EssilorLuxottica: From Eyecare To Eyewear To Smart Glasses

You can listen to this Deep Dive here

A recent Freakonomics podcast episode started with this riddle:

“Name an item that is both a medical device and a fashion accessory. An item that may cost $50 to make, but often sells for over $1,000. An item that was invented eight centuries ago, has improved billions of lives — and yet many people who need it don’t have it, especially children.”

Anyone reading this Deep Dive probably already figured out the answer to this riddle is eyeglasses. The company that absolutely dominates the eyeglasses industry today is EssilorLuxottica. Until 2018, Essilor and Luxottica used to be separate companies. While Esilor focused on lens manufacturing, and distributed corrective lenses and optical equipment, Luxottica focused on designing, manufacturing, and distributing frames for eyeglasses. Following its all-stock merger of equals in October 2018, the new entity became known as EssilorLuxottica.

Essilor itself was the result of merger between Essel and Silor. Essel started as a small network of eyeglass assembly workshops in Paris in 1849, specializing in manufacturing eyeglass frames. It later expanded into lens production. Silor, on the other hand, was established in 1931 by Georges Lissac, and focused on developing new lens materials and treatments. The merger of these two companies combined Essel's expertise in lens design with Silor's innovations in materials, laying the foundation for Essilor’s dominance in the ophthalmic lens industry.

Luxottica had a more colorful history. It was founded by Leonardo Del Vecchio in 1961. He grew up in an orphanage and started apprenticing as a metal engraver at age 14. After working at a place that produced parts for eyeglass frames, Del Vecchio in his mid-twenties decided to open his own workshop in a smalltown in Italy. From the early days, he quickly understood the value and significance of vertical integration in order to control and ensure attractive economics in the overall eyeglasses value chain. Del Vecchio basically tirelessly worked in his entire adult life to ensure his company’s control in each part of eyeglass value chain. From production of frame parts to assembly and the retail outlets through which these very eyeglasses are sold, Del Vecchio built Luxottica over time in a way that ensured he had tight control over the entire value chain.

At the same time, Del Vecchio developed key licensing agreements with global luxury brands that cemented eyeglasses as fashion symbols. Back in 1988, Luxottica signed a licensing agreement with Armani which was a first of its kind and was then followed by numerous similar deals in the following decades that certainly elevated the status of eyeglasses from all sorts of negative connotations. While it may seem surprising today, people did have hesitance in wearing glasses in the past even if they had poor eyesight. From the same Freakonomics podcast:

What we often see in early art are representations of the devil wearing spectacles. They start to take on this magical connotation, whereby glasses allow you to see the things that you shouldn’t see. Another reason why people were reluctant to wear spectacles was because they were so closely associated with aging. You have paintings in which a pair of spectacles are shown alongside a skull. The symbolism of that is quite clear.

Such licensing agreements not only helped gradually brush away all the negative perception around wearing glasses, it also de-commoditized eyewear industry from being everyday necessity for people suffering from poor eyesight to a fashion statement for potentially anyone. Del Vecchio may be the most important figure in the history of commercialization of eyeglasses!

Del Vecchio actually first retired in 2004, only to come back a decade later to become more actively involved in Luxottica again. In the following couple of years, he ousted three Chief Executives and just when the company appeared to be in bit of a turmoil, Del Vecchio conjured a merger that he labeled as “the achievement of a lifetime dream.”

One key part of the eyeglass value chain over which Del Vecchio did not have control was lens design and manufacturing. Almost ~30% of lenses used in eyeglasses sold by Luxottica was coming from Essilor. Since ~70% of global optical lenses market was controlled by just three companies with Essilor leading the industry, it was a potential vector of weakness for Luxottica. There were murmurs even in 2014-15 that Essilor wanted to acquire Luxottica, but Del Vecchio was reluctant to cede control to the French company. By the time the two companies did consummate the merger, Del Vecchio became the Executive Chairman and owned 32% stake in the merged company.

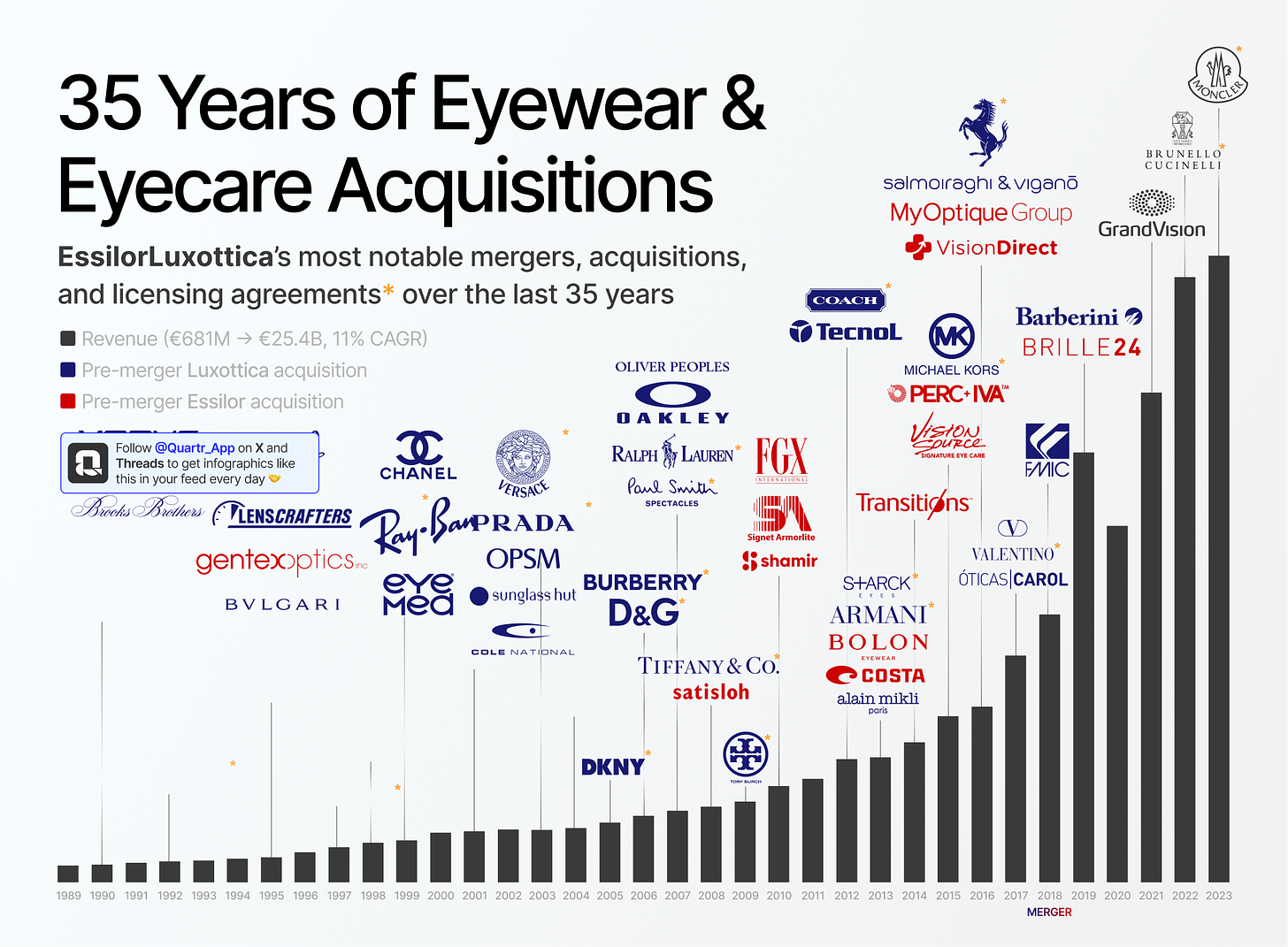

While Del Vecchio passed away in June 2022, his overarching vision of vertical integration and deep control over the value chain still ripples through EssilorLuxottica. As you can see below, these two companies’ history of acquisitions and licensing agreements led to the behemoth they are today. But before we get into the weeds of the company’s businesses and the economics around it, let’s start with a deeper understanding of the overall eyeglass industry.

Here’s the outline for the rest of this Deep Dive:

Industry Context: In this section, I discussed about the size of the eyeglasses market, increasing rate of myopia and why it may be happening, and the potential for solutions to hearing and vision problem to coalesce in the coming years.

Company Overview, and Economics: After some industry context, this section focuses on the business of EssilorLuxottica-both as a merged entity as well as when Essilor and Luxottica used to be independent companies.

Competitive Dynamics: I elaborated on EssilorLuxottica’s moats especially on brand licensing deals as well as the competition with Warby Parker and how it evolved over the last few years. I also discussed how some luxury brands are choosing to go in-house instead of brand licensing and explores whether the big tech “partnership” with the incumbents is a boon or a potential bane for the industry.

Capital Allocation and Management Incentives: I showed EssilorLuxottica’s capital allocation since their merger, as well as management short and long-term incentive structure in this section.

Model Assumptions/Valuation: Model/implied expectations in the current stock price are analyzed here.

Final Words: Concluding remarks on EssilorLuxottica, and disclosure of my overall portfolio (including why I changed my mind on Sartorius preference shares and bought the ordinary shares instead).