Dollar General 1Q'24 Update

Disclosure: I own shares of Dollar General

“Dollar General (DG)’s stock had an interesting reaction to today’s earnings. First it went up by ~6% in pre-market, but then ended the day 5% down.”

I actually wrote that in last quarter’s update and surprisingly, this event more or less repeated this quarter as well. Stock initially went up ~8%, but currently trading ~7% down.

Here are some highlights from today’s call.

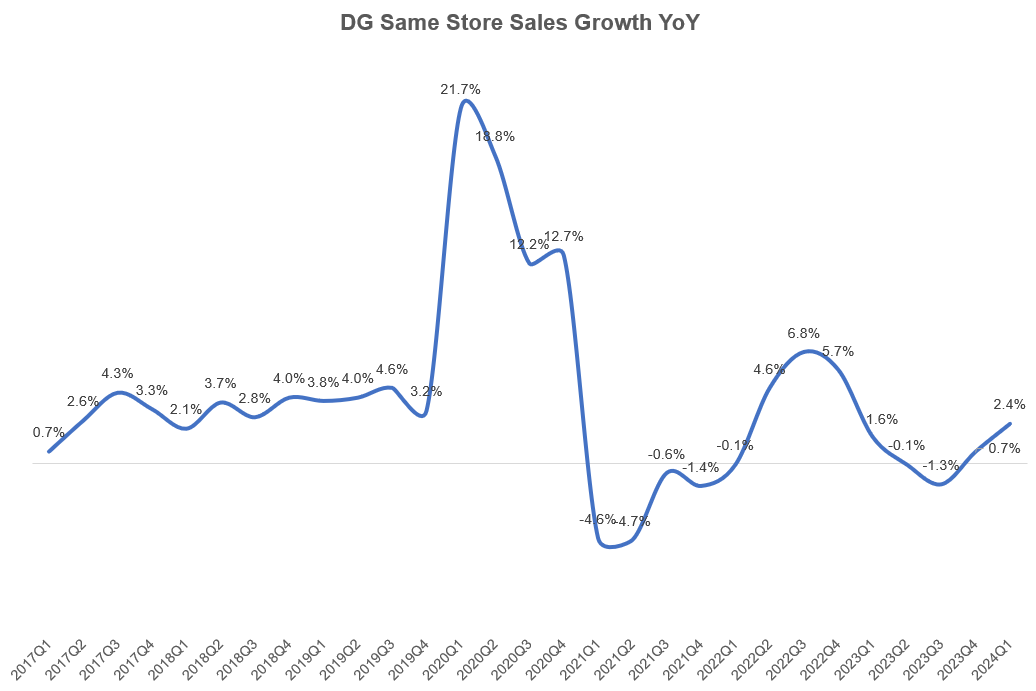

Same Store Sales (SSS)

After three consecutive quarters of tepid SSS growth, DG returned to a more healthy SSS growth of 2.4% in 1Q’24. Like 4Q’23, SSS was again driven by +4% customer traffic growth. This was offset by a decline in avg. transaction amount which was driven by fewer items per basket. DG’s traffic experienced negative growth in 2020, 2021, 2022, and in 1H’2023. Since then, traffic returned to positive trend which is an encouraging sign. Moreover, DG continues to experience trade downs:

like we saw in Q4, what we're seeing is that the next cohort and the one above that, so let's call it middle- to upper-middle income and then in some of the upper-income strata, we're seeing the trade down still come in. So we feel good that we're getting new customers in. We can see it in our data, and that we're retaining at a high level those core customers of ours in that lower income strata

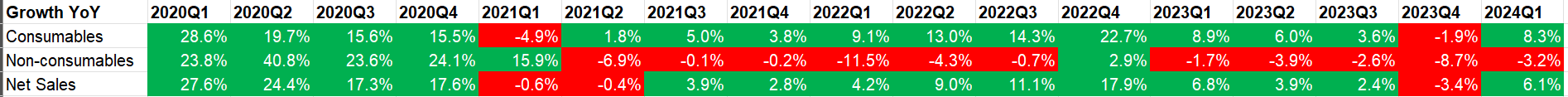

SSS increase was driven entirely by consumable category and was partially offset by declines in non-consumables (home, seasonal and apparel categories). After non-consumables grew faster than consumables during 2020, it was almost 10 consecutive quarters of sales decline YoY in non-consumables (excluding 4Q’22)!!

DG says non-consumables category is under pressure as consumers exhibit more cautious behavior in their discretionary spending. I wonder if the rise of Temu may have contributed to their struggle in selling discretionary items.

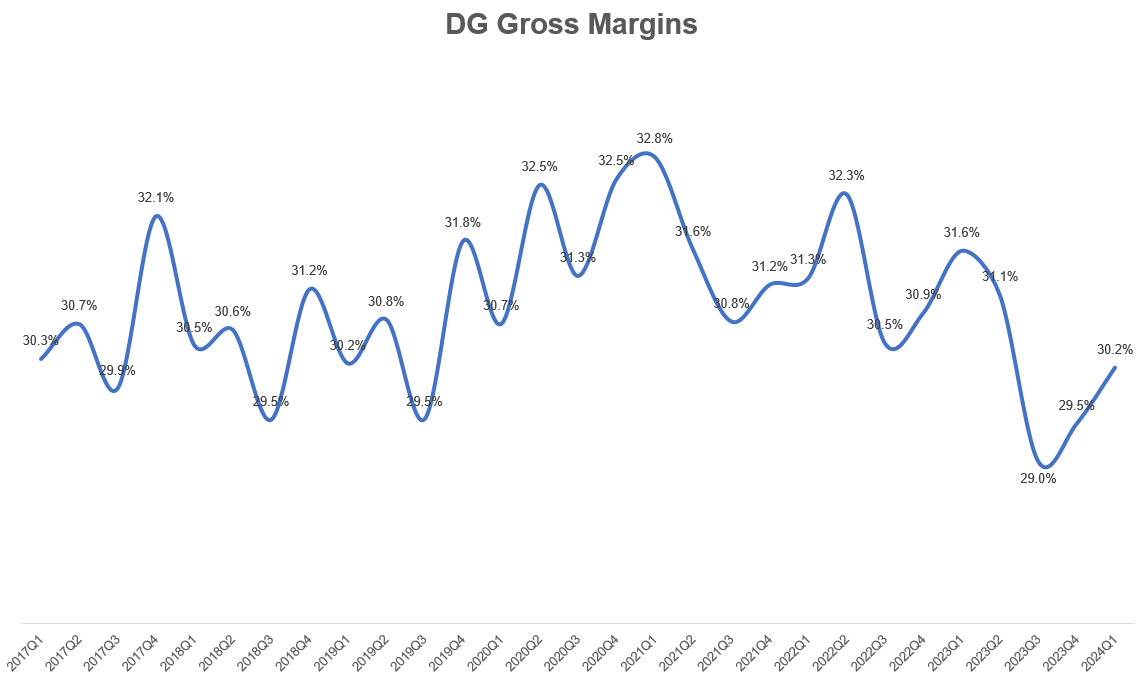

Gross Margin

Since non-consumable segment is relatively higher margin segment, the mix shift has hurt DG’s overall gross margin. Gross margin declined by 145 bps YoY. Apart from mix shift, higher than expected shrink and markdowns contributed to the gross margin pressure:

“Shrink continues to be our most significant headwind and was 59 basis points worse in the first quarter compared to prior year.

With regards to markdowns, we're seeing promotional levels more similar to 2019 levels, as we anticipated coming into the year.”

Shrink

To combat shrink, DG converted 12,000 stores (~60% of total stores) away from self-checkout so far this year. Going forward, DG plans to have self-checkout options available in a limited number of stores, most of which are higher-volume and low shrink locations.

DG management seems a bit cagey when it comes to talking about shrink. While at one point CEO said “what we're seeing on the shrink front right now is what we thought we would”, CFO clearly indicated otherwise during the call:

…shrink is currently trending worse than we initially expected coming into the year, and we now expect this headwind to be greater in 2024 than what was originally contemplated in the financial guidance we provided on our earnings call in March. We're taking aggressive and decisive action to mitigate this challenge, and we're expecting to see improvement later in the back half of 2024 than we had previously anticipated and more significantly, into 2025.

Once self-checkout options become very limited, it’s quite likely that we will see shrink to bottom sometime by this year.

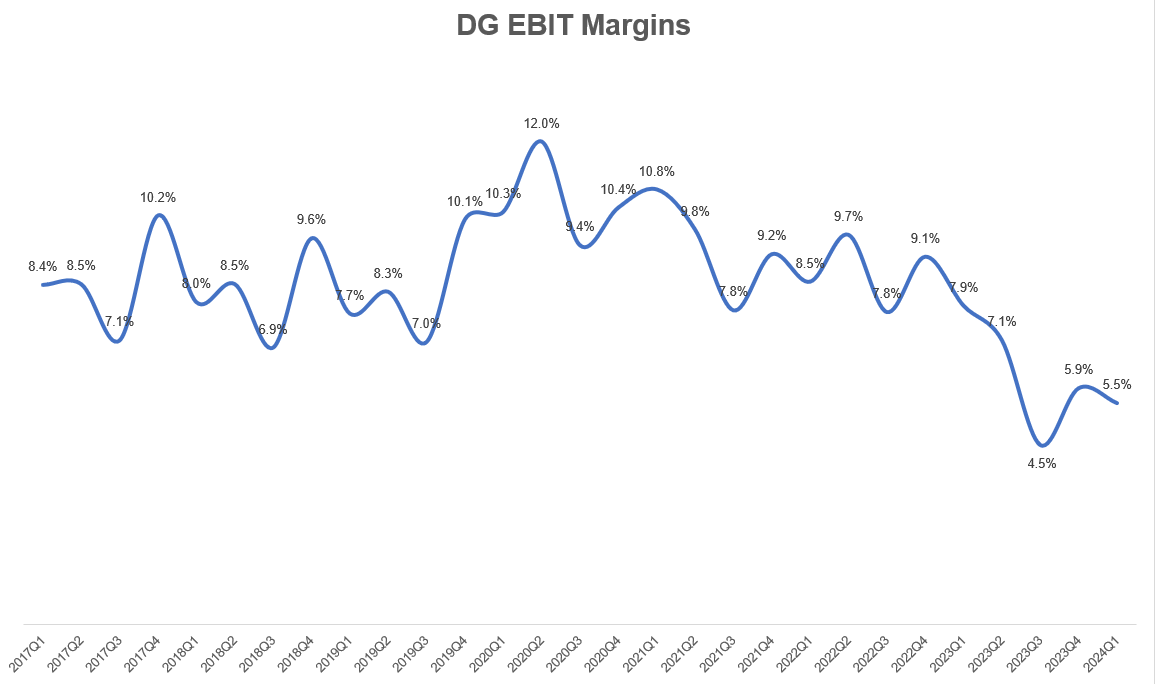

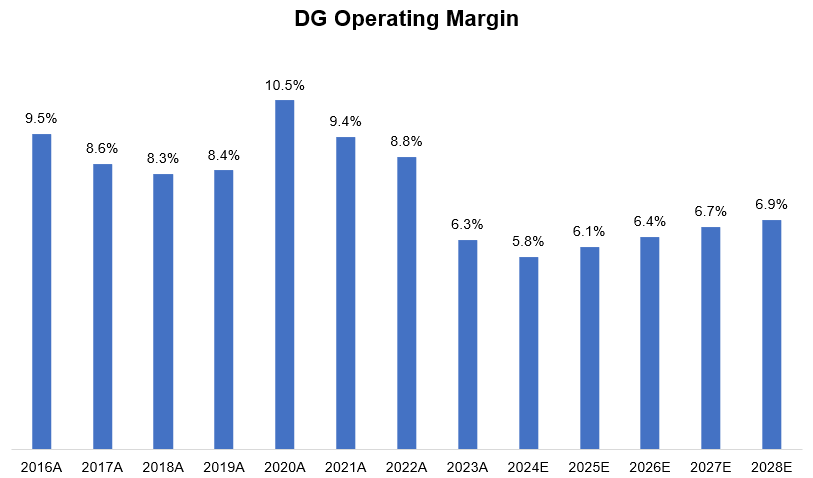

Operating margin

While DG’s operating margin bottomed in 3Q’23 and it came back to close to ~6% in 4Q’23, it has gone slightly in the wrong direction this quarter. SG&A as % of sales increased 97 bps YoY driven by retail labor, depreciation and amortization, incentive compensation, and repairs and maintenance.

Inventory

Inventories stood $6.9 Bn in 1Q’24, -5.5% YoY and a decline of 9.5% on a per store basis. Non-consumables inventory was -19.1% YoY and -22.5% on per store basis.

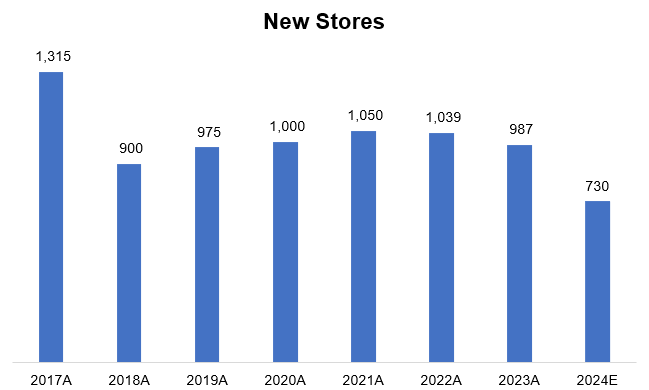

Store expansion

DG has slightly changed its store expansion cadence. While they initially guided 800 new store openings this year, they lowered the number to 730. They now expect to remodel 1,620 stores this year compared to previous expectation of 1,500 remodels.

Outlook

DG’s outlook for 2024 remains the same:

we're reiterating our financial guidance for 2024 and continue to expect net sales growth in a range of approximately 6% to 6.7%, same-store sales growth in a range of 2% to 2.7%, and EPS in a range of $6.80 to $7.55. This guidance continues to assume an estimated negative impact to EPS of approximately $0.50 due to higher incentive compensation expense and an effective tax rate in a range of approximately 22.5% to 23.5%.

Although they don’t typically guide by quarter, DG provided some more color on 2Q’24. 2Q’24 SSS guide is low 2% range and EPS guide is $1.7-1.85.

Final Words

While traffic and SSS trend remain quite encouraging, it’s disappointing to see operating margin trend in the wrong direction. Looking at consensus estimates, market clearly doesn’t expect DG to go back to its earlier ~8-9% operating margin days. As a shareholder, I disagree with market’s pessimism here, but I’m wary that the longer it takes DG to go back to its ~8% operating margin days, the more unlikely it will be for them to return and sustain such margin. As a result, I am drawing a hard line. If DG fails to post operating margin of >6.5% by 2025, I am unlikely to remain a shareholder.

Further reading: My Deep Dive on DG (August, 2023)

Thank you for reading. I will cover Lululemon's earnings next week.