Amazon 4Q'24 Update

Disclosure: I own shares of Amazon

I know Amazon stock went down by ~4% after-hours, but I actually liked the quarter.

Here are my highlights from today’s call.

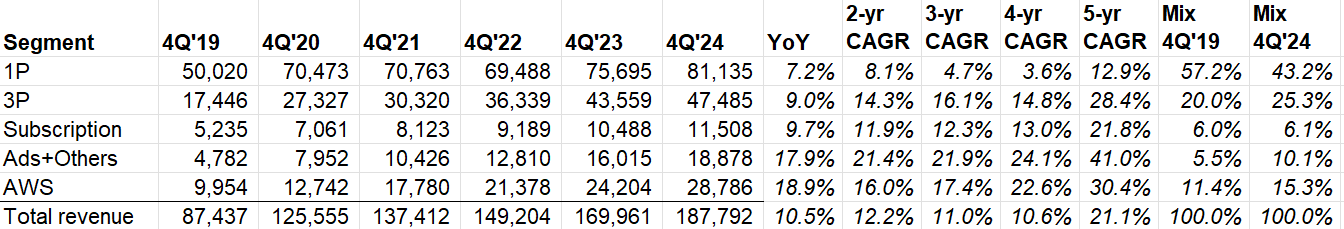

Revenue

Amazon faced ~900 Mn FX headwind in 4Q’24 which was ~700 mn higher than assumed.

For the third consecutive quarters, AWS grew 19% YoY. Ads grew by +18% YoY, and revenues in other segments increased by mostly High Single Digit (HSD) rate.

I’ll discuss more about AWS later, but let’s talk more about Amazon ex-AWS first.

Amazon ex-AWS

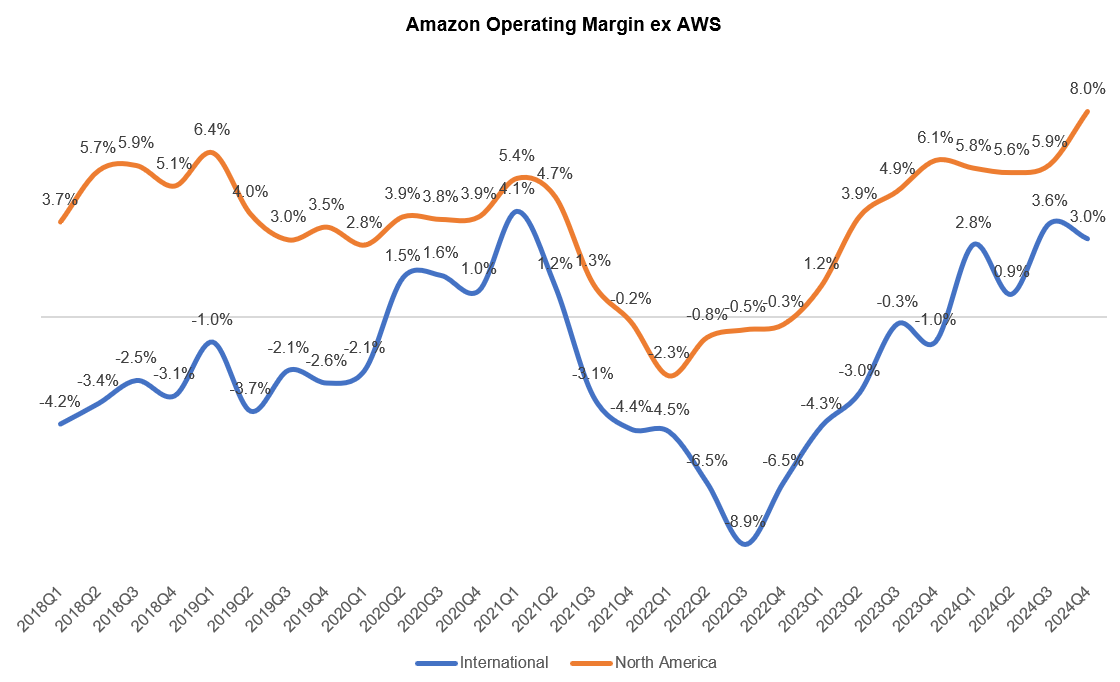

Despite North America segment being more than 2.5x the size of International segment, it grew by 10% whereas international revenue increased by 9% (both FXN).

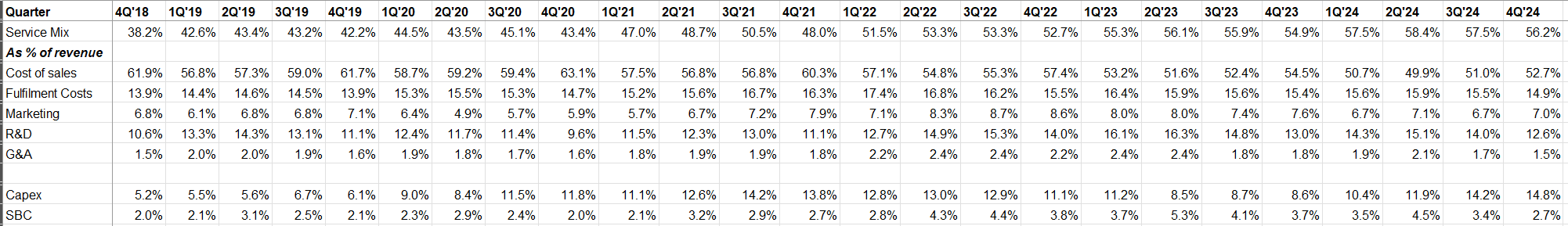

For the 8th consecutive quarters, both North America and international segment experienced YoY operating margin expansion. Amazon reported its highest operating margin in North America segment at least since 2013. Moreover, please note that they currently expense majority of their costs associated with development of the satellite network which will be capitalized when services reach commercial viability. Therefore, the “actual” retail margin is almost certainly even higher.

While most investors are usually more excited by AWS’ prospects and infatuated by their lofty margins, I may be in the minority in being more optimistic about Amazon retail’s long-term profitability. AWS has a couple of pretty capable competitors and thanks to Nvidia being the key bottleneck, the industry value chain may not evolve in a favorable way for AWS. But when I think about Amazon retail’s long-term future, the gap between Amazon and the competitors may keep growing. More on this below.

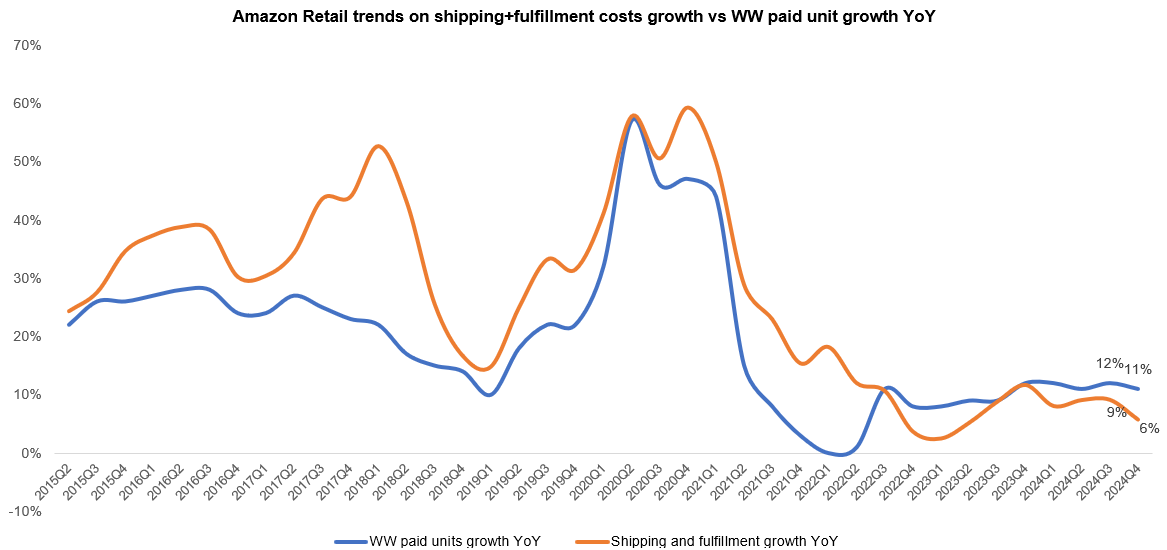

Fulfillment+ Shipping

If you look at worldwide paid unit growth vs shipping+ fulfillment cost growth, you would notice that the latter used to consistently outpace the former pretty much all the time since 2015 until 3Q'22. Since then, unit growth has largely been faster than shipping+ fulfillment costs, indicating operating leverage in their logistics footprint. The gap between the two has, in fact, widened in 4Q’24.

Amazon continues to indicate that they are far from done in optimizing their logistics footprint as well as improving speed of delivery. Some key quotes on this topic below:

2024 also marks the second year in a row where we've lowered our global cost to serve on a per unit basis.

We expanded the number of same-day delivery sites by more than 60% in 2024, which now serve more than 140 metro areas. And overall, we delivered over 9 billion units the same or next day around the world. Our relentless pursuit of better selection, price and delivery speed is driving accelerated growth in Prime membership.

…I'll also tell you that this group of, call it, a half a dozen or so new initiatives is not close to the end of what we think is possible with respect to being able to use robotics to improve the productivity cost to serve and safety in our fulfillment network. And we have kind of the next wave that we're starting to work on now. But I think this will be a many-year effort as we continue to tune different parts of our fulfillment network where we can use robotics. And we actually don't think there are that many things that we can't improve the experience with robotics.

…we have not yet seen diminishing returns and being able to continue to improve the speed of delivery…if you look at what we're doing with Prime Air, the promise there is for a number of items that we'll be able to deliver items to customers inside an hour. And I think when you're ordering everyday essentials where you need something more quickly, it's a big deal. And you see it, it's had a big impact on our everyday essentials. It's had a big impact on our pharmacy business

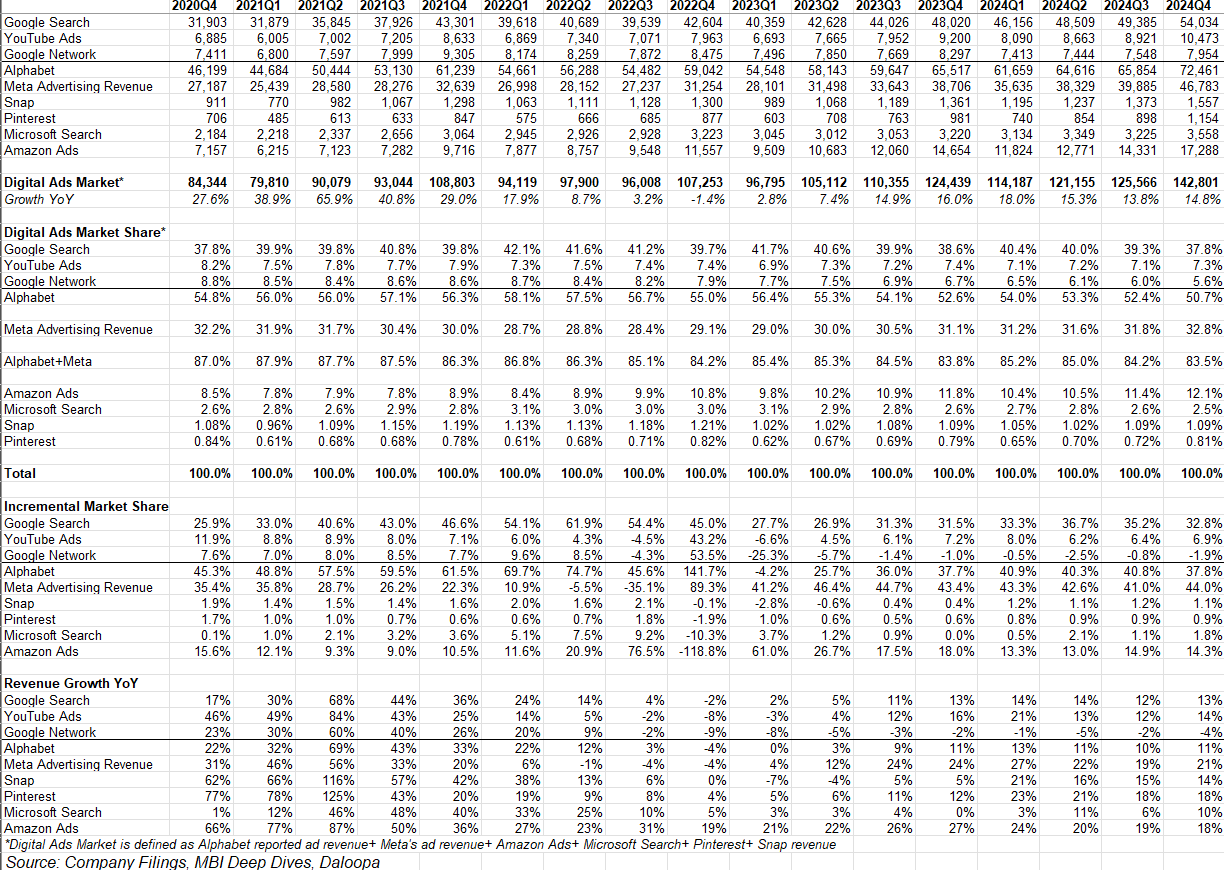

Advertising

Now that we have the earnings of major digital advertising players, I have updated my industry dashboard. Since I started tracking this in 4Q’20, Meta has its highest ever market share while Google posted its lowest ever share in 4Q’24. Amazon’s market share also kept growing both YoY and QoQ.

AWS

Okay, now let’s talk about AWS.

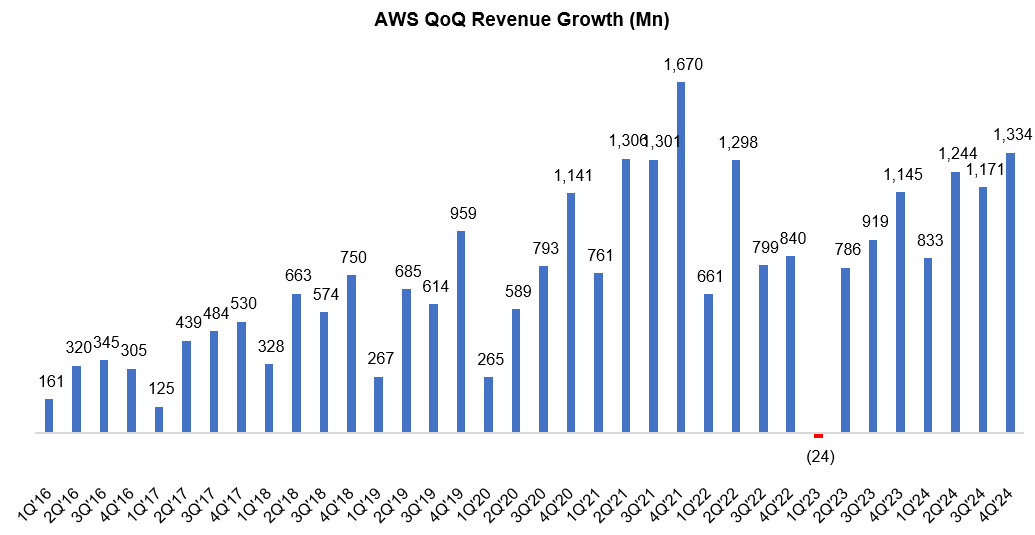

AWS added ~$1.3 Billion incremental revenue QoQ which was the second highest incremental growth QoQ ever.

Azure vs Google Cloud vs AWS

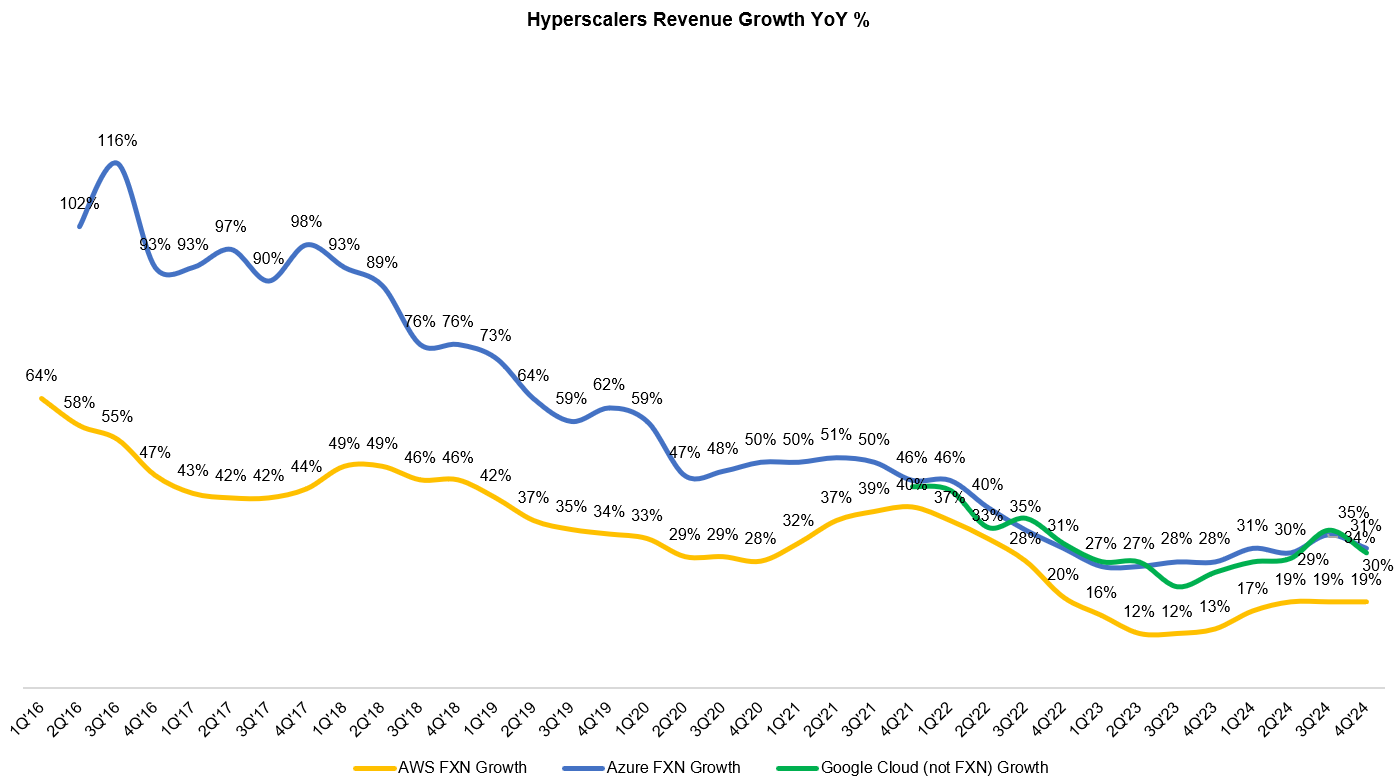

Let’s take a quick look at hyperscalers growth. Azure, Google Cloud, and AWS revenue grew by 31%, 30%, and 19% respectively.

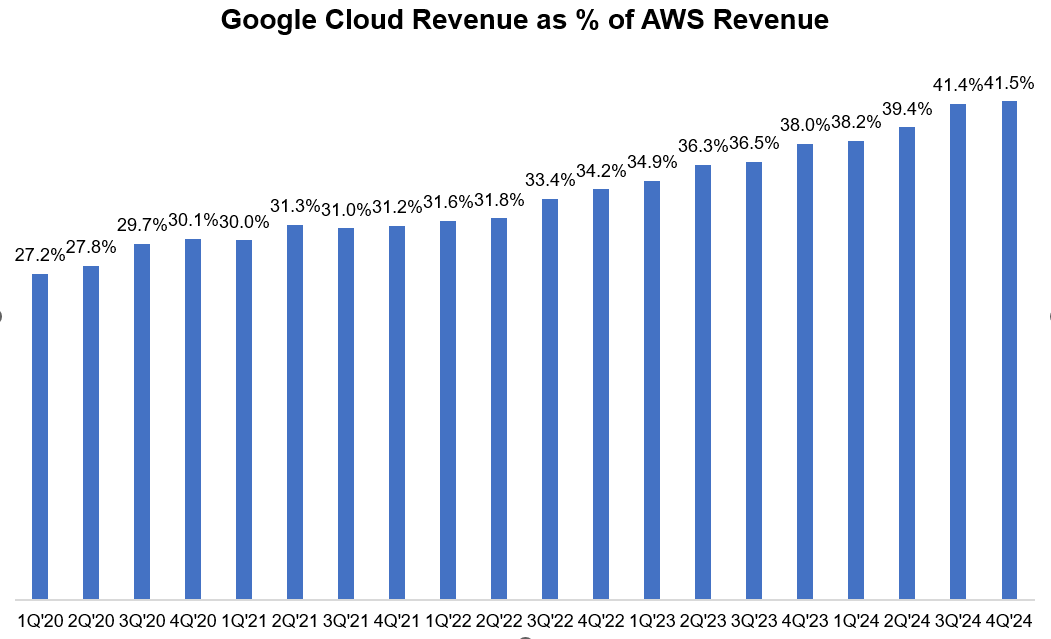

One thing I would like to track is Google Cloud’s operating performance trajectory against AWS. Back in 2020, Google Cloud was only about a quarter of the size of AWS, but now it’s two-fifth of AWS revenue. We don’t know exactly how much of this is GCP, but we can be pretty confident that GCP is leading this catch-up with AWS.

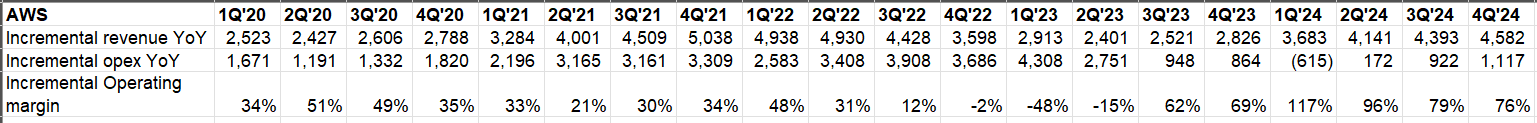

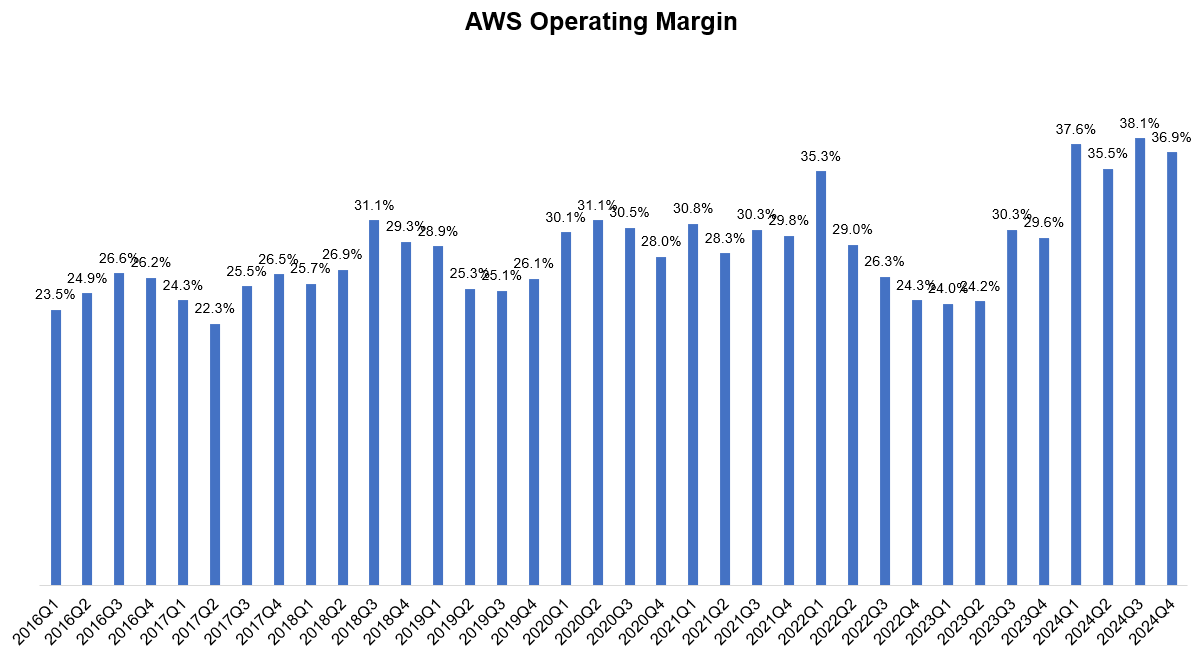

AWS had 36.9% operating in 4Q’24, with incremental operating margin being 76%! Please note that their decision to increase server useful life expanded AWS operating margin by 200 bps.

As you may know, I have been wondering about big tech’s deteriorating earnings quality, Amazon had some interesting comments related to useful life of some PP&E for 2025:

…in Q4, we completed a useful life study for our servers and network equipment and observed an increased pace of technology development, particularly in the area of artificial intelligence and machine learning. As a result, we're decreasing the useful life for a subset of our servers and networking equipment from 6 years to 5 years, beginning in January 2025. We anticipate this will decrease full year 2025 operating income by approximately $700 million.

In addition, we also early retired a subset of our servers and network equipment. We recorded a Q4 2024 expense of approximately $920 million from accelerated depreciation and related charges and expect this will also decrease full year 2025 operating income by approximately $600 million. Both of these server and network equipment useful life changes primarily impact our AWS segment.

Lastly, we also completed a useful life study for certain types of heavy equipment used in our fulfillment centers and are increasing the useful life from 10 years to 13 years beginning in January 2025. We anticipate this will increase full year 2025 operating income by approximately $900 million.

So, the net impact appears to be a decline of operating income of $400 million in 2025 which doesn’t seem to be a big deal. but given the ever increasing size of capex (more on capex later), this can gradually become more important 3-4 years down the line. It would be interesting to see how Microsoft, Google, and Meta respond the following year.

Lots of interesting comments on AWS during today’s call:

AWS is a reasonably large business by most standards, and though we expect growth will be lumpy over the next few years as enterprise adoption cycles, capacity considerations and technology advancements impact timing, it's hard to overstate how optimistic we are about what lies ahead for AWS' customers and business.

Trainium2 just launched at our AWS re:Invent Conference in December. And EC2 instances with these chips are typically 30% to 40% more price performant than other current GPU-powered instances available. That's very compelling at scale.

We're already hard at work on Trainium3, which we expect to preview late in '25 and defining Trainium4 thereafter. Building outstanding performant chips that deliver leading price performance has become a core strength of AWS', starting with our Nitro and Graviton chips in our core business and now extending to Trainium and AI and something unique to AWS relative to other competing cloud providers.

…we also just launched Amazon's own family of frontier models in Bedrock called Nova. These models compare favorably in intelligence against the leading models in the world but offer lower latency, lower price, about 75% lower than other models in Bedrock, and are integrated with key Bedrock features like fine-tuning, model distillation, knowledge bases of RAG and agentic capabilities.

Amazon mentioned they could have grown faster, if not for certain constraints:

It is hard to complain when you have a multibillion-dollar annualized revenue run rate business in AI, like we do, and it's growing triple-digit percentage year-over-year. It's hard to complain. However, it is true that we could be growing faster, if not for some of the constraints on capacity.

And they (constraints) come in the form of, I would say, chips from our third-party partners, come a little bit slower than before with a lot of midstream changes that take a little bit of time to get the hardware actually yielding the percentage healthy and high-quality servers we expect. It comes with our own big new launch of our own hardware and our own chips and Trainium2, which we just went to general availability at re:Invent, but the majority of the volume is coming in really over the next couple of quarters, the next few months. It comes in the form of power constraints where I think the world is still constrained on power from where I think we all believe we could serve customers if we were unconstrained. There are some components in the supply chain, like motherboards too, that are a little bit short in supply for various types of servers. So I think the team has done a really good job scrapping and providing capacity for our customers they can grow. We're still growing at a pretty reasonable clip, as I mentioned earlier, but I do think we could be growing faster if we were unconstrained. I predict those constraints really start to relax in the second half of '25.

Like Microsoft, Amazon seems to be betting that frontier models may be commodity and hence, they want to offer broadest selection of models to their customers:

I think if you run a business like AWS and you have a core belief like we do, that virtually all the big generative AI apps are going to use multiple model types, and different customers are going to use different models for different types of workloads.

You're going to provide as many leading frontier models as possible for customers to choose from. That's what we've done with services like Amazon Bedrock. And it's why we moved so quickly to make sure that DeepSeek was available both in Bedrock and in SageMaker faster than you saw from others. And we already have customers starting to experiment with that.

Amazon also made the case for “Jevon’s paradox”:

I think what's -- one of the interesting things over the last couple of weeks is sometimes people make the assumptions that if you're able to decrease the cost of any type of technology component, in this case, we're really talking about inference, that somehow it's going to lead to less total spend in technology. And we just -- we have never seen that to be the case. We did the same thing in the cloud where we launched AWS in 2006, where we offered S3 object storage for $0.15 a gigabyte and compute for $0.10 an hour, which, of course, is much lower now many years later. People thought that people would spend a lot less money on infrastructure technology. And what happens is companies will spend a lot less per unit of infrastructure, and that is very, very useful for their businesses. But then they get excited about what else they could build that they always thought was cost prohibitive before, and they usually end up spending a lot more in total on technology once you make the per unit cost less.

And I think that is very much what's going to happen here in AI, which is the cost of inference will substantially come down. What you heard in the last couple of weeks that DeepSeek is a piece of it. But everybody is working on this. I believe the cost of inference will meaningfully come down. I think it will make it much easier for companies to be able to infuse other applications with inference and with generative AI.

And I think it's going to -- if you run a business like we do, where we want to make it as easy as possible for customers to be successful building customer experiences on top of our various infrastructure services, the cost of inference coming down is going to be very positive for customers and for our business.

…at the stage we're in right now, AI is still early stage. It does come originally with lower margins and a heavy investment load as we've talked about. And in the short term, over time, that should have -- be a headwind on margins. But over the long term, we feel the margins will be comparable in non-AI business as well.

While Amazon’s explanation may be compelling, here’s a counter perspective from @akramsrazor (slightly edited for clarity):

“Reminder that in 1999 server revenue was $58.5 billion on just under 4 million units. The dollar number was not passed till 2017 despite units 3x.Not that these numbers even matter as much when you consider the $ number on anything is a moving target, but it shows how deflationary certain breakthroughs were in computing. Also when everyone talks about capex related infra stocks, the assumption seems to be that arms race of training foundation models goes on for forever for every giant. That's obviously a bad assumption. And who knows where inference ASICs/GPU ASPs ends up with multiple players battling it out for this compute.”

Opex+Capex

Amazon spent $26.3 Billion in capex in 4Q’24 and indicated 2025 capex will likely be annualized figure of that number i.e. $105 Billion. Where they going to spend all these capex?

Similar to 2024, the majority of the spend will be to support the growing need for technology infrastructure. This primarily relates to AWS, including to support demand for our AI services as well as tech infrastructure to support our North America and international segments.

AWS hinted that the higher capex is basically harbinger of revenue growth in coming years:

The vast majority of that CapEx spend is on AI for AWS. It's the way that AWS business works and the way the cash cycle works is that the faster we grow, the more CapEx we end up spending because we have to procure data center and hardware and chips and networking gear ahead of when we're able to monetize it.

We don't procure it unless we see significant signals of demand. And so when AWS is expanding its CapEx, particularly in what we think is one of these once-in-a-lifetime type of business opportunities like AI represents, I think it's actually quite a good sign, medium to long term, for the AWS business. And I actually think that spending this capital to pursue this opportunity, which from our perspective, we think virtually every application that we know of today is going to be reinvented with AI inside of it and with inference being a core building block, just like compute and storage and database.

If you believe that plus altogether new experiences that we've only dreamed about are going to actually be available to us with AI, AI represents, for sure, the biggest opportunity since cloud and probably the biggest technology shift and opportunity in business since the Internet. And so I think that both our business, our customers and shareholders will be happy medium to long term that we're pursuing the capital opportunity and the business opportunity in AI.

Amazon also indicated they’re going to increasingly focus on logistics and fulfillment in rural areas which is not quite music to your ears if you’re Dollar Store shareholders:

We also have CapEx that we're spending this year in our Stores business, really with an aim towards trying to continue to improve the delivery speed and our cost to serve. And so you'll see us expanding the number of same-day facilities from where we are right now. You'll also see us expand the number of delivery stations that we have in rural areas. We can get items to people who live in rural areas much more quickly, and then a pretty significant investment as well on robotics and automation so we can take our cost to serve down and continue to improve our productivity.

Outlook

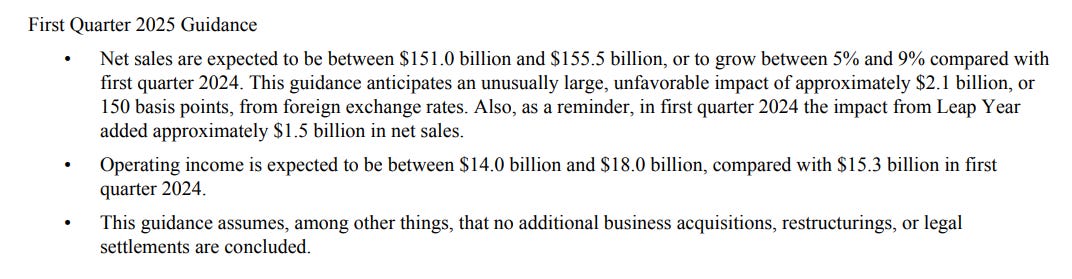

Amazon’s guidance for 1Q’25 is below. Please note consensus 1Q’25 revenue and EBIT before the call were $158.3 Billion and $18.2 Billion respectively.

Closing Words

This was another strong quarter by Amazon. There’s hardly anything to complain about as an Amazon shareholder. Since we will have more disclosure in the 10-K to work with, I will publish my annual update on Amazon a couple of weeks from now. I will share more thoughts on the valuation then.

Please feel free to share with your friends and network. Thank you for reading.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.