Sartorius Stedim: A Pure-play Pick-and-Shovel in Biotech

Disclosure: I own Preference Shares of Sartorius AG

You can listen to this Deep Dive here

In 1870, Florenz Sartorius, at the age of 24, founded Sartorius which was primarily a manufacturer of analytical balances in Germany. By late 1800s, in addition to balances, Sartorius expanded its operations to incubators for poultry farming and heating devices for bacteriological purposes. Before Florenz passed away in 1925, he decided on the succession plan to let his two sons (Wilhelm, and Erich) lead the company.

When Wilhelm died in 1937, Erich became the sole manager of Sartorius and he started to prepare his adopted son Horst Sartorius for the succession. You may be curious how Sartorius operated during the era of Nazi Germany, and your suspicion would be confirmed. From Sartorius’ own website:

During the Third Reich, Sartorius profited from the armaments industry and used forced laborers during World War II. The company's management upheld the regime by conforming to the system. This resulted in restrictions being imposed immediately following the end of the war, which, however, had no long-term consequences. In 1947, Horst Sartorius, representing the third generation, took over the management of the company and its economic restructuring.

Stedim is one of the many acquisitions undertaken by Sartorius.

Stedim, founded in 1978 by Bernard Lemaître and Bernard Vallot in France, initially focused on developing intravenous nutrient supply systems for patients with damaged digestive systems. The company pioneered special ethylene vinyl acetate (EVA) bags for parenteral nutrition and began commercial operations in the early 1980s, collaborating with pharmaceutical giants like Pharmacia and Baxter.

In the 1990s, Stedim developed innovative single-use bag systems for the biopharmaceutical industry to capitalize on the potential of biotechnology. These systems replaced traditional steel and glass containers, offering cost-effectiveness, user-friendliness, and improved safety. Stedim continuously expanded its product range, increasing bag sizes from 50 mL to 1,000 L by 1996 to meet growing industry demands.

Then in 2007, Sartorius acquired a majority stake in Stedim, merging it with its own Biotechnology Division to form Sartorius Stedim Biotech. This merger combined Stedim's expertise in single-use technologies with Sartorius' strengths in filtration, separation, and cell culture, creating a leading international partner for biopharmaceutical research, and industry.

In 2014, Sartorius further sharpened its focus by selling its industrial weighing business and organizing into two divisions: "Bioprocess Solutions"(BPS) and "Lab Products & Services" (LPS).

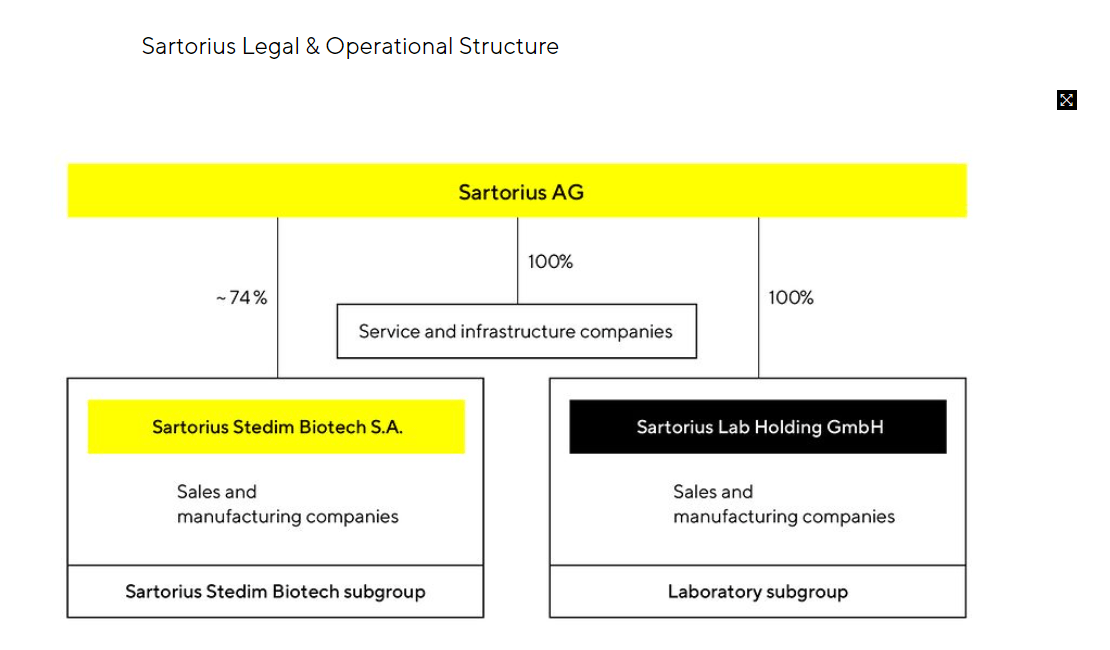

Sartorius has two separate listed entities: Sartorius AG (listed in Germany), and Sartorius Stedim Biotech (listed in France). To simplify, I will mention the former as SAG, and the latter as SSB in this Deep Dive. While SAG owns 100% of LPS division, it owns 74% of SSB shares (the BPS division) but 85% of voting rights. As a result, SSB has ~26% free float and the minority shareholders in aggregate have ~15% voting rights.

As this Deep Dive is on SSB, I will ignore the LPS division. However, since Sartorius AG is the majority shareholder, it is important to note the somewhat unique shareholder structure of its own. After Horst Sartorius (third generation of Sartorius family) died in 1998, he left a ~55% stake to his three daughters; the joint heirship is subject to administration of the executor until mid-2028. This arrangement was stipulated in Horst Sartorius's will, which required his daughters to wait 30 years before receiving their inheritance. In March 2022 a significant transaction took place involving the heirs of Horst Sartorius and LifeScience Holding (LSH) which completed the acquisition of a participation of ~40% of shares of Sartorius heirs. To complicate it even further, in a separate but concurrent deal, Karin Sartorius-Herbst, the eldest daughter of Horst Sartorius, increased her existing stake within the community of heirs (details of the size of stake increases is not disclosed).

Apart from Sartorius heirs, ~38% of Sartorius AG shares is owned by Bio-Rad Laboratories (a publicly listed life science company developing, manufacturing, and marketing a broad range of products for the life science research and clinical diagnostics markets), and the rest 7% is free float. SAG also has non-voting preference shares that entitled its owners typically to a higher dividend than ordinary shares, usually receiving an additional €0.01 per share. Bio-Rad (Ticker: BIO) also owns ~28% of SAG’s preference shares. It is likely that BIO may acquire SAG’s ordinary shares outright after 2028 when Sartorius heirs may sell their stakes.

While all these may seem quite quaint complexity about SAG shareholding structure, there is likely important implications for SSB shareholders as well. I will touch on the implications later in this Deep Dive, but given the technical nature of the industry Sartorius operates in, let’s start with the basics first.

The rest of the Deep Dive is organized as follows:

Industry Context: Given the jargons in this industry, I first discussed the basics related to biologics, monoclonal antibodies, biosimilars, cell and gene therapy, stainless vs single-use bioreactors etc. before getting into the weeds of Sartorius.

Business Overview and Economics: In this section, I expanded on the upstream and downstream bioprocessing of biologics, followed by a discussion on Sartorius product portfolio, customer concentration, revenue mix by region, as well as margin structure. I also highlighted why I am not as worried about China risk here and the shortcomings of focusing on EBITDA for a company such as Sartorius.

Competitive Dynamics: First, I mentioned about the broader biopharma value chain, followed by competitive moats of Sartorius. Then I discussed the competitive dynamics within bioprocessing solution providers.

Capital Allocation and Management Incentives: I showed capital allocation of last decade and half at Sartorius. Then I elaborated on why I am not a fan of management incentives at Sartorius.

Model Assumptions and Valuation: Model/implied expectations in the current stock price are analyzed here.

Final Words: Concluding remarks on Sartorius, and disclosure of my overall portfolio.