Dollar General 4Q'23 Update

Disclosure: I own shares of Dollar General

Dollar General (DG)’s stock had an interesting reaction to today’s earnings. First it went up by ~6% in pre-market, but then ended the day 5% down. Despite the somewhat bizarre stock price reaction throughout the day, I think the worst days are likely behind DG.

Here are some highlights from today’s call.

Same Store Sales (SSS)

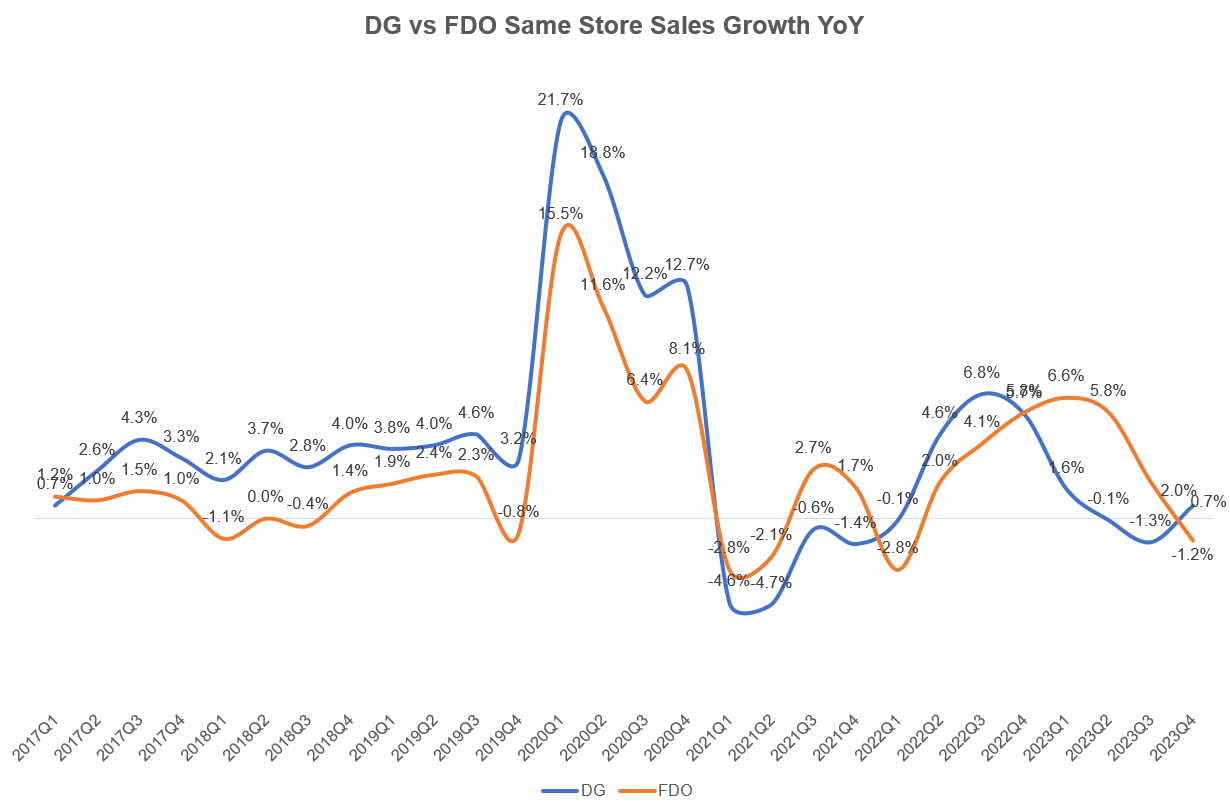

After two quarters of negative SSS growth, DG returned to positive SSS (+0.7%) in 4Q’23 which helped eke out +0.2% SSS growth for FY’23. More importantly, SSS was driven by +4% customer traffic growth which sequentially improved each month of the quarter (and traffic improvement is persisting in current quarter as well). This was offset by a decline in avg. transaction amount, primarily driven by fewer items per basket.

Improving customer traffic trend is quite encouraging as I was always more worried about traffic vs transaction amount growth. Interestingly, DG mentioned they’re seeing some trade down which made me wonder whether the overall consumer may be weaker than it generally appears or it is more of a reflection of DG’s operational improvement that lured some of those customers back:

“what we're starting to see is -- and gives us confidence is that for the first time in many quarters, we're starting to see the trade down come back in. And we hadn't seen that for a few quarters.”

SSS increase was driven entirely by consumable category and was partially offset by declines in the home, seasonal and apparel categories. So, customers seem to be more cautious in their discretionary expenditures.

More importantly, after four consecutive quarters DG has finally posted a better SSS comp than Family Dollar (FDO) which is their closest competitor.

Gross Margin

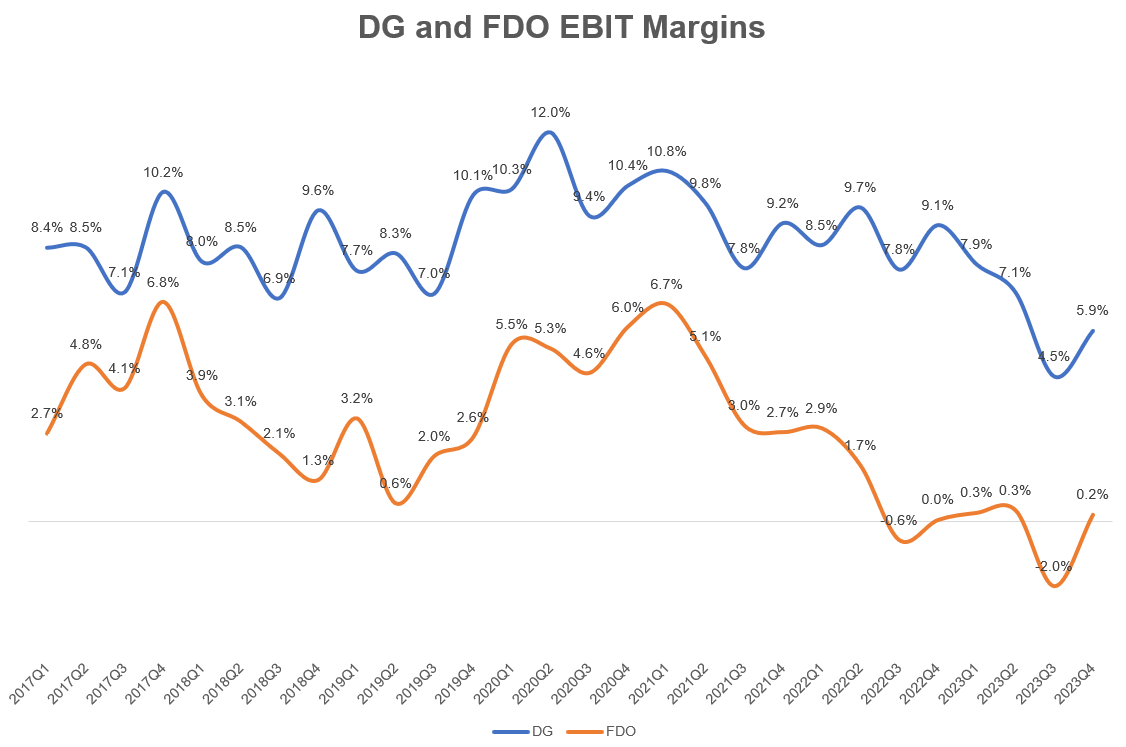

While gross margin declined by 138 bps YoY, it continued to fare much better compared to FDO. Why did DG’s gross margin fall?

This decrease was primarily attributable to increases in shrink and markdowns, lower inventory markups and a greater proportion of sales coming from the consumables category. These were partially offset by decreases in LIFO and transportation costs. Notably, year-over-year shrink headwinds continued to build during the year, increasing more than 100 basis points for both the fourth quarter and full year.

Operating margin

It appears operating margin has bottomed for DG in 3Q’23 and it came back to close to ~6% in 4Q’23. There is still a long way to go back to ~8-10% operating margin that DG used to post during much of the 2017-2022 period.

Inventory

Inventories stood $7 Bn in 2023, +3.5% YoY but a decline of 1.1% on a per store basis. Non-consumables inventory was -17% YoY and -21% on per store basis. There’s still plenty of room for improvement here as inventory turnover came down to 3.9x in 2023 (vs 4.2x in 2022 and 4.4x in 2019).

Store expansion

DG guided 800 new stores expansion (Including 30 popshelf and 15 stores in Mexico) in 2024 which will be the lowest since 2015.

In 2024, DG will also remodel 1500 stores (vs 2,007 stores in 2023) and relocate 85 stores (vs 129 stores in 2023). DG also mentioned they now have fresh produce in 5,400 stores and will target additional 1,500 stores for fresh produce in 2024.

Outlook

Here’s DG’s outlook for 2024:

we expect the following for 2024: net sales growth in the range of approximately 6% to 6.7%, same-store sales growth in the range of 2% to 2.7% and an EPS in the range of $6.80 to $7.55. We currently anticipate an estimated negative impact to EPS of approximately $0.50 due to higher incentive compensation expense. Our EPS guidance assumes an effective tax rate in the range of 22.5% to 23.5%.

I’m encouraged to see a return of somewhat healthy SSS growth outlook for 2024. As you can see below, except for pandemic induced demand in 2020, SSS was consistently hovering around ~2.5%+ during the pre-pandemic period. Following last year’s operational haphazardness which led to management changes, there was certainly a question mark whether DG’s model is indeed broken. If DG returns to it’s ~3% SSS growth, the next beast they need to slay to calm investors is operating margin.

2024 outlook still implies an operating margin closer to ~6% which is long way from DG’s operating margins during the pre-pandemic period. Of course, I don’t expect DG to return to such operating margin level quickly, but a somewhat consistent improvement throughout 2024 should lead us to a clearer pathway to get closer to ~8% operating margin sometime in 2025-26.

When DG was trading near $100 in September 2023, the primary question investors needed to get comfortable with to invest in DG is whether DG’s retail model is durable. As DG is about to embark on their 85th year of operation with store locations within 5 miles of approximately 75% of the U.S. population, I was always confident that the answer to that question is highly likely to be yes as their core value proposition of convenience has lasted the test of time.

Now that the stock price is at $150, we need to answer an additional question: when (if ever) can DG go back to its historical operating margin? I’m optimistic that over time, DG can get closer to the historical average operating margin. Admittedly, it is a slightly harder question than the first one, but I’m happy to be patient here.

Further reading: My Deep Dive on DG (August, 2023)

Thank you for reading.