Alphabet 2Q'24 Update

Yesterday’s Google’s earnings may have been bit of “meh” at first glance, but there were nuggets in the call that may have important implications for the broader market.

Here’s my highlights from the earnings.

Revenue

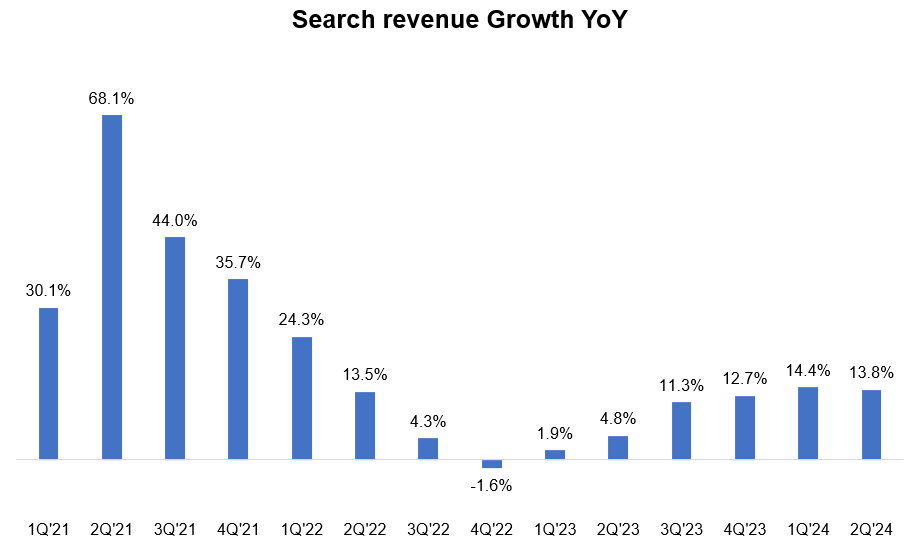

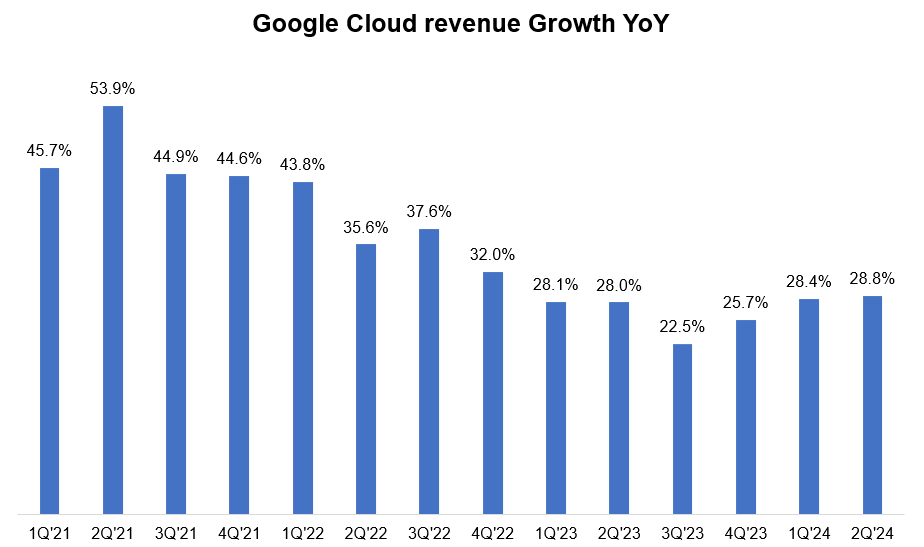

Network segment continues to struggle, but the rest of the businesses continue to grow at healthy double digit rate. Search revenue growth surpassed YouTube ads revenue growth last quarter. For the first time, Cloud posted >$10 Bn quarter while maintaining high 20s growth YoY.

EBIT

Google Services business posted its highest ever margin. Thanks to four consecutive quarters of >70% incremental operating margin (!!), operating margin for Google Services was 40.1% in 2Q’24!

Google Cloud posted its first ever double digit operating margin quarter. TAC continues to tick lower as % of ad revenue. Overall company operating margin expanded from 29.3% in 2Q’23 to 32.4% in 2Q’24.

Search

Some interesting comments on Search from the call:

We are pleased to see the positive trends from our testing continue as we roll out AI Overviews, including increases in Search usage and increased user satisfaction with the results.

…we see even higher engagement from younger users aged 18 to 24 when they use Search with AI Overviews.

…we are seeing that ads appearing either above or below AI Overviews continue to provide valuable options for people to take action and connect with businesses.

…AI expands the types of queries we are able to address and opens a powerful new ways to Search. Visual search via Lens is one. Soon, you'll be able to ask questions by taking a video with Lens. And already, we have seen that AI Overviews in Lens leads to an increase in overall visual search usage. Another example is Circle to Search, which is available today on more than 100 million Android devices.

YouTube

YouTube’s ad revenue missed the consensus numbers by ~3%. After ~21% growth in Q1, the pace of deceleration was a bit surprising. Management explained the reason for such deceleration:

YouTube was lapping negative year-on-year growth in Q1 last year. And then also Q1 benefited from the extra from leap year. And so what you're also seeing here is with YouTube, we were anniversary-ing the ramp in APAC-based retailers that began in the second quarter last year and foreign exchange headwinds as well that we noted. And so there are some timing issues going on.

YouTube’s numbers might have spooked investors about broader digital ads industry (Meta, Snap, Pinterest etc.), but Eric Seufert hypothesized that “broader CTV CPM compression instigated by the influx of inventory from Amazon Prime Video” also likely contributed to YouTube’s deceleration. Of course, it’s always hard to conclude anything about YouTube ads definitively given the subscription side of YouTube. It’s really high time Google started disclosing overall YouTube revenue instead of just ad revenue. If more and more users switched from ads to subscription, that’s far from bad news. However, subscription growth also experienced sequential decline YoY:

we continue to have significant growth in our subscriptions business, which drives the majority of revenue growth in this line. However, there was a sequential decline in the year-on-year growth rate as we anniversaried the impact of a price increase for YouTube TV in the second quarter last year

Some more interesting comments on YouTube:

…Views on CTV have increased more than 130% in the last 3 years. According to Nielsen, YouTube is the #1 most watched streaming platform on TV screens in the U.S. for the 17th consecutive month. Zooming out, when you look not just at streaming but at all media companies and their combined TV viewership, YouTube is the second most watched after Disney. And this growth is happening in multiple verticals, including sports, which has seen CTV watch time on YouTube grow 30% year-over-year.

…we continue to see an improvement in Shorts monetization, particularly in the U.S. We're also seeing a very encouraging contribution from brand advertising on Shorts, which we launched on the product in Q4 last year.

Google Cloud

While Google Cloud revenue growth accelerated to 28.8% in 2Q’24, management mentioned GCP continued to outpace overall Cloud growth. Not sure we will see such persistence of growth at such revenue level/size in too many secular growth industries!

We are the only cloud provider to offer grounding with Google Search, and we are expanding grounding capabilities with Moody's, MSCI, ZoomInfo and more.

I had to ask Perplexity about grounding; if you are in the same boat, see here for explanation.

I will discuss more on Cloud when Amazon posts next week.

AI

At 2 million tokens, we offer the longest context window of any large-scale foundation model to date, which powers developer use cases that no other model can handle. Gemini is making Google's own products better. All 6 of our products with more than 2 billion monthly users now use Gemini.

Google seems to indicate that while GenAI is contributing positively to their own products, model capabilities are converging for the enterprise customers and the full range of potential of multimodal models are yet to be fully explored:

…I think there is a time curve in terms of taking the underlying technology and translating it into meaningful solutions across the board, both on the consumer and the enterprise side. Definitely, on the consumer side, I'm pleased…in terms of how for a product like Search, which is used at that scale over many decades, how we've been able to introduce it in a way that it's additive and enhances overall experience and this positively contributing there.

…I think across our consumer products, we've been able -- I think we are seeing progress on the organic side. Obviously, monetization is something that we would have to earn on top of it. The enterprise side, I think we are at a stage where definitely there are a lot of models. I think roughly, the models are all kind of converging towards a set of base capabilities. But I think where the next wave is working to build solutions on top of it. And I think there are pockets, be it coding, be it in customer service, et cetera, where we are seeing some of those use cases are seeing traction, but I still think there is hard work there to completely unlock those.

…we are all building multimodal models. At least Gemini has been natively multimodal from the ground up. But most of the use cases today that have been unlocked have been around the tech side. So in terms of getting real generative audio, video experience is working well. I think there is still -- it's going to take some time.

Waymo

Google seems quite encouraged at the pace of adoption of Waymo and has decided to make a multi-year investment of $5 Bn.

Waymo served more than 2 million trips to date and driven more than 20 million fully autonomous miles on public roads. Waymo is now delivering well over 50,000 weekly paid public rides, primarily in San Francisco and Phoenix.

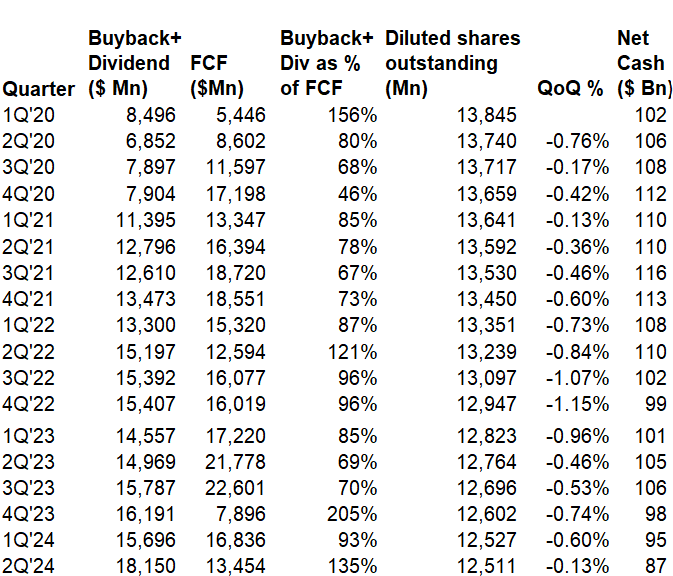

Capital Allocation

Google paid its first dividend last quarter. They returned capital to shareholders through buyback and dividend more than FCF they generated last quarter. As a result, net cash balance decreased from $95 Bn in 1Q’24 to $87 Bn in 2Q’24. If they keep this pace, they may get closer to a balance sheet with zero net cash in the next 3-5 years. There’s been quite a few rumors flying around Google’s potential acquisitions (Hubspot and Wiz are recent examples neither of which apparently likely to consummate as per media reporting); so they may get there soon if they use cash to do large deals.

Despite buying back $15.7 Bn shares, share count only declined by 13 bps QoQ which is of course disappointing. It is not 100% clear why that’s the case; Google issued 32 mn RSUs in 2Q’24 vs 33 mn in 1Q’24 and bought back 111 mn shares in 2Q’24 vs 92 mn in 1Q’24. My best guess is they also issued some contingent shares from some earlier acquisitions (Mandiant maybe?) in 2Q’24.

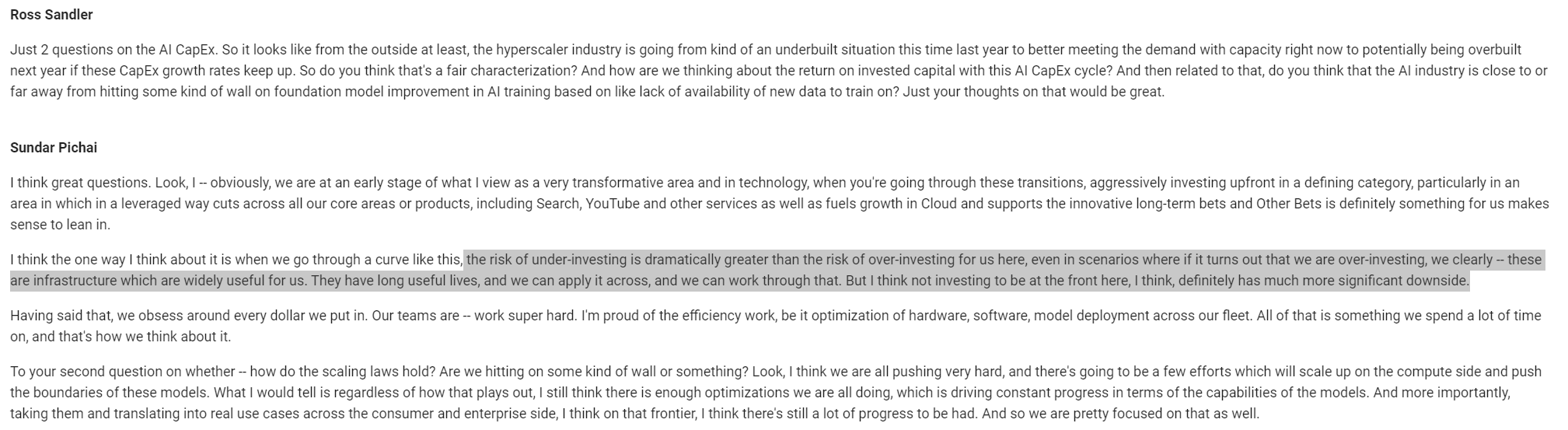

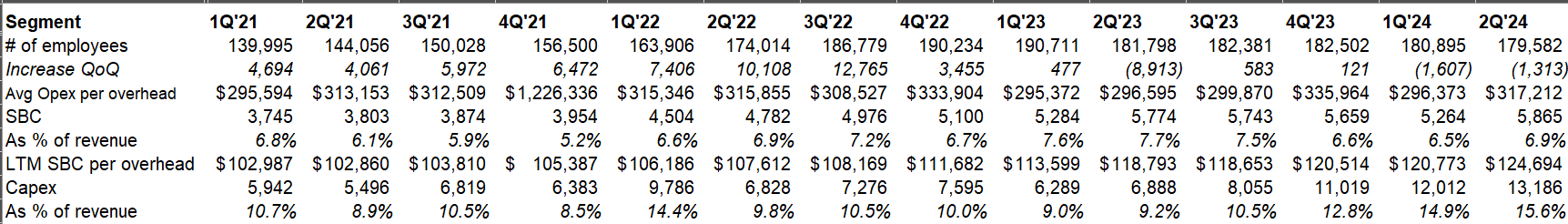

Capex and Opex

Sundar Pichai had a very interesting answer to Ross Sandler’s question on whether hyperscalers are overbuilding capacity. It’s clear that Google is indeed trying to overbuild capacity since the risk of underinvesting is far greater. This answer may have more implications not only for the hyperscalers but also many semiconductor companies as well. See the Q&A below:

Google seems quite aware that the impending depreciation expenses from this potential overinvesting need to be managed to continue to grow earnings:

Our leadership team remains focused on our efforts to moderate the pace of expense growth in order to create capacity for the increases in depreciation and expenses associated with the higher levels of investment in our technical infrastructure.

Given that reality, don’t expect big tech hiring to ramp up anytime soon. Although Google’s headcount declined QoQ for the second consecutive quarter, Google did say headcount will have a “slight” increase in 3Q as they will hire new graduates.

Overall capex is expected to be ~$12 Bn or above for each of the quarters in 2024.

Valuation

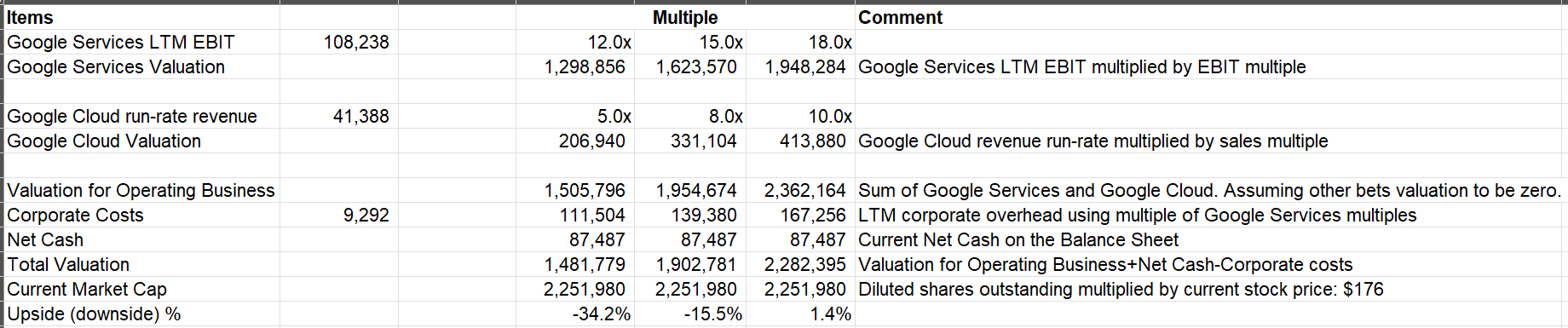

Since 3Q'22, I share the following valuation framework every quarter. As a matter of fact, the stock was also at $176 post 1Q earnings when I mentioned that “For the first time since 3Q’22, each of the following scenario indicates upside to be limited”.

Google’s valuation is far from unreasonable, neither is it very expensive. But is it compelling? The answer appears to be no in my opinion.

I will cover earnings of Amazon and Meta next week. Thank you for reading.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.