Spotify 4Q'23 Update

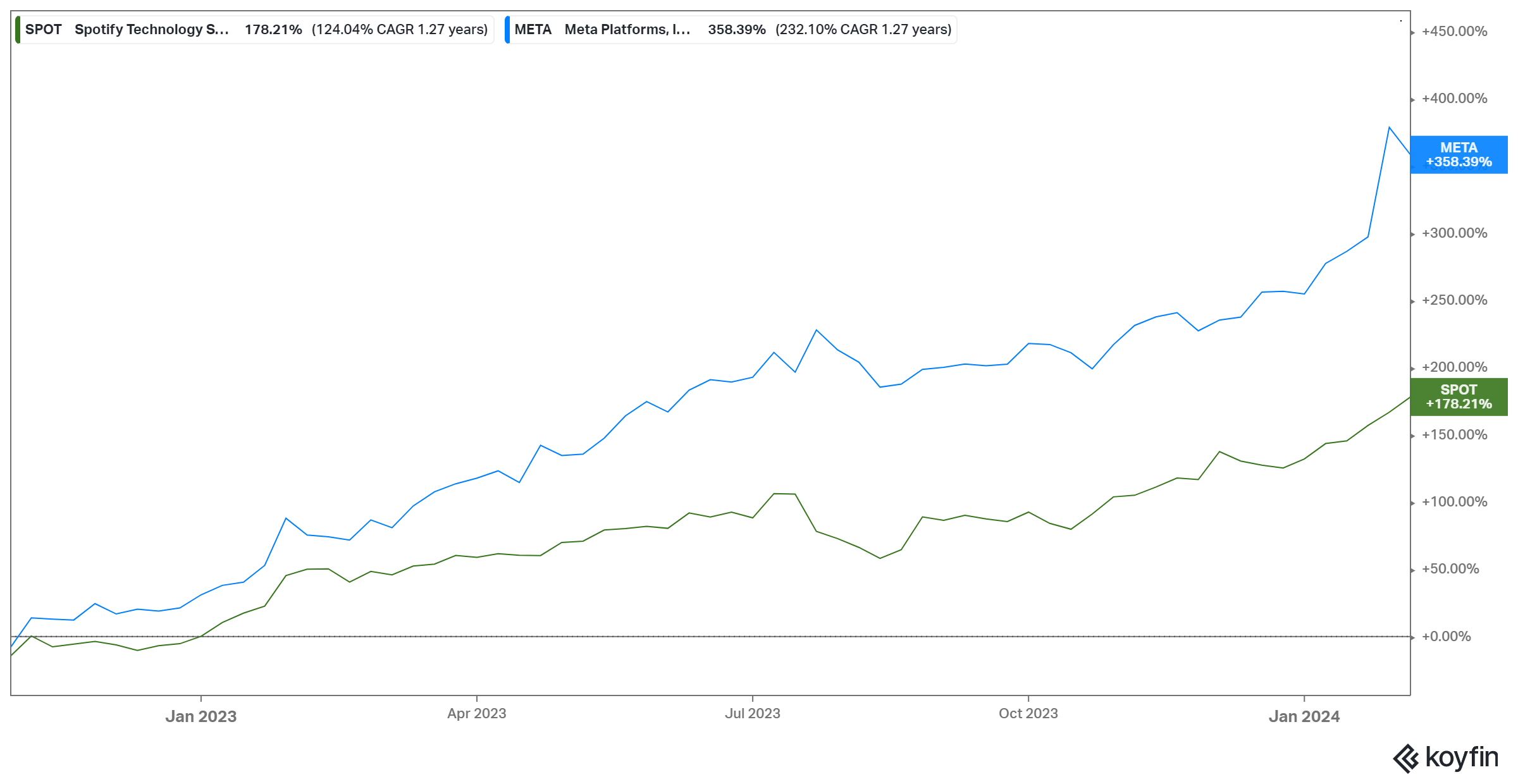

While not exactly Meta-like twists and turns, Spotify’s rise from the ashes of late 2022 perhaps slipped through many investors’ mind. The stock was at ~$70 in December, 2022. Today, it closed at $232.

Before I get to my highlights from today’s call, let me first mention that I am no longer a shareholder of Spotify as I sold my shares today at $243. I will briefly discuss my rationale after discussing the highlights from the call.

Users

This was another strong quarter in both premium subscribers and Monthly Active Users (MAU). Spotify’s MAU momentum over the last 5-6 quarters truly defied my expectations.

However, premium subscriber as % of MAU declined from ~44% in 4Q’21 to ~39% in 4Q’23. Spotify again reiterated that they continue to believe that a strong top of the funnel will eventually lead to upgrade to premium subscription, but considering premium mix as % of MAU has declined for six consecutive quarters may hint that Rest of the World (RoW) from where much of the MAU growth is coming from is a structurally different market; premium penetration in RoW may be structurally lower compared to other regions.

Netflix vs Spotify

This is something I track every quarter. Netflix has almost entirely eliminated the gap with Spotify in terms of subscriber growth that persisted for the last 12 quarters.

I should mention that definition of subscriber of NFLX and SPOT is not apple-to-apple, so I would caution not to infer more than what this data can tell us.

Revenue

4Q’23 enjoyed the full benefit of price increases which helped drive 16.7% growth in premium subscription revenue. While overall reported revenue growth was 16.0%, it was +20% FXN, which was ~300 bps QoQ acceleration. Please note that FXN revenue growth in 3Q’23 also had 300 bps QoQ acceleration.

Podcast

Spotify has been shifting its podcast strategy for the last few quarters; they have clarified their changing strategy during this call:

…we're in a very different position than we were just a few years ago in podcasting because today, Spotify is, in many cases, the #1 podcasting player already.

…so exclusivity makes sense when you're the smaller playing trying to gain scale. When you're the bigger player, the additional value of the exclusivity is far smaller than it is about being aligned.

…while exclusivities were net positive on the side, it's not driving as much as the opportunity that we see on the ad side. And so by broadening distribution, we think we can accomplish a number of different goals. Most notable among them, we are going to be more aligned with the creator. The creator obviously wants to be on many different platforms and wants to have as big of an audience as possible.

Although Spotify guided last quarter that podcast may reach breakeven for 2024, they were already close to breakeven in 4Q’23 and now guided for full-year profitability on podcasting in 2024.

Audiobook

Some interesting details on recently launched audiobook segment:

Data shows that our entry into this market has dramatically accelerated its overall growth. In Q4, we became the #2 provider of audio books behind Audible, which is notable given how entrenched the legacy players are.

…the biggest surprise has been the type of titles that resonate with consumers. These are not the normal titles that traditionally does well, that do well on Spotify, and that's pleasing to see because that means we're bringing a whole new audience to audio books, the format, which is great to see.

Apple

While many had high hopes that EU’s clamp down on iOS ecosystem may lead to some reprieve for a company such as Spotify, we now know Apple seems to be one step ahead of the regulators to kill those hopes. The deadline to be compliant with Digital Markets Act (DMA) in March 07, so EU regulators may still outmaneuver Apple’s tactics. If they do, Spotify did outline the benefits that may accrue to them:

…a la carte purchases, things like superfan things like purchasing of audio books, top-up things that could be quite meaningful for Spotify's revenues is a significant hindrance today because Apple insists on taking a 30% cut, which in many cases, exceeds even our own cuts that we're able to take inside of the app. So some of these more innovative things that we would like to do, we are currently restricted in doing on the iOS ecosystem, which limits some of that more innovative things that we would like to do.

Gross margin (GM)

Overall reported GM was +26.7%. Music GM was +29.1% (same as 3Q’23). GM in ads was 11.6% (vs 8.3% in 3Q’23). Expect GM improvement to continue in 2024:

As you look into 2024, we expect to see a continued improvement in our gross margin trends and a continued improvement in our operating income trends as well.

when you think about the improvements and gross margin moving to 2024, marketplace will be a key contributor, again, along with the podcasting flip and some of the other costs of revenue.

Opex

Spotify had EUR 143 Mn charges for “efficiency” actions aka mostly layoffs. Excluding this charge, Spotify posted EUR 68 Mn operating profit which was more than double of 3Q’23 operating profit.

SBC went down from EUR 100 mn in 4Q’22 to EUR 34 Mn 4Q’23!!

Outlook for 1Q'24

Perhaps even more importantly, Spotify surprised with ~5% operating margin guide in 1Q’24. Moreover, they indicated that both gross and operating margin will likely keep improving throughout the year. That is going to be quite the turnaround from 2022 when they posted -5.5% operating margin. Basically, Spotify is now expected to improve operating margins by more than 1,000 bps (no typo) in just two short years. Perhaps rising interest rates and/or a threat of recession isn’t necessarily a bad thing if that’s what it takes for some of these tech companies to wake up and run the business properly.

Why I sold Spotify

I first bought Spotify in December, 2021 at ~$240. By the end of 2022, I identified buying Spotify as a mistake mostly due to my naivete around their ads business. However, while I was admitting my mistake on the ads business, especially podcast business to myself, bears were essentially doubting whether Spotify is even a real business when the stock was trading at below $100. Since I strongly disagreed with such sentiment, I averaged down and my average cost was $115. Unfortunately, I found it quite hard to hold onto my shares in Spotify and started trimming from $140 and sold whatever I had left today.

Why was it much harder to hold Spotify? As I was introspecting about it, I could find at least four reasons:

a) It is simply hard to hold onto unprofitable companies. When profits are just figment of your imagination i.e. forecasts in the future instead of reality of today, I suspect it is psychologically more challenging to hold onto such stocks, especially for a company that hardly ever made money despite being founded in 2006.

b) While many bears assume Spotify’s core music business as just a commoditized and easily substitutable product, actual users vote differently by having much higher engagement and lower churn compared to other music streaming alternatives. However, as it’s often the case for most bull/bear cases, there is a point/valuation at which bears (or bulls) argument can start to make a bit more sense. For example, while I consider it unlikely that Amazon or Google will snatch any noticeable percentage of subscribers away from Spotify, I also don’t think it is likely that Amazon or Google will ever leave this business. I don’t agree with bears when they say Google/Amazon/Apple want to subsidize losses here and make money through other parts of their respective ecosystem, there is, however, some ounce of truth that their presence is a hindrance for Spotify’s long-term ability to exercise pricing power. By 2030, we will almost certainly reach saturation across the world in music streaming and hence the ability to raise price may become the primary driver of revenue growth in music streaming. The broader point I am trying to drive here is Spotify’s moats, although not as fragile as bears may think, are not quite as strong as most of my portfolio holdings.

c) In retrospect, while $140 may have been too early for me to trim, I didn’t quite envision how quickly they were able to dial up their efficiency button. However, at $240, the stock has somewhat steep expectation embedded in. After today’s earnings, I updated some of my numbers, and I could get to EUR 3-3.5 Bn EBIT (assuming ~8-10% EBIT margin) in 2030 (vs EUR 3.4 Bn Gross Profit in 2023). If you take EUR 3.2 Bn EBIT in 2030, I would still need to assume ~25x EBIT multiple in 2030 to get to ~9-10% IRR. ~25x EBIT may be okay for a business that has pretty robust moats with continued pathway for growth. I wasn’t confident Spotify will fit that description in 2030.

d) Finally, I think I was a bit jumpy in selling Spotify because of what I own in my portfolio. With a significant exposure in tech and a fresh memory of what that led to in 2022 made me perhaps too eager to lighten my exposure to tech as these stocks just kept rallying. And most of the time when I was looking for trimming my exposure to tech, Spotify seemed a better candidate than other tech companies I own in my portfolio.

Since I sold the stock, I am closing my coverage of Spotify for now, but if there is significant upside/downside volatility from here, I may come back to infer the right lessons in the future.

While I have you here, I would like to let you know I am currently working on AppFolio (ticker: APPF) for this month’s Deep Dive. I hope to publish by 22nd of this month.

Thank you for reading.