Alphabet 3Q'24 Update

Alphabet had a pretty impressive quarter!

Here’s my highlights from the earnings.

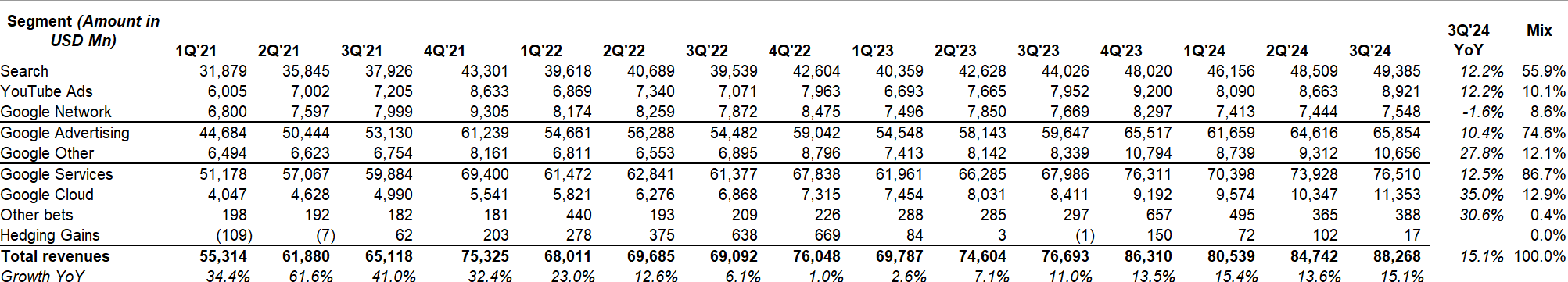

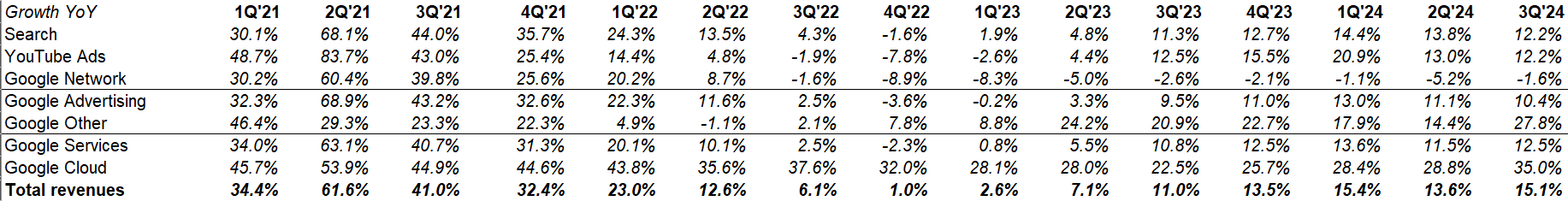

Revenue

Let’s start with not-so-good news. For the 9th consecutive quarters, Google Network revenue kept declining. Everything else is good news. Despite all the disruption narrative, Search keeps humming along. YouTube is doing okay. But the highlight from last quarter was Google Cloud.

Google Cloud grew 35% YoY, highest in the last 8 quarters.

EBIT

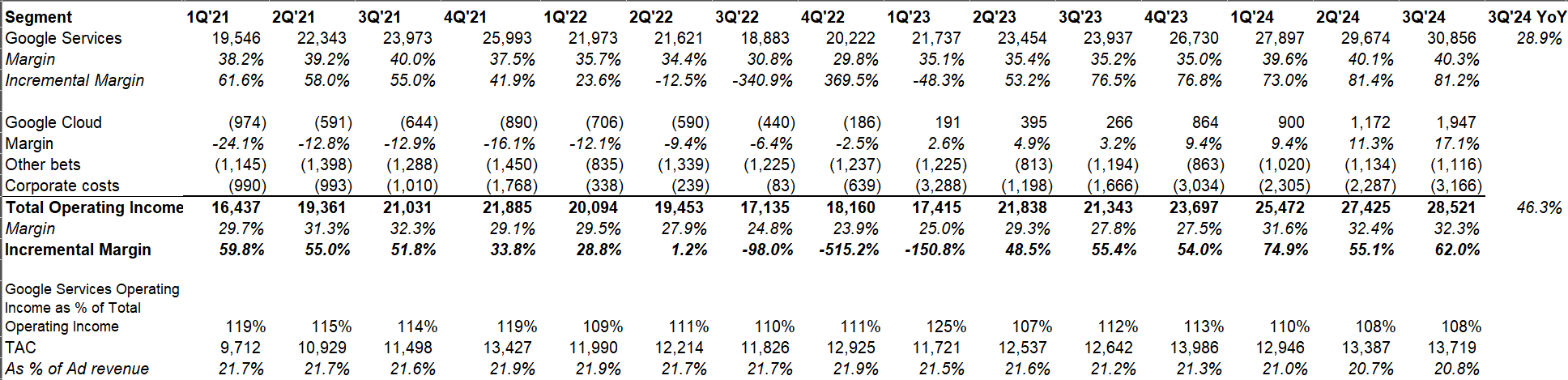

Not only did Google Cloud grow at faster pace at a larger scale, they did so at much higher profitability than ever before. After turning profitable in 1Q’23, Google Cloud posted 17.1% operating margin in 3Q’24. The narrative that Google cannot reliably make money anywhere other than search should be put to rest.

After posting its highest ever margin in 2Q’24, Google Services business reached a new margin peak again in 3Q’24. Thanks to five consecutive quarters of >70% incremental operating margin (!!), operating margin for Google Services was 40.3% in 3Q’24!

Given the qualitative narrative around search in the age of AI, I’m not sure too many people (certainly not me) would predict that Google Service business would keep reaching new heights in terms of operating margin every passing quarter!

Search

Speaking of search, let me share some interesting quotes on Search from the call:

since we first began testing AI overviews, we have lowered machine cost per query significantly. In 18 months, we reduced cost by more than 90% for these queries through hardware, engineering and technical breakthroughs while doubling the size of our custom Gemini model.

In search, recent advancements, including AI overviews, Circle to Search and new features in lens are transforming the user experience, expanding what people can search for and how they search for it. This leads to users coming to search more often for more of their information needs driving additional search queries. Just this week, AI overview started rolling out to more than 100 new countries and territories. It will now reach more than 1 billion users on a monthly basis. We are seeing strong engagement, which is increasing overall search usage and user satisfaction. People are asking longer and more complex questions and exploring a wide range of websites. What's particularly exciting is that this growth actually increases over time as people learn that Google can answer more of their questions. The integration of ads within AI overviews is also performing well, helping people connect with businesses as they search.

Circle to Search is now available on over 150 million Android devices (MBI note: 2Q’24 data was 100 million, so 50 million incremental here over a quarter) with people using it to shop, translate text and learn more about the world around them. 1/3 of the people who have tried circle to search now use it weekly a testament to its helpfulness in potential. Meanwhile, lens is now used for over 20 billion visual searches per month. Lens is one of the fastest-growing query types we see on search because of its ability to answer complex multimodal questions and help in product discovery and shopping. For all these AI features, it's just the beginning, and you will see a rapid pace of innovation and progress here.

AI really supercharges search…with Circle to Search, where we see higher engagement from users aged 18 to 24. AI is expanding our ability to understand intend and connect it to our advertisers. This allows us to connect highly relevant users with the most helpful ad and deliver business impact to our customers.

every month lens is used for almost 20 billion visual searches with 1 in 4 of these searches having commercial intent.

…As you remember, we've already been running ads above and below AI overviews. We're now seeing that people find ads directly within AI overview is helpful because they can quickly connect with relevant businesses, products and services to take the next step at the exact moment they need. As I've said before, we believe AI will revolutionize every part of the marketing value chain.

…people are using a lot of buzz words like answer engines and all that stuff. I mean Google started answering questions about 10 years ago in our search product with featured snippets. So look, I think, ultimately, you are serving users. User expectations are constantly evolving. And and we work hard to stay a step ahead, anticipate and stay a step ahead. And this is why we've kind of really brought multimodality on the input side and the output side in search pretty natively.

Just a lot of very positive data points for Google’s search business. I know management is supposed to highlight the positives, but it’s definitely not getting easier to depict the Search bear case given what Google shared today. You can argue we are still in the early days, but Google Search’s operating performance has so far been much better than most bears would have predicted by mid-2023.

YouTube

In the last 12 months, YouTube's combined ad and subscription revenue has surpassed $50 billion for the first time. Of all the channels uploading to YouTube each month, 70% are uploading shorts. 70 billion YouTube shorts are watched every day. Monetization gap on shorts has continued to narrow.

Moreover, Google DeepMind is going to launch its most capable model for video generation which will help creators produce shorts later this year.

Google Cloud

Sundar Pichai had a very good quote on how customers are using Google Cloud products which is worth reading in full:

Customers are using our products in 5 different ways. First, our AI infrastructure. which we differentiate with leading performance driven by storage, compute and software advances as well as leading reliability and a leading number of accelerators. Using a combination of our TPUs and GPUs, LG AI research reduced inference processing time for its multimodal model by more than 50% and operating costs by 72%.

Second, our enterprise AI platform, Vertex is used to build and customize the best foundation models from Google and the industry. Gemini API calls have grown nearly 14x in a 6-month period. When Snap was looking to power more innovative experiences within their “My AI” chatbot, they chose Gemini's strong multimodal capabilities. Since then, Snap all over 2.5x as much engagement with “My AI” in the United States.

Third, customers use our AI platform together with our data platform, big query, because we analyze multimodal data no matter where it is stored with ultra low latency access to Gemini. This enables accurate real-time decision-making for customers like Hiscox, one of the flagship syndicates in Lloyd's of London, which reduced the time it took to quote complex risks from days to minutes. These types of customer outcomes, which combine AI with data science have led to 80% growth in big query ML operations over a 6-month period.

Fourth, our AI-powered cybersecurity solutions Google threat intelligence and security operations are helping customers like BBVA and Deloitte, prevent deduct and respond to cybersecurity threats much faster. We have seen customer adoption of our Mandan power threat deduction increased 4x over the last 6 quarters.

Fifth, in Q3, we broadened our applications portfolio with the introduction of our new customer engagement suite. It's designed to improve the customer experience online and in mobile apps as well as in call centers, retail stores and more. A great example is Volkswagen of America, who is using this technology to power its new IBW virtual assistant. In addition, the employee agents we delivered through Gemini for Google Workspace are getting superb reviews. 75% of daily users say it improves the quality of their work.

I will discuss more on Cloud when Amazon posts next week.

AI

all 7 of our products and platforms with more than 2 billion monthly users use Gemini models, that includes the latest product to surpass the 2 billion user milestone Google Maps. Beyond Google's own platforms, following strong demand, we are making Gemini even more broadly available to developers.

We're also using AI internally to improve our coding processes, which is boosting productivity and efficiency. Today, more than 1/4 of all new code at Google is generated by AI, then reviewed and accepted by engineers.

Other Bets

Waymo is now a clear technical leader within the autonomous vehicle industry and creating a growing commercial opportunity. Over the years, Waymo has been infusing cutting edge AI into its work. Now each week, Waymo is driving more than 1 million fully autonomous miles and serves over 150,000 paid rights.

Wing, our drone delivery company recently passed the 1-year university of scale in its partnership with Walmart in the Dallas-Fort Worth area, now operating in 11 stores and serving 26 different cities and towns.

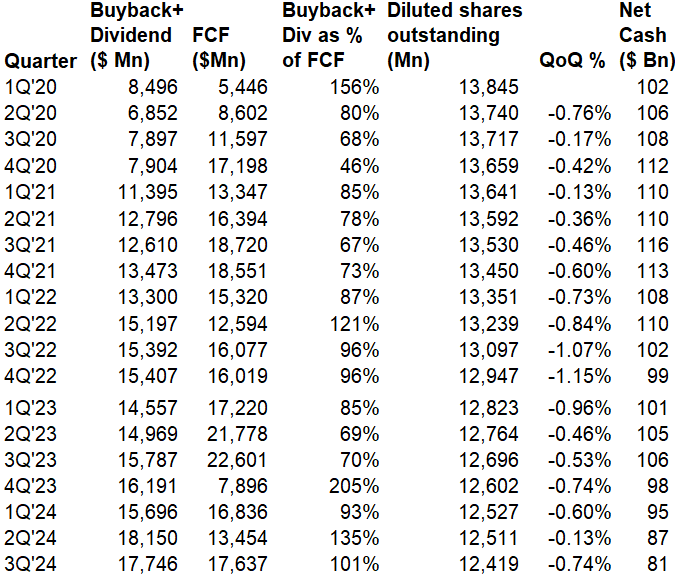

Capital Allocation

Google returned capital to shareholders through buyback and dividend almost equivalent to FCF they generated last quarter. Share count declined by 74 bps QoQ.

Capex and Opex

Some good context around Google’s capex:

as you saw in the quarter, we invested $13 billion in CapEx across the company. And as you think about it, it really is divided into 2 categories. One is our technical infrastructure, and that's the majority of that $13 billion. And the other one goes into areas such as facilities, the bets and other areas across the company. Within TI, we have investments in servers, which includes both TPUs and GPUs. And then the second categories are data centers and networking equipment. This quarter, approximately 60% of that investments in technical infrastructure went towards servers and about 40% towards data center and networking equipment. And as you think about them, we offer both GPUs and TPUs, both internally and to our customers. So we have choices and options based on what our customer needs and what our internal needs are. And as you think about the next quarter and going into next year, as I mentioned in my prepared remarks, we will be investing in Q4 at approximately the same level of what we've invested in Q3, approximately $13 billion. And as we think into 2025, we do see an increase coming in 2025, and we will provide more color on that on the Q4 call, likely not the same percent step-up that we saw between '23 and '24, but additional increase.

For context, Google’s capex is expected to increase by ~55% in 2024 vs 2023, and the consensus estimates imply capex to be $54 Billion in 2025 vs $50-52 Billion in 2024. So, of course nobody is remotely expecting “same percent step up” but my gut says the fact that they even mentioned it perhaps implies the “additional increase” is probably not just a couple of billions of capex increase in 2025, but rather $8-10 Billion increase.

Outlook

Google doesn’t provide guidance, but did mention the below during the call:

As we think about the remainder of 2024, there are a couple of dynamics to consider. In terms of revenue, Year-on-year growth in advertising revenue will continue to be impacted by the increase in strength in advertising revenue in the second half of 2023, in part from APAC-based retailers, and there will be a headwind to year-over-year growth in subscription platforms and devices revenue in the fourth quarter due to the pull forward of our Made by Google launches into the third quarter this year.

Valuation

Since 3Q'22, I share the following valuation framework every quarter. Given I created this table in 2022 which was a very different market than what we have today from sentiment perspective, you can argue this is overly conservative. I’m going to keep it consistent. But I acknowledge the reality that Google not only trades at the lowest NTM P/E multiple among Mag-7 stocks, its multiple is also below S&P 500.

Finally, I do want to mention that Google shareholders should be proud to own a company that was the epicenter of AI research for the last decade or so which led to couple of its employees win the Nobel Prize! When I read the news first, I wished I owned Google! There is hardly any doubt that AI is going to have profound impact on our lives, and on society, and no matter which way the stock goes in the next 10-15 years, History will likely remember Google quite positively.

I will cover earnings of Amazon and Meta this week. Thank you for reading.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.