Amazon 2Q'23 Earnings Update

Disclosure: I own shares, and Jan 2025 $55 call options of Amazon

This was perhaps the best Amazon earnings call from my recent memory, especially on Amazon Retail. Not surprising that the stock was +8% in after hours.

Here are my highlights from tonight’s call.

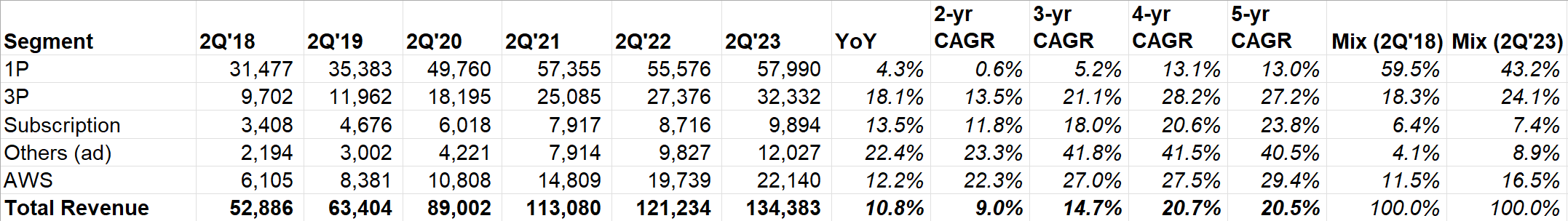

Revenue

3P, subscription, and AWS grew by mid to high teen while ad segment increased by 20%+

The mix-shift from product to services in Amazon continues as services mix increased from ~40% in 2018 to ~60% in 2023.

Let’s start more segment level discussion with AWS.

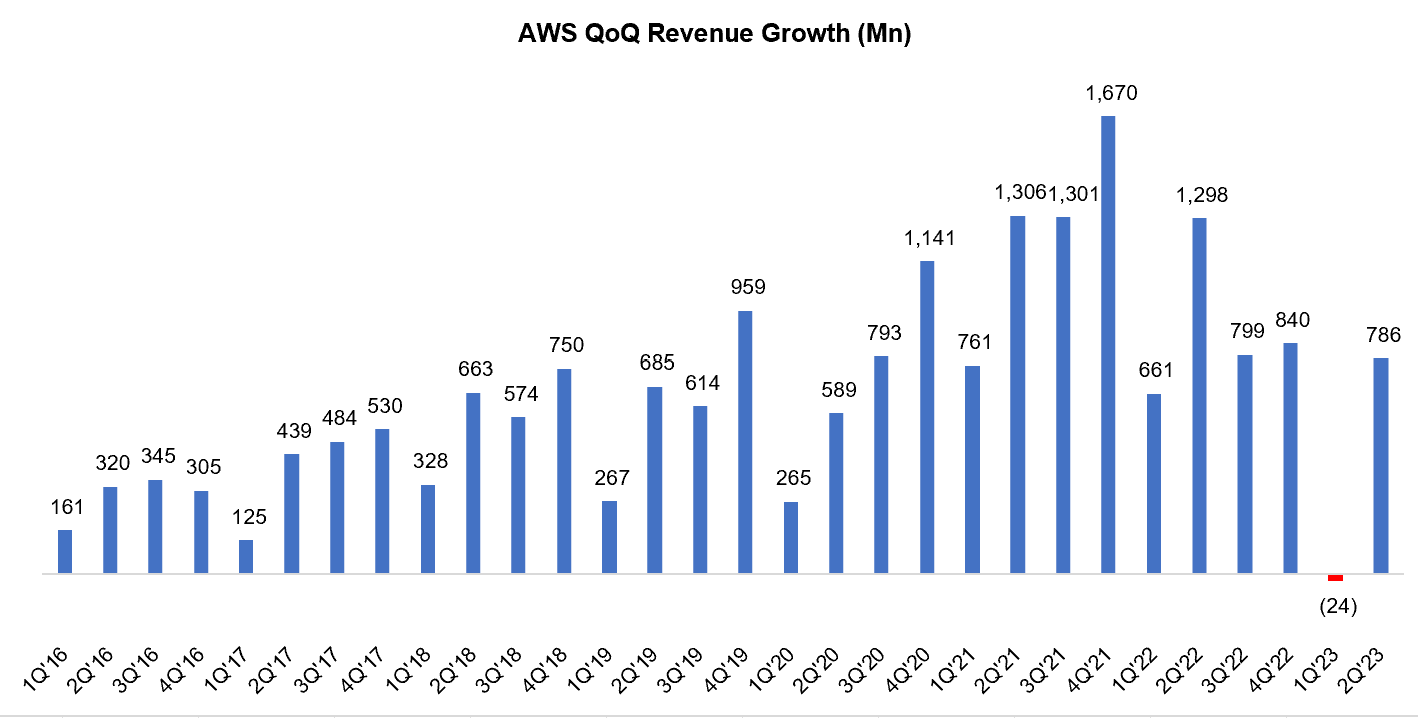

AWS

After experiencing its first QoQ revenue decline in 1Q’23, AWS added $786 Mn revenue QoQ in 2Q’23. The 12% YoY growth reflects the tough comp of 2Q’22; since cost optimization mostly started in the latter half of last year, 3Q’23 and 4Q’23 may prove to be easier comp for AWS. More on this later.

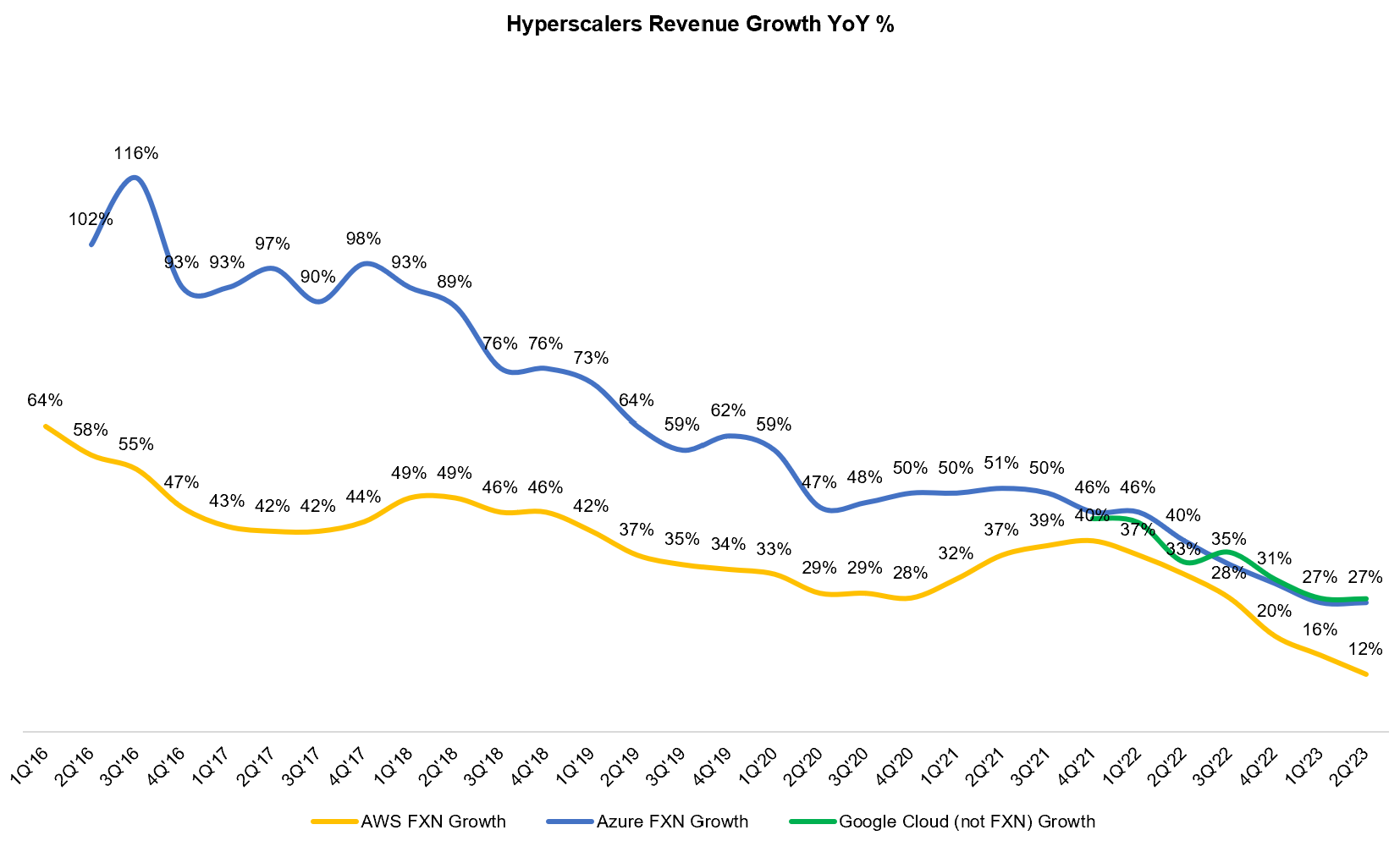

Azure vs Google Cloud vs AWS

Now that we have all the hyperscalers earnings report this quarter, here’s how their growth stacks against each other. As Jassy reminded during the call, don’t ignore the base effect while thinking about % growth: “…AWS has almost doubled the revenue of any other provider.”

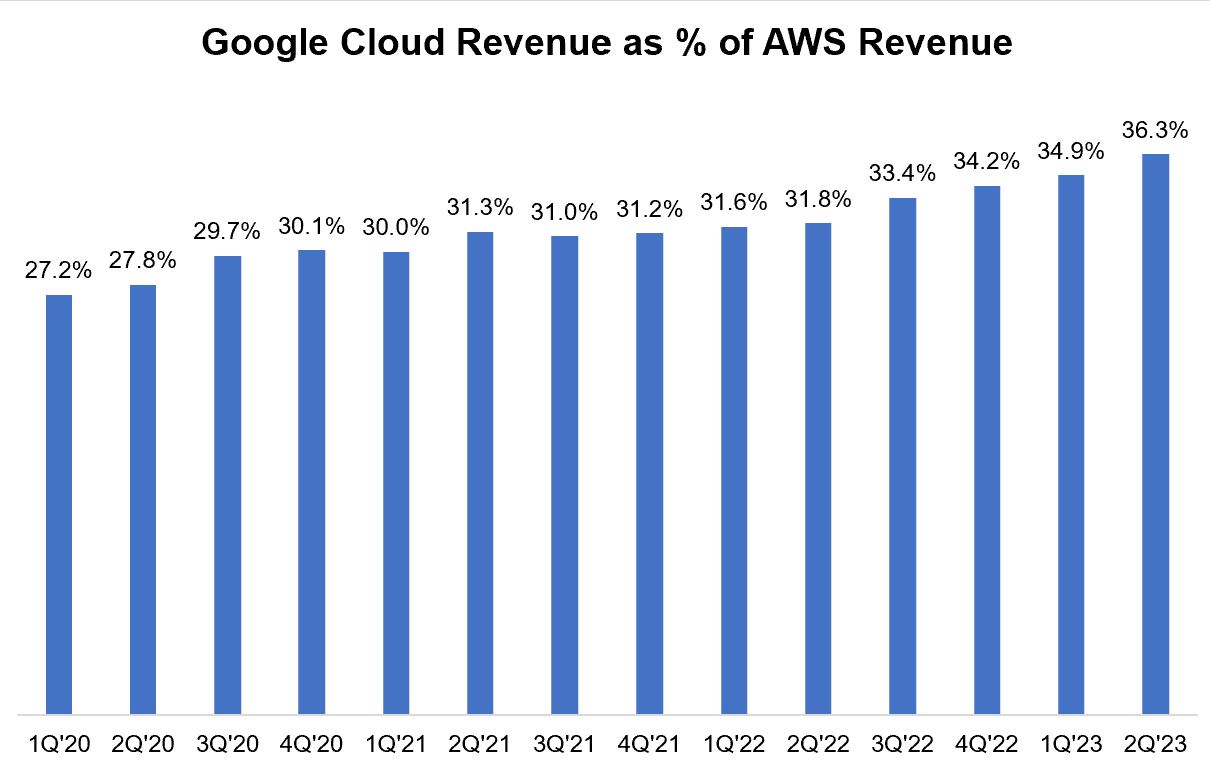

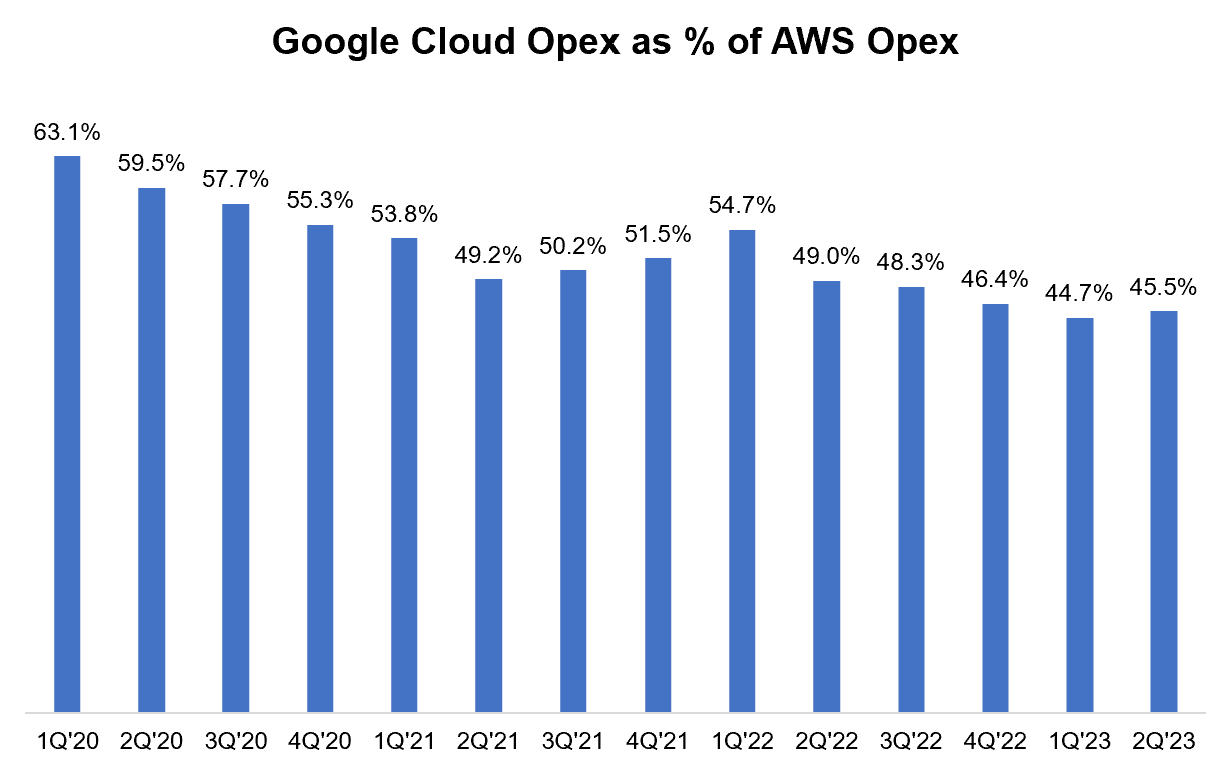

One thing I would like to track is Google Cloud’s operating performance trajectory against AWS. While Google Cloud’s revenue continues to build its gradual momentum against AWS, opex trajectory went slightly in the wrong direction.

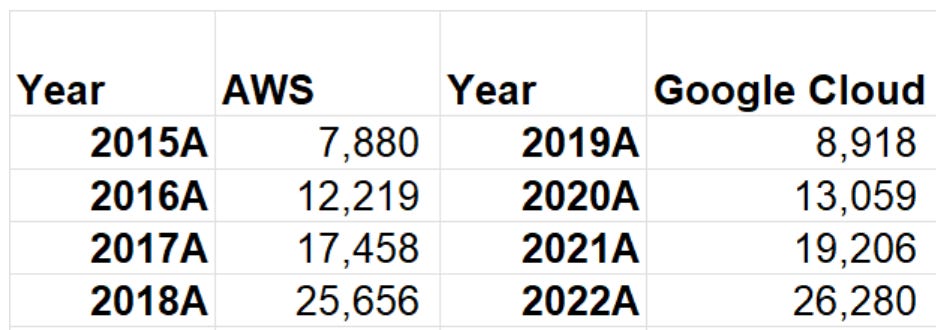

As I have mentioned in Google update early this year, Google Cloud’s revenue closely tracks AWS revenue trajectory just four years apart!

Okay, back to AWS.

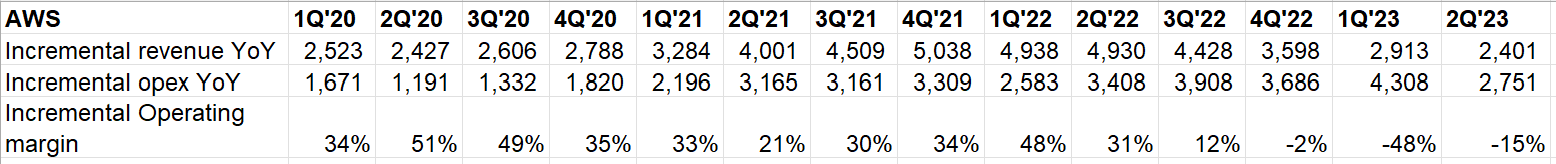

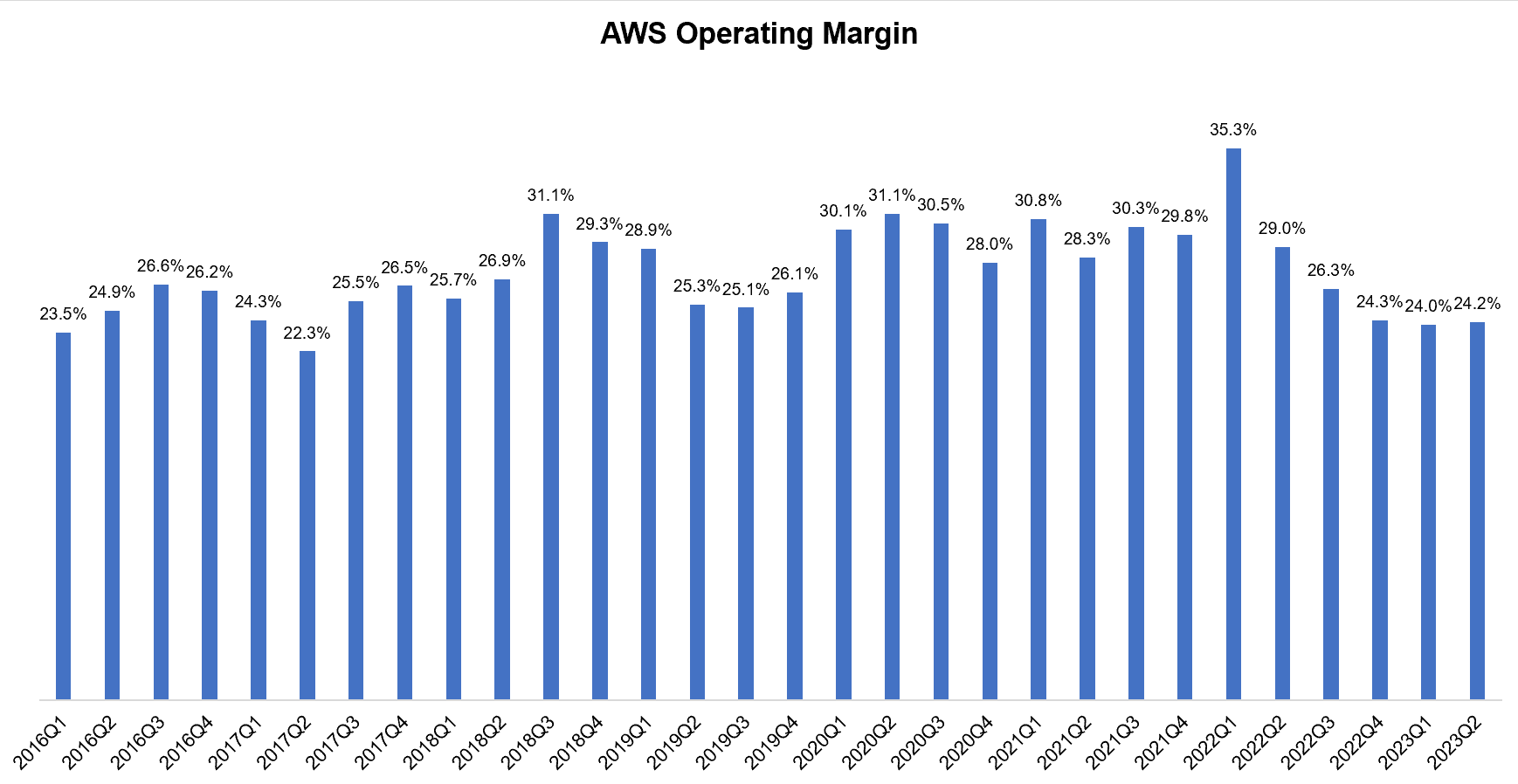

AWS incremental operating margin continued to struggle this quarter as well. At least, operating margin was slightly up, so hopefully AWS operating margin already bottomed in 1Q’23.

Amazon thinks AWS is pretty well positioned for Generative AI (I’m skipping more details as much of it was mentioned in earlier quarters as well):

Remember, the core of AI is data. People want to bring generative AI models to the data, not the other way around. AWS not only has the broadest array of storage, database, analytics and data management services for customers, it also has more customers and data store than anybody else.

It seems highly likely that the cost optimization headwinds may be behind us:

What we're seeing in the quarter is that those cost optimizations, while still going on, are moderating and many maybe behind us in some of our large customers. And now we're seeing more progression into new workloads, new business. So those balanced out in Q2. We're not going to give segment guidance for Q3. But what I would add is that we saw Q2 trends continue into July. So generally feel the business has stabilized, and we're looking forward to the back end of the year

Amazon ex-AWS

Personally, the highlight from this call was Amazon Retail.

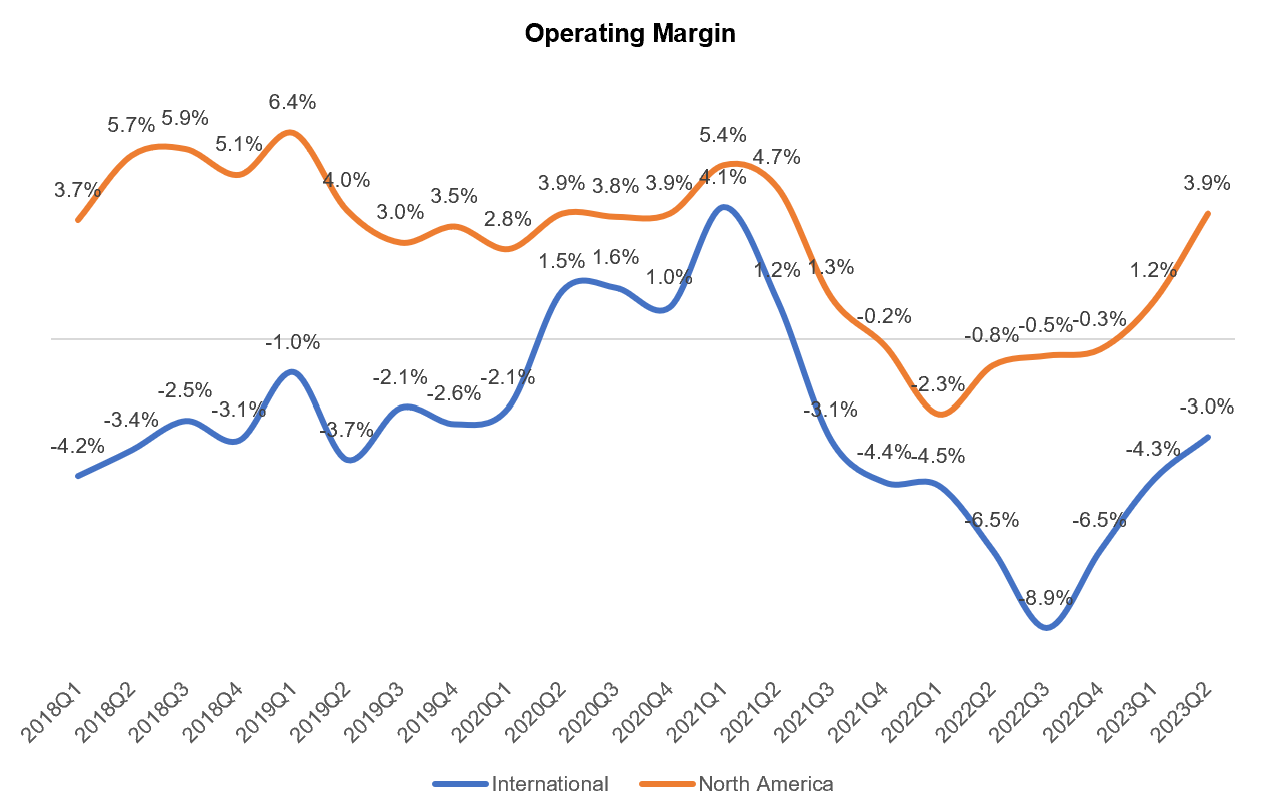

Just see the material margin momentum in North America segment from 1.2% operating margin last quarter to 3.9% this quarter. International segment is also on the right direction:

Management also re-iterated that margins can not only go back to pre-Covid level but do even better:

I continue to believe what I said last quarter…which is I do believe that we'll get back to margins like what we had pre COVID. And I don't think that's the end of what's possible for us there.

Shopify vs Amazon

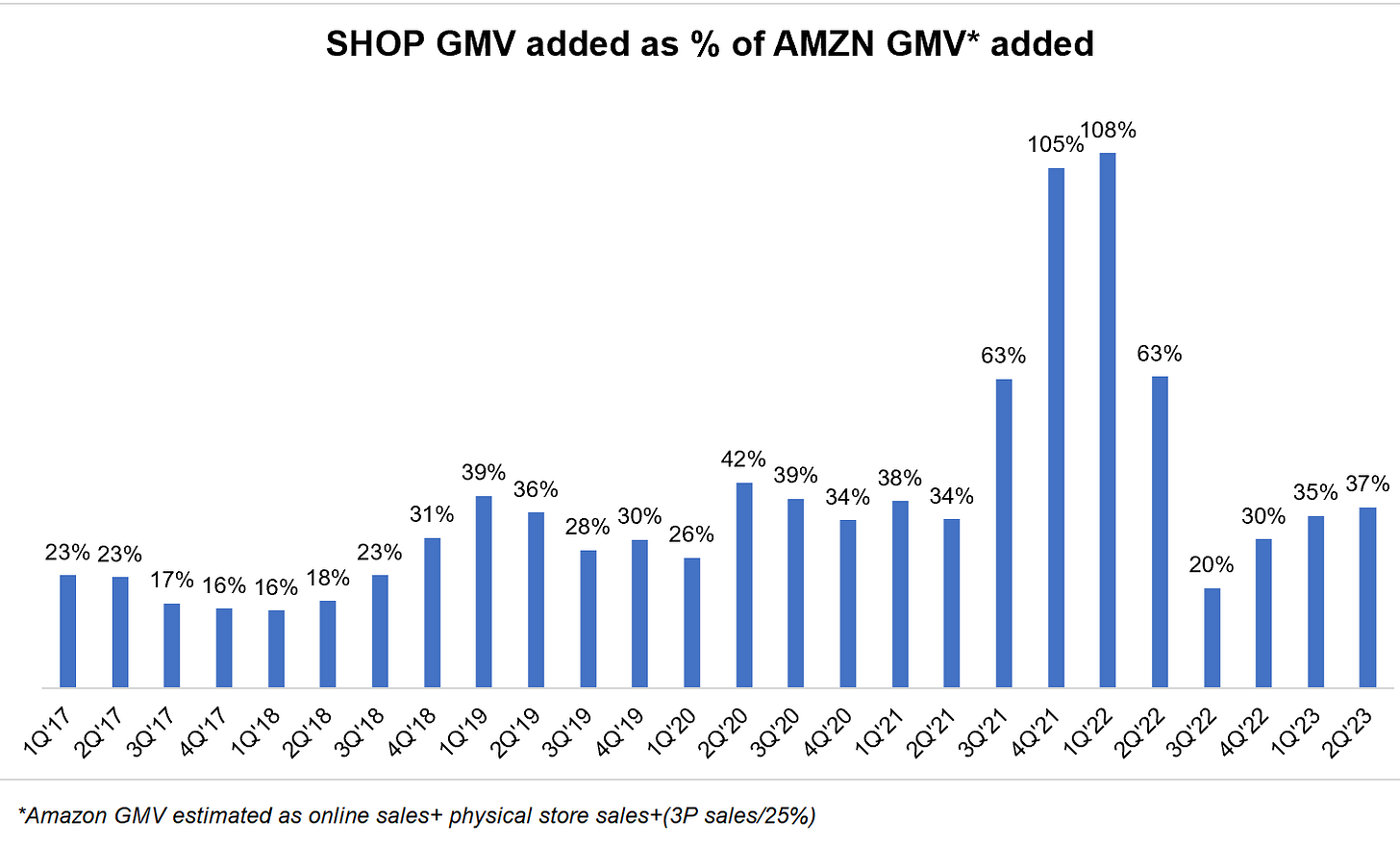

One metric I like to track is Shopify vs Amazon GMV trajectory. Shopify has so far been able to keep up with Amazon.

Amazon Business is currently at $35 Bn gross sales run-rate. Jassy thinks it can be $100 Bn+ business over time.

Fulfillment+ Shipping

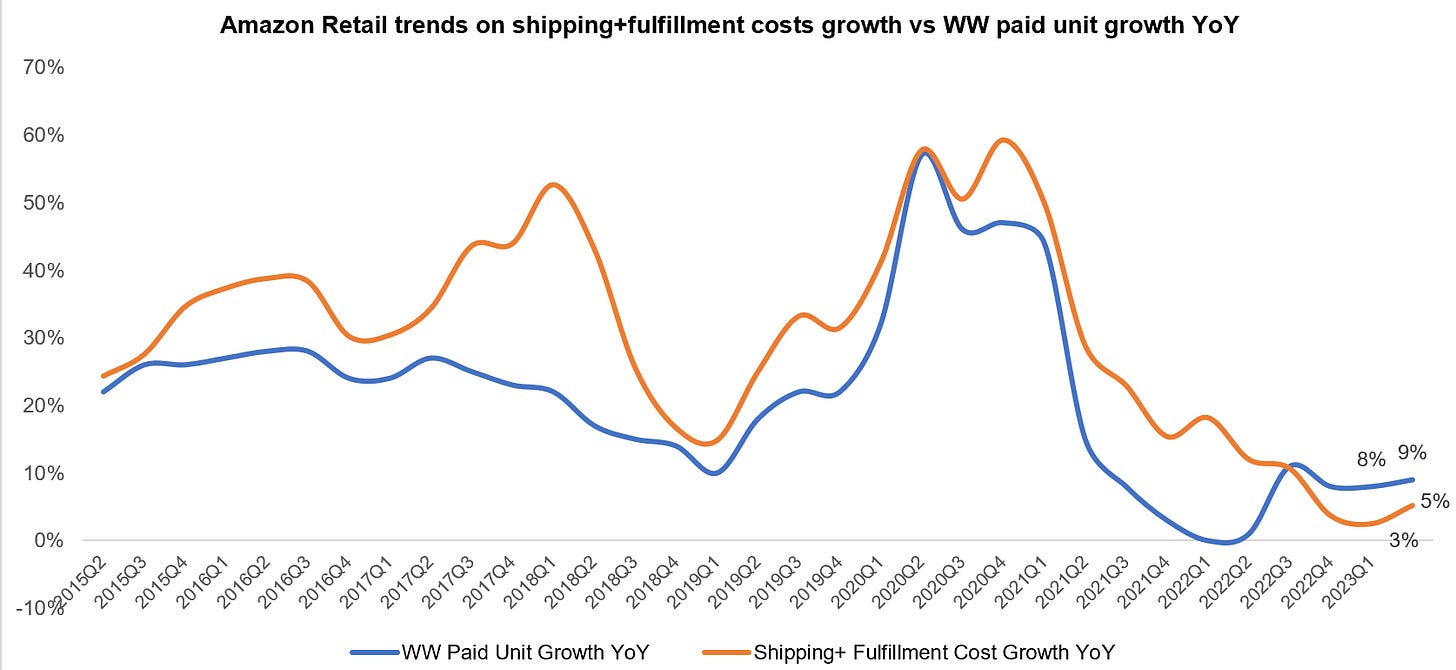

The primary reason I thought this earnings call was excellent is I am much more optimistic about shipping and fulfillment cost as % of GMV may come down over time.

For the fourth consecutive quarters, shipping and fulfillment costs are growing slower than unit growth. 3P units were 60% of overall mix (highest ever) and Amazon saw “good growth in the number of sellers and the unit sold per seller.”

In 2017, Amazon’s shipping and fulfillment expenses as % GMV was estimated to be ~19% which consistently crept upwards every year to exceed ~25% in 2022. This has started to come down this year; I estimate this number was 24.7% in 1H’22 but declined by 190 bps YoY to 22.8% in 1H’23.

If long-term shipping and fulfillment expenses is actually closer to ~20% (or lower), the valuation implications are quite intriguing. I encourage you to play with these assumptions in my Amazon model.

But is such cost structure possible for Amazon Retail? Isn’t same day shipping going to make life difficult for Amazon to attain such cost structure? This calls makes me optimistic about these questions:

Central to our efforts has been the decision to transition our stores' fulfillment and transportation network from 1 national network in the United States to a series of 8 separate regions serving smaller geographic areas. We keep a broad selection of inventory in each region, making it faster and less expensive to get those products to customers.

Regionalization is working and has delivered a 20% reduction in number of touches for our delivered package, a 19% reduction in miles traveled to deliver packages to customers and more than a 1,000 basis point increase in deliveries fulfilled within region, which is now at 76%. This is a lot of progress. Sometimes I hear people make the argument that Amazon is chasing faster speed while driving its costs higher and where it doesn't matter much to customers. This argument is incorrect. There are 2 things to note. First, customers care a lot about faster delivery. We have a lot of data that shows when we make faster delivery promises on a detail page, customers purchase more often, not just a little higher, meaningfully higher. It's also true that when customers know they can get their items really quickly, it changes their consideration of using us for future purchases, too.

Second, when shipments come from fulfillment centers that are closer to customers, they travel shorter distances, which cost less in transportation, get there faster and is better for the environment. There's a lot of goodness in that equation. This ability to have shipments closer to customers is the result of a lot of work and invention on the regionalization side, placement logic and local in-stock algorithms. It's also driven by our development and expansion of same-day fulfillment facilities, which is our fastest fulfillment mechanism and one of our least expensive, too.

Our same-day facilities are located in the largest metro areas around the U.S. so our top moving 100,000 SKUs but also cover millions of other SKUs from nearby fulfillment centers that inject selection into these same-day facilities and have a design that streamlines getting items from order to being ready for delivery in as little as 11 minutes. The experience has been so positive for customers in our business that we're planning to double the number of these facilities. We believe that we are far from the law of diminishing returns and improving speed for customers.

In this last quarter, across the top 60 largest U.S. metro areas, more than half of Prime members' orders arrived at the same day or next day. So far this year, we've delivered more than 1.8 billion units to U.S. Prime members the same or next day, nearly 4x what we delivered at those speeds by this point in 2019.

Opex+Capex

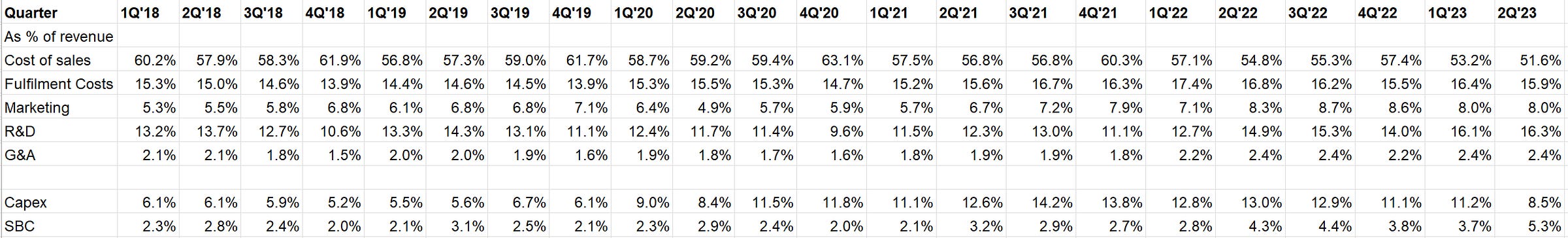

The way Amazon has increased SBC intensity is not really a good look. SBC as % of revenue used to be <3% in 2018-2021, but crept up to ~4% in 2022 and was >5% in 2Q’23. Diluted shares outstanding was +2.7% YoY, not an acceptable dilution for ~$1.5 Tn company.

Amazon’s LTM Capex+ finance leases was $54 Bn, down from $61 Bn; guidance for 2023 is slightly more than $50 Bn (vs $59 Bn in 2022). Much of the capex is going to AWS:

On the how much generative AI may impact the capital expense spend, included in that number is a pretty significant amount of capital expense in the AWS business for large language models and for generative AI. And we have quite a bit of demand right now. And so it's -- like in AWS in general, one of the interesting things in AWS, and this has been true from the very earliest days, which is the more demand that you have, the more capital you need to spend because you invest in data centers and hardware upfront and then you monetize that over a long period of time.

So I would like to have the challenge of having to spend a lot more in capital in generative AI because it will mean that customers are having success and they're having success on top of our services and -- but I think that, that's our best estimate right now on that capital expense and we'll update it if we find it's different.

Other Bets

Apart from SBC, another not so great spot is Amazon’s continued reluctance to share “other bets” details with shareholders. I suspect I may care about this detail more than most Amazon shareholders. Let me explain why.

Before Meta disclosed Reality Labs (RL) expenses, many investors/analysts were underwriting ~$5 Bn loss estimates/year for RL. But when they started disclosing, we got to know investors materially underestimated the expenses. My primary concern is something similar may be happening here at Amazon as well. While minority shareholders don’t quite have a strong say in how Amazon will allocate their capital (probably nobody has enough % of ownership in Amazon to have material influence even if there is no dual class share structure), at the very least we can make a much more informed decision in valuing Amazon.

Outlook

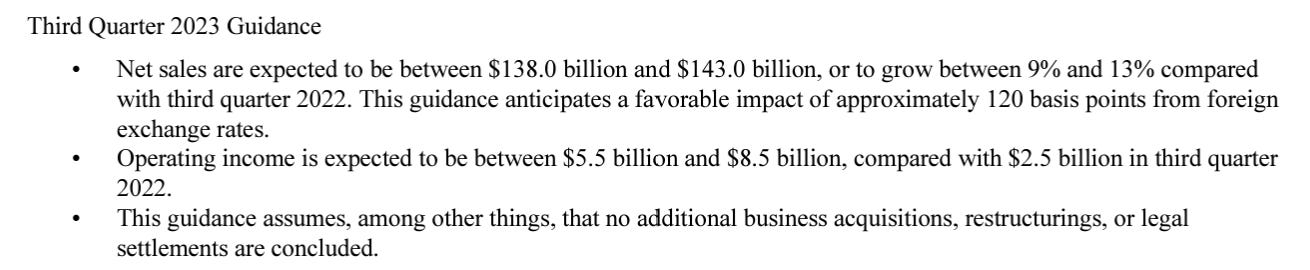

Amazon’s guidance for 3Q’23 is below:

Thank you for reading.