Amazon 1Q'23 Earnings Update

Disclosure: I own shares, and Jan 2025 call options of Amazon

An Analyst asked a legitimate question to Amazon management:

“Does the company ever think about breaking out all the big investments so that we have more clarity on the retail margin structure?”

Andy Jassy provided a word salad in response. As a shareholder, I am not opposed to investing in Alexa, Kuiper etc. But the lack of disclosure to its owners is increasingly distasteful.

Here are my notes from today’s earnings call.

Revenue

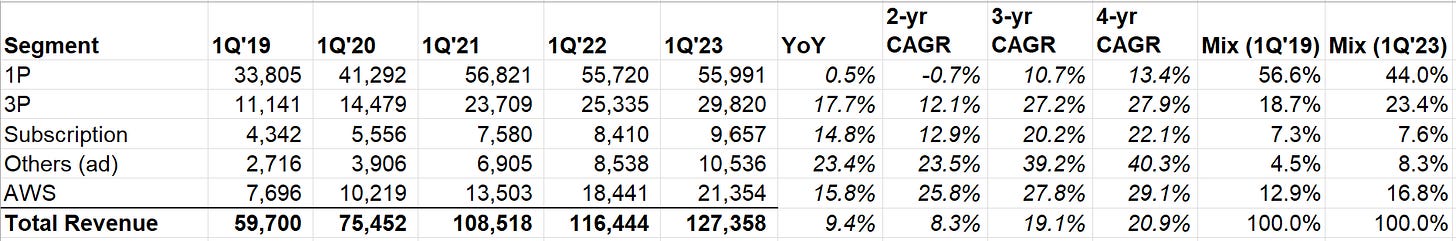

Overall revenue was +9.4% (+11% FXN)

While the low margin 1P segment is flat for last two years, everything else is doing just fine.

Let me spend more time on dissecting AWS which remains a key focus for investors.

AWS

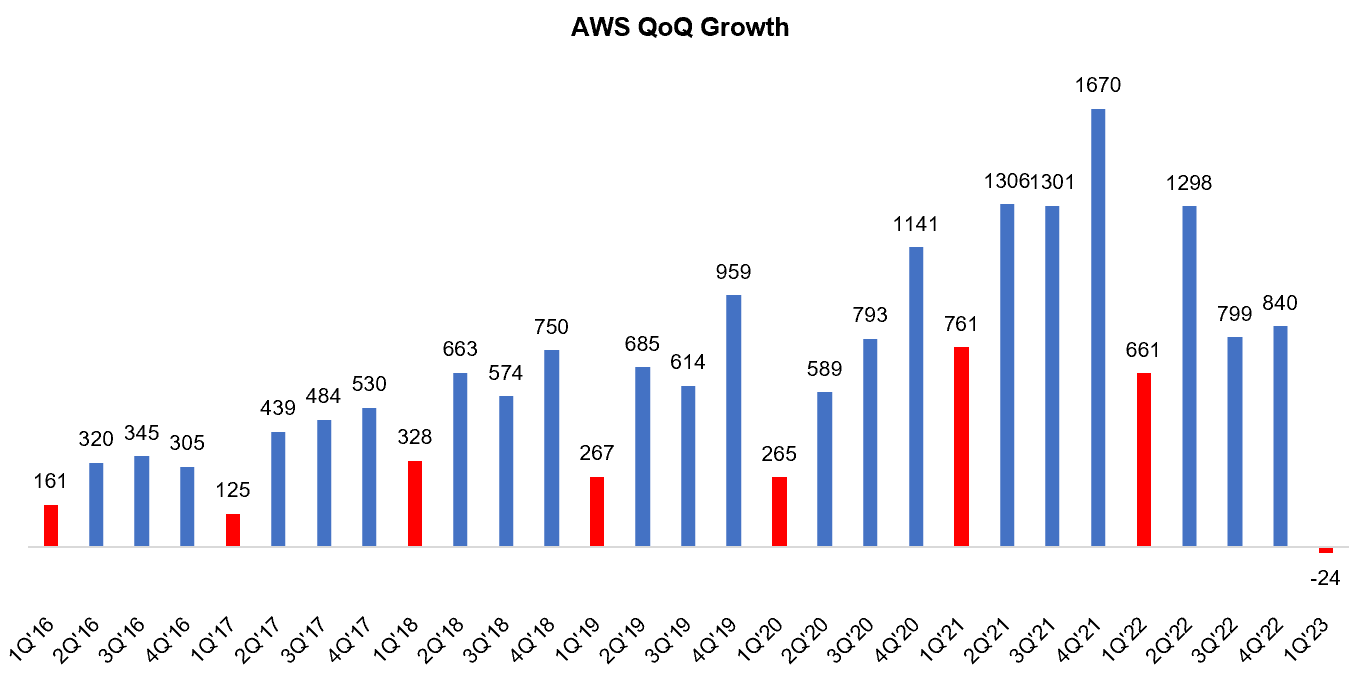

For the first time in its history, AWS QoQ sales declined. Please note that 1Q QoQ has consistently been the weakest since 2016.

Since AWS mentioned last quarter that they exited January at mid-teens growth, this wasn’t quite a surprise.

What, however, spooked investors a bit was the exit growth rate in April:

customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter. And we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1.

One thing to note here is 2Q’22 was a very strong quarter, so even if AWS posts 11-12% YoY growth in 2Q’23, we’ll see ~$550-750 Mn QoQ incremental revenue.

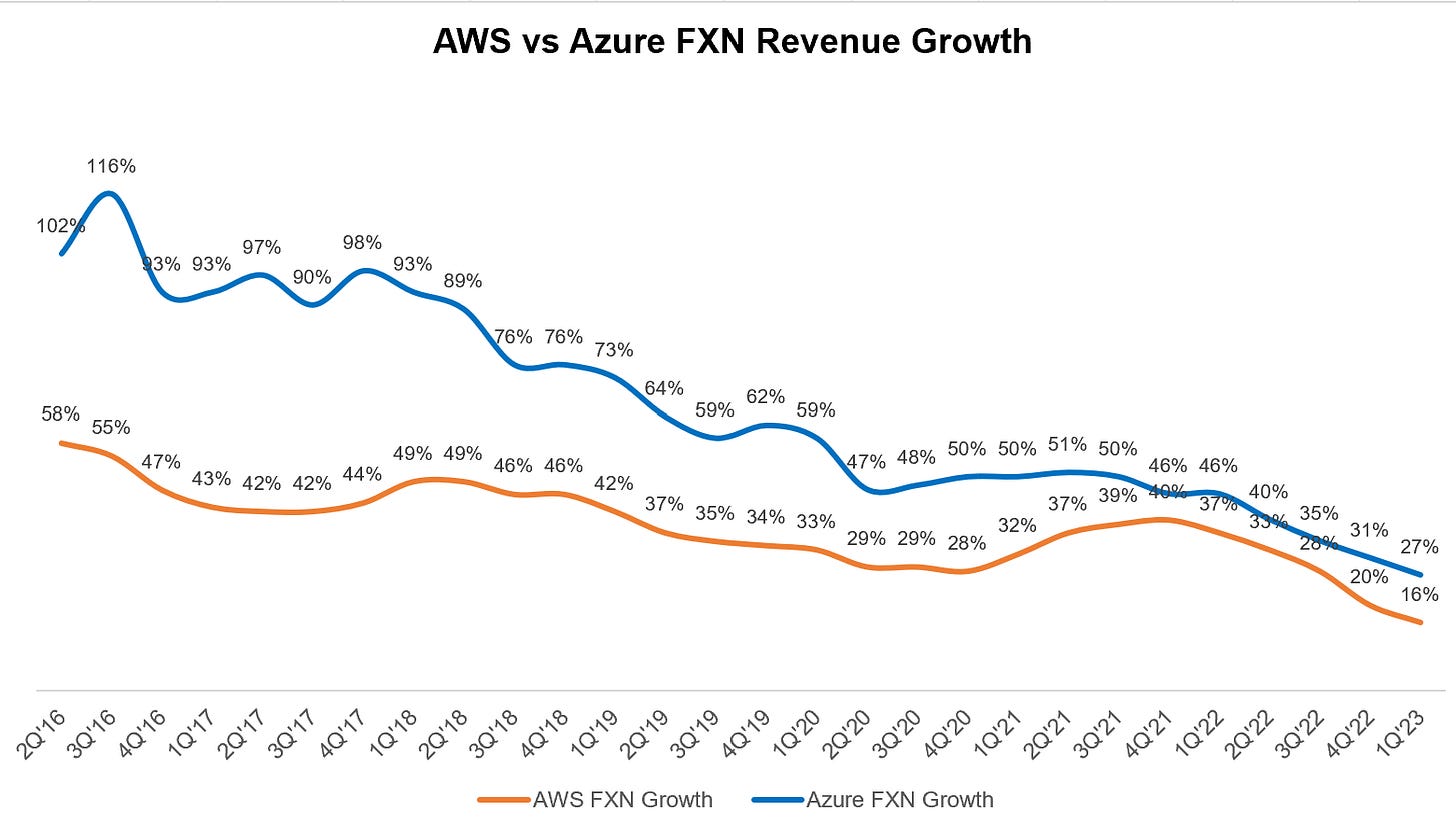

AWS’ numbers now makes Azure’s numbers look even more impressive than it already was! With AWS having higher exposure to startups (vs Azure’s large enterprises) as well as higher % of revenue coming from IaaS rather than PaaS for AWS (vs Azure) means AWS will be more cyclical than Azure.

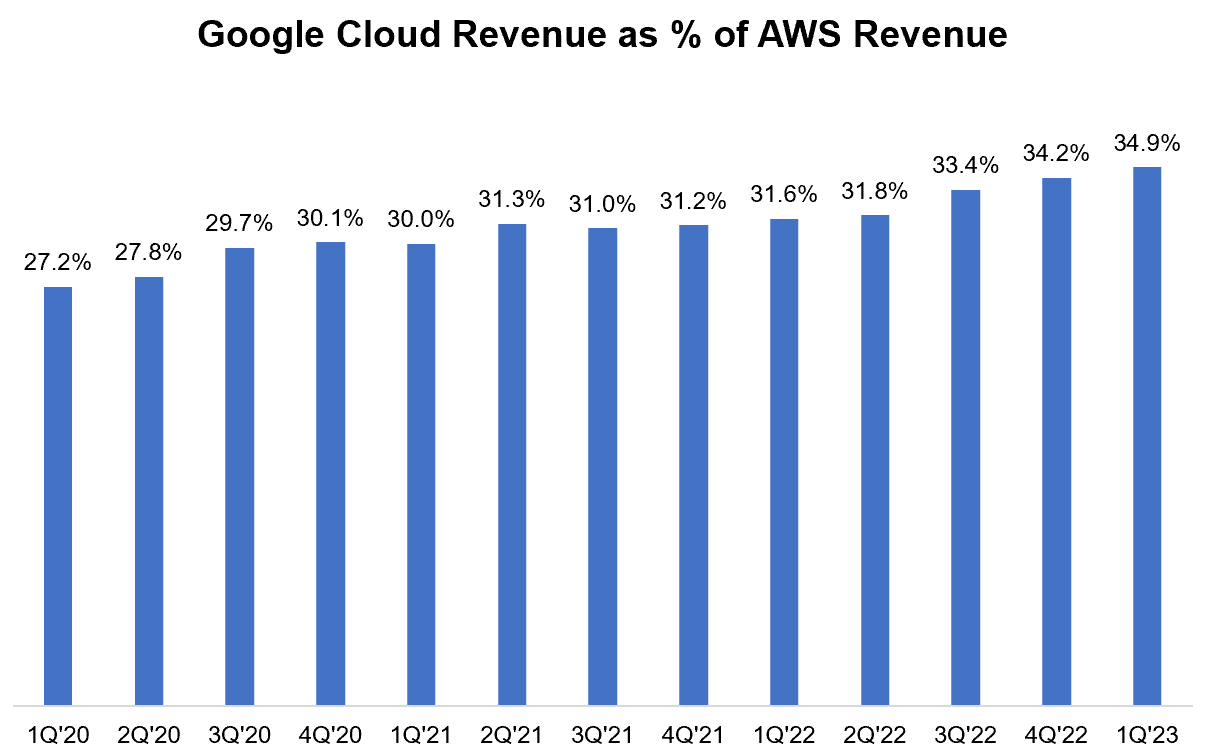

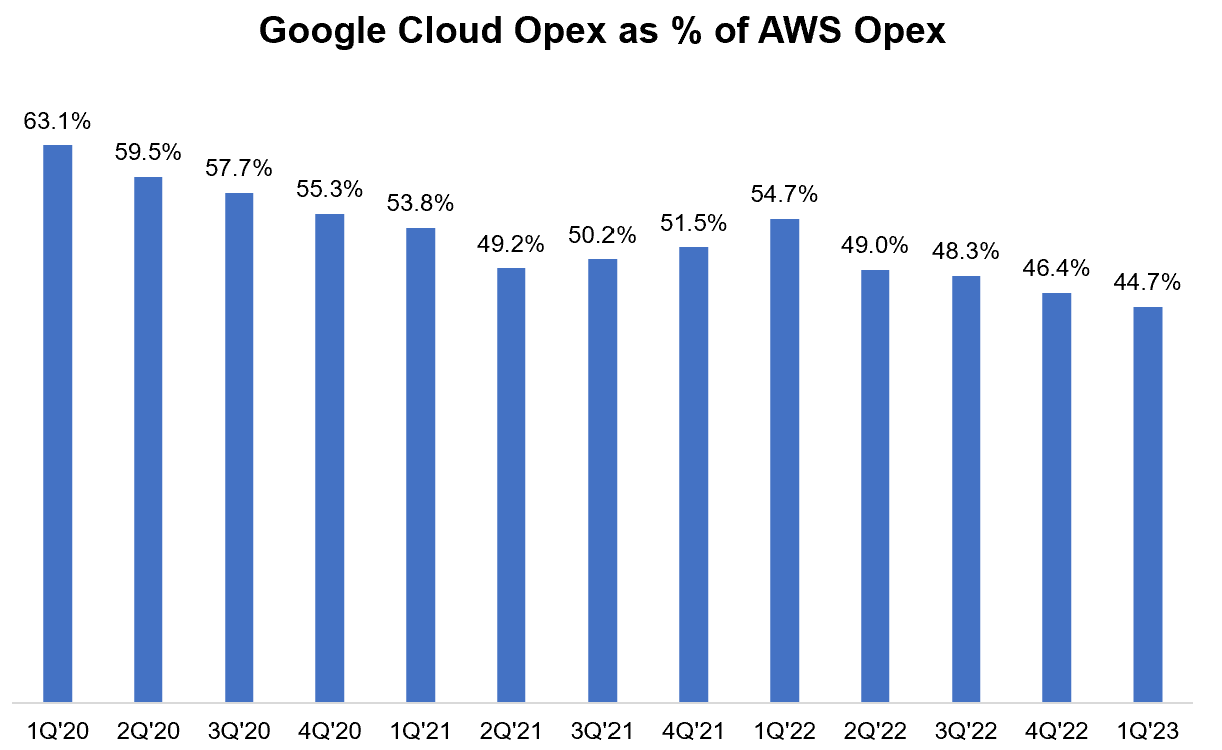

It’s not just Azure; Google Cloud’s numbers also look pretty good now. One caveat is Google Cloud includes Google Workspace, and Alphabet doesn’t disclose GCP numbers.

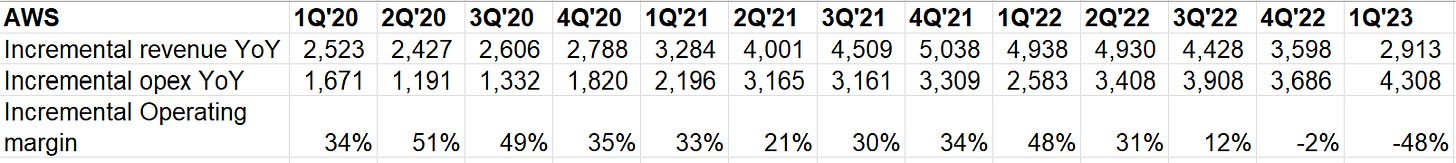

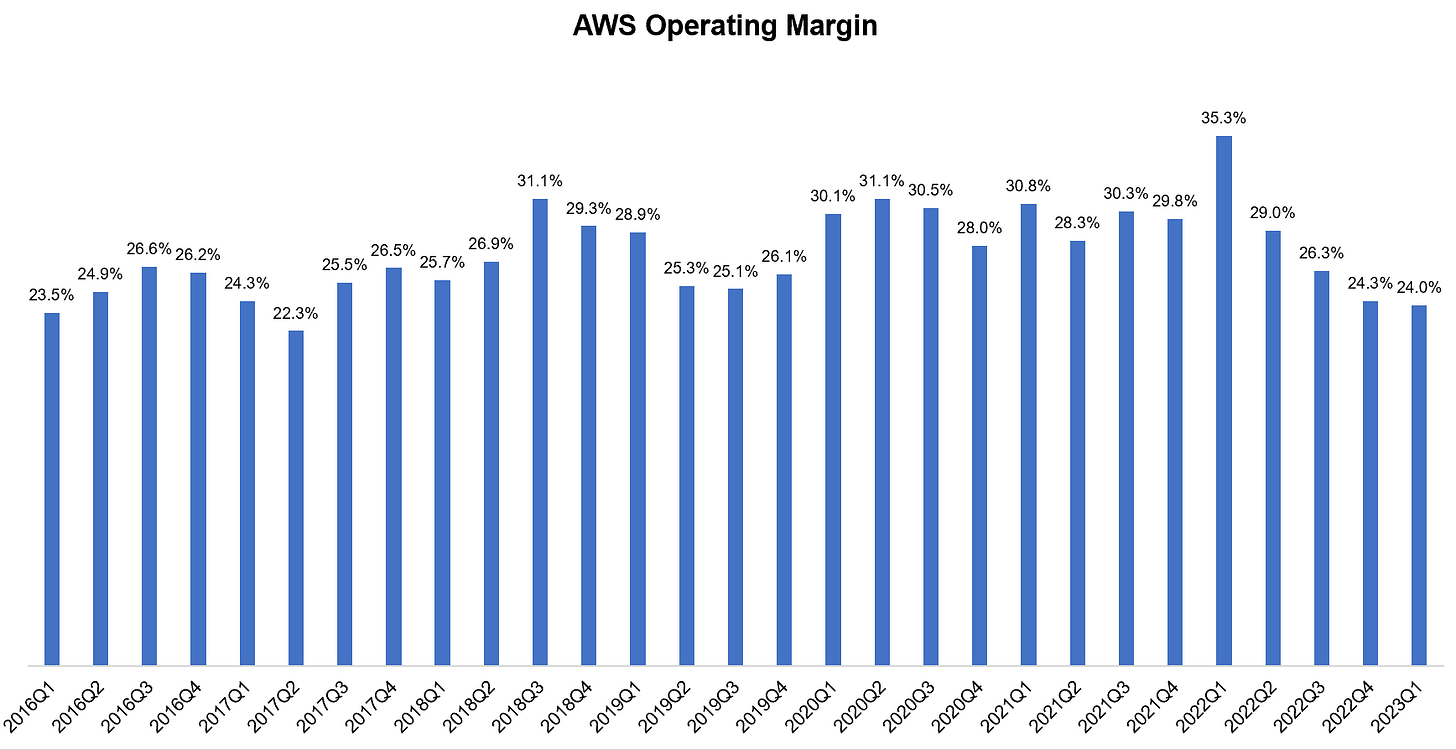

AWS cost structure may also require some further right sizing. 1Q’22 EBIT margin was 35.3% (highest ever), but in 1Q’23, it came down to just 24.0%. Incremental operating margin is now negative for two consecutive quarters.

As expected, there are plenty of generative AI related talking points which I’m not including here. Amazon remains quite upbeat about cloud’s momentum:

few folks appreciate how much new cloud business will happen over the next several years from the pending deluge of machine learning that's coming.

Amazon ex-AWS

While headline figures still don’t seem encouraging, I am personally quite glad about the progress made at retail.

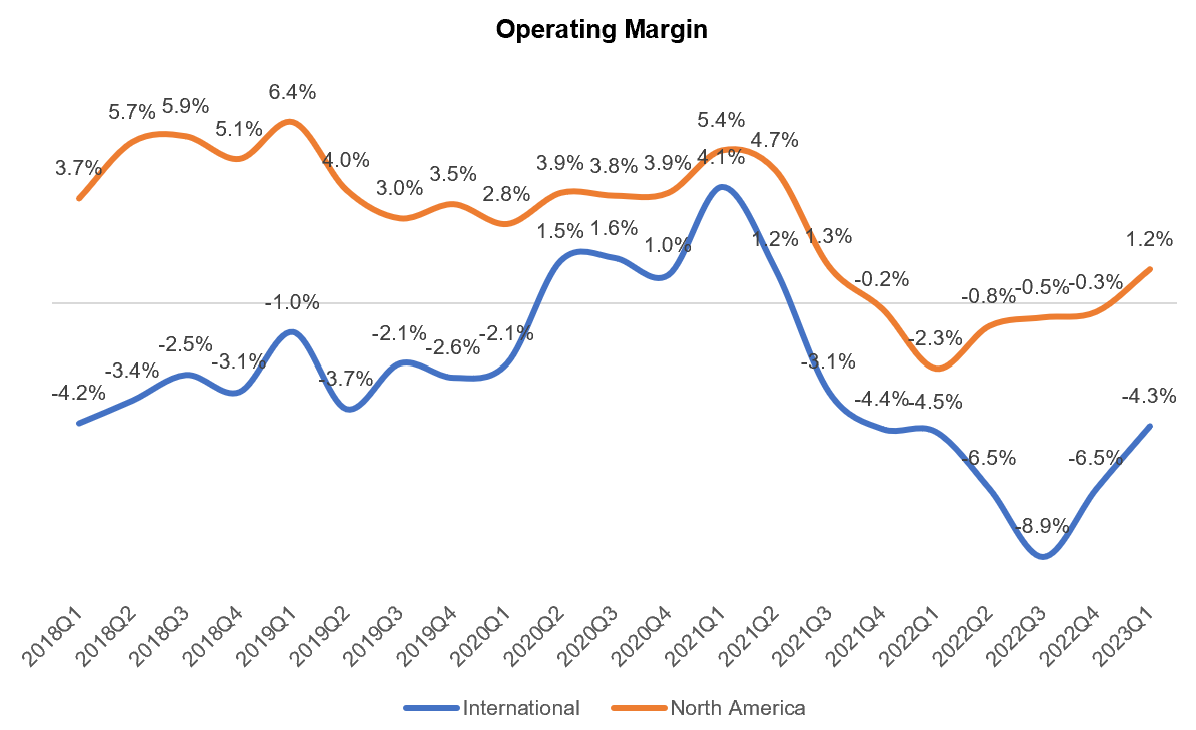

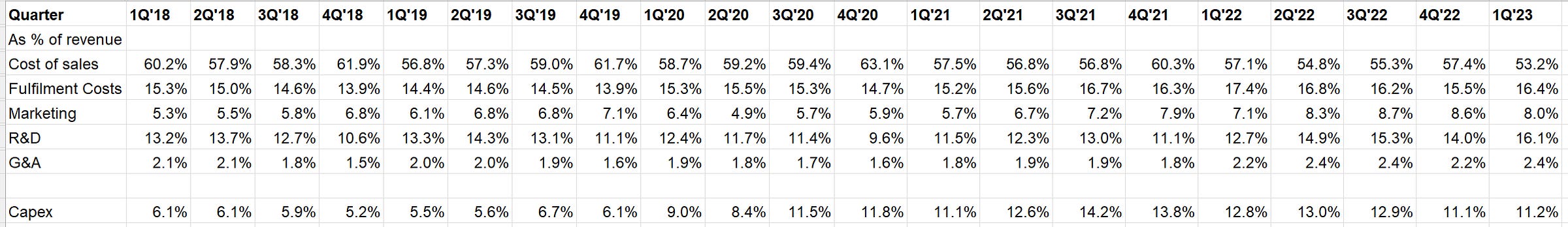

Both North America and International segment’s margins are going in the right direction. North America was profitable in 1Q’23 but still far cry from ~5-6% operating margins seen in 2018 and in 2020.

While Amazon retail is dealing with whole host of issues, the operating margin history in North America is perhaps a strong indication that plenty of undisclosed “other bets” are jammed in this segment. If I were a large shareholder of Amazon, I would push Amazon to disclose and quantify such bets.

I believe most Amazon shareholders are quite conducive to bold, aggressive bets, but not disclosing the bets is not doing anyone any favor.

On International, Amazon reminded us the nuances embedded in margin trajectory there:

I will remind you that, again, that international is an aggregation of established countries which are already profitable and who look a bit like North America, perhaps at an earlier stage of development and working their way to parity on profitability. We have forward-loaded Prime benefits in a lot of these countries that are ahead of the curve that we saw in North America.

We have a large emerging business. In the last 5 years, we've added more than 10 new countries. What we're seeing is if you looked back to North America long ago, it took 9 years for us to reach breakeven profitability in the United States. We see a similar curve in a lot of countries overseas. There's, in fact, additional challenges that we usually have to deal with, things like lack of payment methods, lack of the established infrastructure for -- especially for transportation and infrastructure for the Internet and everything else

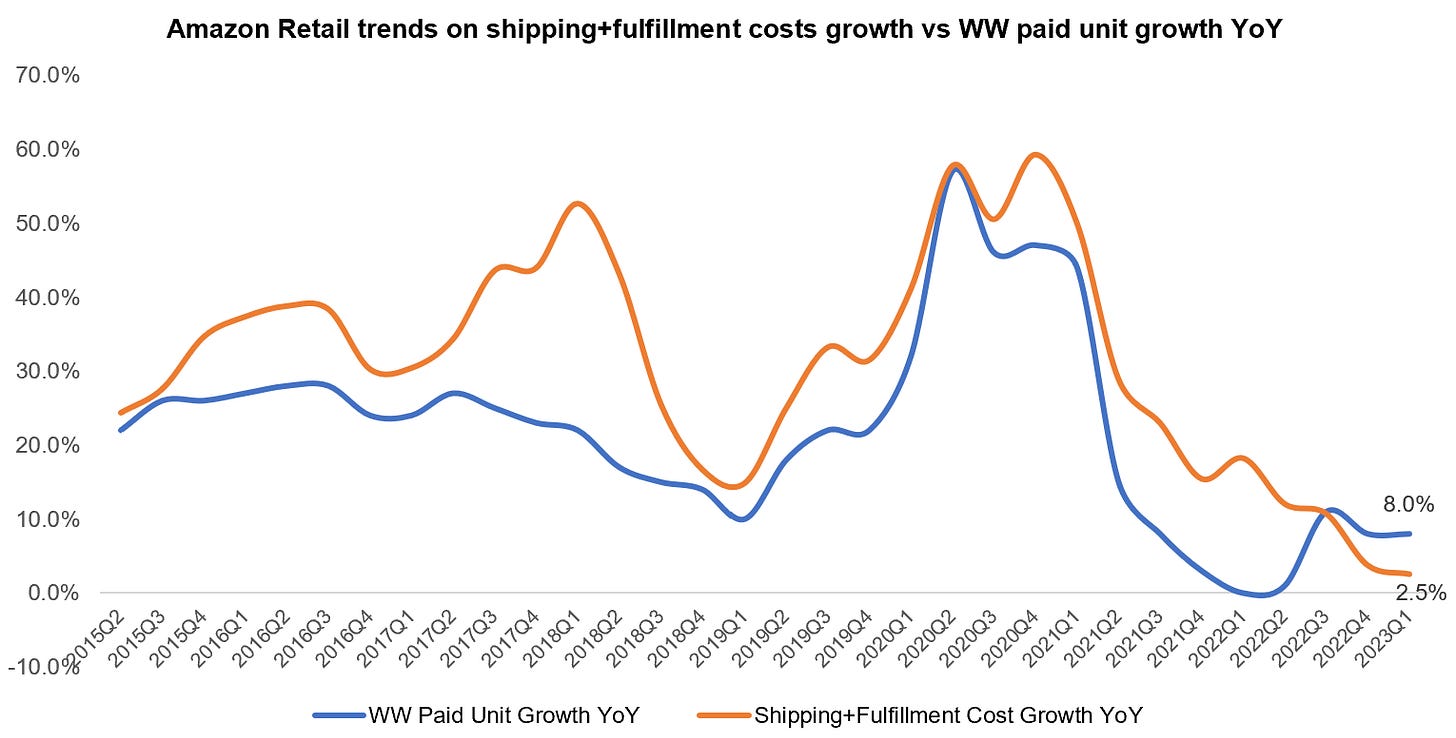

One indication that retail business is progressing well is that for the third consecutive quarters world-wide paid units growth YoY surpassed shipping+ fulfillment cost growth YoY. In fact, the gap is widening, indicating Amazon’s efficiency in dealing with shipping and fulfillment related cost.

Advertising

Amazon continues to buck the broader advertising trend and even mentioned “We have a lot of upside still in advertising”:

On the advertising side, we're continuing to buck wider advertising trends and deliver robust growth. I think there are a few reasons for it. First, even in difficult economies, most people still shop. And with the largest e-commerce shopping venue, we have a lot of customers that companies seek to reach. That, coupled with our very substantial investment in machine learning to make sure customers see relevant ads when they're looking for various items, have meant that these advertisements have performed unusually well for brands, which makes them want to advertise in Amazon.

It's also worth noting that we're still very early in our efforts to find a way to thoughtfully place ads in our broader video, live sports, audio and grocery properties. We have a lot of upside still in advertising.

Alexa

There was a question about Alexa’s long-term viability; Amazon still seems confident that they can make it work, especially in light of generative AI. That sounds plausible, but I guess Alexa has a couple of years left to figure out a viable business model before facing severe cut:

I think when people often ask us about Alexa, what we often share is that if we were just building a smart speaker, it would be a much smaller investment. But we have a vision, which we have conviction about that we want to build the world's best personal assistant. And to do that, it's difficult. It's across a lot of domains and it's a very broad surface area. However, if you think about the advent of large language models and generative AI, it makes the underlying models that much more effective such that I think it really accelerates the possibility of building that world's best personal assistant.

And I think we start from a pretty good spot with Alexa because we have a couple of hundred million endpoints being used across entertainment and shopping and smart home and information and a lot of involvement from third-party ecosystem partners. And we've had a large language model underneath it, but we're building 1 that's much larger and much more generalized and capable. And I think that's going to really rapidly accelerate our vision of becoming the world's best personal assistant. I think there's a significant business model underneath it.

Opex+Capex

There was $470 Mn employee severance charge in 1Q’23. But the overall cost structure still seems quite bloated.

Capex for 2023 will be lower than it was in 2022. While analysts asked for more specifics, Amazon didn’t quite outline any specific number for 2023 capex.

For the full year 2023, we expect capital investments to be lower than our $59 billion investment level in 2022, primarily driven by an expected year-over-year decrease in fulfillment network investments. We're continuing to invest in infrastructure to support AWS customer needs, including investments to support large language models and generative AI.

Outlook

2Q’23 topline is expected to be $127-133 Bn, ~5-10% YoY growth.

Operating income is expected to be between $2.0-$5.5 Bn (vs $3.3 Bn in 2Q’22)

Thank you for reading!