Dollar General 2Q'24 Update

Disclosure: I own shares of Dollar General

I first wrote my Deep Dive on Dollar General back in August 2023. While I wasn't initially excited about owning a piece of the company despite the stock being down 40% from peak then, I changed my mind when the stock went down another ~25% following 2Q'23 earnings.

After today's dismal earnings, the stock went down almost another 30% since 2Q'23 earnings. If you're counting, the stock is now down ~67% from its peak in October, 2022. From listening to today's call, I think it is likely that I underestimated the depth of challenges Dollar General was heading towards.

Here are some highlights from today’s call.

Let's start with DG's assessment on the low-end consumers which is DG's core customer base:

From a monthly cadence perspective, same store sales growth was strongest in June before turning negative in July. Notably the three softest comp sales weeks of the quarter were the last week of each of the calendar months. This pattern suggests that our customers are less able to stretch their budgets through the end of the month. With that in mind, as well as our continued softness in discretionary sales and our own customer data and survey work, we believe the softer than anticipated sales performance in Q2 is at least partially attributable to a core customer that is less confident of their financial position.

I want to provide some additional context around what we're seeing and hearing from our customers. The majority of them state that they feel worse off financially than they were six months ago. As higher prices, softer employment levels and increased borrowing costs have negatively impacted low income consumer sentiment. As a result, our core customers who contributes approximately 60% of our overall sales comes predominantly from households earning less than $35,000 annually. Inflation has continued to negatively impact these households with more than 60% claiming they have had to sacrifice on purchasing basic necessities due to the higher cost of those items.

In addition to paying more for expenses such as rent, utilities and health care, more of our customers report that they are not resorting to using credit cards for basic household needs and approximately 30% have at least one credit card that has reached its limit. And in our latest survey, 25% of our customers surveyed noted they anticipated missing a bill payment in the next six months. While middle and higher income households are seeking value as well, they don't claim to feel the same level of pressure as low income households.

As customers have felt more pressure on their spending, we have also seen corresponding elevation in the promotional environment beyond what we have anticipated coming into the year.

...we are increasing our investment in markdown activity in an effort to support our customers, further drive customer traffic and improve sales.

While some of these data are helpful in gauging the challenges low end consumers face today, it would be more helpful if we could get a time-series data (e.g. what % of consumers claimed they had to sacrifice purchasing basic necessity last year vs today?). My guess is the broader point management is trying to drive would still stand but we could glean more insight in terms of the trend.

But wait a minute; isn't DG supposed to benefit in tough economic environment as middle-class customers tend to trade-down during such period. DG management had a good explanation why we are not seeing that...yet:

First of all...it takes a few quarters to come out of that, meaning our core customer. What we also see is it takes a quarter or more for the trade-in to come in at a higher rate. Now, in saying that, what we've noticed is a trade-in has been slower to come in to the channel than what we had anticipated and/or have seen in the past. I believe that's – there's a couple reasons why. I think the main reason and I believe this is true because it appears in every piece of data that we have is that the job market is still pretty decent, right. It's not as robust as it was. But also, unemployment hasn't spiked greatly, if you will, in the last quarter or so. Normally it takes that jolt to get the trade-in to come in at a heavier clip, if you will.

Now, the middle and the upper middle income are still looking for value. So I don't want you to believe that they're not. But usually to get them to trade in at a higher rate usually takes something a little bit more substantial than we've even seen to occur. I'm not suggesting I want to see that happen to that customer, but we stand ready and willing to certain her when that happens. The other thing that we've noticed is that more and more online activity comes from that cohort. Our core customer continues her online journey pretty much the way she was. It's pretty static, if you will. But we've noticed that middle to upper middle continues to rely on online a little bit more. And so as that occurs, I believe the trade-in slows a little bit on that side. So it's incumbent upon us to take a look at how we offset that piece as well.

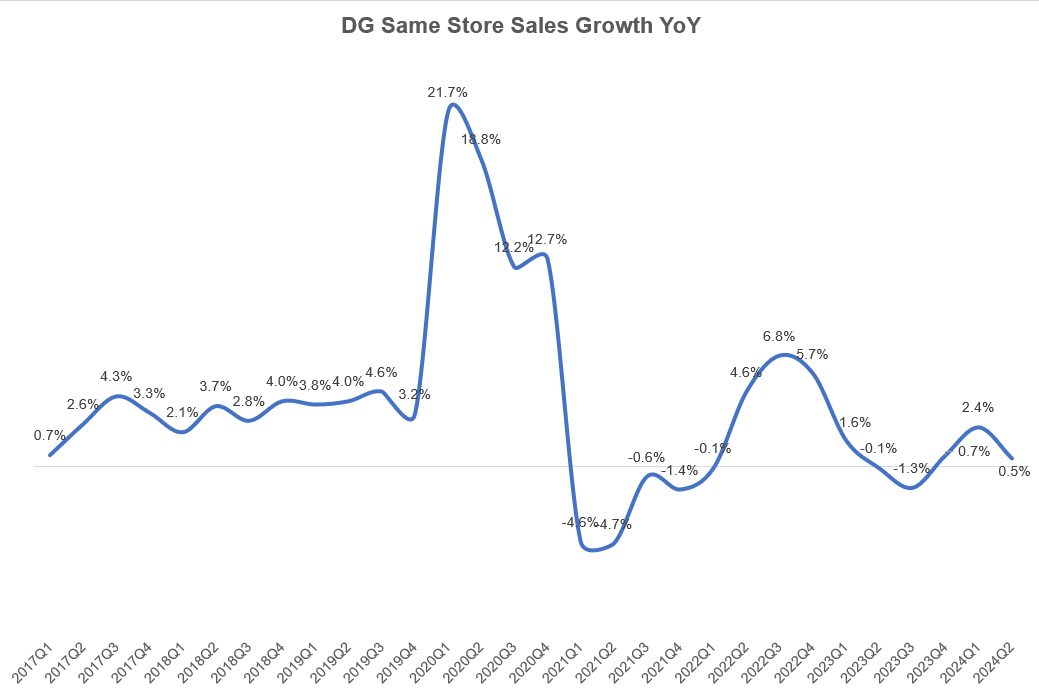

Same Store Sales (SSS)

After a more encouraging SSS of +2.4% 1Q'24, SSS decelerated to just +0.5% in 2Q'24. Traffic remains positive at +1% YoY (vs +4% YoY in 1Q'24) which was offset by transaction amount -0.5% YoY.

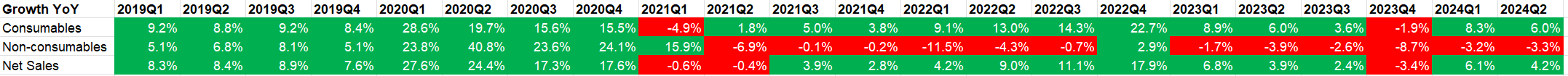

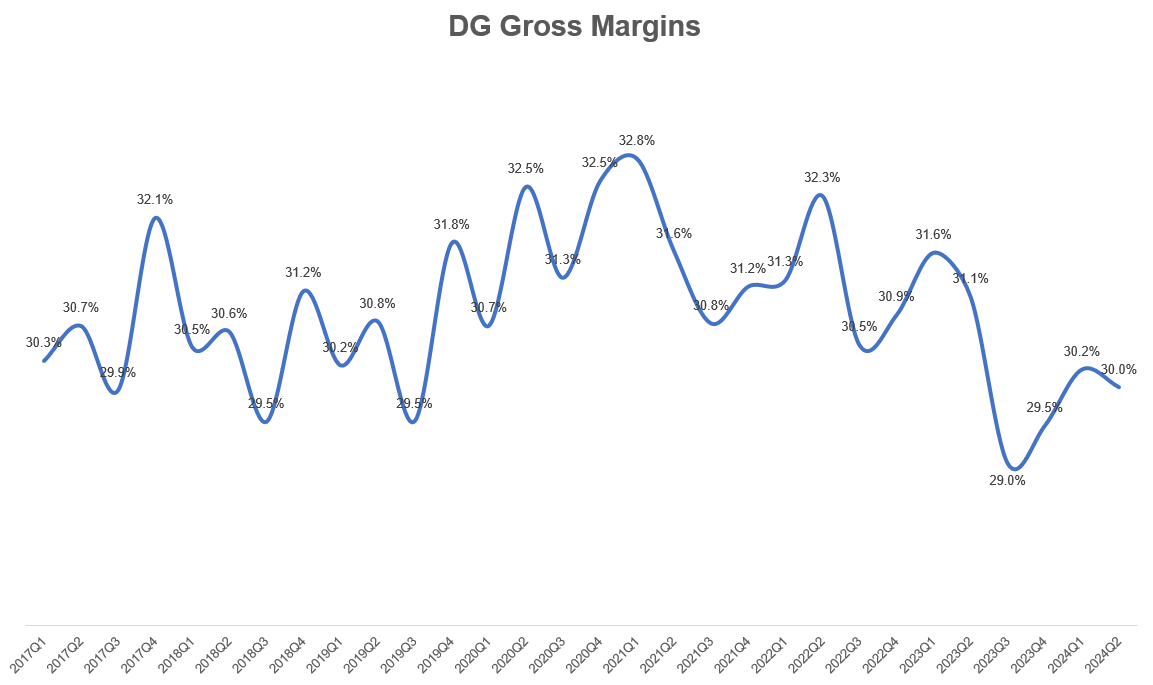

SSS increase was driven entirely by consumable category and was partially offset by declines in non-consumables (home, seasonal and apparel categories). After non-consumables grew faster than consumables during 2020, it was almost 12 consecutive quarters of sales decline YoY in non-consumables (excluding 4Q’22)!!

There are potentially important implications for such persistent decline in non-consumables. LTM non-consumable sales peaked in 1Q'21 at ~$8.2 Bn. In 2Q'24, LTM non-consumables declined by ~$1 Bn since then; in the meantime LTM SG&A increased by $2.4 Bn since then. Before the pandemic, non-consumable sales and DG's overall SG&A almost mirrored each other in 2019. During the pandemic, thanks to the stimulus money, non-consumables soared and while the initial slowdown in non-consumables was interpreted as just Covid hangover, the relentless decline quarter after quarter should make everyone wonder whether something has structurally shifted in the post-pandemic period. It is not just Temu, but even Amazon's one-day shipping promises may have structurally damaged DG's non-consumable business. While they can still hold onto their core customers through consumables business, e-commerce may be taking bites on DG's attractive profit pool of non-consumables.

Shrink

Shrink was 21 bps headwind in Q2 which was in line with DG's expectations and they expect it will turn to a tailwind as they move into Q4 and then much more substantial of a tailwind into 2025.

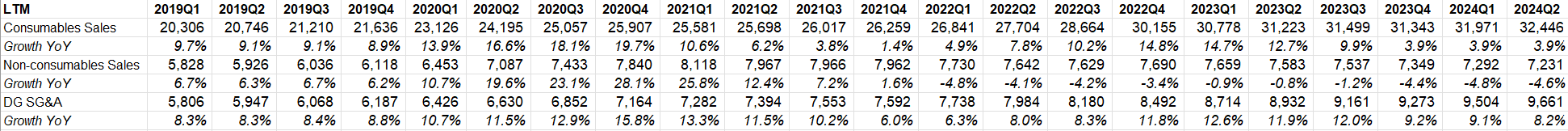

Gross Margin

Speaking of profit pool, DG's gross margin declined by 112 bps YoY, attributable to increased markdowns, increased inventory damages, a greater proportion of sales coming from the consumables category and increased shrink.

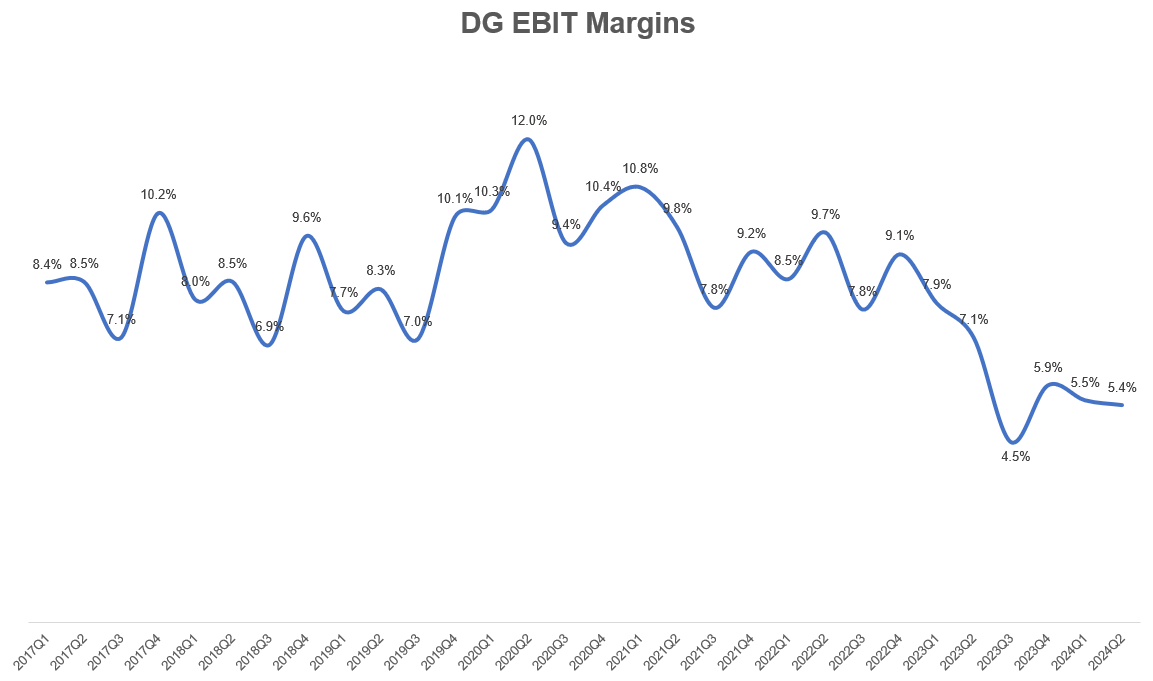

Operating margin

Again, since non-consumables is higher gross margin segment, the decline of this segment is a persistent headwind to margins. And since thanks to inflation, labor costs are increasing. As a result, DG is finding itself in a pretty tough spot.

Inventory

Inventories stood $7 Bn in 2Q’24, -7% YoY and a decline of 11% on a per store basis. Non-consumables inventory was -13% YoY and -17% on per store basis.

Outlook

In light of the tough environment DG has seen in the recent months, DG has lowered its annual EPS guide by almost 20%:

we now expect net sales growth in the range of approximately 4.7% to 5.3% and same store sales growth in the range of approximately 1% to 1.6% (MBI Note: from earlier guide of 6-6.7% sales growth and SSS of 2-2.7%)

Turning to gross margin, we expect additional pressure as a result of the increased promotional markdown activity that Todd noted as well as increased sales mix pressure due to the customers' need to prioritize their spending on the consumables category

Within SG&A, we are seeing an elevated rate of maintenance expense particularly with HVAC units and coolers in the summer months. We're taking steps in the back half of the year to be more proactive in addressing these opportunities in order to provide a more consistent customer experience across our store footprint while also supporting ongoing sales growth. As a result, we expect incremental pressure from the increased repairs and maintenance expense to continue within SG&A in the back half of the year.

Finally, we are also seeing pressure from wage rate inflation closer to approximately 4% this year, which is higher than was contemplated in our initial guidance for the year. With all of this in mind, we are updating our EPS guidance and now expect to deliver EPS in the range of approximately $5.50 to $6.20. (MBI Note: from earlier guide of $6.8-7.55, so EPS is revised down by almost 20%)

...this guidance really assumes more of a macro neutral to slight softening of that consumer. So the low end of the guidance takes that into consideration.

So on that lower end range, we're looking at a comp similar to the comp that we had in the second quarter whereas the higher end of the range would assume that there's some acceleration.

Final Words

This really has been a brutal quarter for DG and as a result, it is not a surprise that the stock is taking a beating. Given the context of relentless decline in non-consumable sales and the implications for margin, it is unfortunately difficult to add to the stock despite the stock being down ~30% today. And if the trend in non-consumables is more secular in nature than a short-term challenge, DG's operating margins from yesteryears may prove to be incredibly difficult to get back to. Therefore, I do not plan to add further capital to DG; I will, however, stay invested as I think the stock can still prove to be a potential hedge if the softness in low-end consumer ends up spreading to middle class in the coming quarters.

Further reading: My Deep Dive on DG (August, 2023)

Thank you for reading. I will cover Lululemon's earnings tonight.