Meta Platforms: Model Update

Disclosure: I own shares of Meta Platforms

So I took this weekend to update my models on Meta and Amazon. I just wanted to leave some brisk thoughts on these updated models.

I will start with Meta today and will share my thoughts on Amazon tomorrow. You can find the updated model on Meta here which I encourage you to download to play around with your own narrative as you see fit.

Let’s start with the frustrating bit: Reality Labs (RL).

Reality Labs (RL)

Revenue Model

Since I just mentioned this is going to be brisk, I am going to assume you have read/followed my earlier piece on Meta in which I went to a much greater length in explaining the thought process behind the structure of the model.

For Reality Labs model, I have segmented revenue build in two categories: a) Virtual Reality (VR), and b) Augmented Reality (AR). Of course, it is nearly impossible to model Reality Labs revenues long-term given how speculative this segment still is and how spotty the adoption has been so far, so take these numbers with a grain of salt.

With Quest launch in late 2023, buzz from Apple Vision Pro, and Meta’s expected launch of Quest 3 Lite in 1H’24, I am modeling an uptick in hardware sales units for VR in 2024 and 2025. Beyond that is just a pure guessing game.

AR glasses is also just as hard to forecast. As Meta mentioned in 4Q’23 call, the new Meta Ray-Ban Smart glasses have been selling well, have seen higher retention than the last version, and with multi-modal AI assistant expected to be active on these glasses soon, I have modeled some momentum in the next couple of years in unit sales. AR glasses are the primary form factor through which Meta wants to put a dent on the dominance of smartphones, and there is an expectation that we may get to see a more tangible glimpses of such consumer ready AR glasses in 2027. My model assumes lower price per unit than what you see in retail price because I am implying Luxxottica keeps ~50% of the hardware revenue.

While there is perhaps a 90% probability of this being “garbage-in-garbage-out” revenue model, it’s the thinking process that counts which we will need to update as we get closer to understanding the adoption rate of such hardware among consumers. Don’t pay too much attention to the revenue/gross profit numbers because I am not modeling Reality Labs to reach anywhere close to profitability even by 2030.

RL Opex

Looking at Reality Labs numbers is really not for the faint hearted. While things may change in the future, so far this meme probably depicts the reality of Reality Labs aptly!

It was disappointing to see Meta mentioning once again that losses will increase “meaningfully” in 2024 despite losing ~$16 Bn in 2023. What does “meaningfully” mean for 2024? I suspect the answer is closer to $20 Bn.

Given how Meta has navigated RL in the last few years, I no longer feel comfortable in assuming RL losses will peak anytime soon. I have modeled continued increase in losses until 2028 when the losses are assumed to have peaked. Nonetheless, even 2030 losses is modeled to be ~$20 Bn.

Am I being too pessimistic? Meta bulls would probably think so, but wouldn’t investors be somewhat incredulous as well if someone told them in 2019 that Meta is going to spend $60 Bn aggregate opex against aggregate revenue of mere $8 Bn in 2019-2023 period. I bet you would think that’s overly pessimistic, and yet that’s what Meta spent over the last 5 years with continued guidance for more losses in RL.

Looking at these numbers, I have come to the sobering conclusion that there is perhaps less than 1% probability for Meta to generate ~10% IRR on their investments in RL. The only way it may make sense to invest as aggressively as they did/do is to assume the bet on RL is far from “other bets”, and it is very much a core bet that is required to protect and even grow Family of Apps (FOA) business for decades to come once they truly can control their destiny on the next platform shift.

Anytime you read how Meta has “pivoted” from Metaverse to AI, remember these losses! As shareholders, it is perhaps not unfair to expect some guidance from management when we can expect RL losses to peak.

Family of Apps (FOA)

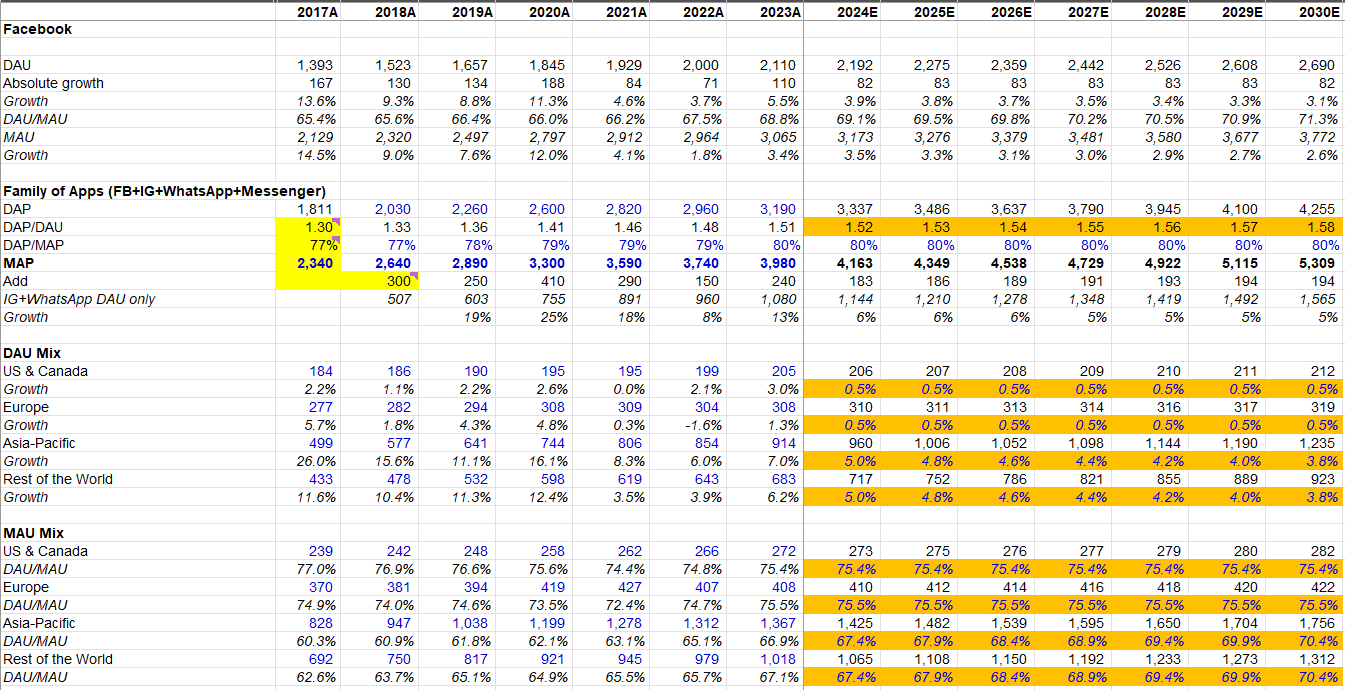

Users: This is all self-explanatory. Just take a peek at the numbers and assumptions going forward.

FOA revenue model

As FOA has regained much of the signal losses from ATT, Meta’s monetization has improved a lot. Since the economy is expected to fare fine and thanks to the continued rollout of Advantage+ and Shop Ads (which quickly became $2 Bn run-rate business after launching just in the US in 2Q’23), I am modeling ARPU momentum to continue in 2024. Beyond 2024, I am modeling closer to MSD type ARPU growth in 2025-2028 in the US and then reach closer to nominal GDP growth by 2030. International ARPU growth is modeled to outpace North America.

Other revenue, which is largely revenue from WhatsApp business platform, is modeled to grow ARPU at a rapid pace throughout this decade. Because we are still in the early stage of WhatsApp Business monetization, despite such seemingly aggressive assumption, I end up with only ~$1.4 ARPU (worldwide) in 2030. There is perhaps a non-negligible probability that this number may be substantially higher than I am modeling, especially if SMBs utilize WhatsApp and AI assistants to chat with customers for customer service, repeat purchases etc. It’s hard to underwrite these numbers with higher conviction until the numbers continue to show up quarter after quarter since WhatsApp monetization has been dreamed by investors for a number of years without seeing a lot of tangible evidence to it in financials. Recent numbers hint that it may be changing, but I will wait before underwriting even more optimistic scenarios.

I should note that my numbers are slightly conservative than street estimates and likely more conservative than buy-side estimates. I am perhaps a bit more concerned about the tough comp in 2H’24, but it is possible that I may be underestimating the multiple tailwinds (Shop ads, Advantage+, ever improving ad infra post-ATT etc.) especially if the economy continues to grow at a healthy pace.

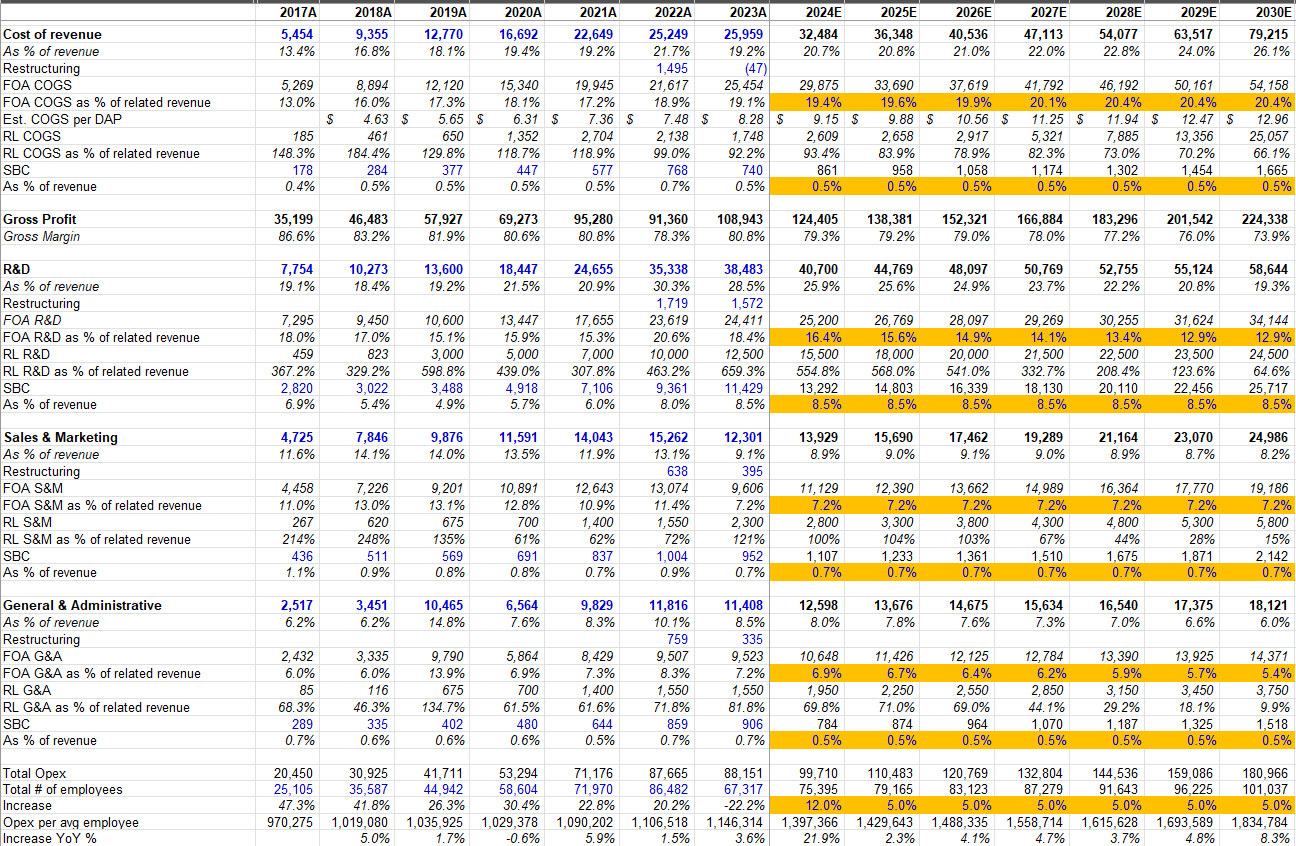

FOA Opex

My Opex model below is also self-explanatory. What I would like to highlight is I do suspect most investors are too eager to model the low end of the opex guide for 2024 ($94-99 Bn) whereas I wonder whether the prior trend of guiding higher opex and then lowering opex almost every quarter throughout the year still holds under Susan Li as reliably as did under David Wehner. If RL losses are indeed going to be ~$20 Bn in 2024, I think there’s a decent probability of total opex to reach closer to $99 Bn rather than $94 Bn. While consensus opex estimates seem to be ~$98 Bn, I have been hearing estimates closer to $94 Bn from some of my buy-side friends which I find to be a tad bit aggressive.

MBI vs Consensus

Thanks to slightly higher opex and lower revenue than consensus estimates, my operating profit lags the street estimates for this year and continues to trail behind street estimates in out years as well.

What if I am closer to the reality than sell/buy-side estimates for Meta in 2024 (and beyond)? While missing estimates may be a terrible news for many investors, I am not sure it should necessarily concern “actual” shareholders of the business since estimates is just one side of the equation, we also need to take a look at valuation multiples. Ultimately, in the near-term (~1 year), it’s the entry and exit multiple that often play a larger role in your return (note: what we have seen in Meta’s stock in the last 12-18 months is highly unusual; it’s not the norm), and forecasting multiple expansion/contraction within the next year or so is usually above anyone’s paygrade.

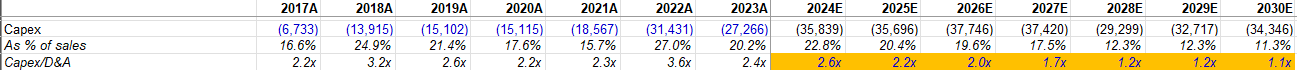

Capex

Before I touch on implied valuation multiples, let me quickly note that I am also modeling capex closer to the high end of Meta’s capex guidance for 2024 (guide: $30-37 Bn). Beyond 2024, I am modeling capex to be persistently above $30 Bn as it may be likely that we are closer to either beginning or mid cycle of AI-related infrastructure investments than to the end of it.

Valuation

To generate ~10% IRR (remember, I’m doing reverse DCF to figure out what I need to believe to generate ~10% IRR), I need to assume ~20x terminal FCF multiple. Please note even the terminal FCF number includes ~$20 Bn losses from RL segment. While that may seem to be a draconian assumption and I tend to agree, Meta management has made my job increasingly difficult by continuing to increase losses “meaningfully” year after year without giving even a hint at how far we may be from RL losses peaking. Since there is every chance of AR/VR being a protracted race between Apple and Meta (and who knows who else if this is indeed the future of computing), it is hard to have high conviction on how the losses will evolve in RL. Nonetheless, capitalizing $20 Bn losses with ~20x multiple is effectively implying RL to be worth negative $400 Bn which obviously just sounds wrong, so perhaps bulls can make a rather convincing argument that the “real” terminal multiple is 2-4 turn lower than what you see here.

Closing Words

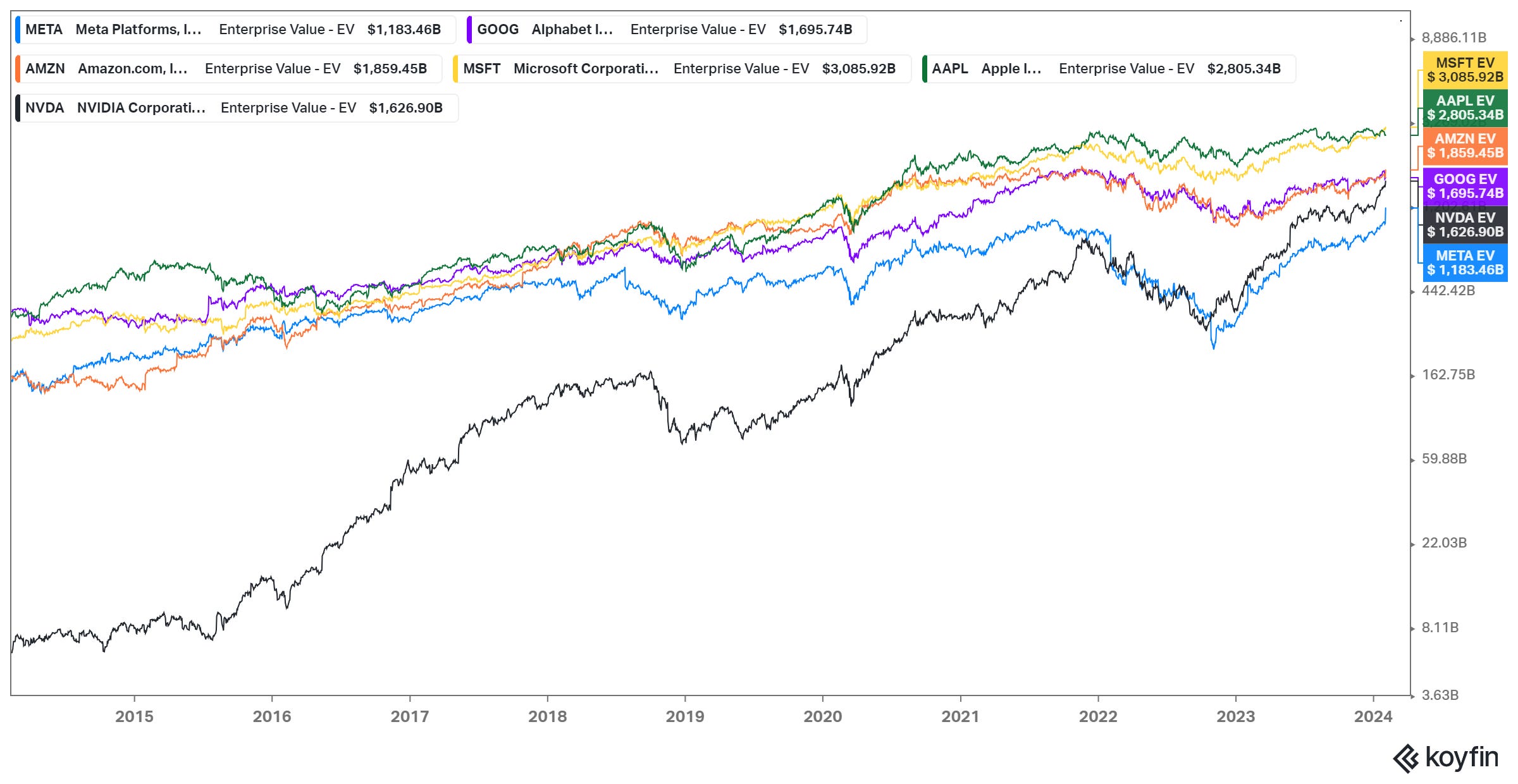

Times have changed a bit; Mark Zuckerberg is now being widely lauded by investors for subscribing to the efficiency religion in operating the company and somehow growing the company faster despite laying off a quarter of the company. If you are not a new reader here, you may be aware that I rate Zuckerberg very highly. Yet, looking back in the last 7-8 years in big tech land, it may be sobering to see Zuckerberg’s company was worth so close to other big tech companies in 2016-17 period, and today those companies are worth $500 Bn to $2 Tn more than Meta is today. Even Nvidia joined this trillion dollar club almost out of nowhere and is even worth more than what Meta is today despite the +400% rally since October, 2022. If Zuckerberg wants to position Meta near the top in this big tech club by 2030-35, he will have to allocate capital much more prudently than he did in the last 5-7 years.

Facebook turned 20 years yesterday; what a Harvard undergrad started as dorm room project turned into a more than a trillion dollar company. It is not lost on me what a downright remarkable achievement this is, but as a shareholder, I hope he continues to have a very high bar for himself for the next couple of decades.

I have exercised my January 2025 $50 call options on Friday last week and converted the options to stocks. I did sell 10% of what I received after exercising the options and plan to keep the rest 90% for the time being since despite the dizzying rally in recent months, the stock still seems reasonably valued.

I will upload an updated Amazon model and share my thoughts by tomorrow.