Some more thoughts on Dollar General

After Dollar General’s (DG) disastrous earnings couple of weeks ago, I was quite concerned about their prospects in the near-term. However, a week later after digesting through Dollar Tree (DLTR) as well as DG management’s explanation in the Goldman Sachs Retailing Conference, I have updated some of my thoughts about DG…in the positive direction.

Nonetheless, I have decided to abide by my decision not to inject more capital to DG, but to increase my notional exposure to DG via long-dated call options. As a result, I now no longer own any share of DG but do own January 2026 $45 Calls for which I have paid $36.8 per share. To be more specific, I still have similar $ exposure to DG as I did before, but doubled the notional exposure now thanks to these call options.

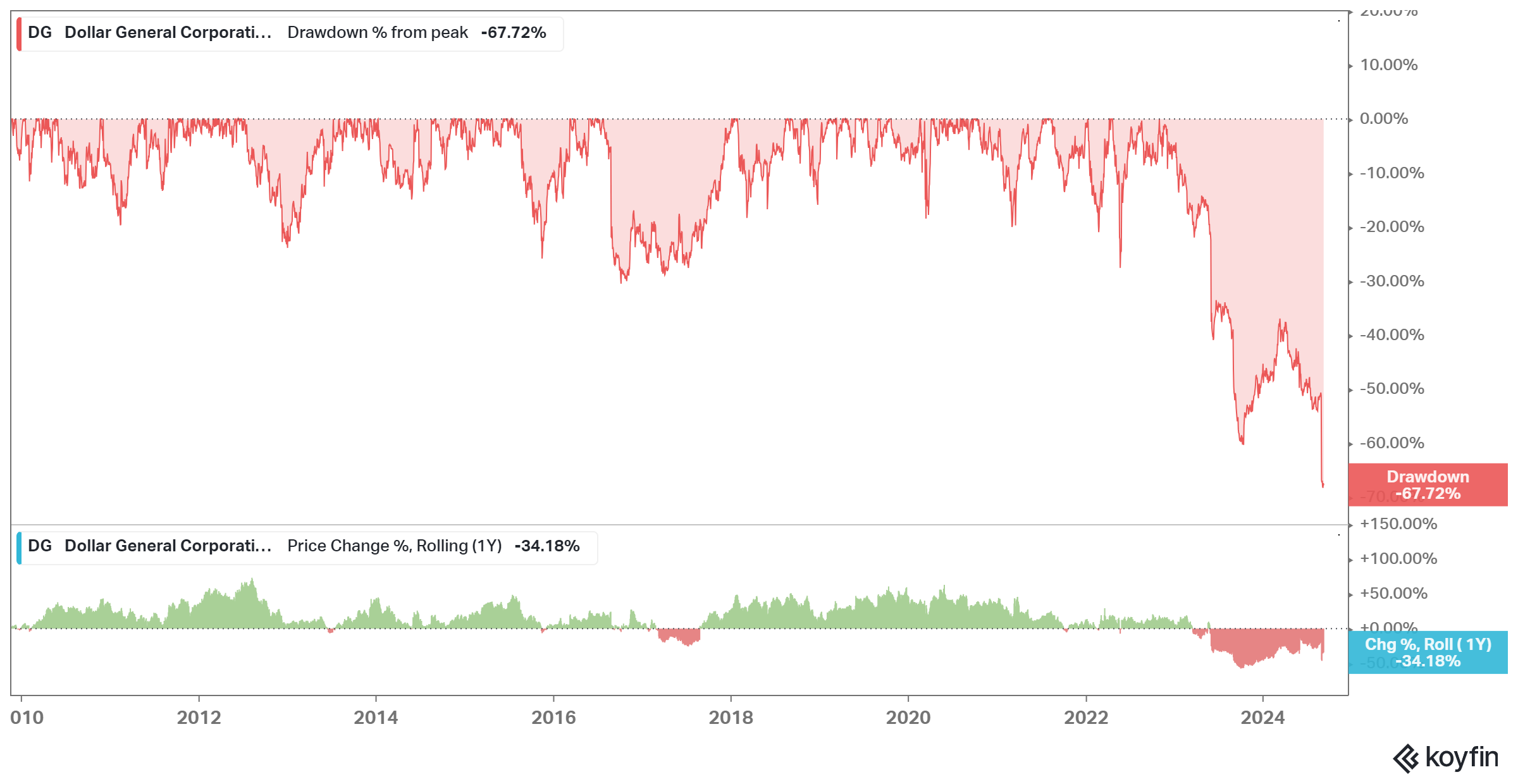

Before I discuss what prompted me to be willing to increase my notional exposure to DG, let me start with the acknowledgement that there are indeed plenty of question marks on DG. When a stock is down ~67% from its peak, it should not be surprising that there are some concerning developments for the business.

There are two distinct vector of concerns:

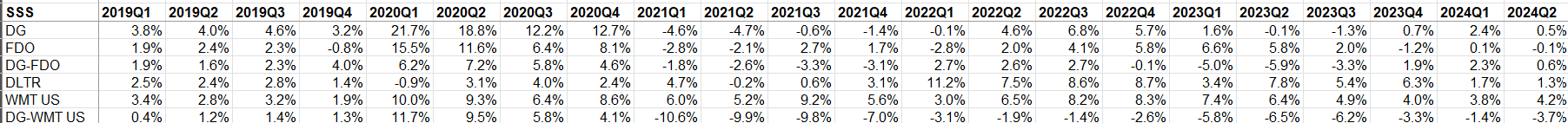

a) Walmart (WMT): while WMT and DG have co-existed and thrived for decades, after WMT’s 14 consecutive quarters of faster Same Store Sales (SSS) growth- it is certainly a fair question to wonder whether something structurally has changed. .

As Alex Morris from “The Science Of Hitting” (TSOH) discussed today, I agree that it is clear WMT has been outexecuting DG in the last three years or so, but the impact of WMT may largely have been confined to the marginal trip and not necessarily a structural question on the DG business model. From TSOH:

I think we need to answer a fundamental question: what value does DG provide to its customers? The primary answer, especially in the ~16,000 stores located in small towns (population of less than 20,000), is convenience. As a reminder, the majority of their products cost under $5, with an average transaction value around $16. (To put that into context, free delivery through Walmart+ is only available on $35+ orders.) The mix is also heavily weighted to consumables, which account for >80% of DG’s revenues.

Put differently, I think most Dollar General customers walk in the store to pick up a handful of products, with the need for (consumption of) those products likely to be in the immediate future.

Given this context, I’m not quite losing my sleep over DG’s consumables business…yet! The value proposition of convenience of DG stores is likely to remain relevant for many years to come, something that can be easily underappreciated by people living in the urban areas with plenty of retail alternatives to choose from. Moreover, DG management reiterated that they primarily gain share from drug stores and grocery stores and there is likely healthy amount of share left by those stores, so I don’t think DG needs to necessarily win a food fight against WMT in the near to medium term to get back to ~3%+ SSS trend in consumables next year. From DG management:

What we have noticed over the years is that our share gains have been coming no surprise, and we've been very vocal about it from drug first and the grocery sector second. Normally, what you find from those 2 cohorts of retailers is a middle to upper middle and even lower and upper income demographic. And that, on a quarterly basis has been for, gosh, probably the last 10 years, that customer, at least in my mind, has been up for grabs, right?…So when I look at Q2, while our core customer was very stable, $30,000 and under, what we saw different from Q1 to Q2 was that while we gained share in that middle income cohort, we gained it at half the rate we did in Q1. And it was obvious to us through the data where the other half went and it went to mass. And I think we called out the guys in Bentonville, took a little bit larger piece of that.

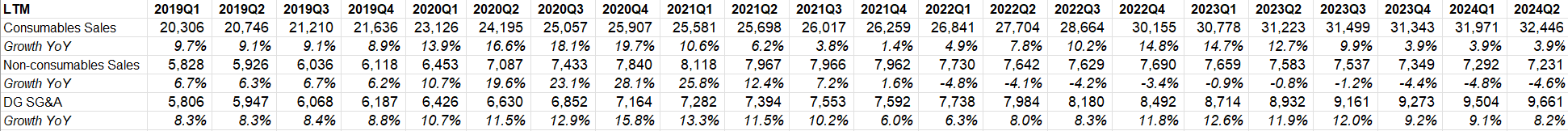

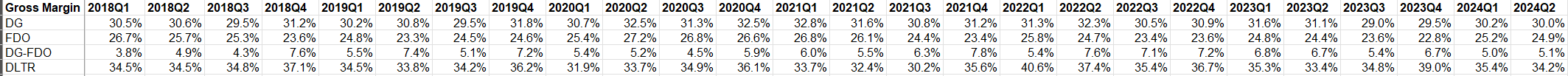

b) Amazon/Temu: As earlier discussed in my earnings update, I do have plenty of sympathy for structural concerns when it comes to non-consumables business. After 10 consecutive quarters of decline in LTM non-consumable sales, it is difficult not to see some impact of Amazon and Temu here. There are some data out there that also seem to substantiate such impact. This is indeed a real concern and unless the trend reverses, it may act as an insurmountable barrier to get back to DG’s long-term operating margin of ~8-9% (vs current ~5%).

One counter argument to this concern is although declining non-consumables certainly pressured gross margins in recent quarters compared to what we have seen in 2020-21 period, gross margin still looks pretty similar to pre-pandemic era. Given DG reported 8.3% operating margin both in 2018 and 2019 despite reporting somewhat similar gross margin to recent quarters, the mix shift from non-consumables to consumables may be more manageable than many suspect. The key difference between 2018-19 and now, of course, is SSS. While DG is guiding SSS to be 1.3% (mid-point) in 2024, they reported >3% SSS in 2018-19 period. Therefore, SSS remains the most important KPI for the stock. So, the question is can this KPI go in the right direction?

DG’s SSS increased by only 0.2% in 2023 and is expected to grow by +1.3% in 2024. Therefore, my first observation here is DG will be up against some pretty soft comp next year. Moreover, given Family Dollar (FDO)’s continued struggle, it is highly likely that we will see an acceleration of store closure to shut down the underperforming stores. As a reminder, almost half of FDO stores is within 5 miles of DG store; therefore, DG should be a beneficiary of such a strategy by FDO and should help DG lift SSS a bit next year or two. Perhaps more importantly, it is the macro commentary by DG (and DLTR) management that makes me think DG is a very, very compelling bet especially in my personal portfolio context (more on this later).

Here’s what DG management said at GS conference last week:

as we look at the quarter, what we saw was a pretty drastic slowdown in change. And it happened suddenly, I would say, mid-quarter-ish if you will. And what led us to start looking even deeper at, is this macro? Is this something internal? Is it a combination? We started to take a look at a couple of different factors.

One being, is it broad-based? And with 20,000 stores, it's an advantage, right, because you're coast to coast. And if it's something macro, normally, you start to see that across the country and it was definitely that. It happened across every region, every division that we had almost the same amount.

Second thing was we looked at was well, is it happening in your new stores? Well, again, we're advantage there with opening as many new stores as we've done. And sure enough, our new store base all sort of ships went down in the harbor at the same time as well. So those are great leading indicators.

And then lastly, what we noticed was an even tighter core consumer at the very last week of each of the months in Q2. While that's always a tighter week of the month for our core consumer, it was by far, though, the weakest in each of the -- when you look at each of the 4 weeks of each of the period. So, that led us to believe it's more macro in nature. While we still have a lot to do in our back-to-basics work, I would tell you that we believe that the macro effect of what we're seeing in our core customer is starting to take effect on her.

…our core customer normally works her 30 to 40 hour a week job but also has a secondary job that she normally works 15 to 25 hours in. What she told us in Q2 was that is going away or has gone away.

…it looks like the economy is slowing at a pretty decent cliff, at least what we're seeing here from the customer base. And that natural progression that we see as she moves, that middle income, all roads lead through Bentonville and usually go to Walmart first, right? And then -- and here's the key. The key is, the trade down in there is this, the customer says, I'm trading in because I'm fleeing, I'm looking for value, right?

And I think you heard other retailers talk about that. The next shoe to drop normally is not I'm seeking value, but I must have value. I've got to make ends meet, where our core customer is today. And then when that happens, that usually then that customer trades into Dollar General.

Given how the stock has traded in the recent months, investors seem to be deeply unwilling to give much credence to management’s explanation, and while I have not been a fan of Todd Vasos (CEO of DG), I happen to find the explanation more reasonable than market likes to think today. Not only DLTR has echoed similar concerns, dollar stores’ history also encourage me to be a bit more optimistic here. I have been discussing some of these aspects with Alex Morris over the last week, and he already aptly explained the historical context in his write-up today. Let me quote from his piece:

In February 2008, Dollar Tree reported its Q4 2007 results. Reported comps declined ~1%, a notable change in trend from prior periods. As CEO Bob Sasser noted at the time, the results reflected “continuing pressure on the consumer from a generally challenging economic environment”. Mr. Market wasn’t too pleased with that explanation: the stock, which had traded up to ~$15 per share in mid-2007, was down >50% by early 2008 (split adjusted).

But then the results started to improve. As you can see below, despite facing intensified macro pressures during the heart of the financial crisis, DLTR started reporting mid-single digit comps.

…The stock, which bottomed well below $10 per share in early 2008, was trading at ~$25 in early 2011. (As an aside, it’s interesting to note that DG’s comp trajectory during this period was quite similar: some weakness in late 2007 and early 2008 followed by stellar results for full year 2008 / 2009.)

…At the time, I’d be willing to bet that analysts and investors questioned whether that answer fully explained what was going on, particularly given that a notable competitor like Walmart was still reporting solid results: “We had a very strong underlying operating performance, exceeding our expectations for the quarter… The price leadership strategy we put in place at the beginning of the year was exactly the right strategy… Price leadership and improved customer service made the difference.”

To the extent DG management is right about macro potentially deteriorating from here, almost all of my portfolio holdings will likely take at least a temporary hit. Most DG investors prefer exposure to dollar stores precisely because of their countercyclicality. Given the recent missteps, this exposure has unfortunately come at a heavy price. I do suspect, however, that it is much more likely than ever that we may be on the cusp of some much needed countercyclical exposure such as DG.

Consensus estimates for 2025 and 2026 operating margins are 5.0% and 5.3% respectively. If DG comes back to 3%+ SSS for the next couple of years, it is very much conceivable to me that actual operating margin may turn out to be ~150-200 bps higher (which would still be ~150-200 bps lower than DG’s long-term operating margins). If we do see return to ~6.5-7% operating margin and multiple re-rates to ~15-16x P/E, the stock can almost double in a couple of years. I don’t think any of my portfolio holdings will double in a couple of years if we face a recession during this time. As a result, despite my concerns about DG, I have decided to ensure that I have appropriate notional exposure to DG. At the same time, I do feel a strong aversion not to inject more capital to water my weeds which is why it still just remains a ~3% position.

Thank you for reading.

Further reading: My Deep Dive on DG (August, 2023)