Amazon 3Q'24 Update

Disclosure: I own Jan 2025 $55 call options of Amazon

Like clockwork, Amazon has posted another impressive quarter. Every part of the business seems to be trending well, and moving in the right direction.

Here are my highlights from today’s call.

Revenue

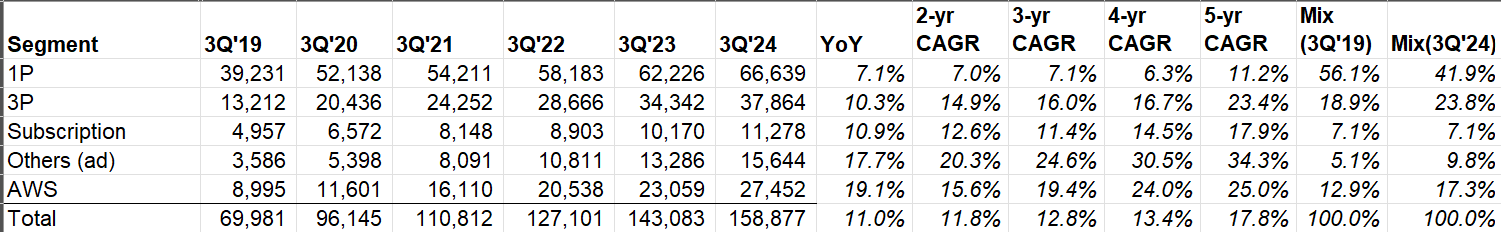

Except 1P, every segment of the business is growing at double digit rate. Both AWS and advertising grew at 19% YoY.

I’ll discuss more about AWS later, but let’s talk more about Amazon ex-AWS first.

Amazon ex-AWS

North America and international sales grew +9% and +12% respectively.

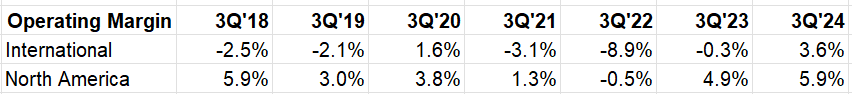

Both North America and international segment posted their seventh consecutive YoY operating margin improvement. Amazon’s operating margin improvement is well telegraphed and understood by investors, but still nice to see them execute so well here.

Lower cost to serve, greater contribution from advertising, improved selection, faster delivery speeds driving consumer demand are some of the things mentioned by management for retail business’ continued improvement.

Some key quotes on retail business below:

Prime remains a core contributor to this growth. Year-over-year paid membership growth accelerated in Q3 from both the U.S. and globally.

When you look at the split between revenue growth and unit growth, you do see some impact of the lower ASP products that we're selling as well as some of the trade down that consumers are doing. But we take that as a real positive, seeing the growth in everyday essential categories, which are really predicated on speed.

So you have to have fast delivery to be able to sell the those products to customers. And when you do, it results in a stickier consumer relationship, higher orders, building larger baskets, which help our ship economics, and repeat orders are stronger. So those are all positive signs, and we'll take any short-term degradation in ASP because what we're focused on primarily is free cash flow here.

…it's easy to lower prices but it's much harder to be able to afford to lower prices. And the same thing is probably true about lower ASP items. It's pretty easy to choose to supply them but it's much harder to be able to afford to economically supply them. And so one of the reasons that we have been so maniacal about cost to serve over the last few years is that as we're able to take our cost to serve down, it just opens up the aperture for more items, particularly lower ASP items that we're able to supply in an economic way.

Given how focused Amazon seems to be in serving lower ASP items, you gotta wonder about the long-term questions that may pose for Dollar stores, especially in urban/semi-urban areas.

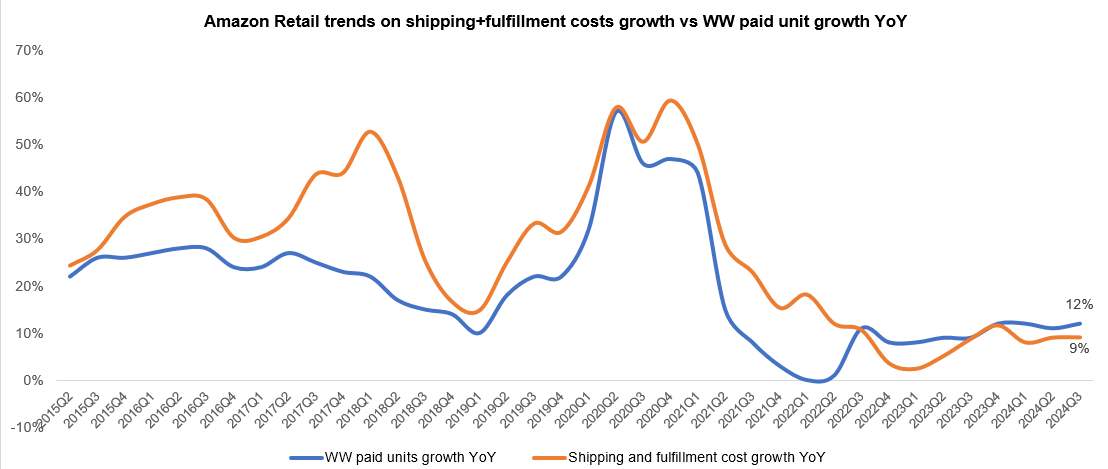

Fulfillment+ Shipping

If you look at worldwide paid unit growth vs shipping+ fulfillment cost growth, you would notice that the latter used to consistently outpace the former pretty much all the time since 2015 until 3Q'22. Since then, unit growth is faster (was at par in 3Q’23) than shipping+ fulfillment costs, indicating operating leverage in their logistics footprint. That theme continued in 3Q’24 which makes me confident that Amazon retail remains very much on track.

The good news is there is likely more upside left here. Their regionalization efforts in logistics is continuing to reap benefits for the company that will likely keep improve customer experience and margins even more over time:

First, we continue to believe there are more gains on top of what we've captured thus far in outbound regionalization and getting more items closer to end consumers. As such, we're in the process of significantly changing the way we inbound items into our fulfillment network and subsequently spread them to our regional fulfillment nodes.

In the last few months, we've made hundreds of changes to our U.S. inbound network and opened more than 15 inbound buildings. While still relatively early in this re-architecture, we've already improved our ability to spread inventory across our fulfillment centers by 25% YoY, allowing us to have more of the requisite items in fulfillment centers closest to the customer so we can compile shipments and ship to customers even more quickly. As we scale and optimize this new design, we expect these changes will further improve inventory placement, offer faster delivery time, save transportation costs, and enable us to increase units shipped per box.

Second, we continue to roll out same-day delivery facilities, which is not only the fastest way to get products to customers but also one of our lowest cost ways to deliver. Over 40 million customers this past quarter have had their orders delivered for free with same-day delivery, an increase of more than 25% year-over-year. And third, we continue to innovate in robotics to speed delivery, lower cost to serve, and further improve safety in our fulfillment network.

We recently launched our 12th-generation fulfillment center design with the first building launching in Shreveport, Louisiana. This is the first facility that incorporates our newest robotics inventions to simplify stowing, picking, packing, and shipping processes. Thus far, this new design reduces fulfillment processing time by up to 25%, increases the number of items we can offer for same-day or next-day delivery and is expected to drive a 25% improvement in our cost to serve during peak within this next generation facility. Though we believe we have more expansive automation and robotics than other retail peers, it's still early days in how much automation we expect in our fulfillment network.

we really do believe that AI is going to be a big piece of what we do in our robotics network. We had a number of efforts going on there. We just hired a number of people from an incredibly strong robotics AI organization. And I think that will be a very central part of what we do moving forward, too

Advertising

…Sponsored Products, we're seeing meaningful growth on a very large base, and we see further opportunity in driving even better performance for advertisers by further improving the relevancy of the ads we show and by providing additional optimization controls. At the same time, some of our newer offerings are in their very early days. We're just entering our first broadcast season for Prime Video advertising, following a very strong showing at upfronts. And we're continuing to support brands of all sizes with our generative AI-powered creative tools across display, video and audio, including our video generator that uses a single product image to curate custom AI-generated videos. While we're generating a lot of advertising revenue today, there remains considerable upside.

AWS

Okay, now let’s talk about AWS.

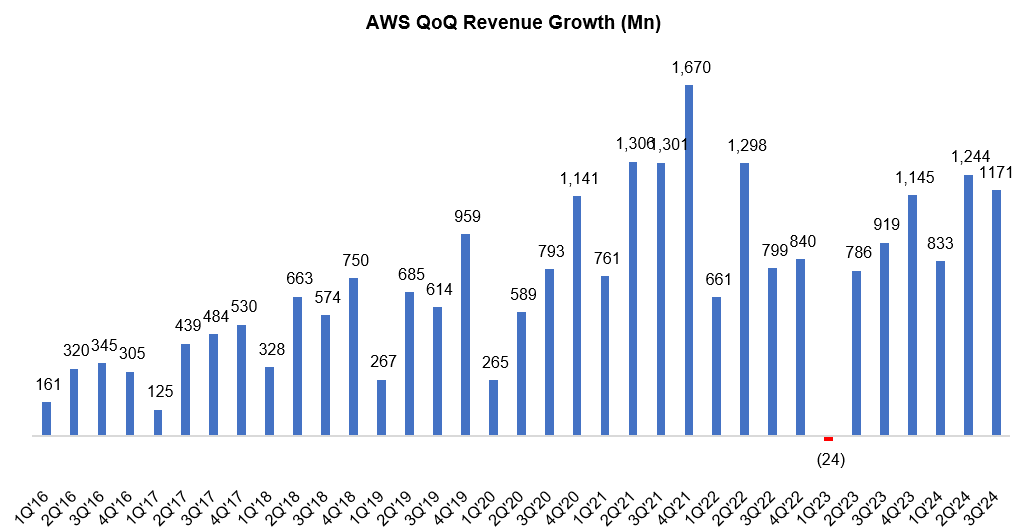

AWS added ~$1.2 Bn incremental revenue QoQ.

Azure vs Google Cloud vs AWS

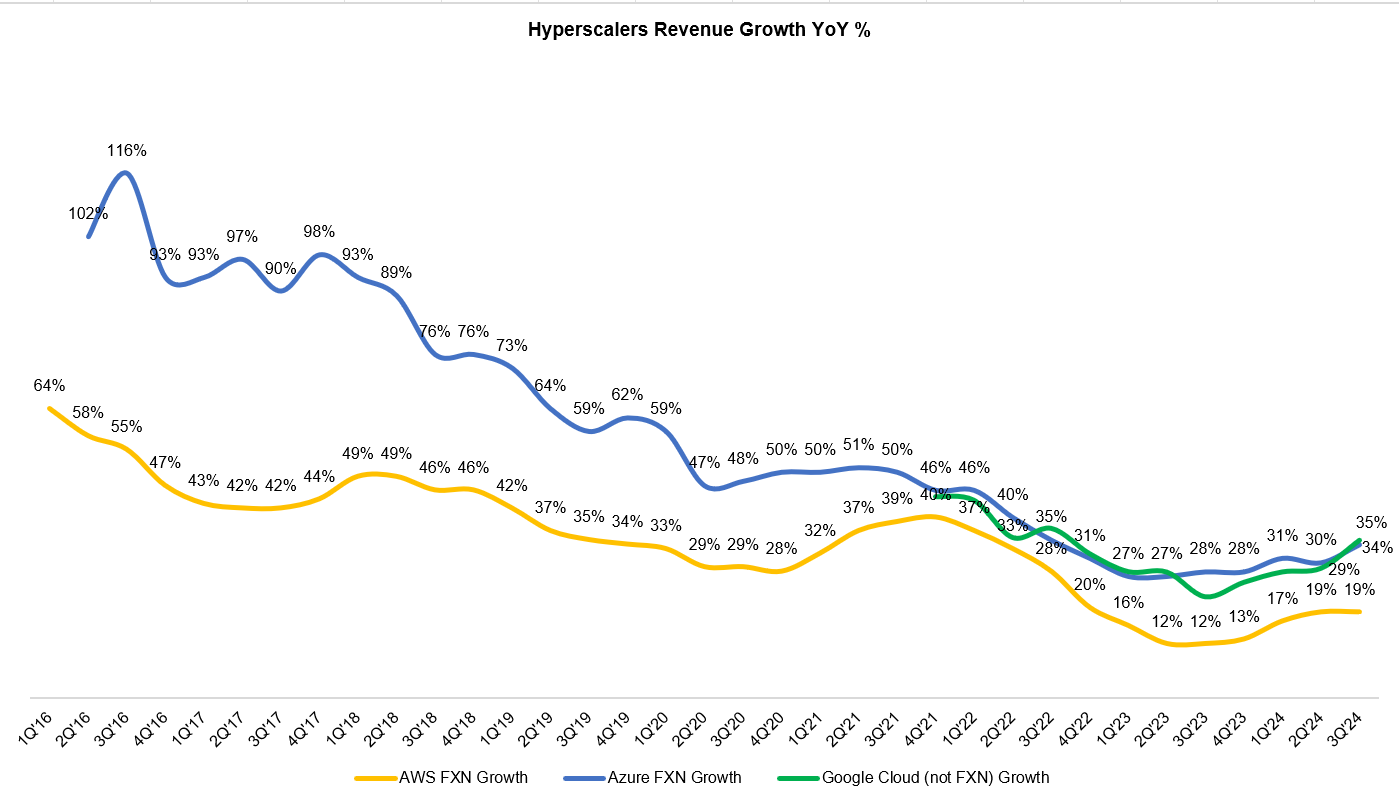

Let’s take a quick look at hyperscalers growth. While both Azure and Google Cloud accelerated in 3Q, AWS growth remained steady at 19%, same as 2Q’24. Do keep in mind AWS’ large base though now that it has annualized run-rate of $110 Billion revenue.

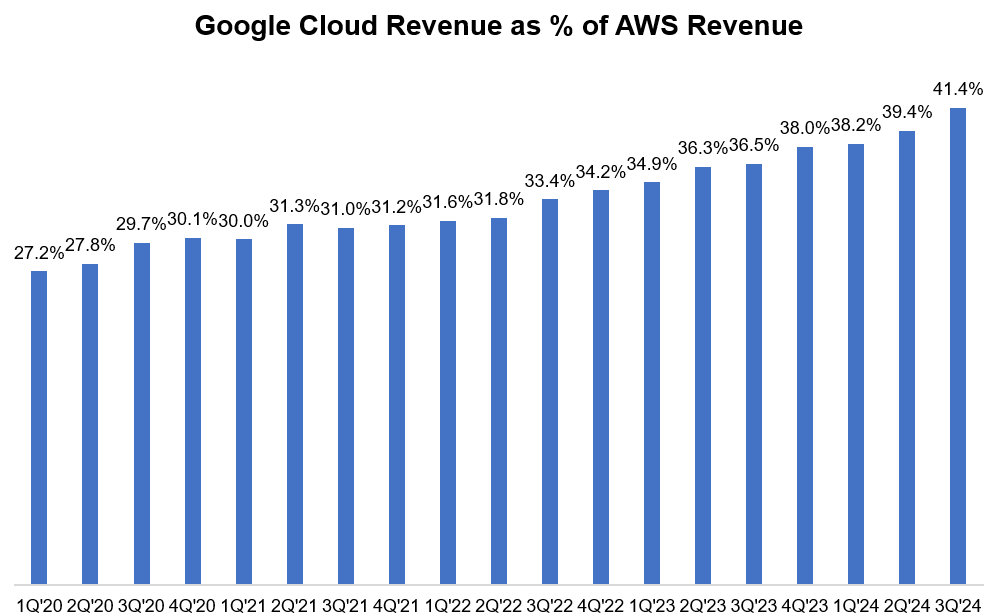

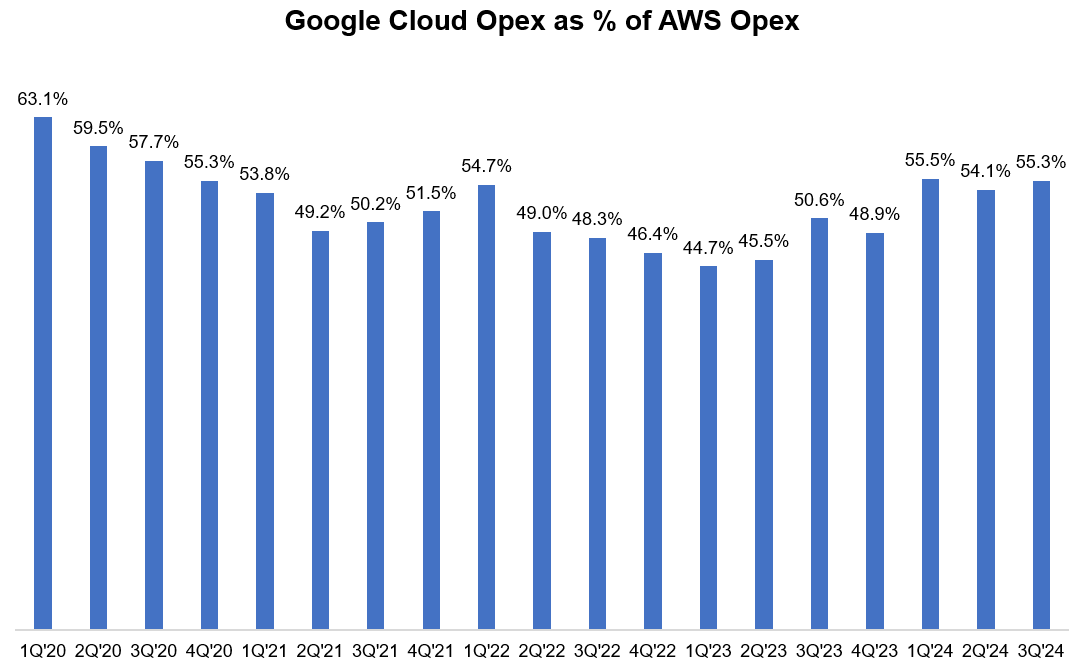

One thing I would like to track is Google Cloud’s operating performance trajectory against AWS. Back in 2020, Google Cloud was only about a quarter of the size of AWS, but now it’s almost two-fifth of AWS revenue. We don’t know exactly how much of this is GCP, but we can be pretty confident that GCP is leading this catch-up with AWS.

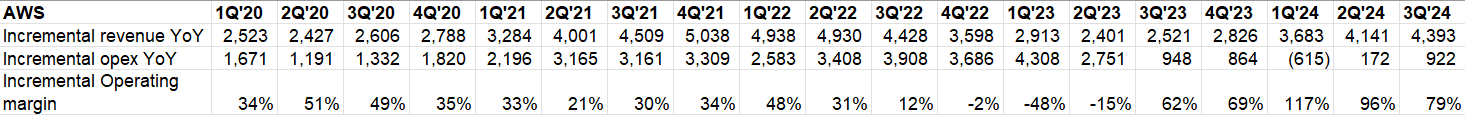

Like Google and Meta, AWS also kept posting almost “obscene” incremental operating margins of ~80% in 3Q’24. AWS, in fact, posted its highest ever operating margin of 38.1% in 3Q’24. What’s driving these incredible operating margins?

…continued focus on cost control, including a measured pace of hiring, a focus on driving efficiencies in our infrastructure, and reducing costs across the business. Additionally, we increased the estimated useful life of our servers starting in 2024, which contributed approximately 200 basis points to the AWS margin increase year-over-year in Q3. As we said in the past, we expect the AWS operating margins to fluctuate, driven in part by the level of investments we're making at any point in time.

I know investors don’t love these margin expansion from extending useful lives of servers, but it’s extremely unlikely that they’re making these numbers up without supporting evidence for doing so. So, I don’t quite frown on this practice.

The following quote from Andy Jassy on AWS was quite insightful:

I think one of the least understood parts about AWS, over time, is that it is a massive logistics challenge. If you think about, we have 35 or so regions around the world, which is an area of the world where we have multiple data centers, and then probably about 130 availability zone through data centers, and then we have thousands of SKUs we have to land in all those facilities.

And if you land too little of them, you end up with shortages, which end up in outages for customers. So most don't end up with too little, they end up with too much. And if you end up with too much, the economics are woefully inefficient. And I think you can see from our economics that we've done a pretty good job over time at managing those types of logistics and capacity. And it's meant that we've had to develop very sophisticated models in anticipating how much capacity we need, where, in which SKUs and units.

And so I think that the AI space is, for sure, earlier stage, more fluid and dynamic than our non-AI part of AWS. But it's also true that people aren't showing up for 30,000 chips in a day. They're planning in advance. So we have very significant demand signals giving us an idea about how much we need. And I think that one of the differences if you were able to get inside of the economics of the different types of providers here is how well they manage that utilization and that capacity. It has a very direct impact on what kind of margins you have over time and what kind of capital efficiency you also have over time.

And so I think you're right…that there are some similarities in the early days here of AI, where the offerings are new and people are very excited about it. It's moving very quickly and the margins are lower than what I think they will be over time. The same was true with AWS. If you looked at our margins around the time you were citing, in 2010, they were pretty different than they are now. I think as the market matures over time, there are going to be very healthy margins here in the generative AI space.

Opex+Capex

Just like other big tech, Amazon's capital intensity has also gone up materially with their increased scale. In 1H’24, they spent $30.5 Bn in capex, ~$22 Billion in Q3, and guided another ~$23 Billion for Q4. Back in 2018-19, capex as % of sales used to be ~5-6%. Capital intensity has almost tripled as it reached 14.2% of sales in 3Q’24.

What are they spending these capex on?

The majority of the spend is to support the growing need for technology infrastructure. This primarily relates to AWS as we invest to support demand for our AI services while also including technology infrastructure to support our North America and international segments.

Additionally, we're continuing to invest in our fulfillment and transportation network to support the growth of the business, improve delivery speeds and lower our cost to serve. This includes investments in same-day delivery facilities, in our inbound network and as well in robotics and automation.

Management emphasized that this may be “once-in-a-lifetime” opportunity, so they would rather be aggressive in their investments:

so the thing to remember about the AWS business is the cash life cycle is such that the faster we grow demand, the faster we have to invest capital in data centers and networking gear and hardware. And of course, in the hardware of AI, the accelerators or the chips are more expensive than the CPU hardware. And so we invest in all of that upfront in advance of when we can monetize it with customers using the resources.

But of course, a lot of these assets are many-year useful life assets. Data centers, for instance, are useful assets for 20 to 30 years. And so I think we've proven over time that we can drive enough operating income and free cash flow to make this very successful return on invested capital business. And we expect the same thing will happen here with generative AI. It is a really unusually large, maybe once-in-a-lifetime type of opportunity. And I think our customers, the business, and our shareholders will feel good about this long term that we're aggressively pursuing it.

For opex, Amazon has started to find its efficiency religion. They mentioned office staff is down slightly YoY (and flat from 2023 end).

Other Bets

Nothing on Kuiper in this call, but Amazon continues to show optimism around Alexa although I’m not sure such optimism around Alexa is shared by many:

We've about 0.5 billion devices out there with a couple of hundred million active endpoints. And when we first were pursuing Alexa, we had this vision of it being the world's best personal assistant and people thought that was kind of a crazy idea.

And I think if you look at what's happened in generative AI over the last couple of years, I think you're kind of missing the boat if you don't believe that's going to happen. It absolutely is going to happen. So we have a really broad footprint where we believe if we rearchitect the brains of Alexa with next-generation foundational models, which we're in the process of doing, we have an opportunity to be the leader in that space.

Outlook

Amazon’s guidance for 4Q’24 is below. Please note consensus 4Q’24 revenue and EBIT before the call were $186.3 Billion and $17.3 Billion respectively.

Closing Words

Amazon seems to be in a pretty strong place in both of its core business: retail and cloud. Both of them are staggeringly large markets with sizable profit pool across the value chain and Amazon remains in a prime position to capture attractive economics. I intend to remain invested at current price.

For more in-depth valuation discussion of Amazon, see my analysis here (February, 2024).

Please feel free to share with your friends and network. Thank you for reading.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.