Autodesk 2Q'FY 2023 Earnings Update

Disclosure: I own shares of Autodesk

"End market demand remained strong during the quarter, resulting in robust new business activity. Renewal rates were again excellent."

This was a solid quarter for Autodesk. Let's dig in.

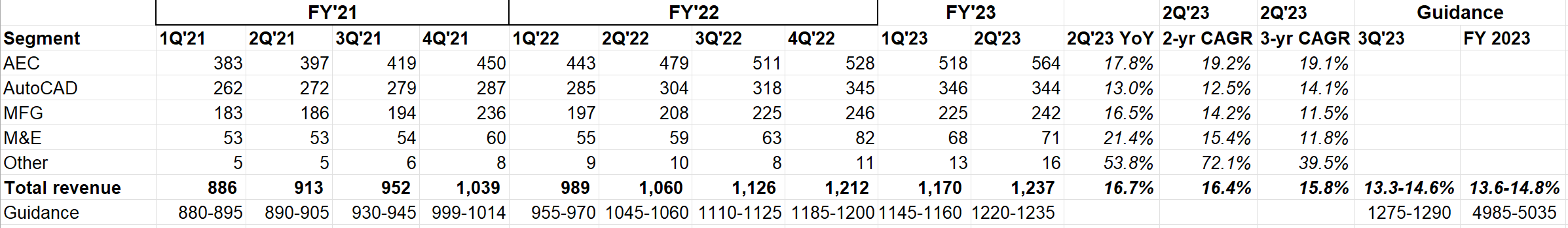

Topline

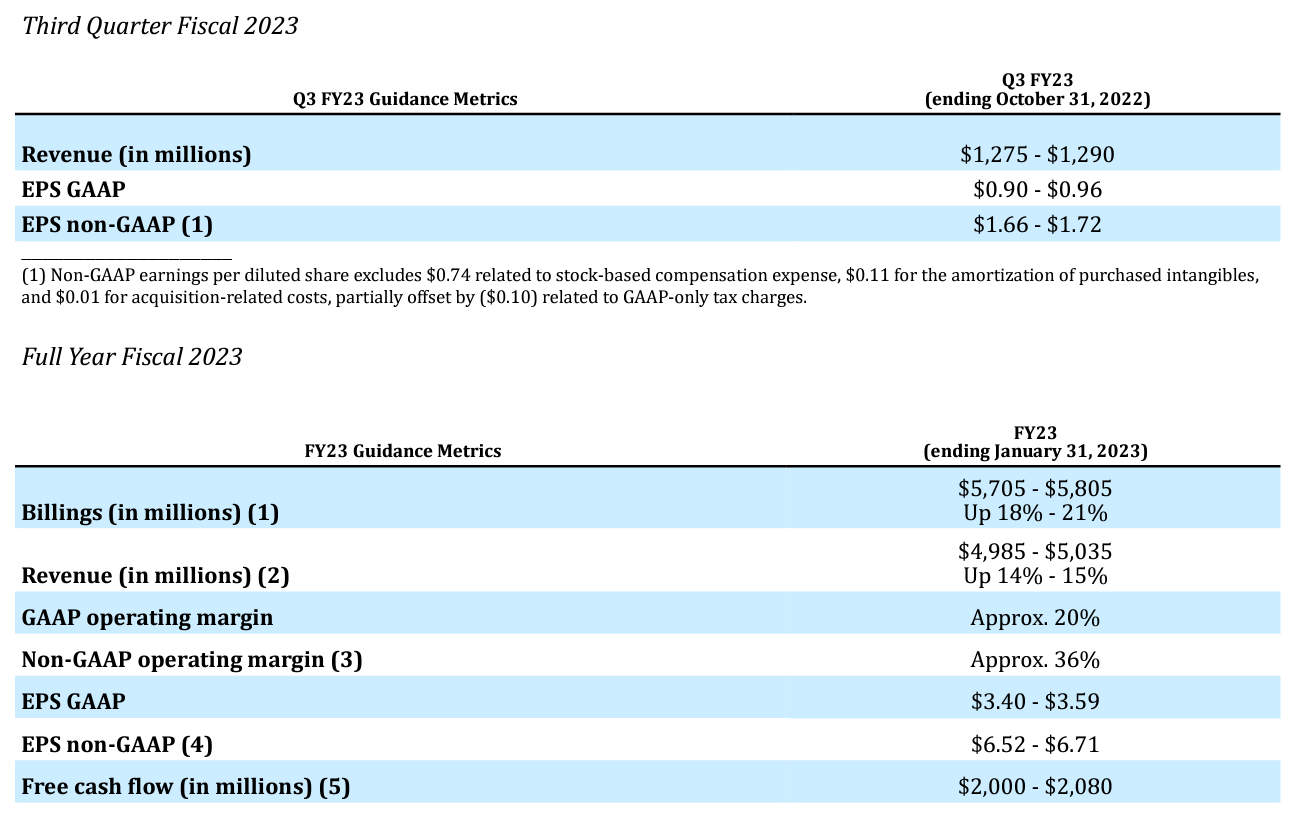

Autodesk beat the high end of topline guidance which, historically speaking, is pretty much the norm. Topline growth continues to hover around mid-teen. Guide for 3Q and full-year also implies mid-teen topline growth.

Fusion 360's subscribers reached 205k in 2Q'23 (vs 189k and 198k in 4Q'22 and 1Q'23 respectively). It also had its first million-dollar contract last quarter.

Direct revenue (higher margin business) grew +18% and now 34% of overall revenue. Net revenue retention +100-110%. Billings increased +17% YoY.

The transition from multi-year to annual billings is expected to start in FY'24.

One of the benefits of introducing "Flex pricing" may not be just converting non-compliant users, but also lowering the barrier for existing subscribers to dabble into other products of Autodesk:

"One of the growth vectors for Flex that I'm particularly excited about is in the long tail of our business. Because what Flex allows you to do, if you're in a smaller company, say you're in a 5-person company and you want to occasionally use Revit for some of the projects you bid on, but the vast majority of your projects are AutoCAD or you want to engage in structural simulation for a particular product, the Flex model lets people dabble. It lets people engage with advanced functionality and advanced capabilities on a pay-per-use basis. And they don't have to commit to an annual subscription or a multiyear subscription to get some of these capabilities."

Autodesk Build saw +45% MAU QoQ. Why is bidding activity important?

"So when you see an increase in bid activity on BuildingConnected, what you're actually seeing is an increase in the book of business of projects that will actually get executed downstream, right? So this is a good predictor of ongoing activity as you close a bid, you actually then move into execution with that particular subcontractor and some of the things associated with that."

Autodesk keeps hearing from its customers that labor market is tight:

"The biggest challenge we hear from these customers is hiring, frankly. We were hearing last year a lot of conversations about, oh boy, fixed bid contracts and inflationary pressures and all these things. As I've said previously, they bake these things now into their business bids and they're able to capture those costs in their contracts. But what they're struggling with is hiring."

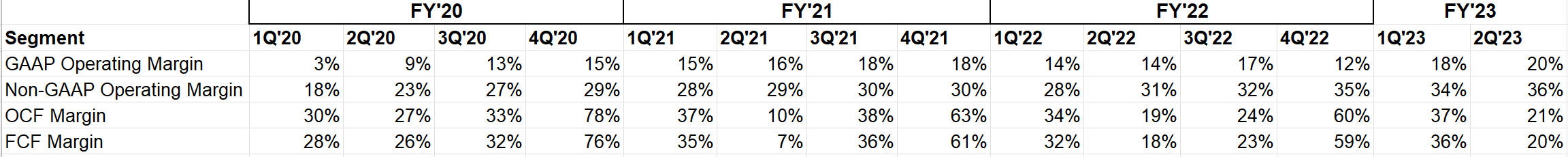

Profitability

Autodesk posted its highest GAAP operating margin in the last quarter at least in the last 10 years. Operating Cash Flow (OCF) Margin and FCF margins are a bit more volatile due to working capital dynamics.

Autodesk has the highest R&D budget among its peer group, but doesn't have the highest headcount in R&D. Why?

"Part of that is because of where we concentrate on R&D and what kind of talent we're pursuing. We're pursuing a lot of cloud talent, a lot of cloud-native talent, full staff development talent that allows us to build out the core cloud capabilities and continue to expand them. That talent resides in certain places, and it has certain costs associated with it and we think that's the right strategy."

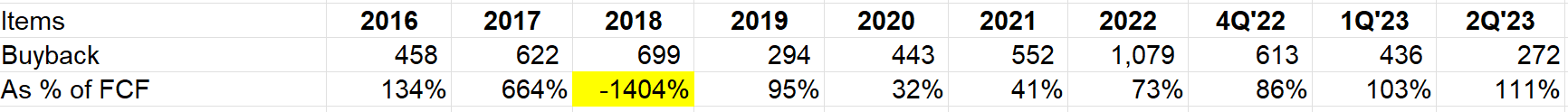

Capital Allocation

Autodesk bought back 1.4 mn shares at $182/share. Weighted avg. share count, however, declined by only 1.8% in last 12 months given most of the buybacks is just offsetting SBC.

While buyback amount slowed down compared to 1Q, Autodesk did repurchase shares in excess of FCF it generated in 2Q. I wish they used their ~$1.5 Bn cash balance more aggressively in buyback.

Don't expect capital return to be major theme though as management reiterated plan to be opportunistic in acquiring companies and buybacks continue to be thought of as primarily to offset SBC.

"We've proactively used our strong liquidity to repurchase 3.5 million shares in the first half of this year, front-loading the offset of next year's dilution."

Given how entrenched Autodesk's moats are in AEC and AutoCAD, a bit more leverage in balance sheet probably would be accretive to shareholders especially if used for buybacks. To be fair, Autodesk did issue $1 Bn debt at 2.4% in October, 2021; so management deserves some credit there.

Outlook

As I discussed after Q1, Autodesk trades at ~23x FY'23 FCF, but half of that FCF is SBC and NWC benefit, so ~45-50x after burdening for SBC and ignoring NWC benefit. If they can maintain mid-teen topline growth with expanding margins (so high-teen GAAP EBIT growth), the stock should work in the long-term.

You can read my Deep Dive on Autodesk here.

Autodesk's earnings threads: FY 1Q'22, 2Q'22, 3Q'22, 4Q'22, 1Q'23