Autodesk 3Q'FY 2023 Earnings Update

Disclosure: I own shares of Autodesk

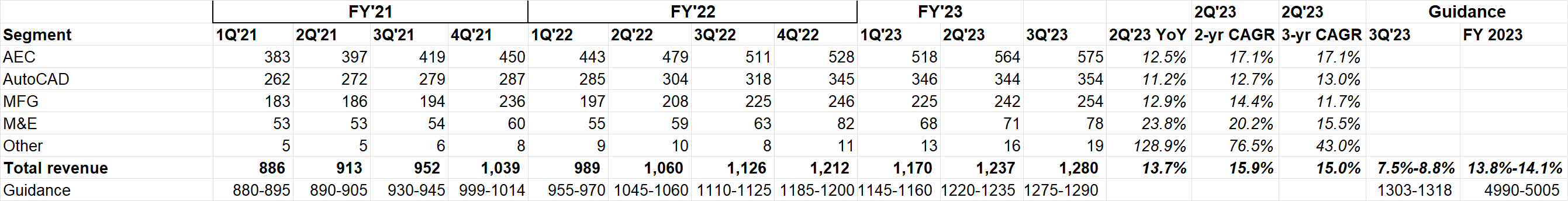

Autodesk had bit of a mixed quarter. While they typically beat the high end of their guidance, Q3 topline was near the low end of the guidance. Moreover, guidance appears to be weak too as Q4 implied topline growth is HSD i.e. ~7-9%.

Q3 had 1-point FX headwind and Q4 is assumed to have 3-point headwind. So, on FXN basis, topline growth may continue to be double digit.

However, Autodesk did see "modest deceleration in our new business, particularly in Europe during Q3, that does have a slight follow-on impact to revenue in Q4."

Net revenue retention continues to be ~100-110% range. However, Autodesk is seeing less demand for multiyear upfront billings and more demand for annual contracts than they expected. Customers are likely being more conscious about their cashflows in a soft macro environment. Autodesk was transitioning to annual billings anyway, but the macro is likely to make the transition quicker than anticipated.

On the customer side, what they've historically had a discount of anywhere from 10% to 5% to have a multiyear contract that's invoiced and collected upfront, and that discount goes away. And we think based on the feedback that we've been getting from our customers that they want to have multiyear contracts with annual billings.

Some interesting quotes from the call:

Across construction, we added almost 1,000 new logos with Autodesk Build's monthly active users growing more than 60% quarter-over-quarter and becoming Autodesk's largest construction products.

we announced Fusion, Forma and Flow, our 3 industry clouds, which will connect data, teams and workflows in the cloud on our trusted platform

Fusion, Forma and Flow connect data, teams and workflows in the cloud on our trusted platform, making Autodesk rapidly scalable and extensible into adjacent verticals from architectural and engineering to construction and operations, from product engineering to product data management and product manufacturing.

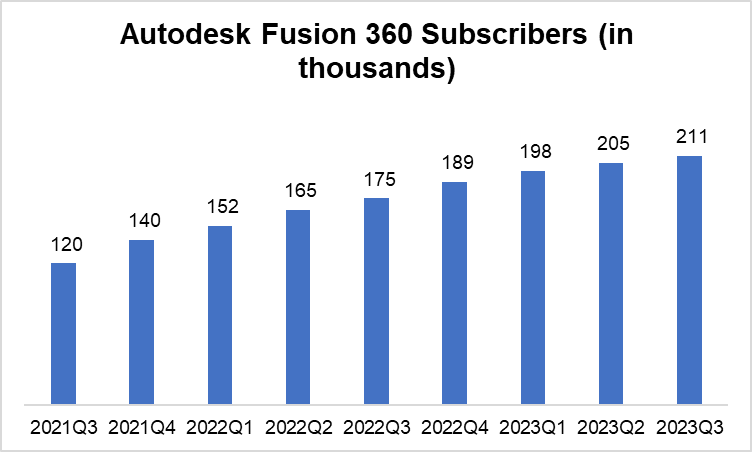

Don't expect these announcements to lead to anything material anytime soon. Fusion took almost a decade to be where it is today; Andrew Anagnost, CEO of Autodesk, seemed to think it'll take ~5 years for Forma to mature and even longer for it to totally replace what the customers are doing.

Speaking of Fusion 360, subscriber number continues to chug along but at a slower pace which is expected given the macro environment.

More caution about macro:

Channel partners remain optimistic, but with hints of caution. Usage rates continue to grow modestly in the U.S. and APAC, excluding China, but are flat in Europe, excluding Russia.

Labor shortage is still the primary concern, but demand softness is appearing on the low end:

one thing continues to pressure the industry more than the demand, and it is the labor shortages and the capacity to execute. Construction companies still have a backlog of business. They're still struggling to execute through the business that they have to.

If anything what we're seeing is softness in the low end of our business, which is what you would expect in a climate like this. LT growth as well with LT renewal rates have seen some pressure. That's where we're seeing things. The collections percentages, the collections renewal rates, these have remained steady throughout the year and throughout the quarter.

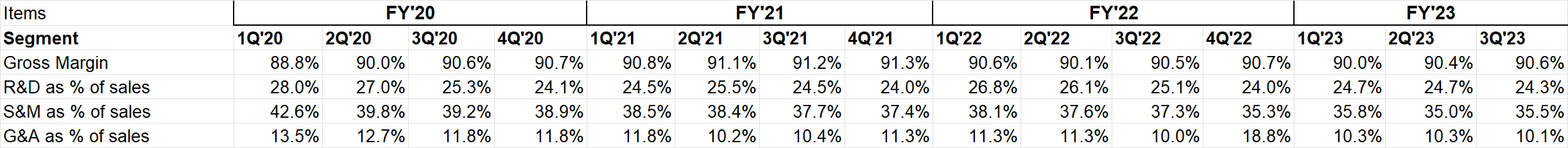

Cost structure

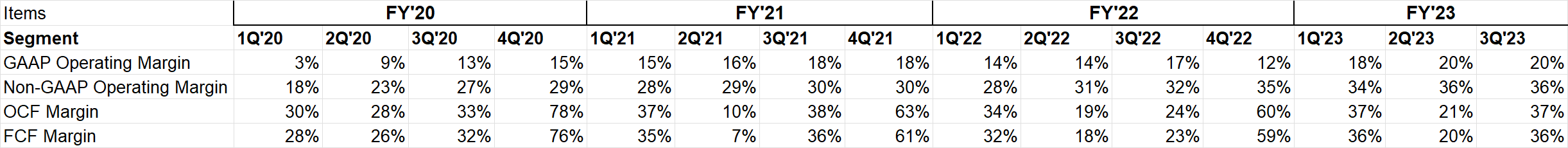

GAAP EBIT margin expanded from ~17% in 3Q'FY22 to ~20% in 3Q'FY23. Non-GAAP margin similarly expanded from ~32% to ~36% in the same time. Management reiterated non-GAAP margin guidance to ~38-40% sometime in FY'23-26 window.

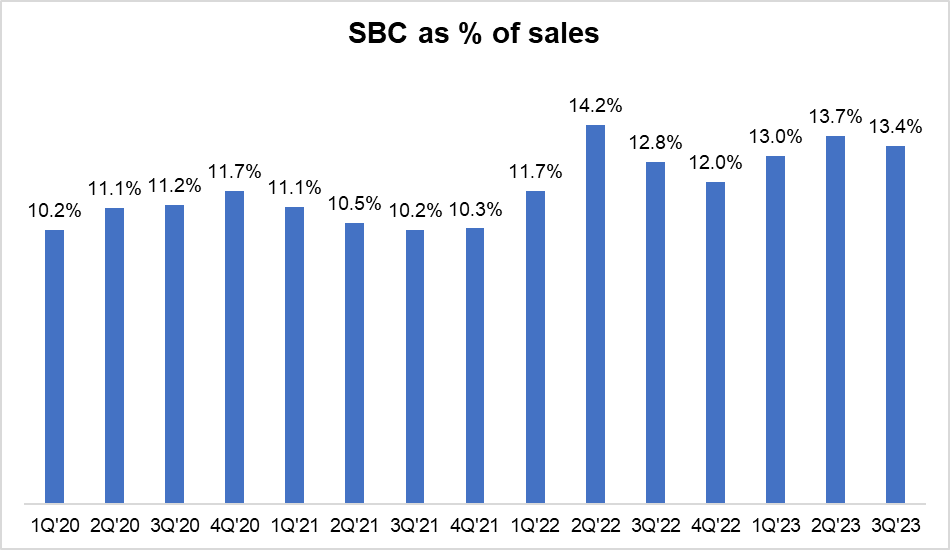

It is disappointing to see management focus on such meaningless number; you can always congratulate yourself just by issuing more SBC to hit your non-GAAP operating margin guidance. More on this later.

Capital allocation

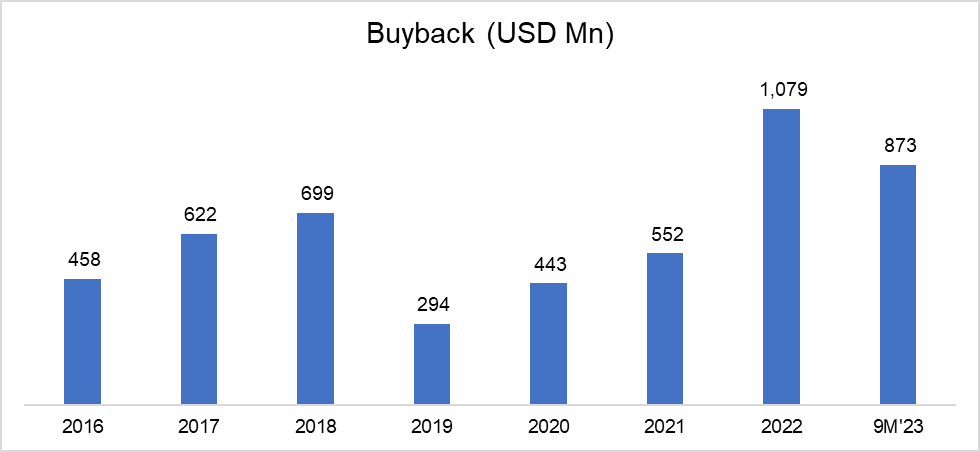

Autodesk so far bought back 4.4 mn shares this year with avg. cost of $200/share. Diluted shares outstanding decreased by 2.2% YoY. Frustratingly, they keep mentioning buying back stock primarily to offset dilution from SBC and don't think it as capital return strategy.

Speaking of SBC, this has become quite the hot topic recently and Autodesk is also under the scanner. While I do criticize the management to focus on meaningless metric such as non-GAAP operating margin, Autodesk hasn't been egregious in Silicon Valley standard.

Although SBC has no sign of cost leverage, off the top of my head I cannot think of any tech company (at least the ones I studied) which experienced any SBC leverage over their cost base. From ~10-11% to ~12-13% of sales is perhaps nothing to be too critical about.

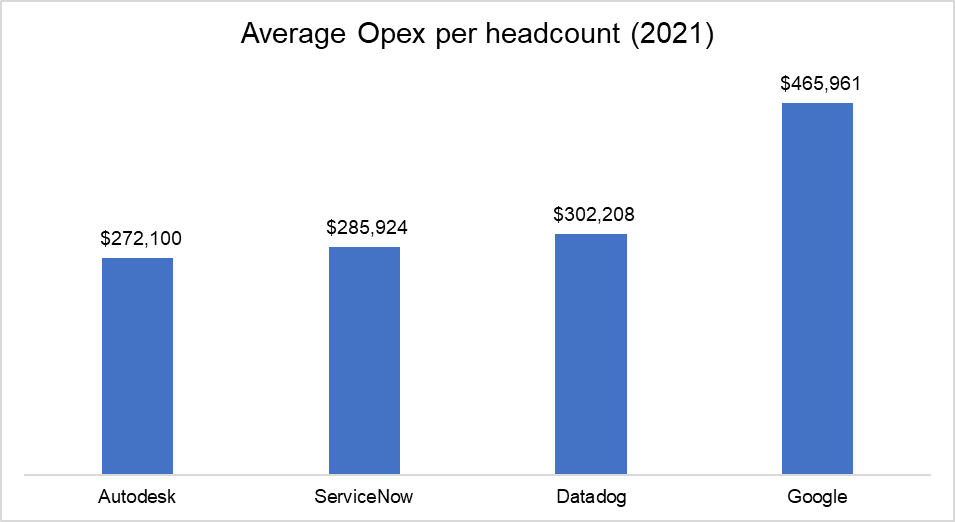

Moreover, by and large, I doubt any management in tech thinks about stock as a currency that needs to be intelligently used based on the price of stock. More realistically, most tech companies have a target comp in mind and a target mix of cash and stock. If your target stock comp is $1000 and the stock is trading at $100, you get 10 shares. On the other hand, if stock starts trading at $10, the employee will receive 100 shares with target comp remaining relatively fixed. The reason any company cannot just simply decide that they don't want to pay or want to pay less in stock is talent has been incredibly sought after in the last few years. I randomly picked four companies in tech in various stages/sub-sectors to see how Autodesk fares against them in terms of total comp and as you can see, Autodesk certainly doesn't stand out. Autodesk, in fact, has been more conservative than many younger software companies. But that is the talent market Autodesk had to operate in. As investors, we cannot simply daydream about low SBC or total comp because these companies need to hire people to run the business.

Autodesk also was relatively more prudent in hiring cadence. Number of employees increased by 13.9% and 9.6% in last two years respectively.

I do want to point out that it appears to me extremely likely that tech comp will go through a prolonged stagnation. Not many businesses can possibly afford to hire even recent college graduates with these eye popping comp packages. It is very, very difficult to build highly profitable businesses when opex per headcount is ~4-6x US GDP per capita. Now that big tech is on the retreat from the talent market (remains to be seen how long that lasts though), it is possible the talent war will cool off. This will also give us more hint just how human capital intensive these businesses need to be (lots of theories out there, but we will have much clearer answers in 2-3 years).

Outlook

Coming back to Autodesk, CFO perhaps intentionally set a cautious tone for FY'2024 as well citing FX, transition to annual billings etc.:

We'll have about a 5-point-or-so incremental FX headwind. That's because of the continued strengthening of the U.S. dollar and then another point of incremental headwind from exiting Russia.

That's going to make it tough for us to grow revenue beyond double digits. On margin, the revenue headwind creates margin growth headwinds, which likely means limited progress on reported margins in fiscal '24. Put another way, margins will look better at constant exchange rates. And then on free cash flow, FactSet consensus right now is a range of $1.2 billion to $1.7 billion. There's a couple of important things to consider.

The first is the rate at which our customers transition to annual billings. And the second is the overall macroeconomic environment. We continue to be focused on executing on that transition as fast as possible because while the change is good for us, and it's good for our customers, from a financial standpoint, we really want the noise behind us. So remember, the faster that we move the multiyear based annual billings, the greater the free cash flow headwind we'll see in fiscal '24. On macro, we will, as usual, give our fiscal '24 guidance based on the macro conditions that we see as we exit fiscal '23.

For my readers in the US, Happy Thanksgiving!

Autodesk's earlier earnings threads: FY 1Q'22, 2Q'22, 3Q'22, 4Q'22, 1Q'23, 2Q'23