Alphabet 1Q'25 Update

Disclosure: I own shares of Alphabet

While Google continues to fend off concerns related to long-term future of search, Alphabet’s business keeps chugging along.

Here’s my highlights from today's earnings.

Revenue

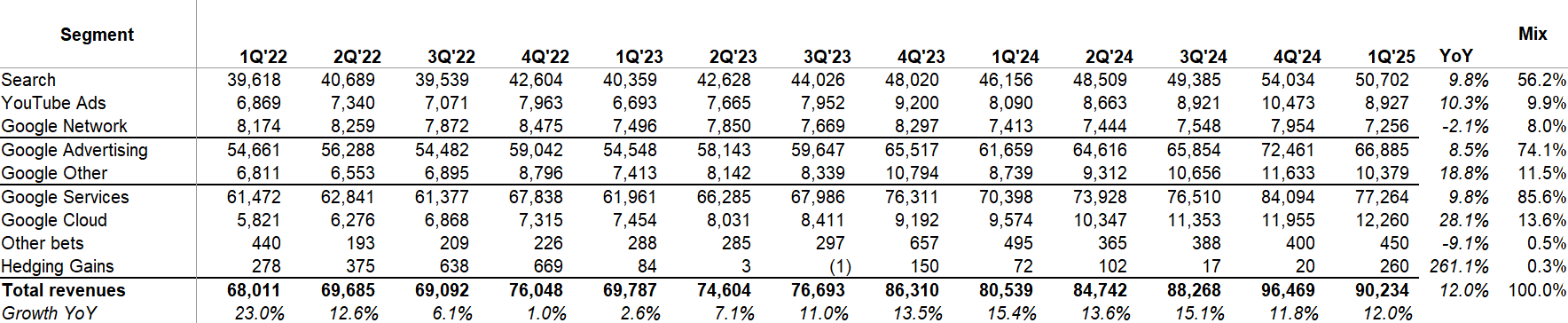

On an FX adjusted basis, Alphabet increased its revenue by 14% in 1Q’25 (~200 bps headwind from FX).

For the 11th consecutive quarters, Google network’s revenue went down. Just when regulators are lambasting Google for their network business in court, it keeps dwindling to oblivion. If Google just spins it off to get rid of the legal hassle, that’s probably an even worse news for the open web. Eric Seufert today made a compelling case to publishers: “be careful what you wish for”.

Both Search and YouTube ads grew by 10% YoY. To appreciate YouTube’s momentum, we may increasingly have to rely on “Subscription, platform, and devices” revenue (formerly known as “Google other” segment). More on this later.

Google Cloud is now at almost $50 Billion revenue run-rate, growing at an incredible ~28% YoY in 1Q’25.

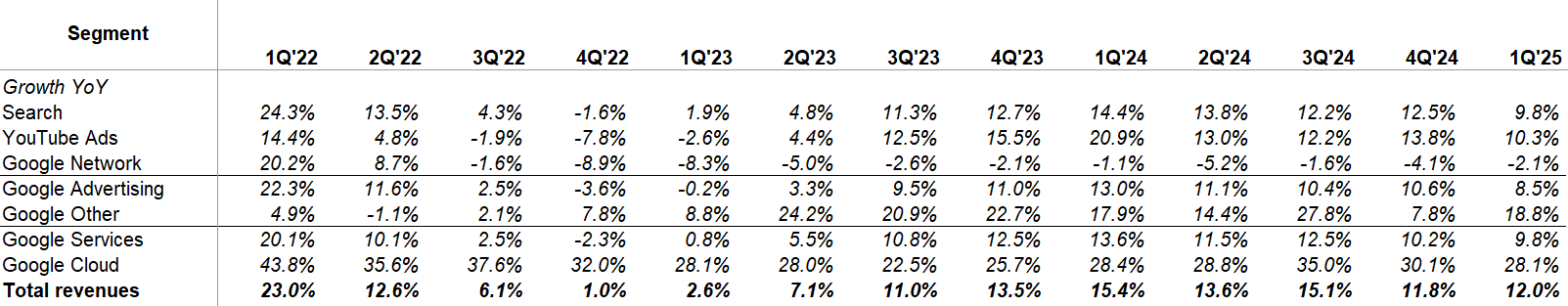

Take a look at growth rates by segment over the last 13 quarters.

EBIT

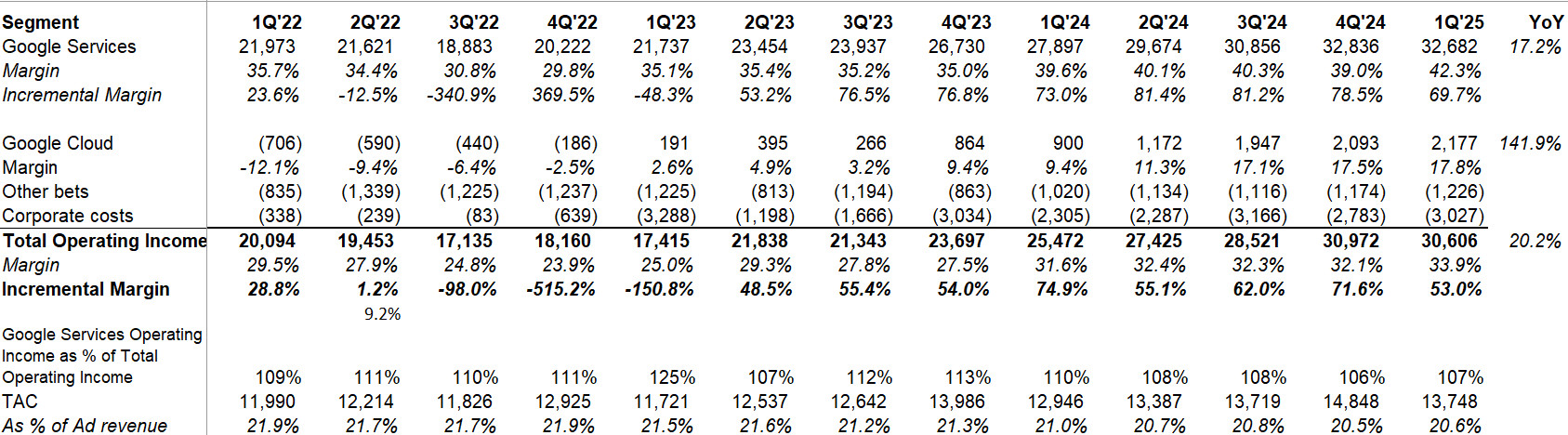

Google continues to post pretty unbelievable margins. Both Google Services and Google Cloud posted their highest ever operating margins. Google Services had another mind-boggling ~70% incremental margin quarter. It’s easy to forget but almost everyone expected the opposite to unfold since ChatGPT came to the scene. With monetization headwind from AI and rising cost per query, it certainly surprised me how much Google was able to expand its margins. For context, Google posted ~30% operating margin in 4Q’22 when ChatGPT was released. They just posted ~42% operating margin for Google Services.

Couple of things helped expand margins: a) the persistent decline of Google network business which has the highest TAC rate and likely one of the lowest margin business for Google Services; and b) the increase of depreciation schedule over the last few years. Google, of course, also enhanced its focus on “durably reengineering the cost base”. The fact that sales & marketing expense was down 4% in 1Q’25 is a good evidence to that approach.

Search

Some interesting quotes on Search from the call; I will include my comments/notes in the parentheses:

…AI Overviews is going very well with over 1.5 Billion users per month and we are excited by the early positive reaction to AI mode.

…We released Gemini 2.5 Pro last month, receiving extremely positive feedback from both developers and consumers. 2.5 Pro is state of the art on a wide range of benchmarks and debuted at number one on the chatbot arena by a significant margin. (Note: it definitely feels Google got its mojo back in model development. It’s TBD whether it is noticeable enough for consumers to care as OpenAI seems to be still better in productizing the model. My guess is it may matter if Google consistently continues to lead and actually ends up increasing the lead over time. Other than that, models may remain mostly commodity and they will have to just capitalize on their existing distribution to compete against OpenAI and others)

…On average AI mode queries are twice as long as traditional search queries. We're getting really positive feedback from early users about its design, fast response time and ability to understand complex nuanced questions. We also continue to see significant growth in multimodal queries. Circle to Search is now available on more than 250 million devices (Note: mentioned to be 200 million last quarter) with usage increasing nearly 40% this quarter. And monthly visual searches with Lens have increased by 5 Billion since October.

…with the launch of AI Overviews, the volume of commercial queries has increased. Q1 marked our largest expansion to date for AI overviews, both in terms of launching to new users and providing responses for more questions.

…For AI overviews overall, we continue to see monetization at approximately the same rate. (Note: this was also mentioned in last quarter, so not a new info)

…In Q1, the number of people shopping on Lens grew by over 10% and the majority of Lens queries are incremental.

…Thanks to dozens of AI part improvements launched in 2024, businesses using DemandGen now see an average 26% YoY increase in conversions per dollar spent for goals like purchases and leads. And when using DemandGen with product feed, on average, they see more than double the conversion per dollar spent year over year.

…We are continuing to make a lot of progress there in terms of people using coding suggestions. I think the last time I had said the number was like 25% of code that's checked in. It involves people accepting AI solutions. That number is well over 30% now.

…Search and Gemini obviously will be two distinct efforts, right? I think there are obviously some areas of overlap, but they're also you know, like expose very, very different use cases. And so, for example, in Gemini, we see people iteratively coding and going much deeper on a coding workflow, as an example. So I think both will be around. Within Search, would think of AI overviews scaling up and working for our entire user base, but an AI mode is the tip of the tree for us pushing forward on an AI forward experience. There will be things which we discover there which will make sense in the context of AI overviews, so I think will flow through to our user base. But you almost want to think of what are the most advanced 1 million people using Search for, the most advanced 10 million people, and then how do 1 billion people use Search for. And we want to innovate and so I think this allows us to do that. But the true north star through all of this is user feedback, user satisfaction, user experience.

From personal perspective, LLM feels like a mix of productivity and search tool. So, the surface area of long-term potential does feel pretty wide. I think it makes sense for now to approach these from multiple angle to gauge what resonates with the users the most.

YouTube

“YouTube now has over 1 Billion monthly active podcast users. YouTube Music and Premium reached over 125,000,000 subscribers, including trials globally.”

I wish Google stopped including the trials in their subscriber numbers. Just report the paying subscriber number!

Subscriptions, Platforms, and Devices

Google announced they not have 270 million subscribers! Back in 1Q’22, both YouTube ads and the then “Google other” (now “subscription, platforms, and devices) segment had ~$6.8 Billion revenue. Three years later, this segment just reported ~$1.5 Billion more revenue than YouTube ads in 1Q’25. Google mentioned this growth is primarily driven by YouTube and Google One subscriptions. If Google can maintain its recent momentum in releasing SOTA models, I think Google One can be a pretty large business for them. Their offering is quite compelling!

Search’s long-term future can be hard to decisively answer, and while Google may be too dependent on search advertising revenue, I think they have plenty of defense to remain relevant for a long time:

All 15 of our products with a half a billion users now use Gemini models. Android and Pixel are two examples of how we are putting the best AI in people's hands, making it super easy to use AI for a wide range of tasks just by using their camera, voice or taking a screenshot.

Google Cloud

Google Cloud more than doubled its revenue in just three years as it grew from $5.8 Billion in 1Q’22 to $12.3 Billion in 1Q’25. Just as Google cloud grew its revenue by 28%, one interesting thing that I noticed is when AWS had ~$12 Billion quarterly revenue in 4Q’20, they also grew revenue by 28%. Two years ago, I mentioned that Google Cloud’s revenue tends to mirror AWS revenue four years apart, but I was skeptical that it would continue. So far, Google cloud is largely still keeping pace with AWS four years apart. I will discuss more on Cloud when Amazon posts later this week.

Management reiterated that demand-supply is still not in an equilibrium:

…we're in a tight demand-supply environment and given that revenues are correlated with the timing of deployment of new capacity, we could see variability in cloud revenue growth rates depending on capacity deployment each quarter.

…We expect relatively higher capacity deployment towards the end of twenty twenty five.

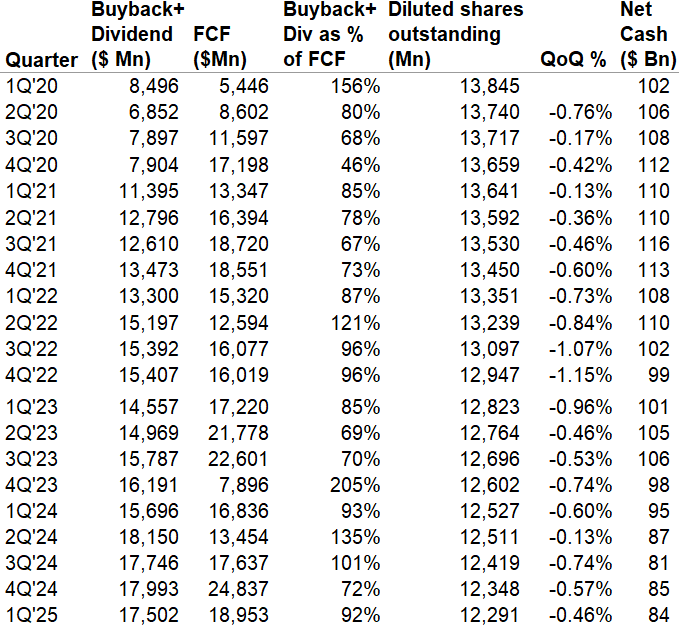

Capital Allocation

In 1Q’25, Google returned 92% of their FCF to shareholders through buyback and dividend. Share count declined by 46 bps QoQ. They also increased dividend by 5% going forward.

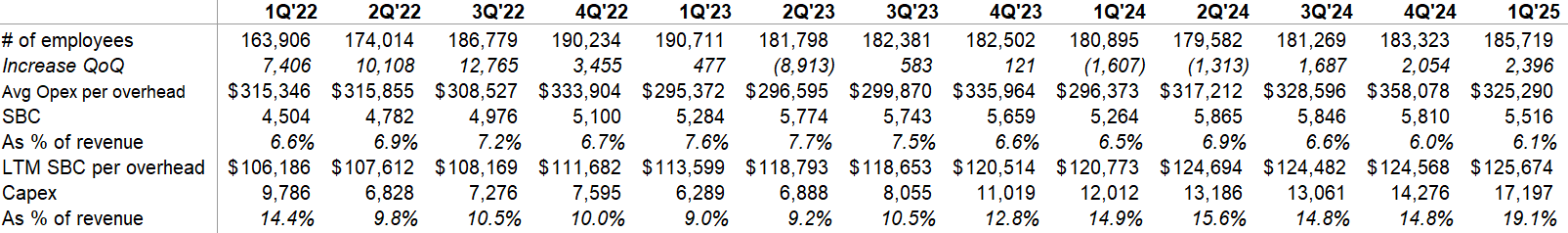

Capex and Opex

Management re-iterated that they expect capex to be $75 Billion in 2025. My sense is no matter what happens in the economy, we will see $75 Billion capex this year, and the real impact of economic situation will sway their capex plan in 2026.

Outlook

Google doesn’t provide guidance, but did remind the headwind from “APAC based retailers” and the tsunami of depreciation expense that’s coming:

With regard to Q2, we're only a few weeks in, so it's really too early to comment. I mean, we're obviously not immune to the macro environment, but we wouldn't want to speculate about potential impacts beyond noting that the changes to the de minimis exemption will obviously cause a slight headwind to our ads business in 2025 primarily from APAC based retailers.

We had about a 31% year over year growth in depreciation this quarter and it will be higher as we go throughout the year. So think about that kind of as a headwind that we have to manage against.

Valuation

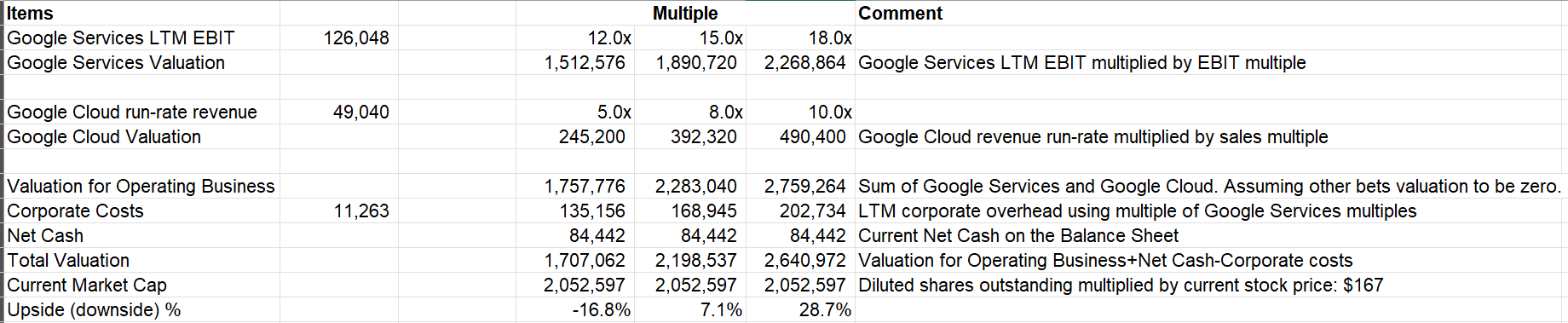

Since 3Q'22, I share the following valuation framework every quarter. The Services business seems to be currently priced at ~15x LTM EBIT, (a segment that has grown EBIT by 14.1% CAGR over the last three years) and Google Cloud at ~5x run-rate revenue.

I will publish my Deep Dive on Synopsys tomorrow, and will cover the other big tech earnings next week. Thank you for reading.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.