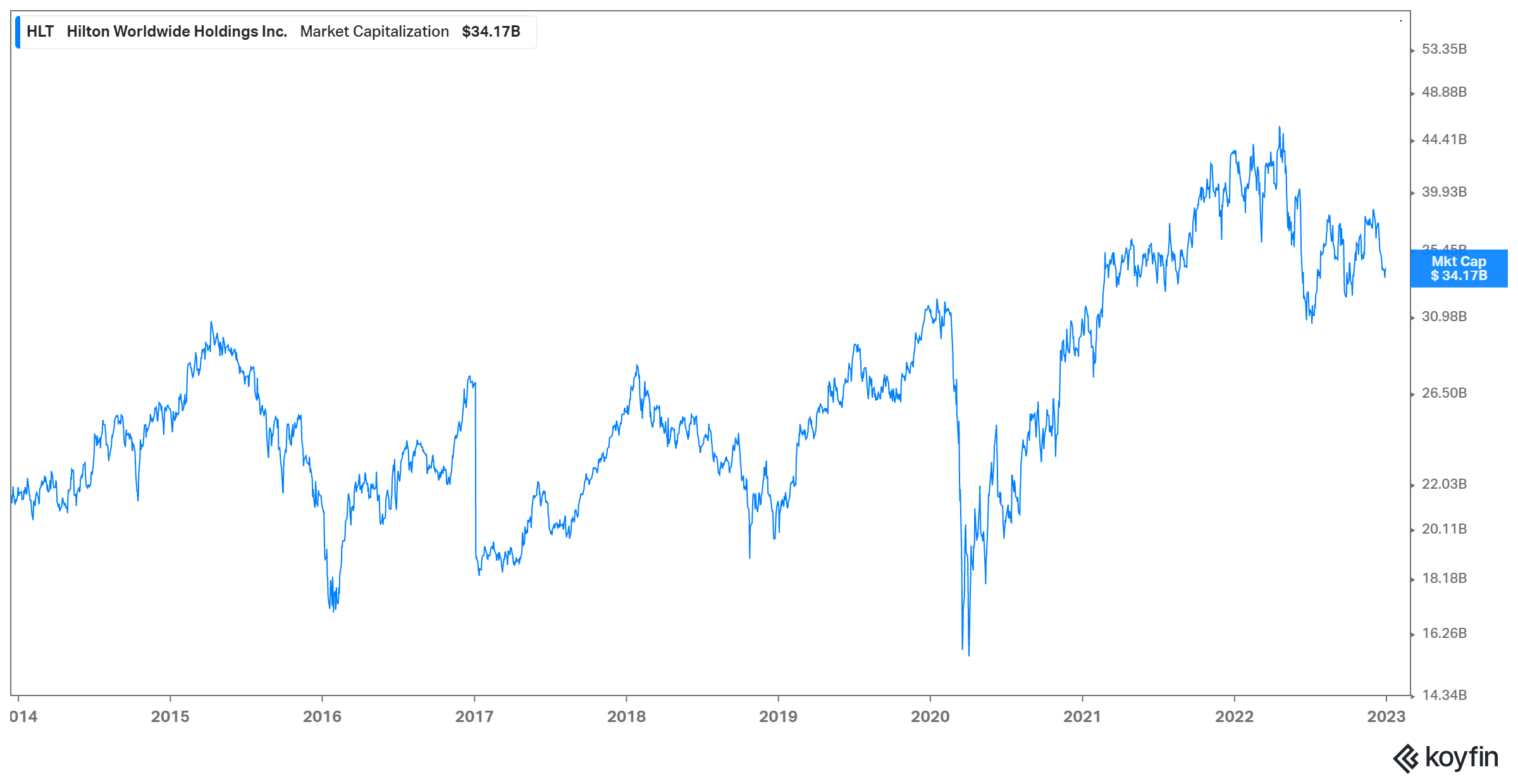

After coming back to public market, the stock went nowhere in the first five years or so and just as it started to go up, Covid-19 cut the stock in half. As the pandemic's worst fears appeared to be behind us, the stock also came roaring back and remains ahead of its pre-Covid highs.

Here's the outline for this month's Deep Dive:

Section 1 The Economics and KPIs of Hilton: I discussed why independent hotel operators want to be part of branded hotel network and how the economics is shared between brands and hotel operators. Moreover, the KPIs to evaluate health of the overall business is elaborated in this section.

Section 2 Competitive Dynamics: The competitive dynamics by geography and by segment is discussed in this section. I also compared and contrasted Marriott and Hilton.

Section 3 Bear concerns: Several bear concerns such as the permanence of demand lost during the pandemic, question on unit growth runway, potential bidding war for incremental property, and the long-term industry value chain dynamic (OTAs, Google, Hotels, Airbnb etc.) are discussed here.

Section 4 Management and Incentives: Hilton' management and incentive structure is discussed in this section.

Section 5 Valuation and Model Assumptions: Model/implied expectations are discussed here.

Section 6 Final Words: Concluding remarks on Hilton, and disclosure of my overall portfolio.