Alphabet 4Q'24 Update

Alphabet had bit of a mixed earnings call. While there were some encouraging data points related to the future of search, their tone in the near-term outlook clamped down on the enthusiasm a bit.

Here’s my highlights from the earnings.

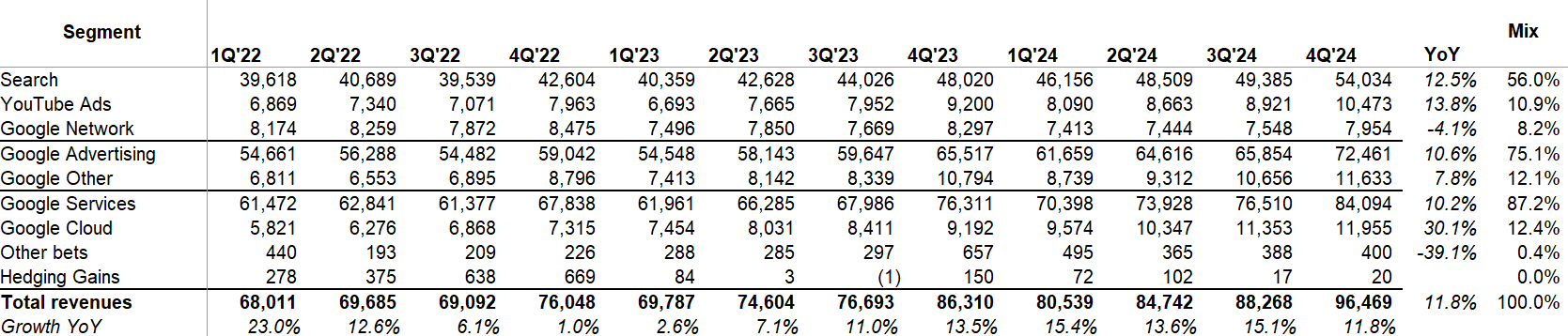

Revenue

Alphabet maintained their low double digit revenue growth. For the 10th consecutive quarters, Google network’s revenue went down. Cloud revenue growth decelerated from 35.0% YoY in 3Q’24 to 30.1% in 4Q’24. I will note, however, that Google usually discloses every quarter that GCP grew at higher rate than overall Cloud, but in this call, they mentioned “GCP grew at a rate that was much higher than cloud overall”. Therefore, the deceleration may have been mostly driven by the rest of cloud e.g. Google Workspace.

Google mentioned all of their advertising revenue was impacted by tough comp in 4Q’23, especially because of “APAC-based retailers”. While a year ago most investors were concerned about “APAC based retailers” driven tough comps for Meta, they weren’t even mentioned once during Meta’s 4Q’24 call and it was Google which highlighted tough comp here.

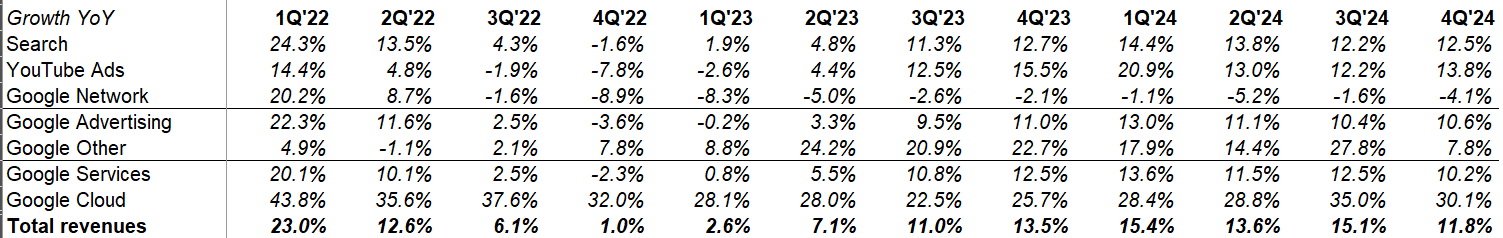

If you look at how Meta’s Family of Apps (FOA), Google Search, and YouTube ads fared over the last three years, it is abundantly clear that Meta is well past the dark days of ATT and continues to gain share. I will update my digital advertising market share dashboard once Amazon posts earnings this week.

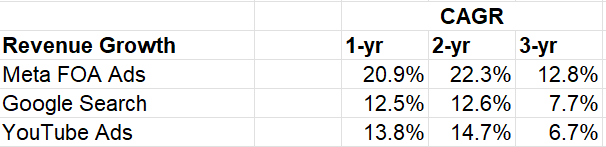

EBIT

Google maintained strong profitability across the board. Google Services posted 39% operating margin and high 70s incremental operating margin. Google Cloud also posted its highest ever margin.

Search

Some interesting quotes on Search from the call:

AI overviews are now available in more than 100 countries. They continue to drive higher satisfaction and Search usage. Meanwhile, Circle to Search is now available on over 200 million Android devices.

We have 7 products and platforms with over 2 billion users and all are using Gemini. That includes Search where Gemini is powering our AI overviews. People use Search more with AI overviews and usage growth increases over time as people learn that they can ask new types of questions. This behavior is even more pronounced with younger users who really appreciate the speed and efficiency of this new format.

We are also pleased to see how Circle to Search is driving additional search use and opening up even more types of questions. This feature results are popular among younger users. Those who have tried Circle to Search before now use it to start more than 10% of their searches. As AI continues to expand the universe of queries that people can ask, 2025 is going to be one of the biggest years for Search innovation yet.

We've already started testing Gemini 2.0 in AI overviews and plan to roll it out more broadly later in the year.

All these are quite encouraging, but one that stood out to me was the below quote:

Google is already present in over half of Journeys where a new brand product or retailer are discovered. By offering new ways for people to search, we're expanding commercial opportunities for our advertisers. Shoppers can now take a photo of a product and using Lens quickly find information about the product, reviews similar products and where they can get it for a great price. Lens is used for over 20 billion visual search queries every month and the majority of these searches are incremental.

In 3Q’24, Google shared the same data that lens is being used 20 billion times per month and highlighted that 1 in 4 query had commercial intent. So in this call, Google is basically confirming not only a significant percentage of these queries are monetizable, they are also incremental.

Sundar later reiterated that the opportunity space is “far from zero-sum”

I think the opportunity space expands. I think there's plenty of it, feels very far from a zero-sum game. There's plenty of room, I think, for many new types of use cases to flourish. And I think for us, we have a clear sense of additional use cases. We can start to tackle for our users in Google Search. And all the early work with AIO view shows that users will react positively to that.

…We are continuing to see growth in Search on a year-on-year basis in terms of overall usage. Of course, within that, AI overviews has seen stronger growth.

Moreover, AI Overviews are monetizing “at approximately the same rate”":

we recently launched the ads within AI overviews on mobile in the U.S., which builds on our previous rollout of ads above and below. And as I talked about before, for the AI Overviews, overall, we actually see monetization at approximately the same rate, which I think really gives us a strong base on which we can innovate even more.

YouTube

While Netflix and Spotify keep hitting new highs, it’s interesting that YouTube likely remains their closest long-term competitor:

…data shows YouTube continues to be #1 in streaming watch time in the U.S. with our share of streaming now at a record high.

…We are now the most frequently used service for consuming podcast in the U.S. according to a recent Edison report. This success reflects our long-term approach of investing in emerging trends from mobile to the living room.

While election wasn’t even mentioned in Meta’s call, Google highlighted the impact of election for YouTube’s results in 4Q’24 which makes me think YouTube will face tough comp in 4Q’25:

The 14% growth in YouTube advertising revenues was driven by strong spend on U.S. election advertising with combined spend from both parties almost doubling from what we saw in the 2020 elections.

YouTube is making rapid progress in shorts monetization:

In 2024, the monetization rate of short relative to in-stream viewing increased by more than 30 percentage points in the U.S., and we expect to make additional progress in 2025.

Google Cloud

Some interesting data points on Google Cloud:

Google data centers deliver nearly 4x more computing power per unit of electricity compared to just 5 years ago…Cloud customers consume more than 8x the compute capacity for training and inferencing compared to 18 months ago.

Last year, we closed several strategic deals over $1 billion, and the number of deals over $250 million doubled from the prior year

In Q4, we saw strong uptake of Trillium, our sixth-generation TPU, which delivers 4x better training performance and 3x greater inference throughput compared to the previous generation.

While some worry about “AI bubble” especially given the capex spree by big tech, Google, like Microsoft, is currently capacity constrained in Q4:

we do see and have been seeing very strong demand for our AI products in the fourth quarter in 2024. And we exited the year with more demand than we had available capacity.

Google highlighted their end-to-end stack in infrastructure will be a competitive advantage in the AI race:

part of the reason we have taken the end-to-end stack approach is so that we can definitely drive a strong differentiation in end-to-end optimizing and not only on a cost but on a latency basis, on a performance basis…I think our full stack approach and our TPU efforts all play give a meaningful advantage. And we plan -- you already see that. I know you asked about the cost, but it's effectively captured when we price outside, we pass on the differentiation.

I will discuss more on Cloud when Amazon posts later this week.

DeepSeek predictably came up, and Google management highlighted their models far well vs DeepSeek. Moreover, Google likes how things are trending more towards inferences:

both our 2.0 Flash models, our 2.0 Flash thinking models, they are some of the most efficient models out there, including comparing to DeepSeek's V3 and R1. And I think a lot of it is our strength of the full stack development end to end optimization, our obsession with cost per query. All of that, I think, sets as well for the workloads had both to serve billions of users across our products and on the cloud side.

A couple of things I would say are if you look at the trajectory over the past 3 years, the proportion of the spend towards inference compared to training has been increasing, which is good because, obviously, inferences to support businesses with good ROIC. And so I think that trend is good.

I think the reasoning models, if anything, accelerates that trend because it's obviously scaling upon inference dimension as well. And so I think -- look, I think part of the reason we are so excited about the AI opportunity is, we know we can drive extraordinary use cases because the cost of actually using it is going to keep coming down, which will make more use cases feasible.

AI

Some more quotes on impact of AI across different businesses in Google:

Last quarter, we introduced a reinvented Google shopping experience, rebuilt from the ground up with AI. This December saw roughly 13% more daily active users in Google shopping in the U.S., compared to the same period in 2023.

…we believe that AI will revolutionize every part of the marketing value chain…Based on the Nielsen meta analysis of marketing mix models, on average, Google AI-powered video campaigns on YouTube delivered 17% higher return on advertising spend than manual campaigns.

Google Other

Google Other or what is currently categorized as “subscriptions, platforms, and devices” have been trending well:

Google One's performance has been outstanding and is one of our fastest-growing subscription products in terms of subscribers and revenue growth.

We continue to have significant growth in our subscription products, primarily due to increase in the number of paid subscribers across YouTube TV, YouTube Music Premium and Google One. With regards to platform, we saw a slight increase in the growth rate in play, primarily due to a strong increase in the number of buyers.

Other Bets

Waymo, which made tremendous progress last year, safely serving more than 4 million passenger trips. It's now averaging over 150,000 trips each week and growing. Looking ahead, Waymo will be expanding its network and operations partnerships to open up new markets, including Austin and Atlanta this year, and Miami next year. And in the coming weeks, Waymo vehicles will arrive in Tokyo for their first international road trip. We are also developing the sixth-generation Waymo driver, which will significantly lower hardware costs.

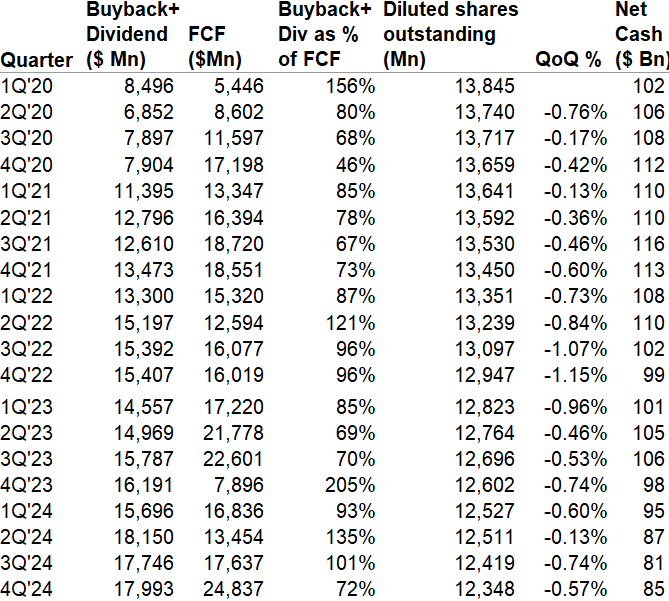

Capital Allocation

In 4Q’24, Google returned 72% of their FCF to shareholders through buyback and dividend. Share count declined by 57 bps QoQ.

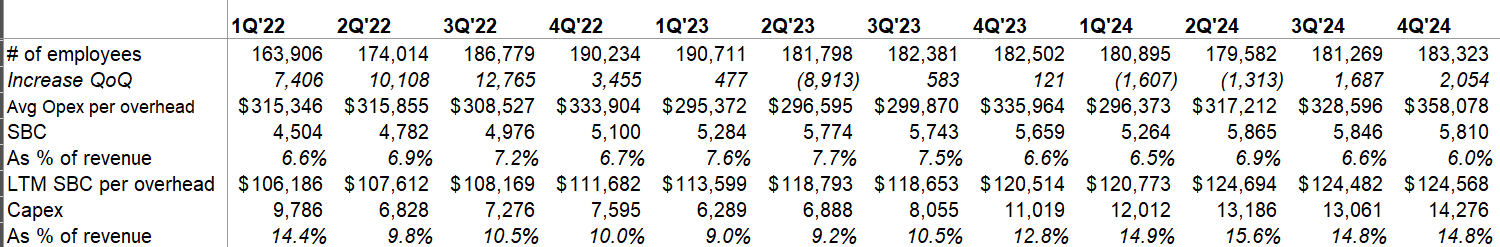

Capex and Opex

Google’s capex increased by 63% YoY in 2024. Management guided it to increase to $75 Billion in 2025 i.e. +43% YoY. They understandably are not interested in being capacity constrained. Let’s see in a year whether $75 Billion capex solves it.

Outlook

Google doesn’t provide guidance, but did mention the below during the call which all sounded somewhat defensive to me:

“in terms of revenue, I'll highlight two items that will have meaningful impact on Q1 revenue across the company. The first is the impact of foreign exchange rates. At the current spot rates, we expect a larger headwind to our revenues from the strengthening of the U.S. dollar relative to key currencies in Q1 versus Q4 2024. Second is the impact of leap year…

These are understandable heads up, but after mentioning tough comp due to “APAC based retailers” to explain 4Q’24 growth numbers, Google somewhat cautioned about tough comp on advertising for entire 2025:

As for our segments, Google Services, advertising revenue in 2025 will be impacted by lapping the strength we experienced in the financial service vertical throughout 2024. And in Cloud, given that revenues are correlated with the timing of deployment of new capacity, we could see variability in cloud revenue growth rates depending on when new capacity comes online during 2025.

As explained in my recent piece on Big Tech’s deteriorating earnings quality, Google also cautioned about increased “pressure on the P&L” due to “higher depreciation”:

the increase in our investment in CapEx over the past few years will increase pressure on the P&L, primarily in the form of higher depreciation. In 2024, we saw 28% year-over-year growth in depreciation as we put more technical infrastructure assets into service. Given the increase in CapEx investments over the past few years, we expect the growth rate in depreciation to accelerate in 2025.

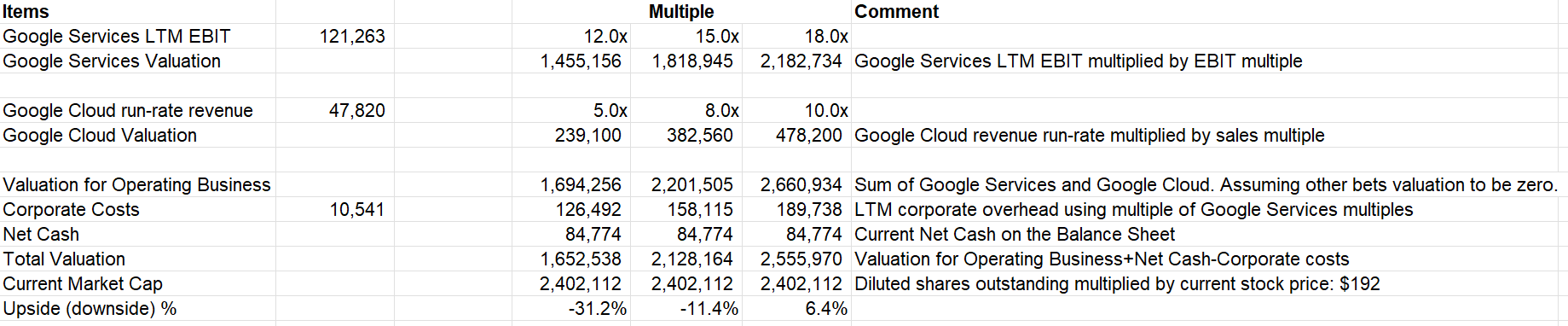

Valuation

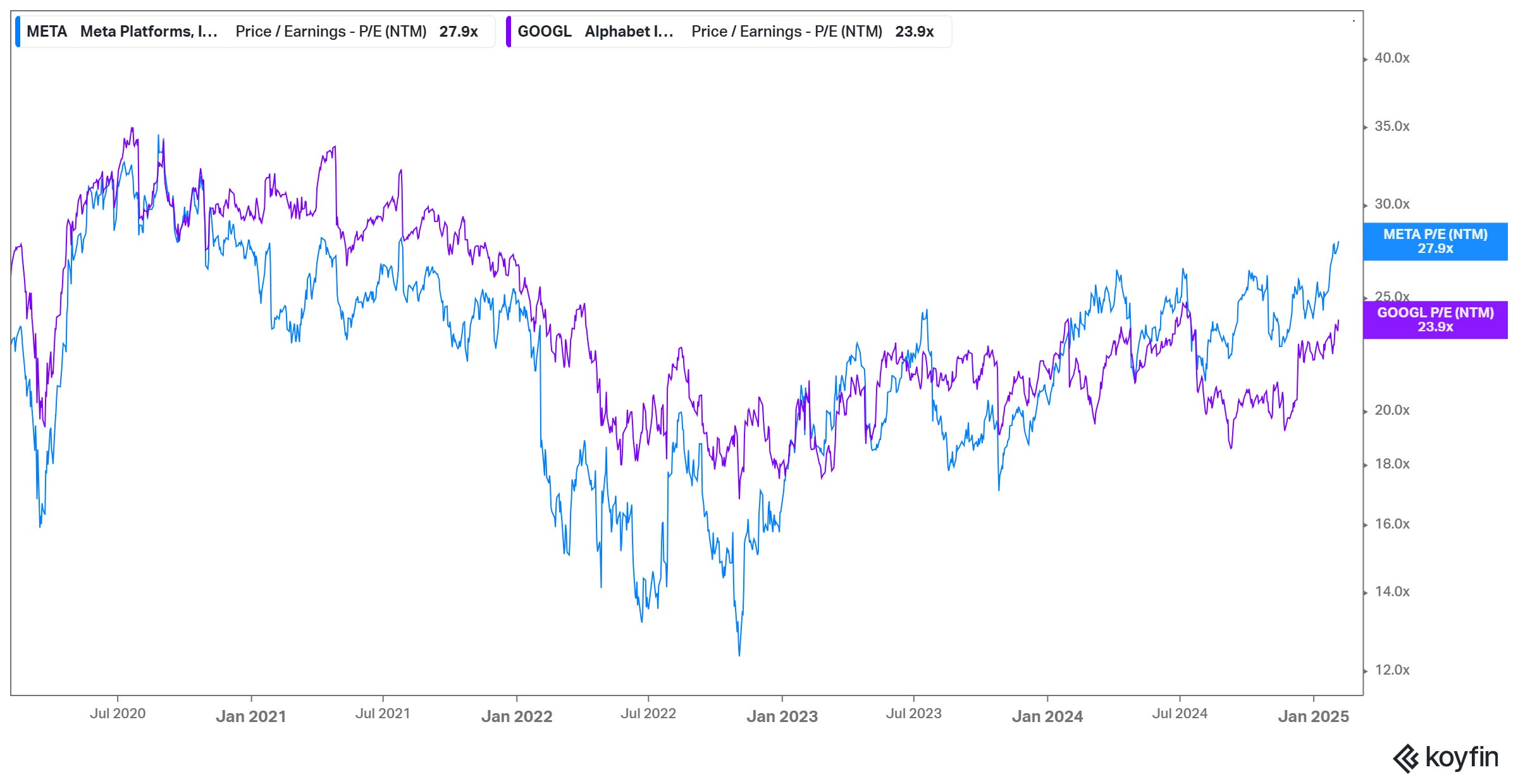

Since 3Q'22, I share the following valuation framework every quarter. Given I created this table in 2022 which was a very different market than what we have today from sentiment perspective, you can argue this is overly conservative. I’m going to keep it consistent. But I acknowledge the reality that Google not only trades at the lowest NTM P/E multiple among Mag-7 stocks. It appears market is largely valuing the Service operating income at 18x and the cloud business at ~10x revenue.

Interestingly, there has been a noticeable multiple differential between Meta and Google these days.

I will cover earnings of Amazon this week. Thank you for reading.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.