Veeva: Durable Vertical Cloud Platform

You can listen to this Deep Dive here

Peter Gassner, founder and CEO of Veeva Systems, apparently had a deep aversion to following the herd from his early childhood. True to his instinct, while in first grade he let his parents know that he doesn’t want to learn how to read. Instead of panicking, his mother was unperturbed: “That's fine. You know, I never met a 18-year old who didn't know how to read. I'm sure you'll get there.”

More than three decades later, Gassner came up with another seemingly crazy, non-herd following idea: “I'm going to make something very specific to an industry, very specific to an industry in the cloud.” Remember, this was a time when people were skeptical of long-term future of cloud itself, let alone a vertical or industry-specific cloud platform.

Gassner’s friends and acquaintances were less receptive with his contrarian hunch than his mother which only emboldened his belief that there may be a big market for catering to a specific industry, especially one with a byzantine of regulation and compliance requirements such as Life Science. With Global Financial Crisis (GFC) in the backdrop, there certainly wasn’t easy money sloshing around waiting to fund anyone’s contrarian thoughts.

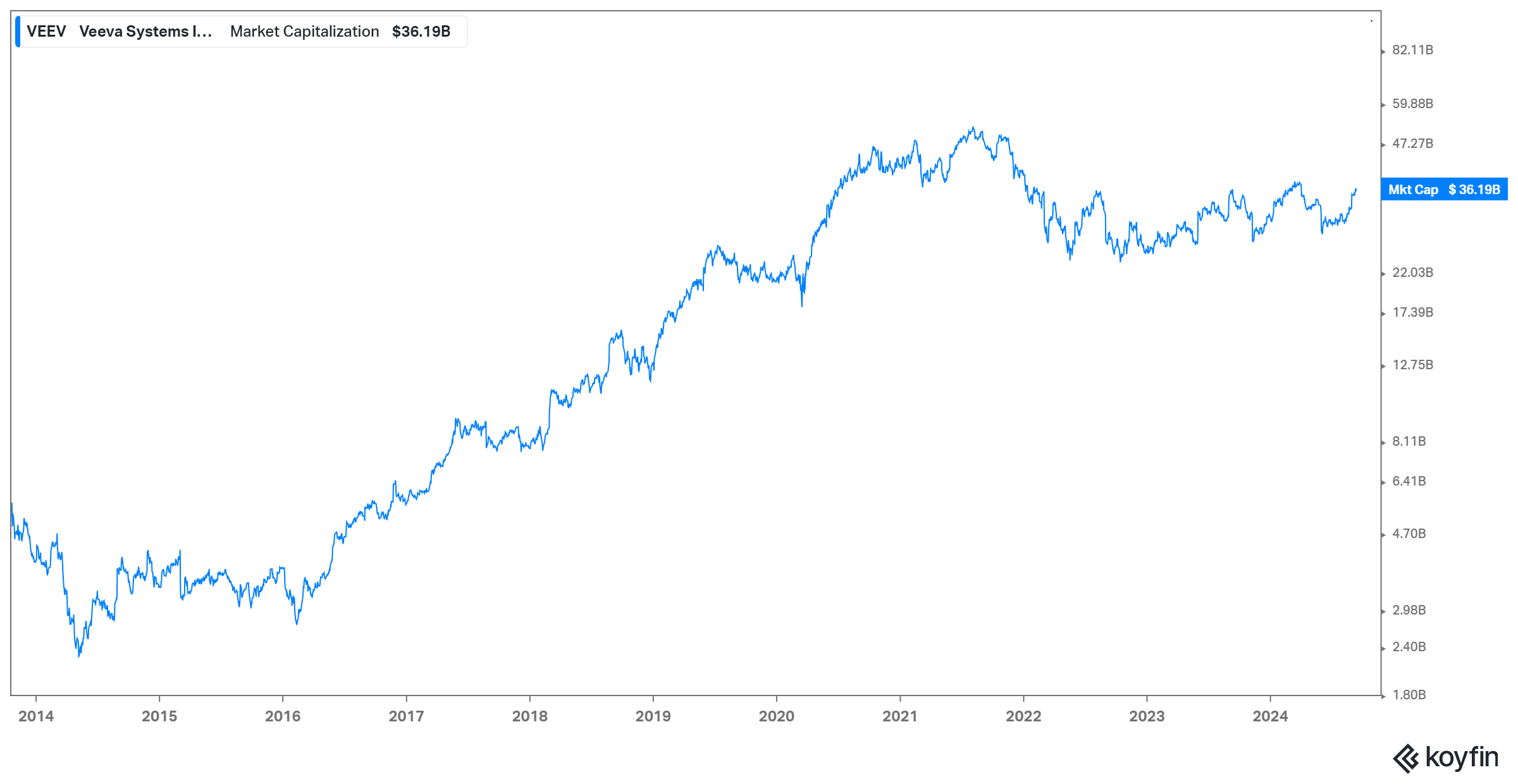

After helping Salesforce IPO in 2004, Gassner, who was SVP of Technology at Salesforce, left the company in 2005 and started seriously pondering about building a vertical cloud platform for life science industry. Gassner raised just $3 million in the seed round to found Veeva in 2007. He raised another $4 million in 2007 before going for IPO in 2013. Even though they raised $7 million before IPO, they apparently burned only $3 million, and the company self-funded itself through internal cash generation to become ~$36 Billion market cap company today. In fact, Veeva posted +23% GAAP operating margin in the year before they went for IPO!

In an era of tech companies burning cash year-after-year to get to the ever elusive promised land sometimes decade(s) later, Gassner truly was a contrarian through-and-through. In Gassner’s words:

The thing is, when we started out, I had a lot of pressure from people, including early investors and stuff to spend more, spend more, spend more. I had a lot of pressure on that. I was the guy who just didn't get it. I just didn't get it.

They were saying, “Spend more,” and they were convinced, I was the guy who just didn't get it. I was too conservative, but that's OK. You get all kinds of outside pressure, and you have no chance for being great if all you're doing is following the herd.

I thought it wasn't right. I thought, “No, I think it's good to have top line and bottom line, and I don't want to take any more money, because then I'll dilute the company. Why would I do that?”

…Gosh, if we're building a lasting company, a lasting company should have a reasonable profit margin.

I always thought, “God, it's sort of like a drug. If I get on that non profitable drug, like when am I going to get off of it and stuff.” It just seemed like, “No, you don't do that. That's not the way to do it.

Given that all it took just burning $3 Million to generate positive cash flow, it may be tempting to think the business was sailing from the very beginning. But as it goes in any business, the early days were typically challenging. When Gassner spoke with potential customers about their CRM product, they all were uninterested. However, he did pick up from those conversations that the customers weren’t quite “emotionally attached” to their existing solutions either. The very first customer Veeva got actually chose Veeva for completely uneconomic reason. The CEO of the customer company just wanted to buy some software to remind his IT team who was actually in charge.

Veeva’s first actual consequential customer was Pfizer. While meeting with Pfizer to discuss Veeva’s offerings, Gassner was met with skepticism as someone from Pfizer wondered how a startup would deliver a complex software product when Veeva had fewer employees than the number of Pfizer employees in that very meeting. Veeva was, nonetheless, able to convince Pfizer that they mean business. When Pfizer signed the deal with Veeva, they paid $3 million cash in upfront payment and thanks to this deferred revenue that leads to positive cash flow cycle, Veeva quickly figured out that they can grow without much dilution if they can just keep executing and delivering their promises to their customers.

So, what does exactly Veeva’s products do? Veeva specializes in industry-specific cloud-based solutions—including data, software, and services—to the global Life Sciences industry. Veeva started its journey with their customer relationship management or CRM solution for life science sales representatives enabling a broad range of industry-specific functions such as drug sample tracking with electronic signature capture, healthcare affiliations management, and the ability to conduct interactive, rich media demonstrations with physicians on a mobile device, with or without an internet connection.

While Veeva initially built its CRM platform on top of Salesforce (more on this later), Veeva decided to build its own platform when they branched out of CRM. Veeva launched “Veeva Vault” in 2011 which is their regulated content management and collaboration solution that enables the management of complex, content-centric processes during clinical trials and managing the workflows and approvals for promotional materials, in compliance with stringent government regulations.

Like its CRM product, Vault also became a huge success for Veeva. Veeva’s revenue increased by more than 10x from just $210 million in 2013 to $2.4 Billion in 2023. What is remarkable is there was a very detailed short pitch by Suhail Capital on Veeva back in 2013 casting a lot of doubt on Veeva’s TAM (To Suhail Capital’s credit, they understood their mistake and ended up going long Veeva in 2016):

total addressable market for all three Veeva products is currently somewhere between $1 billion and $2 billion. The market cap of Veeva is now 3x-6x the entire annual revenue opportunity of its industry!

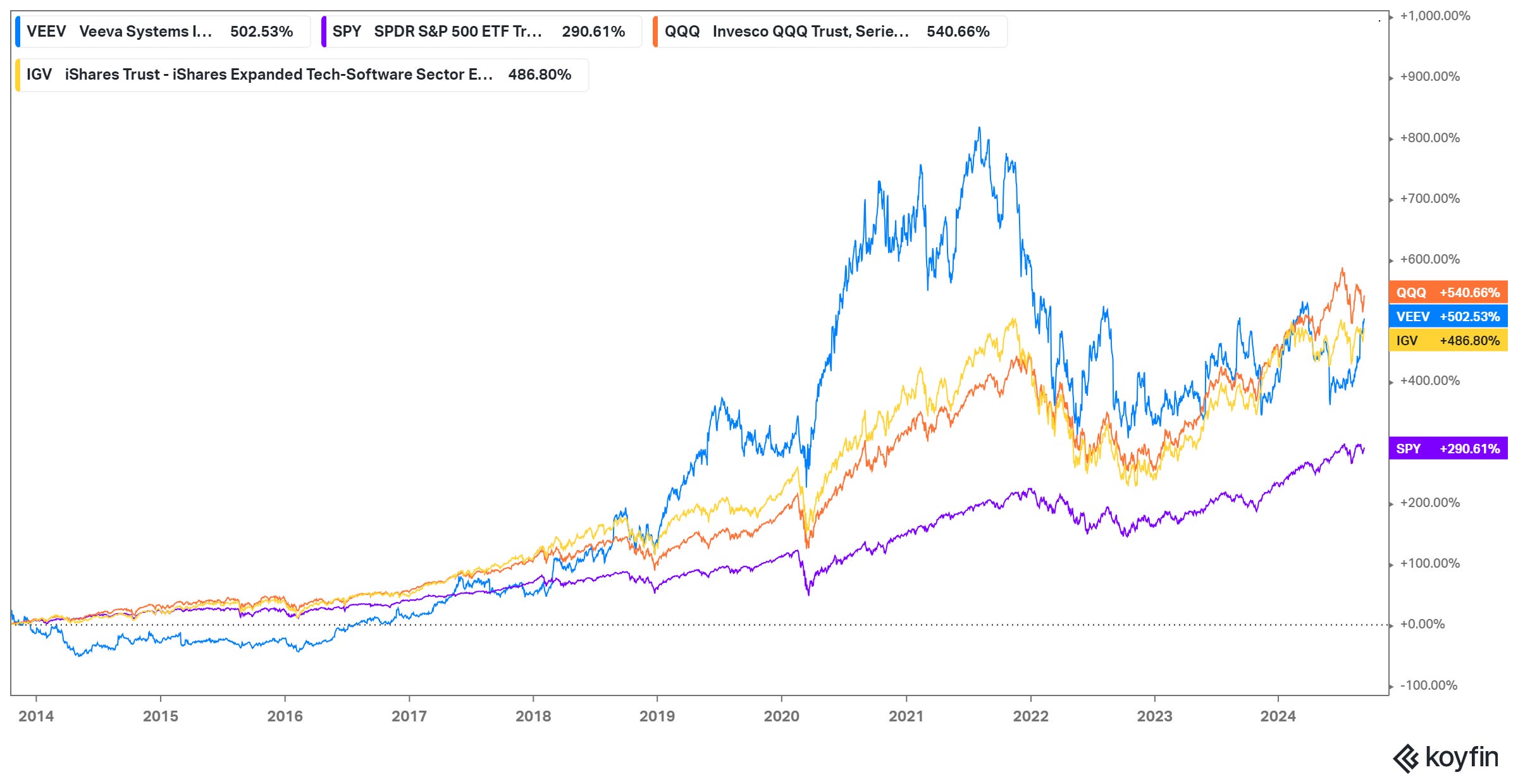

Despite Veeva being down ~33% from its peak in 2021, the stock still 5x-ed since its IPO in October 2013. Veeva remains very much focused on life science industry, but they have also started growing their ambition beyond life science industry.

Here’s the outline for the rest of this Deep Dive:

Business Overview and Economics: I discussed a brief company as well as product overview in this section. The economics of the business is also explained here.

Competitive Dynamics: I elaborated on Veeva’s total addressable market and competitive advantages against point solutions. Recent competitive dynamic, especially against Salesforce is also a key focus in this section.

Capital Allocation and Management Incentives: Veeva has a challenge that many companies probably would like to have. They generate too much cash to deploy which makes capital allocation perhaps one of the key questions for the shareholders today. I discussed the implications here, and highlighted management incentives.

Model Assumptions and Valuation: Model/implied expectations in the current stock price are analyzed here.

Final Words: Concluding remarks on Veeva, and disclosure of my overall portfolio.