Ansys: Picks and Shovels for Innovation

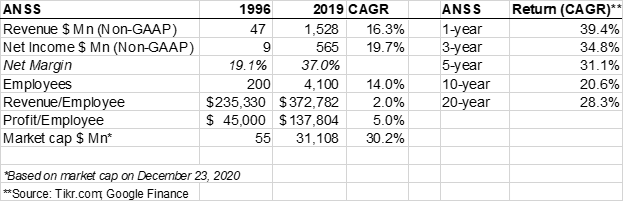

Founded in 1970, Ansys (Ticker: ANSS) came to IPO in 1996. A microcap with only $55 Mn market cap, Ansys has become one of the most successful stocks in the last 25 years. Looking at the CAGR return over different time horizon, it is clear Ansys has created enormous wealth for its shareholders.

Since its IPO in 1996, Ansys’ market cap has become a staggering ~565x of its IPO market cap. From $47 Mn topline with 200 employees, Ansys had grown to become a company with ~$1.5 Bn topline with more than 4,000 employees. At the same time, it has almost doubled its net margin from 19.1% to 37.1%.

Ansys, by any measure, has been an incredibly successful company. To set the scene, I will first explain what exactly Ansys does before exploring further what makes Ansys such a great company.

Here is the brief outline for this month’s deep dive.

Section 1 What is Ansys? I briefly describe what Ansys does and the value proposition of its products.

Section 2 Sizing the TAM: A breakdown of TAM by segment: Foundation, Emerging High-growth Solutions, and New Adjacencies is provided in this section.

Section 3 Source of competitive advantages: I identified four sources of competitive advantage for Ansys which will be discussed in detail here.

Section 4 Valuation and model assumptions: I laid out my valuation approach, and the reverse DCF model assumptions.

Section 5 Management incentives: I looked at the most recent proxy statement and mentioned annual and long-term management incentives.

Section 6 Final words: A brief discussion on my portfolio, and how Ansys fits in.